Life insurance and Accidental Death & Dismemberment (AD&D) insurance are often confused, yet they serve distinct purposes in financial planning. While both offer financial protection, their triggers, coverage amounts, and overall costs differ significantly. This exploration delves into the nuances of each, enabling informed decision-making for your specific needs.

Understanding the core differences between life insurance and AD&D is crucial for building a comprehensive financial safety net. Life insurance provides a death benefit to beneficiaries upon the insured’s death from any cause, while AD&D specifically covers accidental death or dismemberment. This distinction influences policy premiums, payout amounts, and the overall suitability for individual circumstances. We will explore these differences, compare costs, and discuss the claim processes to help clarify the optimal choice for your situation.

Defining Life Insurance and Accidental Death & Dismemberment (AD&D) Insurance

Life insurance and Accidental Death & Dismemberment (AD&D) insurance are both designed to provide financial protection for loved ones, but they differ significantly in their scope and the circumstances under which benefits are paid. Understanding these differences is crucial for making informed decisions about your personal insurance needs.

Life insurance policies primarily aim to replace the financial income a deceased person provided to their dependents. This financial protection can cover various expenses such as mortgage payments, children’s education, living expenses, and outstanding debts. The payout is triggered by the death of the insured individual, regardless of the cause.

Life Insurance Coverage Details

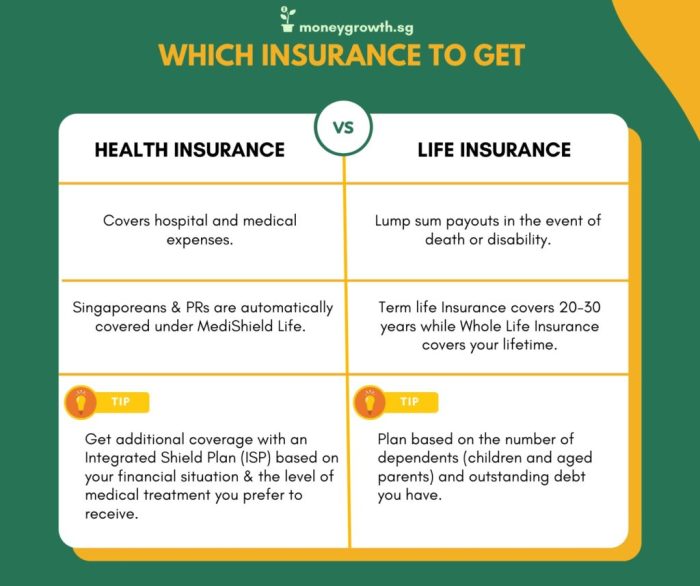

Life insurance policies offer a lump-sum death benefit paid to the designated beneficiary upon the death of the insured. Different types of life insurance policies exist, each with its own features and cost structure. For example, term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and builds cash value. The amount of the death benefit is determined at the time the policy is purchased and is based on factors like age, health, and the desired coverage amount.

Accidental Death & Dismemberment (AD&D) Insurance Coverage Details

AD&D insurance, conversely, specifically covers death or dismemberment resulting from an accident. It doesn’t cover deaths caused by illness or natural causes. The payout is triggered only when the insured person dies or experiences a specified dismemberment (e.g., loss of a limb) due to an accident. The policy usually Artikels specific accidental events that are covered and those that are excluded. The payout amount can vary depending on the severity of the injury or death. For instance, a total and permanent disability may result in a larger payout than the loss of a finger.

Comparison of Life Insurance and AD&D Insurance

The core difference lies in the event triggering the payout. Life insurance covers death from any cause, while AD&D insurance only covers accidental death or dismemberment. Life insurance typically offers a larger death benefit than AD&D insurance, reflecting its broader coverage. AD&D insurance serves as a supplemental policy, providing additional financial support in the specific event of an accidental death or injury. While life insurance is often a long-term commitment, AD&D insurance policies can be more flexible and potentially less expensive.

