Navigating the world of life insurance can feel overwhelming, particularly when faced with the array of options and terminology. This guide focuses specifically on term life insurance, a crucial financial tool offering affordable protection for a defined period. We’ll demystify the process of obtaining and understanding life insurance quotes for term life policies, empowering you to make informed decisions about securing your family’s financial well-being.

From understanding the core features of term life insurance and its differences from other types of life insurance to exploring the factors that influence quotes and the various methods for obtaining them, we’ll cover all the essential aspects. We’ll also delve into analyzing quotes, comparing different providers, and identifying potential pitfalls to ensure you choose a policy that best suits your needs and budget.

Understanding Term Life Insurance

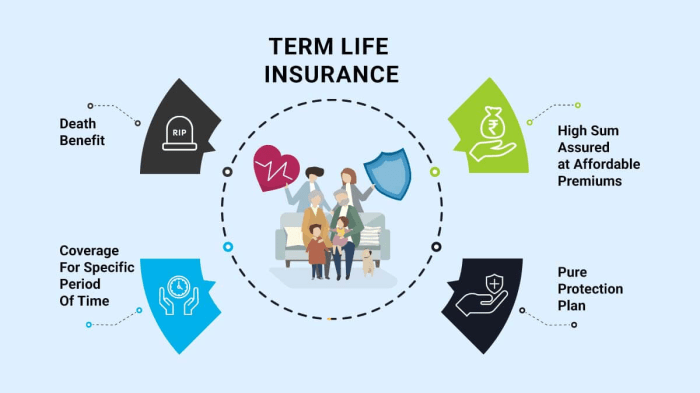

Term life insurance is a straightforward and often cost-effective way to secure your loved ones’ financial future. It provides a death benefit payout only if the insured person dies within a specified period, known as the term. This contrasts with permanent life insurance, which offers lifelong coverage and often includes a cash value component. Understanding its core features and comparing it to other types is crucial for making an informed decision.

Core Features of Term Life Insurance Policies

Term life insurance policies are defined by several key features. The most important is the term length, which dictates the duration of coverage. Premiums remain level for the duration of the term. The death benefit is the amount paid to beneficiaries upon the insured’s death within the term. Finally, the policy’s renewability and convertibility options are significant considerations. Renewability allows the policyholder to extend coverage after the initial term expires, usually at a higher premium. Convertibility offers the option to convert the term policy to a permanent life insurance policy without a medical examination, though this also typically involves higher premiums.

Differences Between Term Life and Other Life Insurance Types

Term life insurance differs significantly from other types of life insurance, primarily in its duration and cost. Whole life insurance, for example, provides lifelong coverage and builds cash value that can be borrowed against. Universal life insurance offers more flexibility in premium payments and death benefit adjustments, but typically has higher costs than term life. Variable life insurance invests the cash value in market-based funds, offering potential growth but also greater risk. In contrast, term life insurance is simpler, less expensive, and ideal for those seeking temporary coverage, such as during periods of high financial responsibility like raising a family or paying off a mortgage. The trade-off is that the coverage ends at the end of the term, unless renewed.

Typical Term Lengths Available for Term Life Insurance

Term life insurance policies are typically available in various terms, ranging from short-term options of 10 or 15 years to longer-term options of 20, 25, or even 30 years. The best term length depends on individual needs and financial circumstances. For example, a young family might choose a 20-year term to cover their mortgage and their children’s education, while an older individual nearing retirement might opt for a shorter term. Choosing the appropriate term requires careful consideration of one’s life stage and financial goals.

Cost-Effectiveness of Different Term Lengths

The cost of term life insurance is directly related to the length of the term and the insured’s age and health. Generally, longer terms have higher premiums because the insurer carries a greater risk over a longer period. However, the cost per year of coverage may be lower for longer terms.

| Term Length (Years) | Approximate Annual Premium (Example – 35-year-old, healthy male, $500,000 coverage) | Total Premium Paid | Cost per year of coverage |

|---|---|---|---|

| 10 | $500 | $5000 | $500 |

| 15 | $600 | $9000 | $600 |

| 20 | $700 | $14000 | $700 |

| 30 | $850 | $25500 | $850 |

*Note: These are example premiums only and actual costs will vary based on individual factors.*

Obtaining Term Life Insurance Quotes

Securing the right term life insurance policy involves careful comparison shopping. Understanding how to obtain quotes efficiently is crucial to finding the best coverage at the most competitive price. This section details the various methods available and guides you through the process of obtaining and comparing quotes from multiple providers.

