Navigating the world of liability insurance can feel overwhelming, especially when searching for affordable options. This guide demystifies the process of finding low cost liability insurance near you, providing a clear understanding of factors influencing price, coverage options, and the steps involved in securing the right policy. We’ll explore various policy types, compare local providers, and equip you with the knowledge to make informed decisions.

Understanding your liability risks is crucial. Whether you’re a homeowner, business owner, or simply want peace of mind, adequate liability insurance protects you from potentially devastating financial consequences. This guide will empower you to find the best balance between cost-effectiveness and comprehensive coverage, tailored to your specific needs and local market.

Understanding “Low Cost Liability Insurance Near Me”

Finding affordable liability insurance can feel overwhelming, but understanding the factors that influence cost and the various types of coverage available empowers you to make informed decisions. This section will clarify the key elements to consider when searching for “low cost liability insurance near me.”

Factors Influencing Liability Insurance Costs

Several factors significantly impact the cost of liability insurance. These include the type of coverage needed, the level of risk associated with your profession or activities, your claims history, and the location of your business or residence. For instance, a high-risk occupation like construction will generally command higher premiums than a lower-risk profession like teaching. Similarly, a business operating in a high-crime area might face higher premiums compared to one in a safer location. Your credit score can also play a role, with better credit often leading to lower rates. Finally, insurers consider the amount of coverage you request; higher coverage limits naturally lead to higher premiums.

Types of Liability Insurance Policies

Liability insurance comes in several forms, each designed to address specific risks.

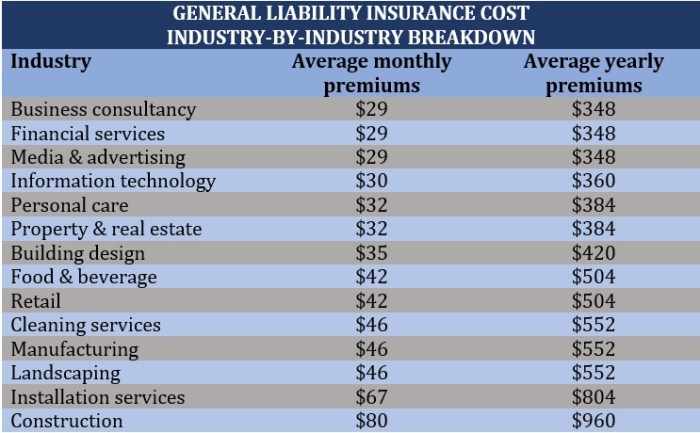

General Liability Insurance

This is a common type of liability insurance that protects businesses from financial losses due to bodily injury or property damage caused by their operations or products. For example, if a customer slips and falls in a store, general liability insurance could cover the medical expenses and any legal costs associated with the incident. This coverage is crucial for many businesses to operate legally and mitigate financial risks.

Professional Liability Insurance (Errors and Omissions Insurance)

Professionals like doctors, lawyers, and consultants often purchase professional liability insurance, also known as errors and omissions (E&O) insurance. This coverage protects them against claims of negligence or mistakes in their professional services. If a doctor makes a medical error, for example, E&O insurance could help cover the resulting legal and financial consequences. This is vital for maintaining a professional reputation and protecting against substantial financial liabilities.

Product Liability Insurance

Manufacturers and distributors of products need product liability insurance to protect against claims of injury or damage caused by defective products. If a company produces a faulty appliance that causes a fire, for instance, product liability insurance could cover the costs associated with the damages and any resulting lawsuits. This type of insurance is essential for businesses that create and sell tangible goods.

Coverage Options Comparison

The specific coverage options available vary widely depending on the insurer and the type of liability insurance. However, some common aspects include the policy limits (the maximum amount the insurer will pay for a claim), the deductible (the amount the policyholder pays before the insurance kicks in), and the types of incidents covered (e.g., bodily injury, property damage, advertising injury).

Comparison of Coverage Levels

A simple comparison could involve considering three different coverage levels for general liability insurance: a low-coverage plan might offer $100,000 per occurrence, a medium-coverage plan might offer $500,000 per occurrence, and a high-coverage plan might offer $1 million per occurrence. The premium for each plan will increase proportionally with the coverage limits. It’s crucial to assess your potential risk and choose a coverage level that adequately protects your assets. For example, a small business might find a $100,000 policy sufficient, while a larger corporation would likely need a significantly higher coverage limit.

Finding Local Insurance Providers

Securing affordable liability insurance often involves identifying local providers who understand your specific needs and offer competitive rates. This process can be streamlined by employing a strategic approach, leveraging readily available resources, and comparing offerings from several companies.

Finding local insurance providers requires a multi-pronged approach. It’s not just about searching online; it involves actively engaging with your community and utilizing specialized tools to ensure you’re getting the best possible coverage at the most competitive price.

