Navigating the world of life insurance can feel overwhelming, especially when faced with the prospect of medical exams. However, securing vital coverage doesn’t always require a trip to the doctor. Life insurance quotes without medical exams offer a streamlined approach to protecting your loved ones, providing a convenient and often quicker path to financial security. This guide explores the intricacies of these policies, helping you understand the eligibility criteria, application processes, and potential advantages and disadvantages compared to traditional life insurance.

We’ll delve into the various types of no-medical-exam policies available, comparing coverage amounts and premiums to help you make an informed decision. We’ll also address common concerns, such as eligibility restrictions, potential risks, and the importance of comparing quotes from multiple insurers to find the best fit for your individual needs and financial situation. Understanding these aspects will empower you to choose a policy that aligns perfectly with your goals.

Understanding “Life Insurance Quotes No Medical Exam”

Securing life insurance is a crucial step in financial planning, providing a safety net for loved ones in the event of your passing. However, the traditional application process often involves medical examinations, which can be time-consuming and potentially deter some individuals from obtaining coverage. “No medical exam” life insurance policies offer a streamlined alternative, allowing individuals to acquire coverage without undergoing a physical examination. Understanding the implications of this approach is vital for making an informed decision.

No medical exam life insurance policies simplify the application process by eliminating the need for a medical examination. This means no blood tests, urine samples, or physical assessments are required. This expediency, however, often comes with trade-offs in terms of coverage amounts and premiums. The insurer assesses risk based on factors such as age, health history (self-reported), lifestyle, and occupation. The absence of a medical exam introduces a higher degree of uncertainty for the insurer, leading to adjustments in policy offerings.

Types of Policies Typically Offered Without Medical Exams

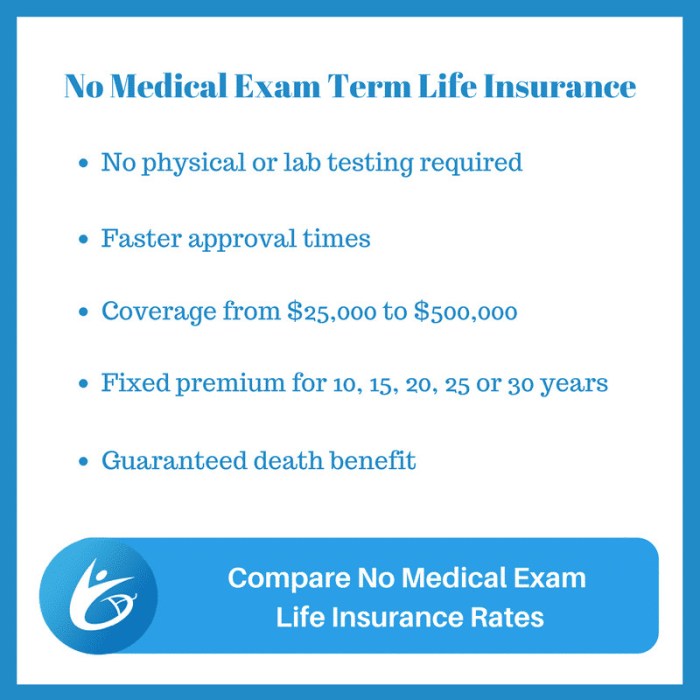

The availability of no-medical-exam policies varies among insurers, but typically, these policies are offered as term life insurance products. These policies provide coverage for a specific period (e.g., 10, 20, or 30 years), and premiums remain level throughout the term. While whole life insurance policies (offering lifetime coverage) might occasionally be available without a medical exam, they are less common due to the increased longevity risk for the insurer. Simplified issue policies, which require a brief health questionnaire instead of a full medical exam, are another option. These policies bridge the gap between fully underwritten and no-exam policies, providing a balance between convenience and cost.

Coverage Amounts and Premiums: A Comparison

Generally, life insurance policies that do not require a medical exam offer lower coverage amounts than policies requiring a full medical examination. This is because the insurer has less information about the applicant’s health status. For example, a healthy 35-year-old applying for a $500,000 policy might qualify for a lower premium with a full medical exam, demonstrating their good health, than with a no-exam policy where the premium would be higher for the same coverage amount. Alternatively, the same applicant might be able to obtain a $250,000 policy with a no-exam option at a comparable premium to the $500,000 policy requiring a medical exam. The exact differences in premiums and coverage amounts vary significantly based on the applicant’s age, health history (as self-reported), and the insurer’s underwriting guidelines.

