Protecting your Limited Liability Company (LLC) from potential financial ruin is paramount. This guide delves into the crucial role of LLC general liability insurance, explaining its core purpose, coverage, and the process of obtaining and utilizing this essential protection. We’ll explore various scenarios, highlighting the importance of understanding policy details and navigating the claims process effectively.

From defining the fundamental aspects of this insurance to providing practical advice on purchasing and utilizing a policy, this resource aims to empower LLC owners with the knowledge needed to make informed decisions about their risk management strategies. We will cover key factors influencing cost, common exclusions, and offer a step-by-step approach to navigating the entire insurance lifecycle.

Defining LLC General Liability Insurance

Protecting your Limited Liability Company (LLC) from financial ruin due to unforeseen circumstances is paramount. General liability insurance serves as a crucial safety net, covering a broad range of potential liabilities your business might face. Understanding its purpose and application is vital for any LLC owner.

General liability insurance for LLCs safeguards your business against financial losses stemming from accidents, injuries, or property damage caused by your business operations or employees. It acts as a buffer, protecting your personal assets even if your LLC is sued. This protection is particularly important given the limited liability offered by an LLC structure, which, while protecting personal assets from business debts, doesn’t always cover liability claims.

Types of Businesses Needing General Liability Insurance

Many types of businesses benefit significantly from general liability insurance. The level of risk varies across industries, but the potential for accidents or incidents leading to liability claims exists in almost every business operation. The need for this insurance is not determined by size, but rather by the inherent risks associated with the nature of the business.

Examples of Crucial Insurance Applications

Several situations highlight the critical role of general liability insurance. Consider a customer slipping and falling on your premises, resulting in injury. Or, imagine a product manufactured by your LLC causing damage to a client’s property. These are common scenarios where general liability insurance would cover legal fees, medical expenses, and property damage settlements, preventing significant financial hardship for the LLC. Further, if a client accuses your business of negligence resulting in financial loss, this insurance can provide crucial coverage for related expenses.

Comparison with Other Business Structures

While the core function of general liability insurance remains consistent across different business structures, the implications of not having it can vary. For sole proprietorships and partnerships, a lack of insurance can directly expose personal assets to liability claims. LLCs offer some protection by separating business and personal assets, but general liability insurance provides an additional layer of security, safeguarding against claims that could potentially pierce the LLC’s liability shield. Corporations, similarly, benefit from this insurance as an extra layer of protection beyond the corporate veil, mitigating risks and protecting shareholder assets. In essence, regardless of the business structure, general liability insurance offers a vital financial safeguard.

Coverage Provided by LLC General Liability Insurance

LLC General Liability insurance offers crucial protection for your business against a range of potential risks. It acts as a financial safety net, covering various claims that could otherwise severely impact your company’s finances and reputation. Understanding the scope of this coverage is vital for effective risk management.

This type of insurance primarily protects your business from financial losses resulting from third-party bodily injury or property damage caused by your business operations. It also covers advertising injury and certain other liabilities. The policy typically covers incidents that occur during the policy period, regardless of when the claim is filed. The specifics of coverage can vary depending on the policy and the insurer.

Commonly Covered Claims

A standard general liability policy typically covers a wide array of claims. These are often categorized into specific areas of liability, providing a comprehensive level of protection for your business. Understanding these categories allows business owners to assess their exposure to risk and choose appropriate coverage levels.

- Bodily Injury: This covers medical expenses, lost wages, and pain and suffering resulting from injuries sustained by a third party on your business premises or as a result of your business operations. For example, a customer slipping and falling in your store.

- Property Damage: This covers the cost of repairing or replacing property belonging to a third party that was damaged due to your business operations. For example, a delivery truck accidentally damaging a customer’s fence.

- Advertising Injury: This covers claims arising from libel, slander, copyright infringement, or other misleading advertising. For instance, a false statement in an advertisement leading to a lawsuit.

- Medical Payments: This covers medical expenses for third parties injured on your premises or as a result of your business operations, regardless of fault. This helps to foster goodwill and potentially avoid more costly lawsuits.

Policy Exclusions and Limitations

It’s crucial to understand that general liability policies do have exclusions and limitations. These are specific situations or types of claims that are not covered under the policy. Carefully reviewing these exclusions is vital to avoid surprises in the event of a claim.

- Expected or Intended Injury: Intentionally causing harm is generally excluded. For example, a deliberate assault by an employee.

- Employee Injuries: Injuries to your employees are typically covered under workers’ compensation insurance, not general liability.

- Pollution or Environmental Damage: Many policies exclude pollution-related incidents, requiring separate environmental liability insurance.

