The Michigan Health Insurance Exchange Marketplace plays a vital role in ensuring access to affordable healthcare for Michigan residents. Understanding its intricacies—from eligibility requirements and plan options to financial assistance and enrollment processes—is crucial for navigating the system effectively. This guide provides a clear and concise overview of the marketplace, empowering individuals and families to make informed decisions about their health insurance coverage.

This exploration delves into the history, evolution, and current state of the Michigan Health Insurance Marketplace, examining its impact on healthcare access and affordability within the state. We’ll dissect the various plan types, eligibility criteria, financial assistance programs, and available resources, providing a comprehensive understanding of this critical component of the Michigan healthcare landscape.

Overview of the Michigan Health Insurance Marketplace

The Michigan Health Insurance Marketplace, also known as the HealthCare.gov marketplace for Michigan residents, serves as a crucial platform for individuals and families to find and purchase affordable health insurance plans. Its primary purpose is to connect consumers with a variety of plans that meet their needs and budget, ensuring access to essential healthcare services. Key features include a streamlined online application process, plan comparison tools, and eligibility assistance for government subsidies that can significantly lower the cost of coverage.

The marketplace’s history reflects the evolution of the Affordable Care Act (ACA). Launched in 2013 alongside the nationwide rollout of the ACA, the Michigan Marketplace initially faced challenges in enrollment and website functionality, common issues across the country during the initial implementation phase. Over time, significant improvements have been made to the website’s user-friendliness and technological stability. Subsequent years have seen adjustments to plan offerings, subsidy calculations, and outreach efforts to increase enrollment among eligible residents. The marketplace has adapted to changing political landscapes and ongoing refinements to the ACA, continuously striving to improve its effectiveness in providing access to quality, affordable health insurance.

The Marketplace’s Role in Providing Affordable Health Insurance

The Michigan Health Insurance Marketplace plays a vital role in expanding access to affordable healthcare for Michigan residents. It achieves this primarily through several mechanisms. The availability of a wide range of plans from different insurance providers allows consumers to compare options and choose the plan that best fits their needs and budget. Crucially, the marketplace offers subsidies, or financial assistance, to eligible individuals and families based on their income. These subsidies significantly reduce the monthly premiums, making health insurance attainable for those who might otherwise struggle to afford it. The marketplace also offers enrollment assistance through navigators and certified application counselors, providing guidance and support to individuals navigating the sometimes complex process of selecting a health insurance plan. This combination of plan choice, financial assistance, and expert support contributes significantly to the marketplace’s success in expanding health insurance coverage within the state.

Eligibility and Enrollment Process

Navigating the Michigan Health Insurance Marketplace can seem complex, but understanding the eligibility requirements and enrollment process simplifies the experience. This section details the steps involved in determining your eligibility and enrolling in a health insurance plan.

Eligibility Requirements

Eligibility for the Michigan Health Insurance Marketplace depends on several factors, primarily income and residency. Applicants must be Michigan residents and U.S. citizens or legal residents. Income levels are crucial; individuals and families must earn below a specific threshold to qualify for subsidies that lower the cost of premiums. These income limits are adjusted annually and are based on the Federal Poverty Level (FPL). For example, a family of four might qualify for subsidies if their income is below a certain percentage of the FPL for that year. Additionally, individuals may qualify for Medicaid or the Children’s Health Insurance Program (CHIP) based on income and family size, even if they don’t qualify for Marketplace subsidies. It’s important to check the Healthcare.gov website for the most up-to-date income guidelines. Pregnant women and new parents also have specific enrollment options and deadlines to consider.

Enrollment Process

The enrollment process is straightforward but requires attention to detail. First, you’ll need to gather necessary documentation. This includes proof of identity (such as a driver’s license or passport), proof of income (like tax returns or pay stubs), and proof of residency (such as a utility bill or lease agreement). Next, you will create an account on the HealthCare.gov website or contact the Marketplace directly. You’ll then provide information about yourself and your family, including your income, household size, and any existing health conditions. Based on this information, the system will determine your eligibility for subsidies and show you available plans within your budget and area. You’ll select a plan that meets your needs and submit your application. After reviewing your application, you’ll receive confirmation of your enrollment and your insurance coverage start date.

Enrollment Periods and Deadlines

The Marketplace has specific enrollment periods. The Open Enrollment Period typically runs for several months each year, usually in the fall. Outside of the Open Enrollment Period, you can only enroll if you qualify for a Special Enrollment Period. This occurs due to specific life events such as getting married, having a baby, or losing other health coverage. Missing the deadlines for enrollment or Special Enrollment Periods can result in a gap in coverage, potentially leading to higher costs if you enroll later. Therefore, it’s crucial to be aware of the annual deadlines.