Key Features Comparison

The following table summarizes the key differences between life insurance and AD&D insurance:

| Policy Type | Coverage | Payout Trigger | Typical Exclusions |

|---|---|---|---|

| Life Insurance | Death of the insured | Death from any cause | Suicide (usually within a specified period), pre-existing conditions, self-inflicted injuries |

| AD&D Insurance | Accidental death or dismemberment | Accidental death or specified dismemberment | Illness, suicide, pre-existing conditions, self-inflicted injuries, war, acts of terrorism (often subject to specific policy wording) |

Coverage Differences and Scenarios

Life insurance and Accidental Death & Dismemberment (AD&D) insurance, while both offering death benefits, differ significantly in their coverage scope and the circumstances under which they pay out. Understanding these differences is crucial for selecting the right coverage for your individual needs. This section will illustrate scenarios where each type of insurance provides benefits, instances of overlapping coverage, and situations where neither policy would offer compensation.

Life Insurance Payout Scenarios

Life insurance policies primarily provide a death benefit upon the insured’s death, regardless of the cause. This means the payout is triggered by the insured’s demise from any cause, whether natural (illness, old age) or accidental.

- A 50-year-old individual passes away from a heart attack. The life insurance policy pays out the death benefit to the named beneficiary.

- A 35-year-old individual dies in a car accident. The life insurance policy pays out the death benefit.

- A 70-year-old individual succumbs to a long-term illness. The life insurance policy pays out the death benefit.

AD&D Insurance Payout Scenarios

AD&D insurance, conversely, only pays out if the insured’s death or dismemberment results from an accident. The accident must typically be unforeseen and unintentional. Furthermore, specific policy terms and definitions of “accident” will vary.

- A 40-year-old individual loses a limb in a workplace accident. The AD&D policy pays out according to the policy’s schedule of benefits for limb loss.

- A 25-year-old individual dies instantly in a car crash. The AD&D policy pays out the death benefit.

- A 60-year-old individual is severely injured in a fall, resulting in permanent disability. The AD&D policy may offer benefits based on the extent of the disability.

Concurrent Coverage Scenarios

Situations exist where both life insurance and AD&D insurance might provide benefits concurrently. This typically occurs when death results from an accident.

- Imagine a scenario where a 45-year-old individual dies in a plane crash. Both the life insurance policy and the AD&D policy would likely pay out, providing a larger total benefit to the beneficiaries.

Scenarios Without Coverage

There are instances where neither life insurance nor AD&D insurance would provide benefits.

- Suicide, within a specific timeframe after policy inception, is often excluded from coverage under both life insurance and AD&D policies. Specific policy terms dictate the exclusion periods.

- Death or injury resulting from self-inflicted harm, excluding accidental injury, generally isn’t covered.

- Death or injury caused by pre-existing conditions, unless specifically covered by a rider or supplemental policy, are typically not covered by AD&D insurance, though they would likely be covered by a life insurance policy.

Premiums and Cost Comparisons

Understanding the cost differences between life insurance and accidental death & dismemberment (AD&D) insurance is crucial for making an informed decision about your financial protection. Both offer valuable coverage, but their premiums and the circumstances under which they pay out differ significantly. This section will explore the factors affecting the cost of each type of policy and illustrate the typical premium differences.

Factors Influencing Life Insurance Premiums

Several factors influence the premium cost of a life insurance policy. These factors are assessed by insurance companies to determine the level of risk associated with insuring an individual. Higher-risk individuals generally pay higher premiums.

Life Insurance Premium Determinants

The most significant factors affecting life insurance premiums include age, health status, lifestyle choices, policy type, and the death benefit amount. Younger, healthier individuals with healthier lifestyles typically qualify for lower premiums. The type of policy chosen (term life, whole life, universal life, etc.) also significantly impacts the cost, with term life insurance generally being the most affordable option. Finally, a higher death benefit amount naturally leads to higher premiums. For instance, a 30-year-old non-smoker in excellent health will receive a much lower premium than a 60-year-old smoker with pre-existing health conditions, for the same coverage amount.

Factors Affecting AD&D Insurance Premiums

AD&D insurance premiums are generally less sensitive to factors like age and health status compared to life insurance. This is because AD&D policies only pay out in the event of accidental death or dismemberment. The focus is on the risk of accidental events, rather than the overall mortality risk.

AD&D Insurance Premium Determinants

While age can play a minor role, the primary factors influencing AD&D premiums include the amount of coverage and the specific terms and conditions of the policy. Policies with higher coverage amounts naturally come with higher premiums. The inclusion of specific riders or benefits (e.g., coverage for specific types of accidents) can also increase the premium. Additionally, the occupation of the insured individual might slightly influence the premium, with higher-risk occupations potentially leading to slightly higher costs.

