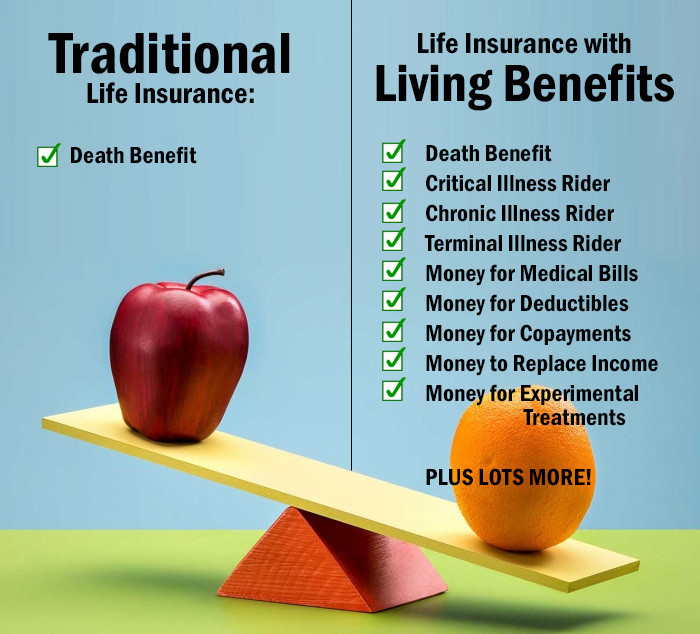

Life insurance, traditionally viewed as a safety net for loved ones after death, is evolving. The emergence of living benefits offers a compelling alternative, providing financial assistance during critical illnesses or long-term care needs while you’re still alive. This exploration delves into the intricacies of accessing these crucial benefits, examining their financial implications, eligibility criteria, and comparisons with other financial tools. We’ll uncover how these benefits can transform a challenging situation into a manageable one, offering peace of mind and financial security when it matters most.

Understanding living benefits involves grasping the diverse types available, such as accelerated death benefits and chronic illness riders. We’ll dissect the application process, highlighting necessary documentation and factors influencing approvals. A crucial aspect is the financial landscape—examining tax implications, comparing advantages against other resources, and showcasing real-world scenarios where living benefits have made a significant difference.

Defining Living Benefits

Life insurance is traditionally associated with providing financial security for loved ones after death. However, many modern policies offer “living benefits,” which allow policyholders to access a portion of their death benefit while they are still alive. These benefits are designed to provide financial assistance during times of significant illness or injury, offering a crucial safety net when facing unexpected medical expenses or loss of income.

Living benefits essentially provide a way to tap into your life insurance policy’s funds for specific circumstances before your death. This allows you to utilize the financial resources you’ve built up to address critical needs, rather than leaving the entire benefit for your beneficiaries. The availability and specifics of these benefits vary considerably depending on the insurer and the policy type.

Types of Living Benefits

Several types of living benefits are commonly offered. Understanding these variations is essential to making an informed decision when choosing a life insurance policy. These options offer flexibility in addressing different health crises.

- Accelerated Death Benefit: This allows you to receive a portion of your death benefit if you are diagnosed with a terminal illness, typically with a life expectancy of less than 12 months. The amount received can vary depending on the policy and the insurer’s guidelines. For example, a policyholder diagnosed with terminal cancer might receive 50% of their death benefit to cover medical expenses and other end-of-life costs.

- Chronic Illness Rider: This rider provides a lump-sum payment or regular payments if you are diagnosed with a chronic illness that significantly impairs your ability to perform activities of daily living. Chronic illnesses covered often include Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis. The payout can be used to cover long-term care expenses, home modifications, or other related costs. A person diagnosed with ALS, for instance, might receive funds to cover specialized medical equipment and in-home care.

- Critical Illness Rider: This rider provides a lump-sum payment upon diagnosis of a specified critical illness, such as heart attack, stroke, or cancer. This payment can be used to cover treatment costs, lost income, or other expenses associated with the illness. A person suffering a major heart attack, for example, could utilize the funds for rehabilitation and medication.

Examples of Living Benefit Utilization

Living benefits can be invaluable in numerous situations, providing crucial financial support during difficult times.

Imagine a family facing a sudden critical illness diagnosis for a parent. The accelerated death benefit or critical illness rider could provide the funds needed for expensive treatments, medication, and lost income. Similarly, a person diagnosed with a chronic illness requiring extensive long-term care could utilize the chronic illness rider to cover the costs of assisted living facilities or in-home care, preserving their financial stability and quality of life. These benefits can also help alleviate the financial strain on families, allowing them to focus on the patient’s care rather than worrying about mounting medical bills. The financial burden is significantly reduced, allowing for a better focus on recovery and well-being.