Enrollment Method Comparison

| Method | Advantages | Disadvantages | Eligibility Assistance |

|---|---|---|---|

| Online (Healthcare.gov) | Convenient, accessible 24/7, detailed plan comparisons | Requires computer literacy and internet access; potential for technical difficulties | Online chat and help resources available |

| Phone | Assistance from trained representatives, helpful for those with limited computer skills | Longer wait times, less control over the process, limited access during off-peak hours | Representatives can assist with eligibility determination |

| In-Person (Navigator Assistance) | Personalized assistance, opportunity for clarification, helpful for those needing extensive support | Limited availability, requires travel to an assistance center, potential scheduling challenges | Navigators provide in-depth guidance and support throughout the enrollment process |

Available Plans and Coverage Options

Choosing a health insurance plan can feel overwhelming, but understanding the different options available on the Michigan Health Insurance Marketplace makes the process much simpler. The marketplace offers a range of plans, each designed to meet varying needs and budgets. These plans are categorized by their level of cost-sharing, influencing how much you pay out-of-pocket versus your insurance company.

The primary way plans are categorized is by their “metal tier”: Bronze, Silver, Gold, and Platinum. These tiers represent the balance between your monthly premium (what you pay each month) and your cost-sharing (deductibles, co-pays, and out-of-pocket maximums). Generally, higher metal tiers mean lower out-of-pocket costs, but also higher monthly premiums.

Plan Metal Tiers and Cost-Sharing

Each metal tier represents a different level of cost-sharing. Understanding these differences is crucial for choosing a plan that aligns with your financial situation and healthcare needs. The following Artikels the typical cost-sharing structure for each plan type. Keep in mind that specific details vary by plan and insurer.

| Plan Type | Average Premium (Example – Actual Premiums Vary) | Deductible (Example – Actual Deductibles Vary) | Out-of-Pocket Maximum (Example – Actual Maximums Vary) |

|---|---|---|---|

| Bronze | $300/month | $7,000 | $7,900 |

| Silver | $450/month | $4,000 | $8,000 |

| Gold | $600/month | $2,000 | $8,100 |

| Platinum | $750/month | $1,000 | $8,200 |

Note: These are example values and actual premiums, deductibles, and out-of-pocket maximums will vary significantly depending on the specific plan, insurer, location, and individual circumstances. Always check the details of each plan before enrolling.

Comparing Plan Costs and Benefits

The choice between plan types involves balancing monthly premiums against potential out-of-pocket expenses. A Bronze plan, for instance, has a lower monthly premium but a higher deductible and out-of-pocket maximum. This means you’ll pay less each month but more if you need significant healthcare services. Conversely, a Platinum plan offers lower cost-sharing but comes with a higher monthly premium. A Silver or Gold plan sits somewhere in between, offering a compromise between premium costs and out-of-pocket expenses.

Consider your typical healthcare utilization when making your decision. If you rarely need medical care, a Bronze plan might be a cost-effective option. However, if you anticipate needing frequent medical attention or have a pre-existing condition, a higher-tier plan might offer better value in the long run by mitigating your out-of-pocket costs.

Financial Assistance and Subsidies

Affording health insurance can be a challenge for many, but the Michigan Health Insurance Marketplace offers substantial financial assistance to make coverage more accessible. Subsidies, in the form of tax credits, can significantly lower the cost of monthly premiums and out-of-pocket expenses, making quality healthcare within reach for a wider population.

Eligibility for these subsidies is primarily based on income. The amount of financial assistance you receive is directly tied to your household income and size, as well as the cost of health insurance plans in your area. Generally, individuals and families earning between 100% and 400% of the Federal Poverty Level (FPL) are eligible for some level of assistance. The higher your income within this range, the smaller the subsidy you will receive. However, even those earning close to 400% of the FPL might find their premiums substantially reduced.

Subsidy Eligibility Criteria

Eligibility for premium tax credits hinges on several factors. Income is the most significant factor, with eligibility generally extending to those earning between 100% and 400% of the Federal Poverty Level (FPL). Household size is also considered, as the FPL varies depending on the number of people in a household. For example, a family of four might be eligible for assistance at a higher income level than a single individual. Citizenship or immigration status also plays a role; legal residents and citizens are generally eligible. Finally, individuals must not have access to affordable employer-sponsored health insurance to qualify for marketplace subsidies.

Premium Tax Credit Examples

Let’s consider two examples to illustrate the impact of subsidies. Imagine a single individual earning $30,000 annually (approximately 150% of the FPL). Without a subsidy, their monthly premium might be $300. With the tax credit, this could be reduced to $150, a 50% reduction. Now, consider a family of four earning $75,000 annually (around 250% of the FPL). Their monthly premium might be $800 without assistance. With a subsidy, this could be reduced to $400, a significant decrease that makes quality healthcare far more affordable. These are illustrative examples, and the actual amounts will vary depending on individual circumstances and plan choices.

