Navigating the world of Michigan car insurance can feel like driving through a blizzard—confusing, unpredictable, and potentially costly. Michigan’s unique no-fault system adds layers of complexity, making it crucial to understand how factors like your driving record, vehicle type, and coverage choices impact your premiums. This guide cuts through the confusion, offering a clear path to finding the best Michigan car insurance quotes and securing the right coverage for your needs.

From deciphering the intricacies of Personal Injury Protection (PIP) to comparing quotes from reputable insurers and exploring strategies to lower your costs, we’ll equip you with the knowledge and tools to make informed decisions. We’ll delve into the key factors influencing your rates, explain the different coverage options available, and provide practical tips for saving money without compromising your protection.

Understanding Michigan’s No-Fault System

Michigan’s no-fault auto insurance system, while designed to streamline accident claims, presents significant complexities for drivers. Unlike many other states, Michigan’s system requires drivers to primarily rely on their own insurance coverage, regardless of fault, for medical expenses and lost wages following a car accident. This means that even if you are not at fault, your own PIP (Personal Injury Protection) coverage will initially pay for your medical bills and lost income. The system also involves intricate calculations for reimbursement and can lead to unexpected costs if coverage is insufficient.

Personal Injury Protection (PIP) Coverage

PIP coverage is the cornerstone of Michigan’s no-fault system. It provides reimbursement for medical expenses, lost wages, and other related costs resulting from a car accident, regardless of who caused the accident. This coverage extends to you, your passengers, and even family members injured while in your vehicle. Crucially, PIP also covers funeral expenses in the event of a fatality. The amount of coverage you choose determines the maximum amount your insurance company will pay out for these expenses. Understanding the various components and limitations of PIP is essential to choosing the right level of coverage.

PIP Coverage Options in Michigan

Michigan law mandates minimum PIP coverage levels, but drivers can choose higher levels for greater protection. The key difference lies in the amount of medical and wage-loss benefits provided. Lower coverage limits may leave you with substantial out-of-pocket expenses if you sustain serious injuries or experience prolonged recovery time. Higher coverage offers greater financial security but comes with a higher premium. The decision of which coverage level to select should be based on a careful assessment of your individual risk tolerance and financial circumstances. Factors to consider include your health, occupation, and the potential for significant medical bills.

Minimum versus Recommended Coverage Levels

The following table compares the minimum required PIP coverage in Michigan with recommended coverage levels, highlighting the significant difference in financial protection:

| Coverage Type | Minimum Required | Recommended | Notes |

|---|---|---|---|

| PIP Medical Benefits | $50,000 | $250,000 or Unlimited | Medical bills can quickly exceed minimum limits, especially with serious injuries. |

| PIP Wage Loss Benefits | $50,000 | $250,000 or Unlimited | Lost wages can significantly impact your financial stability following an accident. |

| Property Damage Liability | $25,000 | $100,000 or higher | Covers damages to other vehicles or property in an accident where you are at fault. |

| Uninsured/Underinsured Motorist Coverage | Not Required (but highly recommended) | $100,000 or higher | Protects you if you are injured by an uninsured or underinsured driver. |

Factors Influencing Insurance Costs

Several key factors combine to determine the cost of car insurance in Michigan. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums. These factors are interconnected, and a change in one can influence the others.

Driving History

Your driving record significantly impacts your insurance rates. Insurance companies assess risk based on past driving behavior. A clean driving record, free of accidents and traffic violations, will generally result in lower premiums. Conversely, accidents, particularly those resulting in injuries or significant property damage, will significantly increase your rates. The severity and frequency of incidents are crucial factors. For example, a single at-fault accident causing minor damage may lead to a moderate rate increase, while multiple accidents or serious violations like driving under the influence (DUI) can result in substantially higher premiums or even policy cancellation. Points accumulated on your driving record also contribute to higher premiums. Insurance companies often use a points system to track infractions, with more points translating to higher risk and therefore higher costs.

Vehicle Type and Age

The type and age of your vehicle are also major factors influencing your insurance premium. Generally, newer, more expensive vehicles cost more to insure due to higher repair costs and potential for greater theft. The vehicle’s safety features also play a role; cars with advanced safety technologies, such as anti-lock brakes and airbags, may qualify for discounts. Older vehicles, while potentially cheaper to insure initially, may have higher repair costs due to parts availability and increased risk of mechanical failure. The make and model of the vehicle also matter; some models are statistically involved in more accidents or have higher theft rates, thus impacting insurance costs. For example, a high-performance sports car will typically have a higher insurance premium compared to a fuel-efficient compact car.