Typical Cost Differences Between Life Insurance and AD&D Insurance

Generally, AD&D insurance premiums are significantly lower than life insurance premiums for comparable coverage amounts. This is because AD&D insurance covers a much narrower range of events. Life insurance protects against death from any cause, while AD&D insurance only covers accidental death or dismemberment.

Hypothetical Premium Comparison

Let’s consider a hypothetical example: A 35-year-old male seeks $100,000 in coverage. He might find that a term life insurance policy costs approximately $20-$50 per month, depending on his health and the length of the term. However, an AD&D policy with the same $100,000 death benefit might only cost him around $5-$15 per month. This significant difference reflects the lower risk profile associated with AD&D insurance. The exact figures would vary based on the specific insurer and policy details. It is crucial to obtain personalized quotes from multiple insurers to compare accurately.

Types of Life Insurance and AD&D Policies

Choosing the right life insurance or Accidental Death & Dismemberment (AD&D) policy requires understanding the various types available and their respective features. This section details the different policy options to help you make an informed decision based on your individual needs and financial situation.

Life Insurance Policy Types

Several types of life insurance policies cater to diverse needs and risk tolerances. The primary distinctions lie in coverage duration, cash value accumulation, and premium flexibility.

- Term Life Insurance: This provides coverage for a specified period (term), such as 10, 20, or 30 years. Premiums are generally lower than other types, making it a cost-effective option for those needing coverage for a defined period, like while raising a family or paying off a mortgage. However, coverage ends at the term’s expiration, and there’s no cash value accumulation.

- Whole Life Insurance: This offers lifelong coverage, building cash value that grows tax-deferred. Premiums are typically higher and remain level throughout your life. The cash value can be borrowed against or withdrawn, offering financial flexibility. However, it’s generally more expensive than term life insurance.

- Universal Life Insurance: This type combines lifelong coverage with flexible premiums and adjustable death benefits. Policyholders can adjust their premiums and death benefit amounts within certain limits, offering adaptability to changing financial circumstances. However, the cash value growth is dependent on the investment performance of the underlying funds, and there’s a risk of the policy lapsing if premiums aren’t sufficient.

- Variable Universal Life Insurance (VUL): Similar to universal life, but allows for investment choices in various sub-accounts, offering the potential for higher returns but also greater risk. The policyholder has more control over the investment strategy, potentially leading to higher growth but also potentially lower returns or even losses.

AD&D Coverage Options

Accidental Death & Dismemberment (AD&D) insurance offers a lump-sum benefit upon accidental death or dismemberment. Policy structures vary primarily in premium payment frequency.

- Single-Premium AD&D: This involves a one-time premium payment for a specified period of coverage. It offers simplicity and cost certainty, with the premium paid upfront. However, the coverage period is fixed and there’s no option to adjust the benefit amount.

- Multiple-Premium AD&D: This requires recurring premium payments, usually annually or monthly, for the duration of coverage. It offers greater flexibility as the coverage can be extended or terminated, and the benefit amount may be adjustable in some cases. However, the ongoing premium payments can become a financial burden.

Comparison of Life Insurance Policy Benefits and Drawbacks

| Policy Type | Benefits | Drawbacks |

|---|---|---|

| Term Life | Lower premiums, straightforward coverage | Limited coverage period, no cash value |

| Whole Life | Lifelong coverage, cash value accumulation | Higher premiums, less flexibility |

| Universal Life | Flexible premiums and death benefit, cash value growth | Investment risk, potential for policy lapse |

| Variable Universal Life | Investment choices, potential for higher returns | Higher risk, complex investment decisions |

Comparison of AD&D Policy Benefits and Drawbacks

| Policy Type | Benefits | Drawbacks |

|---|---|---|

| Single-Premium AD&D | Simplicity, cost certainty | Fixed coverage period, no flexibility |

| Multiple-Premium AD&D | Flexibility, adjustable coverage | Ongoing premium payments, potential for increased cost |

Beneficiary Considerations

Choosing the right beneficiary for your life insurance and AD&D policies is a crucial step in ensuring your loved ones are financially protected in the event of your death or disability. The designation process, and the implications of different choices, vary slightly between these two types of insurance.

