Securing affordable healthcare is a paramount concern for many individuals and families. The landscape of medical insurance can be complex, with a bewildering array of plans, premiums, deductibles, and coverage limitations. This guide aims to demystify the process of finding low price medical insurance, empowering you to make informed decisions about your healthcare coverage without sacrificing essential protection.

We will explore the nuances of different low-cost plans, including HMOs, PPOs, and EPOs, comparing their features and outlining strategies for identifying the best fit for your individual needs and budget. We’ll also delve into the factors influencing insurance costs, available government subsidies, and the potential long-term implications of choosing a plan with limited coverage. Ultimately, our goal is to equip you with the knowledge and tools necessary to navigate the world of affordable healthcare confidently.

Defining “Low Price Medical Insurance”

Finding affordable healthcare coverage can be a challenge, but understanding the nuances of “low-price medical insurance” is the first step towards securing a plan that fits your budget and needs. This involves careful consideration of several key factors beyond just the monthly premium.

Low-price medical insurance refers to health insurance plans that offer lower premiums compared to other plans in the market. However, this lower premium often comes with trade-offs in other areas, such as higher deductibles, co-pays, and potentially higher out-of-pocket maximums. It’s crucial to understand the complete cost picture, not just the monthly payment, to determine if a plan truly represents value for money. A plan with a low premium but a high deductible might end up costing more in the long run if you require significant medical care.

Types of Low-Cost Plans

Several types of health insurance plans can fall under the “low-price” category. The most common include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and EPOs (Exclusive Provider Organizations). Each has a different structure impacting cost and access to care.

Comparison of Low-Price Plan Coverage

The coverage offered by various low-price plans can vary significantly. While all plans must meet minimum essential health benefits requirements (as mandated by the Affordable Care Act in many countries), the extent of coverage and cost-sharing mechanisms can differ dramatically. For instance, a low-cost HMO might offer comprehensive coverage within its network but charge higher fees for out-of-network care. Conversely, a low-cost PPO might allow out-of-network access but at a higher cost. Understanding these differences is critical for selecting a plan that aligns with your healthcare needs and usage patterns.

Comparison Table of Three Low-Price Insurance Plans

The following table compares three hypothetical low-price plans to illustrate the variations in cost-sharing:

| Feature | Plan A (HMO) | Plan B (PPO) | Plan C (EPO) |

|---|---|---|---|

| Monthly Premium | $200 | $250 | $180 |

| Annual Deductible | $2,000 | $1,500 | $3,000 |

| Co-pay (Doctor Visit) | $25 | $40 | $30 |

| Out-of-Pocket Maximum | $5,000 | $6,000 | $7,000 |

Finding Low Price Medical Insurance Options

Securing affordable medical insurance can feel daunting, but with careful planning and research, finding a suitable and budget-friendly plan is achievable. This section Artikels resources and strategies to help you navigate the process of finding low-price medical insurance options that meet your healthcare needs.

Finding the right balance between cost and coverage requires a systematic approach. Understanding your options and utilizing available resources are key to success. This involves comparing plans, understanding your needs, and leveraging assistance programs.

Resources and Strategies for Finding Affordable Health Insurance

Several avenues exist to help individuals locate affordable health insurance. These resources offer guidance, comparison tools, and often direct assistance in enrolling in suitable plans. Understanding these resources is crucial for making informed decisions.

- Healthcare.gov: The official website for the Affordable Care Act (ACA) marketplace. This site allows individuals to compare plans based on price, coverage, and provider networks. It also provides eligibility information for subsidies and tax credits that can significantly reduce the cost of premiums.

- State Insurance Marketplaces: Many states operate their own insurance marketplaces, offering similar services to Healthcare.gov. These state-based marketplaces often have specific programs or initiatives tailored to their local populations.

- Your Employer: If you’re employed, inquire about your employer’s health insurance offerings. Many employers provide group health insurance plans, which often offer lower premiums than individual plans.