Methods for Identifying Local Insurance Providers

Several methods can be employed to effectively identify local liability insurance providers. These methods range from simple online searches to leveraging personal networks and utilizing specialized insurance comparison websites. A combined approach generally yields the best results. Firstly, a comprehensive online search, utilizing s such as “liability insurance [your city/state]”, will reveal a range of local providers. Secondly, checking online directories such as Yelp or Google My Business can provide reviews and contact information for local businesses. Thirdly, asking for recommendations from friends, family, or colleagues can provide valuable insights into the experiences of others. Finally, utilizing insurance comparison websites can streamline the process by allowing you to compare multiple providers simultaneously.

Resources for Finding Reputable Insurance Companies

Finding reputable insurance companies requires diligent research. Several resources can assist in this process, offering valuable insights into provider reliability and customer satisfaction. These resources include online review platforms like Yelp and Google Reviews, which provide user feedback and ratings for various insurance providers. Additionally, the Better Business Bureau (BBB) offers accreditation and complaint resolution services, providing insights into the ethical practices and customer service standards of different companies. State insurance departments also maintain databases of licensed insurers, allowing verification of legitimacy and access to consumer complaint data. Finally, independent insurance rating agencies provide assessments of insurance companies’ financial strength and claims-paying ability.

Comparison of Local Insurance Providers

The following table compares five hypothetical local insurance providers. Remember that pricing and coverage details vary greatly depending on location, individual risk factors, and the specific policy chosen. Always request personalized quotes from multiple providers to ensure you’re getting the best possible deal.

| Company Name | Price Range (Annual) | Coverage Highlights | Customer Reviews (Summary) |

|---|---|---|---|

| Acme Insurance | $200 – $500 | General liability, professional liability, product liability | Mostly positive; praised for quick claims processing. |

| Best Value Insurance | $150 – $400 | General liability, some optional add-ons available | Mixed reviews; some complaints about customer service. |

| Citywide Insurance Group | $250 – $600 | Comprehensive liability coverage, including umbrella options | Positive; known for excellent customer service and extensive coverage. |

| Local Mutual Insurance | $180 – $450 | General liability, personalized service for local businesses | Highly positive; praised for personalized attention and community involvement. |

| Regional Protection Agency | $300 – $700 | Broad coverage options, including specialized liability for various industries | Generally positive; some customers found the pricing slightly higher than competitors. |

Comparing Quotes and Choosing a Policy

Obtaining multiple liability insurance quotes is crucial for securing the best coverage at the most competitive price. Carefully comparing these quotes, understanding the policy details, and identifying your specific needs are essential steps in choosing the right policy for your circumstances. This process ensures you’re not overpaying for unnecessary coverage or underinsured in case of an incident.

Comparing quotes involves more than simply looking at the price. A lower premium doesn’t always equate to the best value. Several key factors influence the overall cost-effectiveness of a policy.

Policy Coverage Details

Different providers offer varying levels of coverage. A seemingly cheaper policy might have lower liability limits, leaving you vulnerable to significant financial losses in the event of a substantial claim. For example, one policy might offer $300,000 in liability coverage, while another might offer $1,000,000. The higher limit provides greater protection but will likely come with a higher premium. Carefully examine the specific types of liability covered (e.g., bodily injury, property damage, advertising injury) and the limits for each. Ensure the coverage aligns with your potential risk exposure.

Deductibles and Premiums

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium. Conversely, a lower deductible means a higher premium. Consider your financial capacity to handle a potential deductible payment in the event of a claim. A balance must be struck between affordability and the financial burden of a potential deductible. For instance, a $500 deductible might seem appealing with a lower premium, but a $1000 deductible could significantly reduce the annual cost, while still being manageable.

Policy Exclusions and Limitations

Every policy has exclusions – situations or events not covered by the insurance. Carefully review these exclusions. Some common exclusions might include intentional acts, pre-existing conditions, or specific types of activities. Understanding these limitations is vital to ensure the policy adequately protects you. For example, a policy might exclude coverage for liability arising from operating a business from your home, if that is a relevant activity.

Obtaining and Reviewing a Policy Document

Once you’ve chosen a policy, carefully review the complete policy document. This document is a legally binding contract outlining the terms and conditions of your insurance coverage. Pay close attention to the definitions of key terms, the coverage limits, the exclusions, and the procedures for filing a claim. Don’t hesitate to contact the insurance provider to clarify any aspects you don’t understand. A clear understanding of the policy document safeguards your rights and ensures you know exactly what’s covered and what’s not.

Illustrative Examples of Liability Scenarios

Understanding the potential costs associated with liability claims is crucial for appreciating the value of liability insurance. The following scenarios illustrate how seemingly minor incidents can quickly escalate into significant financial burdens without adequate coverage.

Scenario 1: Dog Bite Incident

Imagine you own a friendly dog, but during a walk, it unexpectedly bites a child who runs past, causing a laceration requiring stitches and medical attention. The child’s parents could sue you for medical expenses, lost wages (if the parent needed time off work), and pain and suffering. Without liability insurance, you could face medical bills exceeding $5,000, legal fees potentially reaching $10,000 or more, and potentially even larger settlements depending on the severity of the injury and the child’s long-term prognosis. A significant settlement or court judgment could easily exceed $20,000 or more, depending on the jurisdiction and the specifics of the case. Liability insurance, however, would cover these costs, subject to your policy limits and deductible.