Beneficiary Designation for Life Insurance

Designating beneficiaries for a life insurance policy typically involves completing a beneficiary designation form provided by the insurance company. This form allows you to name one or more beneficiaries and specify how the death benefit will be distributed among them. Common options include primary beneficiaries (who receive the benefit first), contingent beneficiaries (who receive the benefit if the primary beneficiary is deceased), and trust beneficiaries (where the benefit is paid to a trust). It’s important to carefully consider the legal and tax implications of each designation. Incorrectly naming a beneficiary could lead to delays in benefit payments or even unintended distribution of funds.

Beneficiary Designation for AD&D Insurance

The process for designating beneficiaries for AD&D insurance is similar to that of life insurance. You’ll usually complete a form provided by your insurer, specifying the individuals or entities who will receive the benefits in the event of accidental death or dismemberment. However, AD&D policies often have a simpler beneficiary structure than life insurance policies, sometimes only allowing for a primary beneficiary. It is still critical to ensure this information is accurate and up-to-date.

Implications of Different Beneficiary Designations

The choice of beneficiary significantly impacts how the death benefit or AD&D payout is distributed. For example, naming a single primary beneficiary ensures that the entire benefit goes to that individual. Naming multiple primary beneficiaries, perhaps with specified percentages, divides the benefit among them. Using contingent beneficiaries provides a backup plan if the primary beneficiary predeceases the insured. Naming a trust as a beneficiary offers greater control over how the funds are managed and distributed, potentially protecting beneficiaries from creditors or mismanagement. These choices have tax implications as well; for instance, leaving the benefit to a spouse may offer certain tax advantages.

Beneficiary Scenarios

Consider these examples: A young couple with a mortgage might name each other as primary beneficiaries on their life insurance policies, with their children as contingent beneficiaries. If one parent dies, the surviving parent receives the benefit to help with expenses. If both parents die, the children would inherit. In an AD&D scenario, a sole proprietor might name their business partner as a beneficiary to ensure business continuity after an accident. Alternatively, a parent might name a trust as the beneficiary of their child’s AD&D policy, ensuring the funds are managed responsibly for the child’s future. These scenarios highlight the importance of considering your specific circumstances when designating beneficiaries.

Claim Process and Payouts

Filing a claim for either life insurance or accidental death and dismemberment (AD&D) insurance involves several steps and requires specific documentation. The process, while similar in some respects, differs significantly in the required evidence and the types of payouts received. Understanding these differences is crucial for beneficiaries navigating the often-emotionally challenging period following a covered loss.

Life Insurance Claim Process

The life insurance claim process typically begins with notifying the insurance company of the death of the insured. This notification usually triggers the company’s claim process, which will involve gathering and submitting various documents. The speed and efficiency of the process can vary significantly based on the insurer and the complexity of the case.

- Notification of Death: The beneficiary or designated representative notifies the insurance company of the insured’s death, usually providing the policy number and the date of death.

- Documentation Submission: This step involves providing the insurance company with crucial documents, including the death certificate, the original life insurance policy, and possibly additional documentation such as the insured’s medical records (depending on the circumstances of death).

- Claim Review and Verification: The insurance company reviews the submitted documents to verify the death and ensure that it aligns with the terms and conditions of the policy. This may involve contacting physicians, coroners, or other relevant parties for additional information.

- Claim Approval and Payment: Once the claim is approved, the insurance company processes the payment to the designated beneficiary. The timeframe for payment can vary, but it generally ranges from a few weeks to several months, depending on the complexity of the claim and the insurer’s processing time.

AD&D Insurance Claim Process

The AD&D claim process shares some similarities with the life insurance claim process, but it differs significantly in the required evidence. Because AD&D policies cover accidental deaths or dismemberments, proof of accident is paramount. The documentation required for an AD&D claim is usually more specific than for a life insurance claim.

- Notification of Accident and/or Death/Dismemberment: The beneficiary or designated representative notifies the insurance company immediately after the accident and/or resulting death or dismemberment. Timely notification is crucial.

- Detailed Documentation of the Accident: This involves providing detailed information about the accident, including a police report, medical reports, witness statements, and any other relevant documentation that substantiates the accidental nature of the event leading to the death or dismemberment.