- Insurance Brokers and Agents: Independent insurance brokers can help you navigate the complexities of the insurance market and find plans that fit your budget and needs. They can compare options from multiple insurers and provide personalized advice.

- Non-profit Organizations: Several non-profit organizations provide assistance with finding and enrolling in affordable health insurance. These organizations often offer free or low-cost services and can help individuals understand their options and complete the enrollment process.

Comparing Insurance Plans Based on Price and Coverage

Comparing different insurance plans involves carefully evaluating several factors beyond just the premium cost. Understanding deductibles, co-pays, and out-of-pocket maximums is essential to accurately assess the true cost of a plan.

- Premium Cost: This is the monthly payment you make to maintain your insurance coverage.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage begins to pay for your medical expenses.

- Co-pay: A fixed amount you pay for a doctor’s visit or other medical services.

- Coinsurance: The percentage of costs you share with your insurance company after you’ve met your deductible.

- Out-of-pocket Maximum: The most you’ll pay out-of-pocket for covered healthcare services in a plan year.

- Provider Network: The list of doctors, hospitals, and other healthcare providers that your insurance plan covers.

To effectively compare plans, use the comparison tools available on Healthcare.gov or your state’s marketplace. These tools allow you to input your personal information and preferences to see a customized list of plans that meet your needs and budget. Remember to carefully review the details of each plan’s coverage before making a decision.

Step-by-Step Guide for Navigating the Insurance Marketplace

Navigating the insurance marketplace can seem complex, but a step-by-step approach can simplify the process.

- Determine Eligibility: Check your eligibility for subsidies and tax credits based on your income and household size.

- Create an Account: Create an account on Healthcare.gov or your state’s marketplace.

- Provide Information: Provide the necessary personal and financial information.

- Compare Plans: Use the marketplace’s comparison tools to review available plans.

- Select a Plan: Choose a plan that best fits your needs and budget.

- Enroll: Complete the enrollment process and pay your first premium.

Remember to carefully review all plan details and ensure you understand the coverage before enrolling. Contacting a healthcare navigator or insurance broker can provide valuable assistance during this process.

Factors Affecting the Price of Medical Insurance

Several key factors interact to determine the cost of your medical insurance premiums. Understanding these factors can help you make informed decisions when choosing a plan. This section will explore the major influences on your monthly or annual insurance costs.

Age

Age is a significant factor influencing insurance premiums. Older individuals generally pay more for health insurance than younger individuals. This is because the likelihood of needing more extensive medical care increases with age. Insurance companies base their pricing models on actuarial data, which demonstrates a higher frequency and cost of healthcare services among older populations. For example, a 60-year-old might pay significantly more than a 30-year-old for the same coverage level due to the increased risk of age-related illnesses and conditions.

Health Status

An individual’s current health status plays a crucial role in determining insurance premiums. People with pre-existing conditions or a history of serious illnesses typically face higher premiums. This is because insurance companies assess the risk of having to cover expensive treatments or ongoing care. Someone with a history of heart disease, for instance, would likely pay more than someone with a clean bill of health, reflecting the higher potential cost of future medical expenses. The Affordable Care Act (ACA) in the United States, however, has mitigated some of this impact by prohibiting insurers from denying coverage based solely on pre-existing conditions.

Location

Geographic location significantly impacts insurance costs. The cost of living, including healthcare services, varies widely across different regions. Areas with high concentrations of specialists, advanced medical facilities, and a higher cost of living generally have higher insurance premiums. For example, insurance in a major metropolitan area with a high concentration of specialized medical facilities might be considerably more expensive than in a rural area with limited access to such services.