- Contractual Liability: Liability assumed under a contract is usually not covered unless specifically included as an endorsement.

- Auto Accidents: Damage caused by owned or hired vehicles typically requires separate commercial auto insurance.

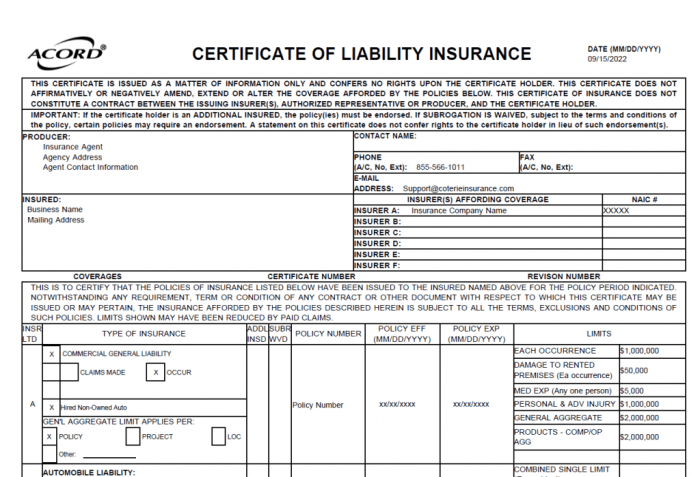

Sample Policy Highlights

A sample policy might Artikel coverage in the following manner, though specific details will vary by insurer and policy:

| Coverage Area | Coverage Limit | Deductible |

|---|---|---|

| Bodily Injury | $1,000,000 per occurrence | $500 |

| Property Damage | $1,000,000 per occurrence | $500 |

| Advertising Injury | $1,000,000 per occurrence | $500 |

| Medical Payments | $5,000 per occurrence | $0 |

This is a simplified example. Actual policies are significantly more detailed and include specific definitions, conditions, and exclusions.

Understanding Policy Limits and Deductibles

Policy limits and deductibles are critical components of any general liability policy. Understanding these aspects ensures you are adequately protected and prepared for potential financial responsibility.

Policy Limits represent the maximum amount the insurer will pay for covered claims. In the sample above, the limit is $1,000,000 per occurrence for bodily injury and property damage. This means the insurer will not pay more than this amount for a single incident, regardless of the actual losses. Choosing appropriate limits depends on your business’s risk profile and potential exposure to large claims. A higher limit provides greater protection but also comes with a higher premium.

Deductibles are the amount you, the policyholder, are responsible for paying before the insurance coverage kicks in. In the example, the deductible is $500 per occurrence. This means you will have to pay the first $500 of any covered claim. Higher deductibles generally lead to lower premiums, but you bear more financial risk upfront.

Choosing the right policy limits and deductibles requires careful consideration of your business’s risk profile and financial capacity. Consulting with an insurance professional is highly recommended.

Factors Affecting the Cost of LLC General Liability Insurance

Several key factors influence the cost of general liability insurance for your LLC. Understanding these factors can help you secure the best possible coverage at a competitive price. Premiums are determined through a risk assessment process, considering both inherent and controllable aspects of your business.

Business Size Impact on Premiums

The size of your business significantly impacts your insurance premiums. Larger businesses, with more employees and higher revenue, generally face higher premiums. This is because larger operations often have a greater potential for incidents leading to liability claims. For example, a large construction firm with numerous employees and projects carries a higher risk profile than a small home-based consulting business. Insurers consider factors such as the number of employees, annual revenue, and the overall scope of operations when calculating premiums. Larger operations typically have more potential exposures to liability claims, hence the higher cost.

Industry Type and Insurance Costs

The type of industry in which your LLC operates is a major determinant of your insurance costs. High-risk industries, such as construction, manufacturing, or healthcare, typically have higher premiums due to the increased likelihood of accidents and injuries. Conversely, businesses in lower-risk industries, such as consulting or administrative services, may qualify for lower premiums. The inherent risks associated with specific tasks, the use of equipment, and the potential for property damage all play a significant role. For instance, a restaurant faces higher risks related to foodborne illnesses and slip-and-fall accidents compared to a software development company.

Factors Increasing or Decreasing Insurance Premiums

Numerous factors can influence your insurance premiums, either increasing or decreasing their cost. A strong safety record, for example, can lead to lower premiums, as demonstrated by businesses with comprehensive safety programs and few prior claims. Conversely, a history of claims or violations can significantly increase premiums. Other factors include the location of your business (higher crime rates can lead to higher premiums), the type of coverage you choose (higher coverage limits generally mean higher premiums), and the claims history of your business (a history of claims increases premiums). Furthermore, implementing risk management strategies, such as thorough employee training and safety protocols, can often lead to lower premiums.

