Life insurance isn’t just about protecting your loved ones; certain policies offer a valuable financial safety net you can tap into during life’s unexpected turns. Many policies accumulate cash value over time, providing a source of funds accessible through policy loans. Understanding the intricacies of accessing these funds, however, is crucial to making informed financial decisions.

This guide explores the various types of life insurance policies that allow you to borrow against your accumulated cash value, detailing the process, associated costs, and potential risks. We’ll also compare this borrowing method to other options, helping you determine if it’s the right choice for your circumstances. By the end, you’ll possess a comprehensive understanding of how to leverage your life insurance policy for your financial advantage.

Types of Life Insurance with Loan Features

Life insurance policies with cash value components offer the valuable option of borrowing against the accumulated value. Understanding the differences between these policy types and their associated loan features is crucial for making informed financial decisions. This section will explore three common types: whole life, universal life, and variable universal life insurance, detailing their loan access, interest rates, and limitations.

Whole Life Insurance Loan Access

Whole life insurance policies build cash value steadily over time, guaranteed to grow at a fixed rate. This cash value serves as collateral for loans. Loan approvals are generally straightforward, as the cash value acts as security. Borrowing against your whole life policy doesn’t impact the death benefit, provided the loan and any accrued interest remain outstanding. However, excessive borrowing could eventually deplete the cash value, leading to a lapse in the policy.

Universal Life Insurance Loan Access

Universal life insurance policies also accumulate cash value, but the growth rate isn’t fixed; it fluctuates based on the underlying investment performance. Loan availability is tied directly to the current cash value. Similar to whole life, borrowing against your universal life policy typically doesn’t affect the death benefit unless the cash value is depleted. However, the fluctuating cash value introduces a level of uncertainty regarding the loan amount available. Interest rates on universal life loans can also be variable, unlike the typically fixed rates on whole life loans.

Variable Universal Life Insurance Loan Access

Variable universal life insurance policies provide a similar loan feature, but the cash value growth is directly linked to the performance of the underlying investment options chosen by the policyholder. This introduces greater risk and potential for higher returns (or losses), impacting the available loan amount. Loan availability and interest rates are both subject to change based on the policy’s investment performance and the insurer’s current rates.

Loan Feature Comparison Table

The following table summarizes the key differences in loan features across these three policy types:

| Policy Type | Loan Availability | Interest Rates | Loan Limits |

|---|---|---|---|

| Whole Life | Generally readily available; based on cash value | Typically fixed, often lower than market rates | Up to the policy’s cash value |

| Universal Life | Available, but dependent on current cash value; may fluctuate | Variable; can adjust over time | Up to the policy’s cash value |

| Variable Universal Life | Available, but highly dependent on fluctuating cash value; potentially less predictable | Variable; subject to market conditions and policy performance | Up to the policy’s cash value |

Accessing the Loan Value

Accessing the cash value of your life insurance policy is generally a straightforward process, but the specifics vary depending on your insurer and the type of policy you hold. Understanding the steps involved and the necessary documentation will ensure a smooth and efficient loan application.

The process typically begins with contacting your insurance company. You can usually initiate this by phone, mail, or through their online portal. You’ll need to provide your policy number and request a loan application. The insurer will then send you the necessary forms, outlining the terms and conditions of the loan, including interest rates and repayment options. Once completed, you submit the application along with the required documentation. The insurer reviews the application, and once approved, the loan proceeds are usually disbursed within a few business days, though this timeframe can vary.

Required Documentation

Securing a loan against your life insurance policy requires providing certain documents to verify your identity and policy details. These typically include a completed loan application form, a copy of your policy, and government-issued identification, such as a driver’s license or passport. Depending on the loan amount or your insurer’s requirements, additional documentation might be needed, such as proof of income or bank statements. Failure to provide the necessary documentation can delay the loan approval process.