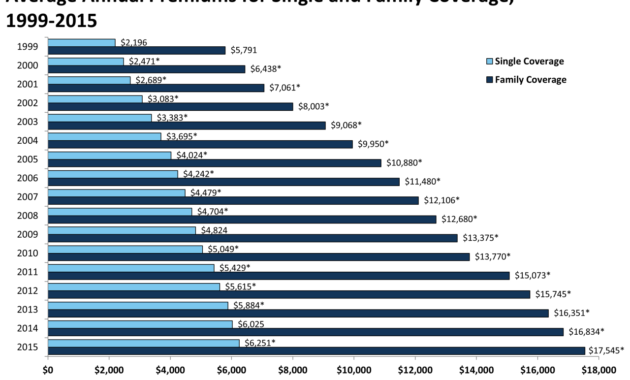

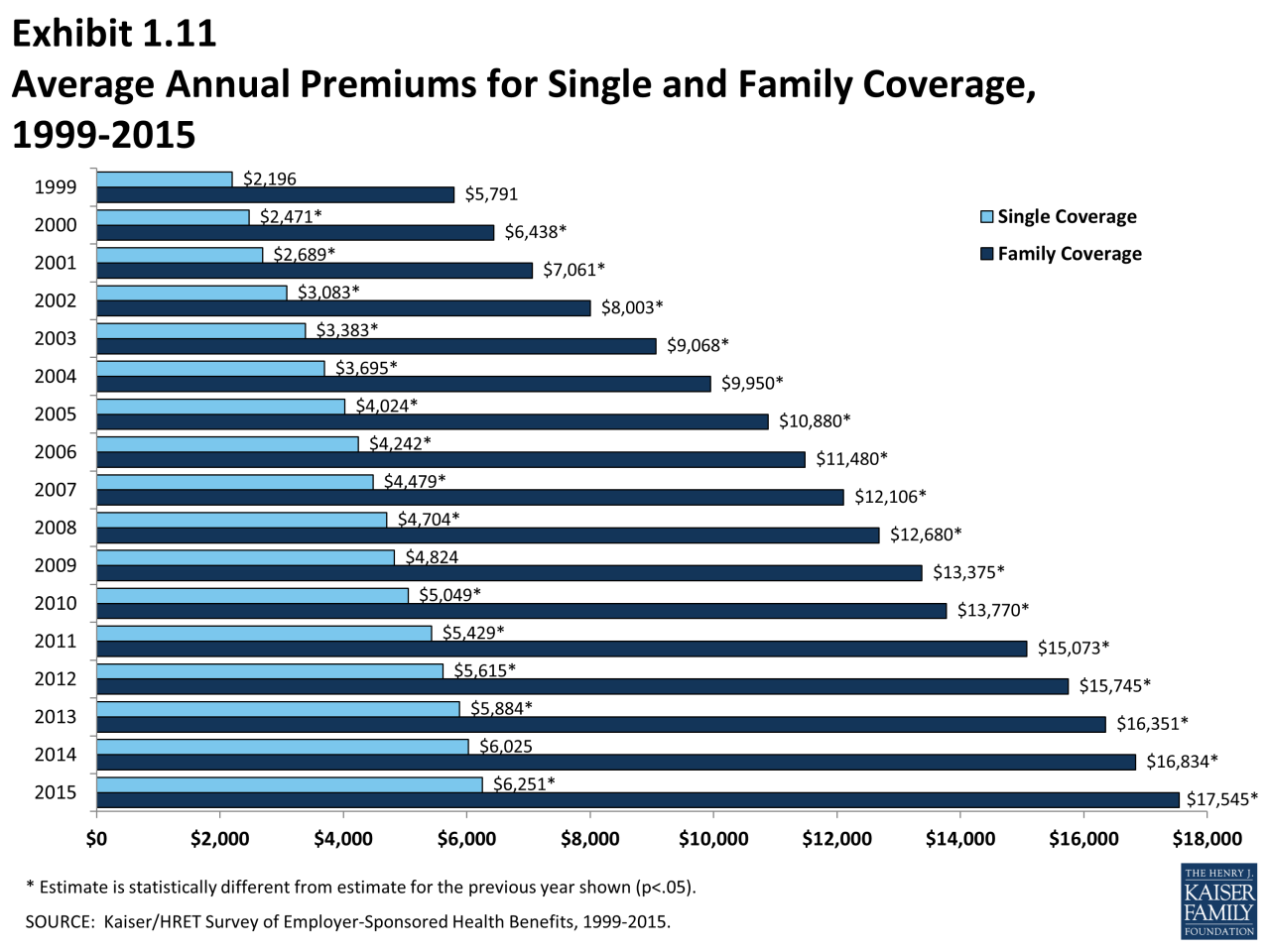

Family Size

Family size can influence insurance premiums, particularly in plans that cover dependents. Larger families typically result in higher premiums because the potential for multiple claims increases. A plan covering a family of four will generally be more expensive than a plan covering a single individual, reflecting the increased likelihood of medical expenses for multiple family members.

Employer-Sponsored versus Individual Plans

The cost of insurance varies greatly depending on whether it’s obtained through an employer or purchased individually. Employer-sponsored plans often offer lower premiums due to economies of scale and group purchasing power. Employers negotiate rates with insurance companies on behalf of their employees, resulting in more favorable pricing than individuals can typically obtain on their own. Individual plans, on the other hand, tend to have higher premiums due to the lack of this group purchasing power. The individual market often involves more administrative costs, which are reflected in the premium prices.

Pre-existing Conditions

Pre-existing conditions, as mentioned earlier, can significantly affect insurance costs. While the ACA prevents insurers from denying coverage based solely on pre-existing conditions, these conditions can still influence premium costs. The impact depends on the specific condition, its severity, and the potential for future medical expenses. For example, someone with diabetes might see a higher premium than someone without, reflecting the ongoing costs associated with managing the condition. However, the degree of impact is significantly lessened due to protections provided under the ACA and similar legislation in other countries.

Understanding Coverage Limitations of Low-Price Plans

Securing affordable medical insurance is a priority for many, but it’s crucial to understand that lower premiums often come with trade-offs. Low-price plans frequently feature limitations that can significantly impact your healthcare experience and ultimately your out-of-pocket expenses. Understanding these limitations is key to making an informed decision.