Cost Factor Comparison for Different Business Types

| Business Type | Typical Premium Range | Factors Affecting Cost | Risk Level |

|---|---|---|---|

| Software Development | $300 – $800 per year | Low employee count, low risk of physical injury | Low |

| Restaurant | $500 – $1500 per year | Higher risk of slips, trips, falls; foodborne illness | Medium |

| Construction | $1000 – $3000+ per year | High risk of workplace injuries; property damage | High |

| Healthcare Clinic | $1500 – $5000+ per year | Medical malpractice risk; potential for serious injury | High |

Purchasing LLC General Liability Insurance

Securing the right general liability insurance for your LLC involves a multi-step process that requires careful consideration and comparison. Understanding the process, from obtaining quotes to comparing policy options, is crucial for protecting your business.

Obtaining Quotes from Different Insurance Providers involves actively seeking out multiple insurance companies and requesting quotes based on your specific business needs. This comparative approach ensures you find the most suitable coverage at the best price.

Obtaining Insurance Quotes

The process of obtaining quotes typically begins with online searches or referrals. Many insurance providers offer online quote tools where you input basic business information, allowing for a quick comparison of preliminary pricing. It’s recommended to contact several insurance providers directly, both large national companies and smaller, regional insurers. Each provider may offer different coverage options and pricing structures. During these interactions, be prepared to provide detailed information about your business, including its size, location, industry, and the nature of your operations. This information allows insurers to accurately assess your risk profile and provide a tailored quote.

Applying for General Liability Insurance

Applying for general liability insurance typically involves completing an application form provided by the insurer. This form will request comprehensive information about your business, including its legal structure, address, business activities, number of employees, and annual revenue. You may also be asked to provide details about any prior insurance claims or incidents. Accuracy is paramount in this process; inaccurate information can lead to policy rejection or disputes later. After submitting the application, the insurer will review your information and may request further documentation, such as proof of business registration or financial statements. Once the application is approved, the insurer will issue a policy document outlining the terms and conditions of your coverage.

Comparing Policy Options and Features

Once you receive quotes from multiple providers, carefully compare the policies. Don’t focus solely on price; consider the coverage limits, deductibles, exclusions, and any additional features offered. Higher coverage limits provide greater protection in case of a significant claim, while a lower deductible means you pay less out-of-pocket in the event of a covered incident. Pay close attention to exclusions—specific events or circumstances not covered by the policy. Some policies may offer additional features, such as legal defense coverage or product recall protection, which can significantly enhance your protection.

Checklist Before Purchasing a Policy

Before committing to a policy, review this checklist:

- Verify the insurer’s financial stability and reputation.

- Ensure the policy’s coverage limits adequately protect your business’s assets and potential liabilities.

- Carefully review all exclusions and limitations within the policy.

- Understand the policy’s deductible and how it will impact your out-of-pocket expenses.

- Compare premiums from multiple providers to ensure you’re receiving competitive pricing.

- Confirm the policy’s renewal process and terms.

- Read the entire policy document thoroughly before signing.

Claims Process for LLC General Liability Insurance

Filing a claim with your general liability insurance provider is a crucial step in protecting your LLC from financial losses resulting from covered incidents. Understanding the process, required documentation, and effective communication strategies will significantly improve your chances of a successful claim resolution.

Steps Involved in Filing a Claim

Prompt notification to your insurer is paramount. Generally, you should contact your insurance provider as soon as reasonably possible after an incident occurs. This allows them to begin investigating the claim promptly. Following the initial notification, your insurer will guide you through the specific steps required for your particular claim. This may involve completing claim forms, providing supporting documentation, and potentially participating in interviews or investigations. The process can vary depending on the complexity of the claim and the specific terms of your policy. Expect some back-and-forth communication as the insurer gathers information and assesses liability.

Documentation Required During the Claims Process

Comprehensive documentation is essential for a smooth claims process. This typically includes, but is not limited to, a completed claim form provided by your insurer, police reports (if applicable), medical records (if injuries are involved), witness statements, photographs or videos of the incident and any damages, and any relevant contracts or agreements. Maintaining meticulous records of all communication with your insurer is also crucial. Failure to provide complete and accurate documentation can significantly delay or even jeopardize your claim.