Methods for Obtaining Life Insurance Quotes

There are several ways to obtain term life insurance quotes, each with its own advantages and disadvantages. Choosing the right method depends on your personal preferences and comfort level with technology and personal interaction.

- Online Quote Engines: Many insurance companies and independent comparison websites offer online quote tools. These platforms allow you to input your information and receive instant quotes from multiple providers. This method is generally quick and convenient, offering a broad overview of available options.

- Insurance Agents: Working with an insurance agent provides personalized guidance. Agents can explain policy details, compare options based on your specific needs, and handle the application process. This approach offers a more hands-on experience but may take longer than using an online tool.

- Insurance Brokers: Similar to agents, brokers can access quotes from a wide range of insurance companies. However, brokers represent you, the client, rather than a specific company, allowing for a broader comparison of options and potentially better negotiating power. Like agents, this approach is more personalized but might require more time investment.

Information Required for a Life Insurance Quote

Insurance providers need specific information to generate an accurate quote. This data helps them assess your risk profile and determine the appropriate premium. Providing accurate and complete information is essential for receiving a relevant quote.

- Age: Your age is a key factor influencing premium calculations, as older individuals generally face higher risks.

- Gender: Historically, gender has played a role in risk assessment, although this is becoming less significant in some regions due to evolving regulations.

- Health Status: This includes details about your medical history, current health conditions, and lifestyle habits (smoking, alcohol consumption, etc.). Accurate reporting is crucial for avoiding potential issues later.

- Desired Coverage Amount: This is the amount of death benefit you want the policy to pay out to your beneficiaries.

- Policy Term Length: This refers to the duration for which the coverage remains active (e.g., 10, 20, or 30 years).

- Beneficiary Information: You’ll need to provide details about the person or people who will receive the death benefit.

Step-by-Step Guide for Obtaining Quotes from Multiple Providers

A systematic approach ensures you obtain comprehensive quotes and make an informed decision.

- Determine Your Needs: Assess your financial situation, family responsibilities, and desired coverage amount before starting the quote process.

- Gather Necessary Information: Collect all the personal and health information required by insurance providers (as detailed above).

- Obtain Quotes Online: Use online comparison websites or individual company websites to obtain quotes quickly. Keep track of the information provided to each company for easy comparison.

- Contact Agents or Brokers: If you prefer personalized assistance, reach out to insurance agents or brokers to discuss your needs and obtain quotes from a wider range of providers.

- Compare Quotes: Carefully review all quotes, paying attention to the coverage amount, premium cost, policy terms, and any exclusions or limitations.

- Review Policy Documents: Before making a final decision, thoroughly review the policy documents to understand the terms and conditions.

Comparison of Quote Acquisition Methods

The choice of method impacts the speed and convenience of obtaining quotes.

- Online Quote Engines: Speed: Very Fast; Convenience: High. Offers instant quotes from multiple providers but may lack personalized guidance.

- Insurance Agents: Speed: Moderate; Convenience: Moderate. Provides personalized service but might take longer to receive quotes and complete the process.

- Insurance Brokers: Speed: Moderate; Convenience: Moderate. Offers a broader range of options and personalized service, but the process may take longer than using online tools.

Illustrative Examples of Term Life Insurance Quotes

Understanding how different factors influence term life insurance quotes is crucial for making informed decisions. The following examples illustrate how age, health, and coverage amount significantly impact the premiums you’ll pay. Remember, these are illustrative examples only and actual quotes will vary based on the specific insurer and your individual circumstances.

Example Term Life Insurance Quotes

It’s important to note that these examples are simplified and do not include all the factors that an insurance company would consider. Factors like occupation, family history, and lifestyle choices also play a role in determining premiums.

Example 1: Healthy 30-Year-Old, $500,000 Coverage, 20-Year Term

Annual Premium: Approximately $700 – $1000

Scenario: A healthy, non-smoking 30-year-old male with no significant health issues applies for a 20-year term life insurance policy with $500,000 in coverage. The premium reflects a relatively low risk profile.

Example 2: Healthy 45-Year-Old, $250,000 Coverage, 10-Year Term

Annual Premium: Approximately $800 – $1200

Scenario: A healthy, non-smoking 45-year-old female with a clean bill of health applies for a 10-year term policy with $250,000 in coverage. The higher age results in a higher premium, even with a lower coverage amount and shorter term. The shorter term also reduces the overall cost compared to a longer term.