Beneficial Scenarios for Borrowing

Borrowing against your life insurance policy can be a valuable financial tool in various situations. For instance, it can provide a quick source of funds for unexpected emergencies, such as significant medical expenses or home repairs. The loan can also help bridge short-term financial gaps, such as covering tuition fees or unexpected job loss. It’s crucial to remember that this is a loan and must be repaid with interest; therefore, careful consideration of the repayment plan is essential before taking out a loan. For example, a family facing a sudden, large medical bill might utilize a policy loan to cover immediate costs without needing to sell assets or deplete savings. Similarly, someone facing unexpected unemployment might use a policy loan to cover living expenses until they find new employment.

Interest Rates and Fees

Understanding the financial implications of borrowing against your life insurance policy is crucial. This section details how interest rates are determined, Artikels potential fees, and compares these loans to other borrowing options. Knowing these details will help you make an informed decision about whether a life insurance loan is the right choice for your financial needs.

Interest rates on life insurance loans are typically variable and are based on several factors. These include the current market interest rates, the type of policy, the insurer’s risk assessment of the policyholder, and the length of the loan term. Generally, the rates are higher than those offered on savings accounts but may be lower than other forms of borrowing, especially if your policy has accumulated significant cash value. The insurer will clearly state the interest rate at the time of the loan application. It’s important to note that the interest accrued is typically added to the loan balance, increasing the total amount owed.

Life Insurance Loan Fees

Several fees can be associated with obtaining a life insurance loan. These fees can vary significantly depending on the insurance company and the specific policy. Common fees include loan origination fees (a one-time fee for processing the loan), administrative fees (for ongoing management of the loan), and potential early repayment penalties if you choose to pay off the loan before the agreed-upon term. Some insurers might also charge a higher interest rate if the loan-to-cash-value ratio exceeds a certain threshold. It is essential to carefully review the policy documents and any loan agreement to fully understand all associated costs before proceeding.

Comparison of Loan Options

The following table compares the interest rates and fees associated with life insurance loans to those of personal loans and home equity loans. Keep in mind that these are typical rates and fees, and actual amounts can vary depending on your creditworthiness, the lender, and other factors. Using this information, you can compare the cost-effectiveness of different borrowing options.

| Loan Type | Typical Interest Rate | Fees | Advantages/Disadvantages |

|---|---|---|---|

| Life Insurance Loan | Variable, typically 4-8% | Loan origination fee, administrative fees, potential early repayment penalties | Advantages: Often lower interest rates than personal loans; readily available if sufficient cash value exists. Disadvantages: Interest accrues, potentially reducing policy death benefit; may affect policy’s cash value growth; specific terms and conditions vary widely by insurer. |

| Personal Loan | Variable, typically 6-20% | Origination fee, prepayment penalties (sometimes) | Advantages: Flexible loan amounts and terms; readily available from banks and credit unions. Disadvantages: Higher interest rates than life insurance loans (often); requires a credit check; may affect credit score. |

| Home Equity Loan | Fixed or Variable, typically 4-8% | Closing costs, appraisal fees, potential prepayment penalties | Advantages: Lower interest rates than personal loans; tax deductible interest (in some cases). Disadvantages: Requires homeownership; risks foreclosure if loan is not repaid; loan amount is limited by home equity. |

Risks and Considerations

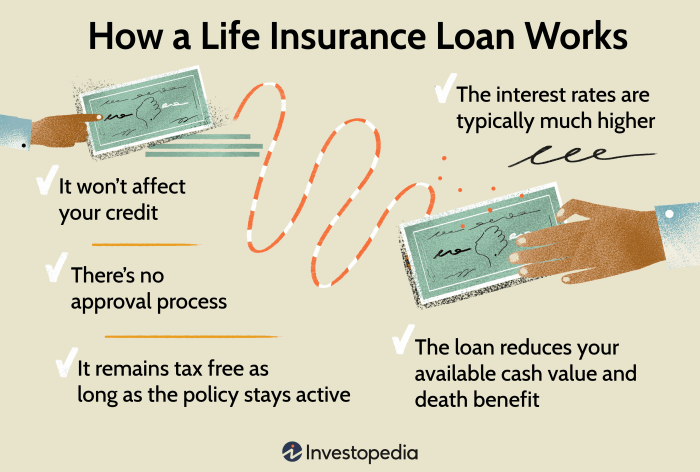

Borrowing against your life insurance policy, while offering financial flexibility, carries inherent risks that require careful consideration. Understanding these potential downsides is crucial before taking out a loan. Failing to do so could significantly impact your financial well-being and the ultimate benefit for your beneficiaries.