Examples of Common Claim Scenarios and Their Outcomes

A common scenario is a customer slipping and falling on your premises. If you have general liability insurance, and the incident is deemed your responsibility due to negligence (e.g., a wet floor without proper warning signs), your insurance would likely cover medical expenses for the injured customer and any legal costs associated with a potential lawsuit. Conversely, if the customer was negligent (e.g., ignoring clearly posted warning signs), your claim might be denied or partially covered. Another common scenario involves property damage caused by your business operations. For example, if a contractor working for your LLC accidentally damages a client’s property, your insurance would typically cover the cost of repairs or replacements, assuming the damage was accidental and not intentional. However, if the damage was caused by willful negligence or intentional actions, coverage might be limited or denied.

Effectively Communicating with the Insurance Provider During a Claim

Clear and concise communication is key. Respond promptly to all inquiries from your insurer, providing complete and accurate information. Maintain detailed records of all communication, including dates, times, and the names of individuals involved. If you have questions or concerns, do not hesitate to contact your insurer and request clarification. Professional and courteous communication will help foster a positive working relationship and facilitate a smoother claims process. Remember to follow up on any outstanding requests or actions, ensuring all necessary documentation is submitted in a timely manner.

Illustrative Scenarios and Case Studies

Understanding the practical applications of LLC general liability insurance is crucial. The following scenarios and case studies illustrate both successful claims and claim denials, highlighting the importance of this coverage for small businesses. They also demonstrate the potential financial ramifications of operating without adequate insurance.

Successful Property Damage Claim

Imagine Sarah, owner of “Sarah’s Sweet Treats,” a small bakery. A delivery truck, while making a turn, accidentally backs into Sarah’s storefront, causing significant damage to the window and interior. Sarah immediately contacts her insurance provider and files a claim, providing photos of the damage, a police report, and the delivery company’s insurance information. After investigation, the insurance company confirms the accident was not Sarah’s fault. They cover the cost of repairing the storefront, including replacing the window and repairing interior damage, totaling $10,000. Sarah’s business was able to resume operations quickly with minimal disruption thanks to her general liability insurance.

Claim Rejection Due to Policy Exclusion

John, owner of “John’s Handyman Services,” was hired to repair a homeowner’s roof. While working, he accidentally drops a tool, causing damage to the homeowner’s antique vase. John files a claim with his general liability insurer. However, his policy specifically excludes damage caused by intentional acts. Because the damage to the vase resulted from John’s actions while working on the roof, the insurance company determined the damage was not accidental. The claim was denied because the policy did not cover damage caused by negligence during the course of work. The homeowner then sued John for the cost of the vase. Without insurance to cover the liability, John faced significant personal financial repercussions.

Successful Utilization of General Liability Insurance by a Small Business

“EcoClean,” a small janitorial service, experienced a successful utilization of general liability insurance. During a routine cleaning at a client’s office, a cleaning solution was accidentally spilled, causing damage to a valuable carpet. EcoClean immediately reported the incident to their insurer. The claim was processed smoothly; the insurer covered the cost of professional carpet cleaning and repair, preventing a costly legal dispute and preserving the positive relationship with the client. This positive experience reinforced the value of having adequate insurance coverage for a small business.

Financial Implications Without Insurance

Consider a hypothetical scenario: A small coffee shop, “Brewtiful Mornings,” experiences a plumbing failure, causing significant water damage to the neighboring business. Without general liability insurance, “Brewtiful Mornings” would be solely responsible for the repair costs of the damaged property. If the damage is extensive, the costs could easily reach tens of thousands of dollars, potentially forcing the coffee shop to close permanently due to the financial burden. This illustrates the significant financial risk associated with operating a business without appropriate liability insurance.

Summary

Securing adequate LLC general liability insurance is not merely a financial precaution; it’s a strategic investment in the long-term viability and stability of your business. By understanding the intricacies of coverage, navigating the purchasing process with informed choices, and effectively managing claims, LLC owners can confidently mitigate risks and focus on growth. This guide serves as a foundational resource to navigate this essential aspect of business ownership, equipping you with the knowledge to protect your investment.

FAQ

What is the difference between LLC general liability insurance and other types of business insurance?

General liability insurance protects against common business risks like bodily injury or property damage caused by your business operations. Other types of insurance, like professional liability (errors & omissions) or commercial auto insurance, cover different specific risks.

How much does LLC general liability insurance typically cost?

Costs vary significantly depending on factors like business size, industry, location, and risk profile. Quotes from multiple insurers are essential for comparison.

Can I get general liability insurance if my LLC is brand new?

Yes, many insurers offer policies for newly formed LLCs. However, your premium may be higher initially due to a lack of established business history.

What happens if I file a false claim?

Filing a fraudulent claim is a serious offense and can lead to policy cancellation, denial of future claims, and potential legal consequences.

How long does it take to get a general liability insurance policy?

The process can typically be completed within a few days to a few weeks, depending on the insurer and the complexity of your application.