Driving Behaviors

Your driving habits, even beyond accidents and violations, can influence your insurance costs. Insurance companies may offer discounts for safe driving practices, such as completing defensive driving courses. High mileage may also increase premiums, as more time spent on the road generally correlates with a higher risk of accidents. Similarly, commuting long distances daily may lead to higher rates than shorter, local commutes. For example, a driver who regularly commutes 100 miles a day will likely pay more than someone who drives only a few miles a day for errands. Usage-based insurance programs are becoming increasingly popular, tracking driving behavior through telematics devices or smartphone apps. These programs can reward safer driving habits with lower premiums. Conversely, risky driving behaviors like speeding or aggressive driving, even if not resulting in accidents or tickets, could be reflected in higher rates through such programs.

Finding and Comparing Quotes

Securing the best Michigan car insurance rate requires diligent comparison shopping. This involves understanding the online quote process, researching reputable providers, and carefully analyzing policy features. By following a systematic approach, you can confidently choose a policy that meets your needs and budget.

Online Quote Acquisition: A Step-by-Step Guide

Obtaining car insurance quotes online is a straightforward process that typically involves providing basic information and comparing offers from different providers. The following steps Artikel a typical online quote process.

- Visit Insurance Company Websites: Begin by visiting the websites of several insurance companies operating in Michigan. Many companies have user-friendly interfaces designed for easy quote generation.

- Provide Required Information: You will be asked to provide information about yourself, your vehicle, and your driving history. This usually includes your name, address, date of birth, driving record, vehicle details (year, make, model), and desired coverage levels.

- Review and Compare Quotes: Once you’ve submitted your information, you’ll receive a personalized quote from each company. Carefully compare the premiums, coverage options, and policy details offered by each provider.

- Refine Your Search (Optional): Based on the initial quotes, you may want to adjust your coverage choices or explore different deductible options to see how it affects the premium. Many online quote tools allow you to easily experiment with different scenarios.

- Contact Companies Directly (Optional): If you have questions or need clarification on specific policy details, contact the insurance companies directly. Many offer phone and email support for quote-related inquiries.

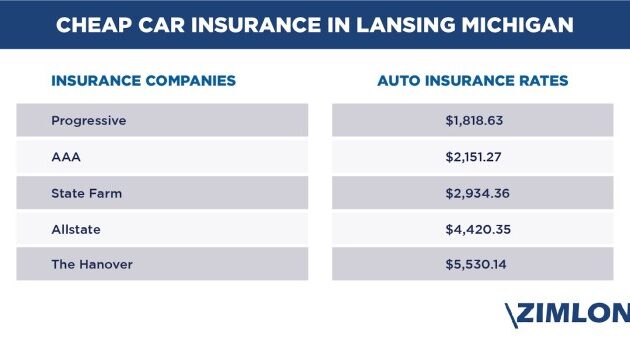

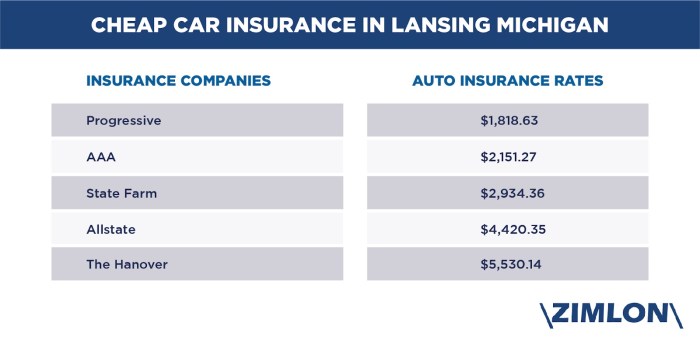

Reputable Michigan Insurance Providers

A variety of reputable insurance companies operate within Michigan, each offering diverse policy options and coverage levels. It’s important to research several providers to ensure you find the best fit for your individual needs.

- State Farm

- Allstate

- Geico

- Progressive

- AAA

- Farmers Insurance

- Auto-Owners Insurance

This is not an exhaustive list, and many other reputable companies offer services in Michigan.