Accessing Living Benefits

Accessing the funds from your life insurance policy’s living benefits requires a formal application process. This process, while varying slightly between insurance providers, generally involves submitting a claim and providing supporting documentation to substantiate your need for the funds. The speed and success of your claim will depend on several factors, including the type of benefit, your policy terms, and the accuracy and completeness of your application.

The application process typically begins with contacting your insurance provider. You’ll likely need to complete a claim form, which will ask for detailed information about your health condition, the purpose for which you’re requesting the funds, and supporting documentation. This process is designed to ensure the legitimacy of your claim and to comply with regulatory requirements.

Application and Claim Process

After contacting your insurance provider, you will typically receive a claim form and instructions for completing it accurately. This form will request detailed personal information, including policy details, medical history, and the specific living benefit you are seeking to access. You’ll need to clearly describe your situation and the reason you need the funds, providing supporting documentation to verify your claim. The provider will then review your application, which might involve additional requests for information or clarification. Finally, once the review is complete, they will notify you of their decision regarding your claim.

Required Documentation

The documentation required to support a living benefits claim varies depending on the specific benefit and the insurer. However, common documents include a completed claim form, medical records from your physician documenting your diagnosis and prognosis, and possibly financial statements if the benefit is linked to specific financial hardships. In some cases, you might also need to provide proof of income, statements from other healthcare providers, or other documentation supporting your claim. It’s always best to gather all relevant documents beforehand to streamline the application process. For example, if you’re claiming accelerated death benefits due to a terminal illness, you’ll likely need a physician’s statement confirming your diagnosis and prognosis, including life expectancy.

Factors Influencing Approval and Payout Amounts

Several factors influence the approval of your living benefits claim and the final payout amount. The primary factor is the specific terms and conditions Artikeld in your life insurance policy. The type of living benefit you’re claiming (e.g., accelerated death benefit, chronic illness benefit, or long-term care benefit) will determine the eligibility criteria and the maximum payout. The severity and prognosis of your illness also play a significant role, particularly for benefits tied to terminal or chronic illnesses. Your insurer may require independent medical examinations to verify your condition and prognosis. Furthermore, the policy’s face value and the amount already paid out will influence the potential payout amount. For instance, a policy with a higher face value will typically allow for a larger payout, but the payout might be reduced if a portion of the death benefit has already been accessed through other living benefits. Finally, the insurer’s underwriting guidelines and internal policies also play a role in the final decision.

Financial Implications of Living Benefits

Accessing living benefits from a life insurance policy can have significant financial implications, both positive and negative. Understanding these implications is crucial before making any decisions about utilizing this feature. Careful consideration of tax liabilities and comparison with alternative financial resources are essential.

Tax Implications of Accessing Living Benefits

Tax Implications of Living Benefits

The tax implications of accessing living benefits vary depending on the specific type of policy and how the benefits are accessed. Generally, withdrawals from a life insurance policy’s cash value may be subject to income tax on any earnings above the cost basis. This cost basis represents the premiums paid into the policy, minus any prior withdrawals. For example, if you’ve paid $50,000 in premiums and have a cash value of $75,000, only the $25,000 gain would be potentially taxable upon withdrawal. However, loans against the policy’s cash value are typically not taxed, though interest may accrue. It’s crucial to consult with a tax advisor to understand the specific tax implications based on your individual circumstances and policy type. Furthermore, the rules and regulations regarding tax implications are subject to change, making professional consultation essential.

Comparison of Living Benefits with Other Financial Resources

Living benefits offer a unique financial resource compared to other options like savings accounts, retirement accounts, or home equity loans. While savings accounts and retirement accounts provide readily accessible funds, they may not offer the same level of potential growth as a life insurance policy. Home equity loans, while offering access to a significant amount of capital, require the collateral of your home. Living benefits, particularly policy loans, can offer access to funds without the need to sell assets or incur significant debt, but they reduce the death benefit available to beneficiaries. The decision to utilize living benefits depends on an individual’s risk tolerance, financial goals, and overall financial situation. A thorough comparison of all available options, considering both short-term and long-term financial implications, is essential.

Hypothetical Scenario Demonstrating Financial Impact

Let’s consider Sarah, a 60-year-old woman diagnosed with a serious illness requiring extensive medical treatment. She has a life insurance policy with a cash value of $150,000 and a death benefit of $250,000. Facing significant medical expenses, Sarah decides to access $50,000 through a policy loan. This loan does not immediately incur income tax, but interest will accrue. This allows her to cover immediate medical costs without depleting her savings or taking out a high-interest loan. However, the death benefit payable to her beneficiaries will be reduced to $200,000 after accounting for the loan and accrued interest. This demonstrates the trade-off inherent in utilizing living benefits: immediate financial relief at the cost of a reduced death benefit. A comprehensive financial plan accounting for both short-term needs and long-term implications is crucial in making informed decisions.