Borrowing against your life insurance policy isn’t without its potential drawbacks. While it offers a convenient source of funds, it’s essential to weigh the potential negative consequences against the short-term benefits. The most significant risks revolve around repayment, the impact on your death benefit, and the overall cost of borrowing.

Consequences of Loan Default

Failure to repay a life insurance loan can have serious repercussions. The most common outcome is the policy lapsing. This means the insurance company will terminate the policy, and you will lose all accumulated cash value and future death benefit protection. This loss can be substantial, especially if the policy has been in effect for many years. In some cases, the insurer may use the cash value to repay the outstanding loan, leaving nothing for the policyholder or their beneficiaries. The severity of the consequences depends on the policy type, the loan amount, and the insurer’s specific policies regarding loan defaults. For example, a term life insurance policy offers no cash value to borrow against, while whole life policies generally do. The specific terms of your policy should be carefully reviewed.

Impact on Death Benefit

The death benefit of your life insurance policy can be significantly affected by outstanding loans. The amount your beneficiaries receive will be reduced by the outstanding loan balance and any accrued interest. This reduction can dramatically decrease the financial protection intended for your loved ones. Imagine a policy with a $500,000 death benefit and a $100,000 outstanding loan. The beneficiaries would only receive $400,000. This reduction is a direct consequence of borrowing against the policy and is a critical factor to consider when evaluating this financial strategy.

Interest Rates and Fees

Life insurance loans typically accrue interest, which can add to the overall cost of borrowing. These interest rates can be relatively high compared to other loan options. Furthermore, many policies also include administrative fees associated with the loan process. These fees can vary depending on the insurance company and the policy type. It is essential to understand the total cost of borrowing, including interest and fees, before deciding to take out a loan. Ignoring these costs can lead to a significantly higher overall debt burden. Always compare interest rates and fees with other potential borrowing sources to ensure you’re getting the best possible deal.

Alternatives to Borrowing

Borrowing against your life insurance policy can have significant long-term financial implications. Exploring alternative funding sources can help you avoid depleting your policy’s cash value and maintain its death benefit protection for your beneficiaries. Consider these alternatives, categorized for clarity, before resorting to a policy loan.

Short-Term Solutions for Immediate Needs

Short-term solutions are ideal for bridging a temporary financial gap. These options offer quick access to funds but may come with higher interest rates or fees compared to long-term strategies.

- Personal Loans: These loans from banks or credit unions are typically repaid over a set period, with fixed monthly payments. Pros: Relatively easy to obtain for good credit; fixed repayment schedule. Cons: Can have higher interest rates than other options; impacts credit score if not managed properly.

- Lines of Credit: Similar to a credit card, a line of credit provides access to funds as needed up to a pre-approved limit. Pros: Flexibility to borrow only what you need; revolving credit allows for repeated borrowing. Cons: Interest rates can fluctuate; requires responsible management to avoid high debt.

- Credit Cards: While convenient for small, short-term expenses, high-interest rates make them less suitable for larger sums or long-term financing. Pros: Widely accessible; convenient for small purchases. Cons: Extremely high interest rates can quickly accumulate debt; can negatively impact credit score.

Long-Term Solutions for Larger Expenses

For significant expenses like home renovations or education costs, long-term solutions offer more manageable repayment terms and potentially lower interest rates. However, they usually require more planning and preparation.

- Home Equity Loans or Lines of Credit (HELOC): Using your home’s equity as collateral, these loans offer lower interest rates than personal loans. Pros: Lower interest rates than unsecured loans; substantial borrowing power. Cons: Risk of foreclosure if payments are missed; reduces home equity.