- Claim Review and Verification: The insurance company thoroughly investigates the accident and reviews all submitted documentation to determine if the death or dismemberment qualifies for benefits under the policy’s terms. They may conduct their own investigation.

- Claim Approval and Payment: Upon approval, the insurance company pays the designated beneficiary the benefits Artikeld in the policy. The payout can vary depending on the nature of the injury or death.

Claim Processing Time Comparison

While there is no single definitive timeframe, life insurance claims generally take longer to process than AD&D claims. Life insurance claims often require more extensive documentation and verification, especially in cases of ambiguous cause of death. AD&D claims, while requiring strong evidence of accidental cause, are often processed faster because the cause of the event is usually more straightforward. Life insurance claims may take several weeks to several months, while AD&D claims might be processed within a few weeks to a couple of months. However, individual insurer practices and the complexity of the claim significantly influence processing time for both types.

Illustrative Examples

Understanding the differences between life insurance and AD&D insurance payouts is best achieved through visual representations. The following descriptions aim to provide clear comparisons of payout triggers and amounts under various scenarios.

Visual Representation of Payout Triggers

Imagine two Venn diagrams, one representing Life Insurance and the other AD&D Insurance. The Life Insurance diagram is a large circle encompassing a wide range of events leading to death, including illness, disease, and accidents. The AD&D Insurance diagram is a smaller circle, entirely contained within the Life Insurance circle. This smaller circle represents only accidental death or dismemberment. The overlapping area, which is the entirety of the AD&D circle, highlights that AD&D is a subset of the broader coverage provided by life insurance. The area outside the AD&D circle but within the Life Insurance circle represents deaths from non-accidental causes, covered only by life insurance.

Payout Amount Comparison Across Scenarios

Consider a $500,000 life insurance policy and a $250,000 AD&D policy for the same individual.

| Scenario | Life Insurance Payout | AD&D Insurance Payout |

|---|---|---|

| Death due to heart attack | $500,000 | $0 |

| Death due to car accident | $500,000 | $250,000 |

| Loss of limb in a work accident | $0 (unless a specific rider is included) | Partial payout (amount varies by policy and injury) |

| Death from a terminal illness | $500,000 | $0 |

This table illustrates that while both policies can provide payouts in the event of accidental death, only life insurance covers death from any cause. AD&D provides a specific benefit for accidental death or dismemberment, and the payout amount can be less than the life insurance benefit. Note that the payout amount for loss of limb under AD&D varies significantly depending on the specific policy and the extent of the injury. Some policies might offer a percentage of the death benefit, while others may have a schedule of payments for different types of injuries. Life insurance typically does not cover dismemberment unless it’s a specific rider added to the policy.

Final Wrap-Up

Ultimately, the choice between life insurance and AD&D insurance, or the combination of both, depends on individual financial goals and risk tolerance. While life insurance offers broader protection against death from any cause, AD&D provides targeted coverage for accidental events. By carefully weighing the coverage, costs, and claim processes of each, individuals can make informed decisions to secure their financial future and that of their loved ones. A comprehensive understanding of these distinct yet complementary insurance options empowers you to build a robust and personalized financial safety net.

User Queries

What is the difference in claim processing times between life insurance and AD&D?

AD&D claims generally process faster than life insurance claims due to the simpler verification process involved in proving accidental death or dismemberment. Life insurance claims may require more extensive investigation.

Can I have both life insurance and AD&D insurance simultaneously?

Yes, many individuals carry both life insurance and AD&D insurance for more comprehensive coverage. AD&D serves as supplemental protection in case of accidental death or dismemberment, while life insurance offers a broader safety net.

Are there age limits for AD&D insurance?

Yes, most AD&D insurers have age limits, often restricting coverage after a certain age (e.g., 65 or 70). The specific age limits vary by insurer and policy.

What if my death is ruled a suicide? Will my AD&D or life insurance pay out?

Typically, neither AD&D nor most life insurance policies will pay out if the death is ruled a suicide, though some life insurance policies may offer a partial payout after a certain period.

Убедитесь сами: более 40 МФО предоставляют займ на карту без проверки истории с моментальным переводом. Заявка одобряется без проверки кредитной истории.