Comparison of Insurance Company Features

Different insurance companies offer varying features and benefits. Comparing these aspects is crucial to selecting a policy that aligns with your individual requirements. For example, some companies may offer discounts for bundling home and auto insurance, while others may specialize in specific types of coverage, such as classic car insurance. Analyzing features like roadside assistance, accident forgiveness programs, and customer service ratings can help differentiate between providers. Direct comparison of policy documents is highly recommended.

Questions to Ask Insurance Providers

Before committing to a policy, it’s crucial to clarify any uncertainties and ensure the chosen policy adequately addresses your needs.

- What specific coverages are included in the policy? This ensures a clear understanding of what is and isn’t covered under the policy.

- What are the deductibles and premiums for each coverage level? This allows for a direct comparison of cost versus coverage.

- What discounts are available? Many companies offer discounts for safe driving, bundling policies, or other factors.

- What is the claims process? Understanding the steps involved in filing a claim can be beneficial in the event of an accident.

- What is the customer service reputation of the company? Access independent ratings and reviews to gauge the responsiveness and helpfulness of the company’s customer service.

Understanding Policy Coverage

Choosing the right Michigan auto insurance policy requires a clear understanding of the various coverages offered. This section details the common types of coverage, their limits, and what they do and don’t cover. It’s crucial to carefully review your policy to ensure it adequately protects you and your financial interests.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. However, it does not cover your own medical bills or vehicle repairs. Liability coverage is typically expressed as three numbers, such as 25/50/10. This means $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $10,000 for property damage. These limits are minimums under Michigan law, and higher limits are strongly recommended. Exclusions may include intentional acts, damage to your own vehicle, or injuries to passengers in your vehicle (unless you have Uninsured/Underinsured Motorist coverage).

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. In Michigan, where many drivers carry only the minimum liability coverage, this is especially important. It can cover your medical bills, lost wages, and vehicle repairs, even if the at-fault driver doesn’t have enough insurance to cover your losses. However, the coverage typically has limits, and it may not cover all damages in a serious accident. The benefits are substantial in protecting you from financial ruin following an accident caused by a negligent uninsured driver. Limitations include the specific policy limits and the possibility of needing to pursue a claim against your own insurance company, which can be a complex process.

Personal Injury Protection (PIP)

Michigan is a no-fault state, meaning your own insurance company covers your medical bills and lost wages regardless of who caused the accident. PIP coverage is mandatory in Michigan and pays for your medical expenses, rehabilitation costs, and lost wages, up to your policy limits. It also covers medical expenses for passengers in your vehicle. However, PIP coverage has limitations. It usually doesn’t cover pain and suffering unless you have a serious injury. Furthermore, the amount of lost wages covered may be limited, and there may be deductibles or co-pays.

Property Damage Coverage

This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It also covers damage to other people’s property. The policy will usually have a deductible that you’ll need to pay before the insurance company covers the rest of the costs. The coverage is limited to the actual cash value of your vehicle less the deductible. This means that if your car is totaled, you will receive the car’s value before the accident, minus the deductible, not the replacement cost.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects. This type of coverage is optional. It helps protect your financial investment in your vehicle from a variety of unforeseen circumstances. The policy typically has a deductible.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in a collision, regardless of fault. This is also optional coverage. Similar to comprehensive coverage, it usually has a deductible.

Essential Elements of a Comprehensive Car Insurance Policy

A strong car insurance policy in Michigan should include the following:

- Sufficient Liability Coverage: Amounts significantly higher than the state minimums are recommended.

- Uninsured/Underinsured Motorist Coverage: This is crucial given the high number of uninsured drivers in Michigan.

- Personal Injury Protection (PIP): Mandatory in Michigan, but ensure you understand the limits and benefits.

- Property Damage Coverage: To cover damage to your vehicle and others’ property.

- Consider Comprehensive and Collision Coverage: To protect against a wider range of risks.

- Review Policy Limits and Deductibles Carefully: Choose limits and deductibles that fit your budget and risk tolerance.

Saving Money on Michigan Car Insurance

Securing affordable car insurance in Michigan, known for its unique no-fault system, requires a strategic approach. Several methods can significantly reduce your premiums, allowing you to maintain adequate coverage without breaking the bank. By understanding these strategies and actively implementing them, you can effectively manage your insurance costs.

Several factors influence your Michigan car insurance rates. Understanding these factors empowers you to make informed decisions that lead to lower premiums. This includes choices regarding your vehicle, driving habits, and the insurance policy itself.

Strategies for Lowering Premiums

Numerous strategies can help you lower your Michigan car insurance premiums. These range from simple adjustments to your driving habits to more involved choices about your policy coverage.