- 401(k) Loans: Borrowing from your retirement savings plan can provide a relatively low-interest loan, but it reduces your retirement nest egg. Pros: Lower interest rates than most other options; payments go back into your retirement account. Cons: Reduces retirement savings; risks penalties if job is lost before loan is repaid.

- Selling Assets: Selling investments, a vehicle, or other non-essential assets can provide immediate cash without incurring debt. Pros: No interest payments; avoids additional debt. Cons: Loss of asset value; may require finding a buyer.

Illustrative Examples

Let’s examine how life insurance loans can be utilized in different real-life scenarios, highlighting both the advantages and potential drawbacks. Understanding these examples can help you assess the suitability of borrowing against your life insurance policy.

The following scenarios illustrate the practical applications and consequences of borrowing against your life insurance policy. It’s crucial to carefully weigh the pros and cons before making a decision.

Home Improvements Loan

The Miller family needed to renovate their aging home. Facing rising repair costs, they considered various financing options. They had a significant cash value built up in their whole life insurance policy. They decided to borrow $30,000 against their policy to fund the kitchen and bathroom renovations. The loan process involved completing an application, providing necessary documentation, and undergoing a brief underwriting review. The funds were disbursed promptly, allowing the Millers to begin the renovations immediately. The renovations increased their home’s value and improved their quality of life. The Millers planned to repay the loan gradually over several years, ensuring that the interest payments were manageable within their budget. However, they also understood that if they failed to repay the loan, it would reduce their death benefit.

Unexpected Medical Expenses Loan

Following a sudden illness, the Garcia family incurred substantial medical expenses. Their health insurance covered a portion, but significant out-of-pocket costs remained. They had a term life insurance policy with a cash value component. They decided to borrow $15,000 against the policy to cover these unexpected medical bills. Accessing the funds was relatively straightforward; they submitted an application and received the money within a few business days. This quick access to funds prevented the family from facing financial hardship. However, the interest charged on the loan increased their overall debt. The Garcias are working diligently to repay the loan, but they acknowledge that the interest payments represent an added financial burden.

Loan Default Impact on Death Benefit

Mr. Jones borrowed heavily against his universal life insurance policy over several years to fund various personal expenses. Due to unforeseen circumstances, he was unable to keep up with the loan repayments. Consequently, the outstanding loan balance grew substantially. Upon Mr. Jones’s death, the death benefit payable to his beneficiaries was significantly reduced by the outstanding loan amount and accrued interest. Instead of receiving the full $200,000 death benefit, his beneficiaries received a substantially smaller amount. This scenario highlights the importance of responsible borrowing and the potential impact on the intended beneficiaries. Careful financial planning and regular loan repayments are crucial to avoid this outcome.

Final Review

Borrowing against your life insurance policy can be a powerful financial tool, offering access to funds when you need them most. However, careful consideration of the interest rates, fees, and potential impact on your death benefit is essential. By weighing the advantages and disadvantages, and understanding the alternatives, you can make an informed decision that aligns with your financial goals and risk tolerance. Remember to consult with a financial advisor to personalize your strategy.

Q&A

What happens if I die with an outstanding loan on my life insurance policy?

The outstanding loan amount, along with any accrued interest, will be deducted from your death benefit before it’s paid to your beneficiaries.

Can I borrow 100% of my policy’s cash value?

No, most insurers impose loan-to-cash value ratios, typically ranging from 80% to 90%, meaning you can’t borrow the entire accumulated value.

Are there any tax implications for the interest paid on a life insurance loan?

Generally, interest paid on life insurance loans isn’t tax-deductible. However, this can vary depending on your specific circumstances and local tax laws; consulting a tax professional is advisable.

What are the typical processing times for a life insurance loan?

Processing times vary by insurer, but generally range from a few days to a couple of weeks. Providing all necessary documentation promptly can expedite the process.

What if I can’t repay the loan on my life insurance policy?

Failure to repay the loan can lead to the policy lapsing, meaning you lose the coverage and any accumulated cash value. The insurer may also pursue collection actions.