Scenario 2: Slip and Fall on Your Property

A delivery person slips on an icy patch on your front steps in winter, resulting in a broken wrist and requiring surgery and physical therapy. The individual could sue you for medical expenses, lost wages, and pain and suffering. Medical bills alone could exceed $15,000, while legal fees and potential settlements could easily push the total cost well beyond $30,000. The lack of appropriate winter maintenance on your property could be seen as negligence. Liability insurance would cover the costs associated with the lawsuit, medical expenses, and settlements, helping to mitigate the financial risk.

Scenario 3: Accidental Damage to Rented Property

You’re renting an apartment and accidentally damage a significant portion of the wall while moving furniture, requiring extensive repairs. Your landlord could hold you responsible for the cost of repairs, which could easily amount to several thousand dollars, depending on the extent of the damage and the cost of materials and labor. Without renter’s insurance (a form of liability insurance), you would be fully responsible for these expenses. However, renter’s liability insurance would cover the cost of repairing the damage, providing financial protection and peace of mind.

Additional Resources and Support

Securing the right liability insurance can feel overwhelming, but accessing the right information and asking the right questions can significantly simplify the process. This section provides valuable resources and guidance to help you navigate your search for affordable liability insurance.

Finding the best policy involves more than just comparing prices. Understanding your needs and effectively communicating with insurance providers are crucial steps. The following resources and questions will empower you to make informed decisions.

Reliable Online Resources for Insurance Information

Several reputable online platforms offer comprehensive information on insurance. These resources can help you understand different policy types, compare coverage options, and even find local providers. Utilizing these tools can save you time and ensure you’re making an informed decision.

- The Insurance Information Institute (III): The III provides unbiased information on various insurance topics, including liability insurance. Their website features articles, FAQs, and resources to help consumers understand their insurance options.

- NAIC (National Association of Insurance Commissioners): The NAIC is an association of state insurance regulators. Their website offers information on insurance regulations and consumer protection resources.

- Your State’s Department of Insurance: Each state has a Department of Insurance that regulates insurance companies within its borders. Their websites usually provide consumer information, complaint procedures, and a directory of licensed insurers.

- Consumer Reports: Consumer Reports often publishes articles and ratings on insurance companies, providing valuable insights into customer satisfaction and claims handling.

Questions to Ask Insurance Providers

Before committing to a liability insurance policy, it’s crucial to ask clarifying questions to ensure the policy meets your specific needs and expectations. Thorough questioning safeguards you from unforeseen issues and helps you choose a policy that offers adequate coverage.

- What specific types of liability are covered under this policy?

- What are the policy limits (the maximum amount the insurer will pay for a claim)?

- Are there any exclusions or limitations on coverage?

- What is the claims process, and how long does it typically take to resolve a claim?

- What is the deductible amount (the amount you pay out-of-pocket before the insurance coverage begins)?

- What factors will affect my premium cost in the future (e.g., claims history, changes in coverage)?

- What are your customer service hours and contact methods?

- What is the company’s financial stability rating?

Tips for Negotiating a Lower Insurance Premium

Negotiating a lower premium can save you money over the life of your policy. Several strategies can be employed to achieve this, increasing your overall savings.

- Bundle policies: Combining multiple insurance policies (e.g., home and auto insurance) with the same provider often results in discounts.

- Improve your credit score: A higher credit score can often lead to lower insurance premiums, as it’s seen as an indicator of lower risk.

- Increase your deductible: Choosing a higher deductible (the amount you pay before insurance coverage begins) can lower your premium, but be sure you can afford the higher out-of-pocket expense.

- Shop around and compare quotes: Obtain quotes from multiple insurers to compare prices and coverage options. This competitive approach helps you find the best value.

- Take advantage of discounts: Many insurers offer discounts for things like safety features in your home or vehicle, security systems, or completing a defensive driving course.

- Maintain a clean driving record (for auto liability): A history of safe driving can significantly reduce your auto insurance premiums.

- Negotiate directly: Don’t be afraid to politely negotiate with the insurer. Explain your situation and ask if they can offer a lower rate.

Final Wrap-Up

Finding low cost liability insurance near you doesn’t have to be a daunting task. By understanding the factors that influence pricing, comparing providers, and carefully reviewing policy details, you can secure the protection you need without breaking the bank. Remember, proactive planning and informed decision-making are key to safeguarding your financial future against unforeseen liabilities. Utilize the resources and advice provided here to confidently navigate the process and secure a policy that offers both value and peace of mind.

Question Bank

What is the difference between general liability and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions insurance) protects against claims of negligence or mistakes in professional services.

How long does it take to get a liability insurance quote?

The time varies depending on the provider and the complexity of your application. Online quotes can be instant, while others may require a few days for a full assessment.

Can I bundle my liability insurance with other types of insurance?

Yes, many insurers offer discounts for bundling policies, such as homeowners, auto, and liability insurance. Check with providers for available bundles.

What happens if I make a claim?

The claims process varies by insurer, but generally involves reporting the incident, providing necessary documentation, and cooperating with the investigation. Your insurer will then handle the claim according to your policy terms.