Lower premiums typically translate to less comprehensive coverage. This means you might face higher costs when you need care. This section details the common limitations associated with low-cost plans and helps you weigh the pros and cons before enrolling.

Restricted Provider Networks

Low-price plans often restrict you to a specific network of doctors, hospitals, and other healthcare providers. Choosing a plan with a narrow network might mean you can’t see your preferred doctor or specialist. If you need care outside the network, you’ll likely pay significantly more out-of-pocket, even for essential services. This limitation can be particularly problematic for individuals with ongoing health conditions requiring specialized care. For example, a patient with a rare disease might find that only a few specialists within a limited network are equipped to treat their condition, forcing them to make difficult choices or face substantial extra costs.

High Deductibles and Copays

Many low-cost plans feature high deductibles, meaning you’ll pay a substantial amount out-of-pocket before your insurance coverage kicks in. Similarly, co-pays – the fixed amount you pay for each doctor’s visit – can be higher in lower-priced plans. A high deductible plan might seem appealing initially due to the low monthly premium, but if you require frequent medical care, the high upfront costs can quickly negate any savings. Imagine someone needing regular checkups and medications for a chronic condition; the high deductible and co-pays could significantly strain their finances.

Cost-Sharing Mechanisms: A Comparison

Different cost-sharing mechanisms, such as deductibles, co-pays, and coinsurance, significantly influence the overall cost of your healthcare. High deductible health plans (HDHPs) require a larger upfront payment before insurance coverage begins, while plans with lower deductibles but higher co-pays or coinsurance distribute costs differently. HDHPs often pair with health savings accounts (HSAs), allowing pre-tax contributions to cover future medical expenses. However, this requires financial planning and discipline. Conversely, plans with lower deductibles offer more immediate coverage but usually come with higher premiums. The best option depends on your individual health needs and financial situation.