Example 3: Applicant with Pre-existing Condition, $100,000 Coverage, 15-Year Term

Annual Premium: Approximately $1500 – $2500 (or potentially higher)

Scenario: A 40-year-old male with a history of high blood pressure applies for a 15-year term policy with $100,000 in coverage. The pre-existing condition significantly increases the premium, even with a lower coverage amount compared to Example 1. The increased risk associated with the health condition results in a substantially higher cost.

The significant difference in premiums across these examples highlights the impact of age, health, and coverage amount. A younger, healthier applicant with a lower coverage amount will generally receive a lower premium. Conversely, older applicants, those with pre-existing conditions, or those seeking higher coverage amounts will face significantly higher premiums. It’s vital to compare quotes from multiple insurers to find the most suitable policy.

Additional Considerations

Securing term life insurance is a significant financial decision. While obtaining quotes and understanding the policy’s details are crucial, several other factors warrant careful consideration to ensure the policy effectively meets your evolving needs. Regular review and professional guidance are key components of responsible financial planning.

Your life insurance needs are not static; they change as your circumstances evolve. Therefore, a periodic review is essential to maintain adequate coverage. This review should consider changes in your income, family size, debt levels, and financial goals. Failing to adjust your coverage as your life changes could leave you and your loved ones underinsured, negating the very purpose of the policy.

Reviewing Life Insurance Needs Periodically

Regularly reviewing your life insurance needs is vital to ensure your coverage remains sufficient. Consider reviewing your policy annually or at least every three years, coinciding with significant life events like marriage, the birth of a child, a career change, or a major purchase like a house. During these reviews, assess whether your current coverage still aligns with your financial responsibilities and future goals. For example, if your income increases substantially, you may need to increase your coverage amount to maintain the same level of protection. Conversely, if your debt decreases significantly, you may find you need less coverage. This proactive approach guarantees your policy remains a valuable asset, providing the appropriate level of financial security throughout your life.

Seeking Advice from a Financial Advisor

Navigating the complexities of life insurance can be challenging. A financial advisor provides expert guidance, helping you determine the appropriate type and amount of coverage based on your individual circumstances and financial goals. They can explain complex policy features, compare different insurers and policies, and help you understand the long-term implications of your decisions. This unbiased perspective ensures you make informed decisions, selecting a policy that best protects your family’s financial future. A financial advisor can also help you integrate life insurance into a broader financial plan, ensuring it works in harmony with other financial goals like retirement planning or college savings.

Situations Where Term Life Insurance is Beneficial

Term life insurance, due to its affordability and straightforward structure, proves beneficial in various life stages.

- Mortgage Protection: A term life insurance policy can be used to pay off a mortgage in the event of the policyholder’s death, preventing financial hardship for surviving family members. This is particularly important for families with young children or significant debt.

- Income Replacement: Term life insurance can replace a portion of lost income for a surviving spouse or partner, enabling them to maintain their lifestyle and meet financial obligations. The coverage amount should be calculated based on the deceased’s income and the family’s expenses.

- Child’s Education Funding: A term life insurance policy can provide funds for a child’s education expenses, ensuring their future opportunities are not compromised in the event of a parent’s death. This can be particularly valuable for families planning for college or other significant educational investments.

- Debt Consolidation: Term life insurance can be used to pay off outstanding debts such as credit card balances, personal loans, or other liabilities, preventing financial burden on surviving family members. This ensures financial stability during a difficult time.

Conclusion

Ultimately, securing the right term life insurance policy is a significant step towards financial preparedness. By understanding the factors that affect your quotes, diligently comparing options from different providers, and carefully reviewing policy details, you can confidently choose a plan that provides adequate coverage for your loved ones. Remember, regular review of your life insurance needs is crucial as your circumstances evolve. Proactive planning ensures peace of mind, knowing you’ve taken the necessary steps to protect your family’s future.

Essential FAQs

What is the difference between guaranteed and non-guaranteed premiums?

Guaranteed premiums remain fixed throughout the policy term, while non-guaranteed premiums can fluctuate based on the insurer’s investment performance. Guaranteed premiums offer greater predictability.

Can I get term life insurance if I have a pre-existing condition?

Yes, but your premiums may be higher. Insurers assess your health history and may require additional medical information.

How long does it take to get a life insurance quote?

Online quotes are often instantaneous, while quotes obtained through agents or brokers may take a few days, depending on the complexity of the application.

What happens if I die before the term expires?

Your designated beneficiaries will receive the death benefit as stipulated in your policy.

Can I convert my term life insurance policy to a permanent policy?

Some term life insurance policies offer a conversion option, allowing you to switch to a permanent policy without a medical exam, but typically at a higher premium.