- Maintain a Clean Driving Record: Accidents and traffic violations significantly increase your insurance rates. Careful driving and adherence to traffic laws are the most effective ways to keep your premiums low. A single at-fault accident can lead to a substantial increase for several years.

- Choose a Safe Vehicle: Insurance companies consider the safety features and theft risk of your vehicle when determining premiums. Cars with advanced safety features and lower theft rates typically command lower insurance costs. For example, a vehicle with a high safety rating from the IIHS (Insurance Institute for Highway Safety) will likely result in a lower premium than a vehicle with a poor safety record.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in the event of a claim, but it results in lower premiums. Carefully consider your financial situation to determine the appropriate deductible level. A $1000 deductible, for example, is typically cheaper than a $500 deductible, but requires a larger upfront payment in the event of a claim.

- Shop Around and Compare Quotes: Different insurance companies offer varying rates. Comparing quotes from multiple insurers ensures you find the best price for the coverage you need. Online comparison tools can streamline this process significantly.

- Consider Usage-Based Insurance: Some insurers offer programs that track your driving habits through telematics devices or smartphone apps. Safe driving behavior, such as avoiding speeding and hard braking, can lead to premium discounts.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, often results in significant savings. Insurance companies frequently offer discounts for bundling policies, recognizing the reduced risk associated with insuring multiple lines of coverage with a single provider.

For example, bundling your car insurance with your homeowner’s insurance could result in a 10-15% discount on your overall premium. This discount can vary significantly depending on the insurer and the specific policies bundled.

Impact of Safe Driving Courses

Completing a state-approved defensive driving course can demonstrably reduce your insurance premiums. Many insurance companies offer discounts to drivers who complete these courses, recognizing the positive impact on driving safety and accident reduction. The discount amount varies by insurer but is often a significant percentage of your premium.

For instance, completing a certified defensive driving course could result in a 5-10% discount on your premium, potentially saving hundreds of dollars annually.

Available Discounts

Beyond the strategies mentioned above, various discounts may be available to drivers. These discounts can further reduce your insurance costs, making it more affordable to maintain comprehensive coverage.

- Good Student Discount: Students with good grades often qualify for discounts, reflecting their lower risk profile.

- Multiple Vehicle Discount: Insuring multiple vehicles with the same company often leads to a discount on each policy.

- Anti-theft Device Discount: Vehicles equipped with anti-theft devices may qualify for a discount due to the reduced risk of theft.

- Payment Plan Discount: Paying your premium in full upfront may result in a discount compared to paying in installments.

- Military Discount: Active duty military personnel or veterans may be eligible for discounts.

Dealing with Accidents and Claims

Navigating the aftermath of a car accident in Michigan can be stressful, but understanding the claims process can significantly ease the burden. This section Artikels the steps involved in filing a claim, interacting with insurance adjusters, and resolving any disputes that may arise. Remember, prompt and accurate reporting is crucial for a smoother claims process.

Filing a Claim After a Car Accident

Following a car accident in Michigan, prompt action is vital. First, ensure the safety of yourself and others involved. Call emergency services if necessary. Then, gather information at the scene: take photos of the damage to all vehicles, the accident location, and any visible injuries. Record the names, addresses, phone numbers, insurance information, and driver’s license numbers of all drivers and witnesses. File a police report, especially if there are injuries or significant property damage. Contact your insurance company as soon as possible to report the accident and begin the claims process. They will guide you through the necessary steps and provide you with a claim number. Failure to promptly report the accident could jeopardize your claim.

Dealing with Insurance Adjusters

Insurance adjusters investigate claims to determine liability and the extent of damages. Cooperate fully with the adjuster, providing all requested documentation, including photos, police reports, and medical records. Be clear and concise in your communication, accurately describing the events leading up to the accident and the extent of your injuries and damages. Remember, you are not required to give a recorded statement without legal representation. Keep detailed records of all communication with the adjuster, including dates, times, and the substance of conversations. Maintain a professional and respectful attitude throughout the process. If you feel the adjuster is not being fair or is not properly addressing your claim, seek legal counsel.