Scenarios Where Low-Price Plans May Not Offer Adequate Coverage

Understanding when a low-cost plan might fall short is critical. Below are some scenarios where the limitations of such plans become apparent:

- Unexpected Illness or Injury: A serious accident or sudden illness requiring hospitalization and extensive treatment could quickly deplete your savings if you have a high deductible and limited coverage.

- Chronic Conditions Requiring Ongoing Care: Individuals with chronic diseases like diabetes or heart conditions need frequent medical visits and medications. The cumulative cost of co-pays and medications can be substantial with a high-deductible plan.

- Need for Specialized Care: Conditions requiring specialists, such as oncology or cardiology, often involve high costs. If your low-cost plan has a narrow network excluding your preferred specialists, you might face significant out-of-pocket expenses.

- Pregnancy and Childbirth: Prenatal care, delivery, and postnatal care can be expensive. Low-cost plans might not offer sufficient coverage for these essential services, leading to unexpected high bills.

- Mental Health Treatment: Mental health services are increasingly important, but some low-cost plans may have limited coverage or require higher co-pays for these services, potentially hindering access to care.

Government Subsidies and Assistance Programs

Securing affordable medical insurance can be a significant challenge for many individuals and families. Fortunately, several government subsidies and assistance programs exist to help alleviate these financial burdens, making healthcare more accessible. These programs offer varying levels of support, depending on factors like income, household size, and citizenship status. Understanding these options is crucial for navigating the complexities of healthcare financing.

Government subsidies and assistance programs aim to reduce the cost of health insurance premiums and out-of-pocket expenses for eligible individuals and families. These programs primarily function by lowering the cost of purchasing insurance through the marketplace or by providing direct financial assistance for healthcare services. The availability and specifics of these programs vary by location and are subject to change, so it’s essential to consult the most up-to-date information from official government sources.

Eligibility Requirements for Various Programs

Eligibility for government assistance programs typically hinges on several key factors. Income level is a primary determinant, with programs often establishing income thresholds based on the Federal Poverty Level (FPL). Household size also plays a significant role, as larger families generally qualify for higher levels of assistance. Citizenship status and immigration status are often considered, with certain programs specifically designed for U.S. citizens or legal residents. In some cases, age, disability status, and pregnancy may also influence eligibility. For example, Medicaid often has specific eligibility criteria based on age, income, disability, and pregnancy, while the Affordable Care Act (ACA) marketplace subsidies are income-based. Each program has its own detailed requirements, necessitating careful review of the specific program guidelines.

The Application Process for Government Assistance Programs

Applying for government assistance programs typically involves completing an application form, providing necessary documentation, and undergoing an eligibility review. Application methods can vary, with some programs offering online applications, while others may require paper applications submitted by mail. Required documentation often includes proof of income, identification, and household size. The processing time for applications can vary depending on the program and the volume of applications. Applicants should expect to provide detailed financial information and may be asked to provide additional documentation to support their application. Once approved, individuals will receive a determination letter outlining the level of assistance they will receive.

Choosing Between Different Assistance Programs: A Decision-Making Flowchart

A flowchart can help individuals navigate the selection process for choosing between different government assistance programs. The flowchart would begin by assessing the individual’s income level relative to the FPL. If the income is below a certain threshold, the individual would be directed to explore Medicaid eligibility. If the income is above the Medicaid threshold but still within the range for ACA subsidies, the individual would then explore options through the Health Insurance Marketplace. If income is too high for either program, the individual may need to explore other options, such as employer-sponsored insurance or private insurance plans. The flowchart would incorporate decision points based on other factors such as age, disability, and family size, ultimately guiding the individual to the most appropriate program based on their specific circumstances. The flowchart would need to be updated regularly to reflect changes in eligibility criteria and program availability.

Long-Term Implications of Choosing Low-Price Insurance

Opting for low-price medical insurance might seem appealing initially, offering significant short-term cost savings. However, a thorough consideration of the long-term financial and health consequences is crucial before making this decision. Failing to do so could lead to unexpected and potentially devastating financial burdens and compromised healthcare.