Eligibility and Limitations

Accessing living benefits from a life insurance policy isn’t a guaranteed right; it’s subject to specific criteria and limitations Artikeld in the policy contract. Understanding these eligibility requirements and restrictions is crucial before relying on these benefits. Eligibility often hinges on the severity and documentation of a qualifying illness or injury, while limitations might include benefit caps, waiting periods, and exclusions for certain conditions.

Eligibility for living benefits typically centers around the insured individual’s health status. The policy will specify the types of critical illnesses, chronic conditions, or terminal illnesses that qualify for benefit payouts. Commonly included are conditions like cancer, heart attack, stroke, kidney failure, and other life-threatening diseases. However, the specific definition of each condition, including required diagnostic criteria and severity levels, will vary among insurers and policy types. Detailed medical documentation, such as physician’s statements, test results, and hospital records, is usually required to substantiate a claim.

Qualifying Health Conditions

Policies typically list specific conditions that qualify for living benefits. These lists are not exhaustive and may vary significantly between insurers. For example, one policy might cover only a small number of critical illnesses, while another might offer broader coverage for a wider range of conditions, including those requiring long-term care. The policy document will explicitly state which illnesses or injuries are covered and the required severity for benefit activation. It is vital to carefully review this section of the policy to understand what is and is not covered. For instance, a policy might cover a heart attack resulting in hospitalization, but not a less severe cardiac event requiring only outpatient care.

Limitations and Exclusions

Even if an insured individual meets the criteria for a qualifying condition, several limitations and exclusions can affect the payout amount or eligibility. These limitations are often detailed in the policy’s fine print. Common limitations include benefit caps, which set a maximum payout amount regardless of the total medical expenses incurred. Waiting periods, often ranging from several months to a year, might also apply before benefits become accessible after a diagnosis. Furthermore, many policies exclude pre-existing conditions, meaning illnesses or injuries diagnosed before the policy’s effective date. Other exclusions might encompass conditions stemming from self-inflicted injuries, risky behaviors, or participation in illegal activities.

Examples of Denied or Restricted Claims

Consider a scenario where an individual is diagnosed with early-stage cancer. While cancer is generally covered, the policy might stipulate that benefits are only payable if the cancer is deemed “terminal” or meets specific staging criteria. If the cancer is in its early stages and highly treatable, the claim might be denied or restricted. Another example involves a person suffering a stroke but not meeting the policy’s definition of a “major stroke” based on neurological impairment or functional limitations. In such cases, the claim for living benefits could be denied or reduced. Similarly, if an individual’s health condition is deemed to be primarily due to a pre-existing condition not disclosed during the application process, the claim may be denied or severely limited. The specifics of each scenario will always depend on the individual policy’s terms and conditions.

Illustrative Examples

Understanding the practical application of living benefits is crucial. The following examples illustrate how these benefits can significantly impact families facing critical illnesses and substantial medical expenses. These scenarios are hypothetical but reflect real-world situations where living benefits have provided invaluable support.

Let’s consider a scenario where Sarah, a 45-year-old mother of two, is diagnosed with a serious illness requiring extensive treatment and rehabilitation. Her life insurance policy includes living benefits, allowing her to access a portion of her death benefit to cover medical bills, lost income, and childcare expenses. Without access to these funds, Sarah and her family would likely face overwhelming financial strain, potentially jeopardizing their home and their children’s future. However, with the living benefits, Sarah can focus on her recovery, knowing her family’s immediate needs are met. This allows for better management of her illness and a smoother path towards recovery.

A Family Utilizing Living Benefits to Cover Medical Expenses

Imagine a heartwarming scene: a family gathered in their living room. The father, recently diagnosed with cancer, is comfortably seated on a sofa, his wife gently holding his hand. Their two young children are playing quietly nearby, oblivious to the seriousness of the situation. The atmosphere, despite the gravity of the circumstances, is calm and hopeful. This is because the family is utilizing the living benefits from their life insurance policy. The financial burden of the father’s medical treatments, including chemotherapy and hospital stays, is significantly eased. The living benefits cover not only the direct medical expenses but also the lost income from the father’s inability to work, ensuring the family can maintain their living standards and avoid financial hardship. The vibrant colors of the children’s toys contrast subtly with the more muted tones of the room, representing the contrast between the children’s carefree lives and the serious challenges faced by the parents. The scene is bathed in the soft glow of late afternoon sunlight streaming through a nearby window, symbolizing hope and resilience amidst adversity.