Situations Where a No-Medical-Exam Policy Might Be Beneficial

A no-medical-exam life insurance policy can be particularly beneficial in situations where a traditional medical exam presents challenges. For example, individuals with pre-existing health conditions that might make obtaining a traditional policy difficult may find this type of policy more accessible. Individuals who need coverage quickly, without the delay of scheduling and undergoing a medical examination, also benefit. Finally, someone with a busy schedule who finds it difficult to attend a medical exam appointment may find this option convenient. A person needing temporary coverage might also consider a no-exam policy as a short-term solution.

Eligibility Criteria for No Medical Exam Policies

Securing life insurance without a medical exam offers convenience, but eligibility isn’t guaranteed. Insurance companies carefully assess several factors to determine your suitability for these simplified policies. Understanding these criteria is crucial for a successful application.

Insurance providers utilize a risk assessment model that considers various factors to determine eligibility for no-medical-exam life insurance. This model is significantly different from the comprehensive underwriting process used for traditional life insurance policies, focusing on readily available information to predict the likelihood of a claim.

Age Limits and Coverage Amounts

Age is a primary factor influencing eligibility. Generally, no-medical-exam policies cater to applicants within a specific age range, typically younger individuals, with maximum age limits often falling between 60 and 80, depending on the insurer and the specific policy. Coverage amounts are also usually capped at lower levels compared to traditional policies, reflecting the reduced underwriting scrutiny. For instance, a 45-year-old might qualify for a $250,000 policy, while a 65-year-old might be limited to $100,000. These limits are designed to mitigate the increased risk associated with the lack of a medical examination.

Impact of Pre-existing Health Conditions

Pre-existing health conditions can significantly impact eligibility for no-medical-exam life insurance. While these policies are designed to streamline the application process, insurers still consider the applicant’s overall health profile, often based on self-reported information. Applicants with serious pre-existing conditions, such as heart disease, cancer, or diabetes, are less likely to be approved, or may only be offered significantly reduced coverage amounts, or higher premiums. The insurer may require additional information or even decline the application altogether.

Comparison of Eligibility Requirements Across Providers

The following table provides a simplified comparison. Note that specific eligibility criteria can vary greatly and are subject to change based on the insurer’s underwriting guidelines and the applicant’s individual circumstances. This data is for illustrative purposes and should not be considered exhaustive or definitive.

| Insurance Provider | Maximum Age | Maximum Coverage | Key Eligibility Considerations |

|---|---|---|---|

| Provider A | 65 | $250,000 | Self-reported health, driving record, lifestyle questions |

| Provider B | 70 | $100,000 | Age, occupation, tobacco use |

| Provider C | 60 | $500,000 | Height, weight, recent travel history, family medical history |

| Provider D | 80 | $50,000 | Age, health questionnaire, lifestyle factors |

Last Point

Securing life insurance is a crucial step in financial planning, and the availability of no-medical-exam policies significantly simplifies the process for many individuals. While these policies may have limitations compared to traditional options, their convenience and accessibility make them a viable choice for those seeking straightforward coverage. By carefully weighing the advantages and disadvantages, understanding eligibility requirements, and comparing quotes from multiple providers, you can confidently choose a policy that offers the appropriate level of protection for you and your family, ensuring peace of mind for years to come. Remember, proactive planning is key to a secure financial future.

Popular Questions

What is the maximum coverage amount typically offered with no-medical-exam life insurance?

Coverage amounts vary significantly depending on the insurer and applicant factors, but are generally lower than traditional policies. Expect limits in the range of $250,000 to $500,000, though some may offer slightly more.

Can I get a no-medical-exam policy if I have a pre-existing condition?

While some pre-existing conditions might not disqualify you, they may influence eligibility and premium rates. Disclosure is crucial. The insurer might offer coverage with limitations or higher premiums.

How long does the application process typically take for a no-medical-exam policy?

The process is often quicker than traditional policies, typically taking a few days to a couple of weeks for approval, depending on the insurer and the complexity of the application.

Are there any specific age restrictions for no-medical-exam life insurance?

Yes, most insurers set age limits, typically ranging from 40 to 65 years old, though this can vary. Younger applicants might find broader eligibility.

What happens if I don’t disclose a pre-existing condition?

Non-disclosure of a pre-existing condition can lead to policy rejection or denial of claims if the condition contributes to a death claim. Honest disclosure is paramount.