Resolving Disputes with Insurance Companies

Disputes with insurance companies can arise regarding liability, the value of damages, or the extent of coverage. If you cannot resolve a dispute through direct communication with the adjuster, consider the following options: First, review your policy carefully to understand your coverage and rights. Then, escalate the issue to a higher level within the insurance company, such as a supervisor or claims manager. Consider mediation or arbitration, which involves a neutral third party helping to resolve the dispute. As a last resort, you may need to file a lawsuit to protect your interests. It’s advisable to seek legal counsel if you are facing significant challenges in resolving a dispute with your insurance company.

Handling a Car Accident Claim: A Flowchart

A visual representation of the claims process is highly beneficial. Imagine a flowchart beginning with “Accident Occurs,” branching to “Ensure Safety & Call Emergency Services if Needed,” then to “Gather Information (Photos, Police Report, Witness Details),” followed by “Notify Insurance Company,” and leading to “Cooperate with Adjuster (Provide Documentation).” If the claim is settled amicably, the process concludes. However, if a dispute arises, the flowchart branches to “Escalate to Supervisor,” then to “Mediation/Arbitration,” and finally, as a last resort, to “Legal Action.”

Illustrative Examples of Insurance Scenarios

Understanding how different scenarios impact your Michigan car insurance is crucial for making informed decisions. The following examples illustrate the potential effects of accidents, coverage choices, and other factors on your premiums and claims process.

Minor Accident Impact on Premiums

Imagine you’re backing out of a parking spot and lightly tap another vehicle, causing minor damage to a bumper. This is considered a minor accident. While you might not require a significant claim, your insurance company will likely be notified. Even minor accidents can lead to a slight increase in your premium, typically a few percentage points, reflecting the added risk. The extent of the premium increase depends on factors such as your driving record and the specific details of the accident. For instance, if you were deemed at fault, the increase might be larger than if the other driver was at fault.

Significant Accident and Claim Process

Consider a more serious scenario: a collision at an intersection resulting in significant damage to both vehicles and injuries to the occupants. This would trigger a more extensive claims process. You’d need to report the accident to your insurance company immediately, providing details and potentially exchanging information with the other driver’s insurance company. Depending on the severity of the injuries and the extent of the property damage, the claim could take weeks or even months to resolve. Your premiums will likely increase substantially following such an accident, particularly if you were deemed at fault, potentially doubling or even tripling depending on the specifics of the accident and your insurance history.

Cost Difference: Minimum vs. Comprehensive Coverage

Let’s compare the annual cost of minimum coverage versus comprehensive coverage for a typical driver in Michigan. Minimum coverage, fulfilling the state’s no-fault requirements, might cost around $500 annually. This covers only the minimum required liability and personal injury protection. Comprehensive coverage, on the other hand, includes collision, comprehensive, and potentially higher liability limits. This broader coverage would likely cost significantly more, potentially $1500 to $2500 annually, depending on factors like vehicle type, driving record, and location. The substantial difference highlights the increased protection provided by comprehensive coverage against a wider range of potential losses.

Typical Car Insurance Policy Cost Breakdown

Imagine a pie chart representing the cost breakdown of a $1200 annual premium. A large slice (approximately 40%) represents liability coverage, protecting you against claims from others involved in an accident where you are at fault. Another significant slice (30%) represents personal injury protection (PIP), covering your medical expenses and lost wages regardless of fault. A smaller slice (20%) covers Uninsured/Underinsured Motorist coverage, protecting you in accidents with drivers lacking sufficient insurance. The remaining 10% covers administrative fees and other associated costs. This visual representation illustrates how the majority of your premium goes towards liability and PIP, reflecting the core components of Michigan’s no-fault system.

Epilogue

Securing affordable and comprehensive car insurance in Michigan requires careful planning and understanding. By leveraging the information presented here—from comprehending the state’s no-fault system to strategically comparing quotes and implementing cost-saving strategies—you can confidently navigate the insurance landscape and find a policy that provides the necessary protection at a price you can manage. Remember, proactive research and informed decision-making are key to securing the best possible car insurance in Michigan.

Commonly Asked Questions

What is the minimum car insurance coverage required in Michigan?

Michigan requires minimum coverage for PIP (Personal Injury Protection) and property damage liability. Specific amounts vary; check the state’s official resources for the most up-to-date requirements.

How often can I get my car insurance rates reviewed?

You can typically request a review of your rates whenever you like, especially if your circumstances have changed (e.g., improved driving record, new car, change in address).

Can I get car insurance if I have a DUI on my record?

Yes, but it will likely be significantly more expensive. Insurers consider DUI convictions high-risk factors.

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others. Collision coverage pays for damages to your vehicle, regardless of fault.