Positive Impact of Living Benefits on Family Financial Stability: A Case Study

Consider the Johnson family. Mr. Johnson, a successful entrepreneur, was diagnosed with a debilitating stroke. His medical bills were astronomical, and he was unable to work for an extended period. However, their life insurance policy included substantial living benefits. These benefits covered the majority of his medical expenses, enabling them to retain their home, avoid accumulating significant debt, and ensure their children’s education wasn’t compromised. The family’s financial stability was maintained, allowing them to focus on Mr. Johnson’s recovery and their emotional well-being. Without living benefits, the Johnson family faced the prospect of financial ruin, a burden that would have compounded the stress of dealing with a serious illness. The living benefits provided a crucial safety net, allowing them to navigate this challenging period with relative stability and peace of mind. This example underscores the significant role living benefits play in mitigating financial risks associated with critical illnesses.

Comparison with Other Financial Tools

Choosing the right financial tool depends heavily on individual circumstances and financial goals. While life insurance with living benefits offers unique advantages, it’s crucial to compare it against other options like Health Savings Accounts (HSAs) and disability insurance to determine the best fit. This comparison highlights the strengths and weaknesses of each, enabling informed decision-making.

Understanding the nuances of each financial tool allows for a more strategic approach to financial planning. This section provides a clear overview of how living benefits compare to HSAs and disability insurance, outlining scenarios where one might be more beneficial than the others.

Comparison of Financial Tools

| Financial Tool | Purpose | Advantages | Disadvantages |

|---|---|---|---|

| Life Insurance with Living Benefits | Provides a death benefit and allows access to a portion of the policy’s cash value for specific needs (e.g., critical illness, long-term care) while you’re still alive. | Provides a safety net for unexpected medical expenses or long-term care needs; death benefit protects beneficiaries; potential tax advantages depending on the policy structure. | Can be more expensive than other options; access to funds may be limited by policy terms and conditions; may not be suitable for all financial situations. The return on investment may be lower than other investment options. |

| Health Savings Account (HSA) | Tax-advantaged savings account used to pay for qualified medical expenses. | Triple tax advantage (contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free); funds can be used for future medical expenses; money rolls over year to year. | Only available to individuals enrolled in a high-deductible health plan (HDHP); limited to qualified medical expenses; withdrawals for non-medical expenses are subject to taxes and penalties. |

| Disability Insurance | Provides income replacement in the event of a disabling illness or injury that prevents you from working. | Replaces a portion of your income during disability; can help maintain your lifestyle and financial stability; various policy options are available to meet individual needs. | Premiums can be expensive, particularly for comprehensive coverage; approval of claims can be complex; may not cover all types of disabilities or conditions; waiting periods before benefits begin. |

Circumstances Favoring Living Benefits

Living benefits may be a more suitable option than HSAs or disability insurance when facing significant, unexpected medical expenses, especially those related to critical illnesses or long-term care needs that are not fully covered by health insurance or other resources. For example, a diagnosis of a serious illness requiring extensive treatment and rehabilitation could necessitate the use of living benefits to cover costs exceeding HSA limits or the coverage offered by disability insurance, which may not cover all medical expenses. Furthermore, if an individual anticipates needing long-term care in the future, living benefits could help offset the substantial financial burden this often entails. In contrast, HSAs are primarily for routine medical expenses and disability insurance focuses on income replacement.

Final Conclusion

In conclusion, the incorporation of living benefits into life insurance policies represents a significant advancement in financial planning. By offering access to funds during times of critical need, these benefits alleviate financial burdens associated with debilitating illnesses and long-term care. While understanding eligibility criteria and limitations is essential, the potential for enhanced financial security and peace of mind makes exploring living benefits a prudent step for anyone seeking comprehensive financial protection. The ability to proactively address potential future challenges, rather than reactively facing them, underscores the value proposition of this evolving aspect of life insurance.

Query Resolution

What is the difference between an accelerated death benefit and a chronic illness rider?

An accelerated death benefit allows you to access a portion of your death benefit early if you have a terminal illness. A chronic illness rider provides benefits for specific chronic conditions, even if you are not terminally ill.

Can I use living benefits for any illness?

No, eligibility typically requires a serious illness meeting specific criteria defined in your policy. Review your policy’s terms and conditions for a complete list of qualifying conditions.

How does the payout from living benefits work?

Payouts vary depending on the policy and the specific benefit. It might be a lump sum or structured payments. The amount is usually a percentage of the death benefit, and the remaining death benefit may be reduced.

Will using living benefits affect my beneficiaries?

Yes, accessing living benefits will reduce the death benefit payable to your beneficiaries upon your death. The extent of the reduction depends on the amount accessed.

Are there any tax implications associated with receiving living benefits?

The tax implications can vary and depend on several factors, including the type of policy and the specific circumstances. It’s crucial to consult with a tax professional to understand the potential tax consequences.