Understanding the potential long-term implications allows for informed decision-making, enabling individuals to balance affordability with the need for adequate healthcare coverage. This understanding empowers individuals to make choices that best align with their long-term health and financial well-being.

Potential Long-Term Financial Consequences of Limited Coverage

Choosing a low-price plan often means accepting limited coverage. This translates to higher out-of-pocket expenses for medical services, prescription drugs, and hospital stays. Over time, these costs can accumulate significantly, potentially leading to substantial debt. For example, a single unexpected hospitalization could easily exceed the annual premium of a low-cost plan, leaving the individual with a massive bill. The accumulation of smaller, frequent medical expenses, such as doctor visits and prescription refills, also contributes to the long-term financial burden. These costs can impact other financial goals, such as saving for retirement or a child’s education.

Risks Associated with Inadequate Medical Care

Inadequate medical care resulting from cost constraints poses significant health risks. Delaying or forgoing necessary medical treatment due to high out-of-pocket costs can lead to the worsening of existing conditions and the development of new, more serious health problems. For instance, delaying treatment for a chronic illness like diabetes could lead to severe complications, requiring more extensive and costly treatment in the future. Similarly, avoiding preventative care, such as regular check-ups and screenings, increases the likelihood of detecting diseases at later, more advanced stages, when treatment is more complex and expensive.

Strategies for Mitigating Financial Risks

Several strategies can help mitigate the financial risks associated with unexpected medical expenses. Establishing a dedicated health savings account (HSA) allows for tax-advantaged savings specifically for medical expenses. Increasing the deductible on your plan can lower your premiums but requires more savings to cover expenses before insurance kicks in. Exploring options like catastrophic health insurance plans, which provide coverage for major medical events, can offer a safety net for unexpected, high-cost medical situations. Furthermore, thoroughly researching and comparing different plans before enrollment is essential to understand the coverage limitations and potential out-of-pocket expenses.

Hypothetical Scenario: Low-Price vs. Comprehensive Plan

Consider two individuals, both 35 years old and in good health. Individual A chooses a low-premium plan with a high deductible and limited coverage, paying $200 per month. Individual B chooses a more comprehensive plan with a lower deductible and broader coverage, paying $500 per month. Over ten years, Individual A pays $24,000 in premiums. However, if Individual A experiences a serious illness requiring a $50,000 hospital stay, their out-of-pocket expenses could easily exceed the savings from the lower premium. Individual B, despite paying a significantly higher premium of $60,000 over the same period, would likely have significantly lower out-of-pocket costs in such a scenario. This illustrates that while a low-price plan offers short-term savings, the potential for catastrophic out-of-pocket expenses can far outweigh the initial cost savings in the long run.

Wrap-Up

Choosing low price medical insurance requires careful consideration of your individual health needs, financial situation, and long-term goals. While securing affordable coverage is crucial, it’s equally important to understand the potential limitations of such plans. By carefully weighing the pros and cons, comparing various options, and utilizing available resources, you can make an informed decision that balances cost-effectiveness with adequate healthcare protection. Remember to actively engage with your insurance provider and stay informed about changes in your coverage to ensure you receive the care you need when you need it.

FAQs

What is a high-deductible health plan (HDHP)?

A high-deductible health plan features a higher-than-average deductible but typically lower premiums. You pay more out-of-pocket before insurance coverage kicks in.

Can I lose my insurance if I change jobs?

Whether you lose coverage depends on your employer’s plan and whether you qualify for COBRA or other continuation coverage options. Check your plan documents or consult your HR department.

What is a pre-existing condition?

A pre-existing condition is a health issue you had before starting a new insurance plan. The Affordable Care Act (ACA) generally prevents insurers from denying coverage or charging higher premiums based on pre-existing conditions.

Where can I find help applying for government assistance?

Healthcare.gov is a primary resource for information and applications for government subsidies and assistance programs like the ACA marketplace.