Applying for Financial Assistance

Applying for financial assistance is integrated into the enrollment process on the Michigan Health Insurance Marketplace website. During the application, you’ll provide information about your household income, size, and citizenship status. The system will then automatically calculate your eligibility for premium tax credits and cost-sharing reductions. If approved, the subsidy will be applied directly to your monthly premiums, reducing your out-of-pocket cost. You will not receive a separate check or payment; the reduction is reflected in your monthly bill. In some cases, further verification of income might be requested to confirm eligibility.

Navigating the Marketplace Website and Resources

The Michigan Health Insurance Marketplace website offers a user-friendly platform designed to guide individuals through the process of selecting a health insurance plan. Its intuitive design and comprehensive resources aim to simplify what can often be a complex process. Understanding the website’s key features and available support is crucial for a successful enrollment experience.

The Michigan Health Insurance Marketplace website provides a centralized location for browsing available health insurance plans, comparing coverage options, determining eligibility for financial assistance, and completing the enrollment process. Key features include a plan comparison tool, a personalized eligibility checker, and secure online enrollment capabilities. The site is designed to be accessible on various devices, including desktops, tablets, and smartphones.

Website Features and Functionalities

The website’s plan comparison tool allows users to filter plans based on various criteria, such as price, provider network, and coverage details. Users can input their personal information, such as age and location, to receive a personalized list of plans. The eligibility checker determines whether an individual qualifies for financial assistance based on income and household size. The enrollment process is straightforward and secure, allowing users to complete their application online and track their progress. The website also provides access to frequently asked questions (FAQs), educational materials, and contact information for assistance. For example, users can easily compare plans side-by-side, highlighting key differences in deductibles, co-pays, and out-of-pocket maximums.

Available Resources and Support

Several resources are available to assist individuals navigating the marketplace website and enrollment process. These resources include phone support, email support, online chat, and in-person assistance at designated enrollment centers. Trained navigators are available to answer questions, provide guidance, and assist with the application process. These navigators can help users understand their options, compare plans, and complete the enrollment process efficiently and accurately. For instance, a user struggling to understand the difference between HMO and PPO plans can receive personalized clarification from a navigator.

Using Website Tools to Compare Plans and Estimate Costs

The website’s plan comparison tool simplifies the process of comparing health insurance plans. Users can filter plans based on their specific needs and preferences, allowing them to identify the most suitable option. The tool provides detailed information on each plan’s coverage, costs, and provider network. Users can also use the cost estimator tool to predict their monthly premiums and out-of-pocket expenses. For example, a user can compare plans with different deductible amounts and see how this affects their overall cost. This allows for informed decision-making based on individual financial situations and health needs.

Helpful Resources

Finding the right resources can streamline the enrollment process. Below is a list of helpful resources:

- Website: [Insert Michigan Health Insurance Marketplace Website Address]

- Phone Number: [Insert Phone Number]

- Email Address: [Insert Email Address]

- FAQs: [Insert Link to FAQs]

- Navigator Program Contact Information: [Insert Contact Information for Navigator Program]

Comparison with Other State Marketplaces

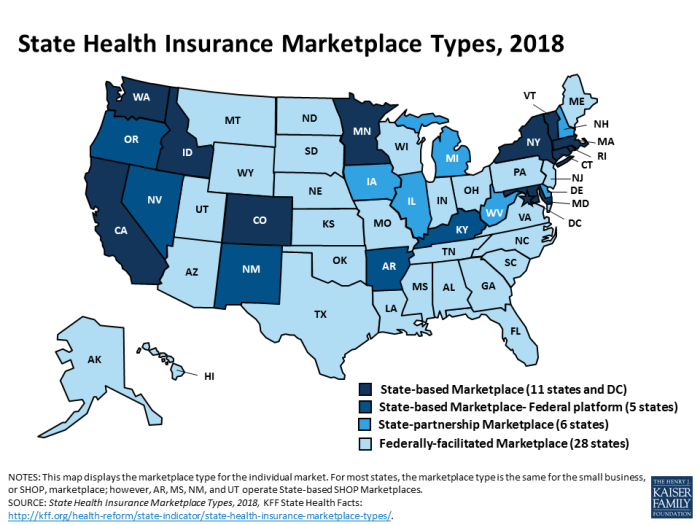

The Michigan Health Insurance Marketplace, like those in other states, aims to provide a streamlined process for individuals and families to obtain health insurance coverage. However, significant variations exist across state marketplaces due to differing state regulations, political climates, and the level of federal involvement. Comparing Michigan’s marketplace with others reveals both commonalities and crucial distinctions that impact consumer experience and access to affordable healthcare.

State marketplaces generally share the core function of offering a platform to compare and enroll in health insurance plans compliant with the Affordable Care Act (ACA). However, the specific plans available, eligibility requirements, and the extent of financial assistance can vary considerably. These variations stem from a combination of federal guidelines and individual state decisions regarding Medicaid expansion, the level of outreach and assistance offered to consumers, and the types of plans contracted with insurers.

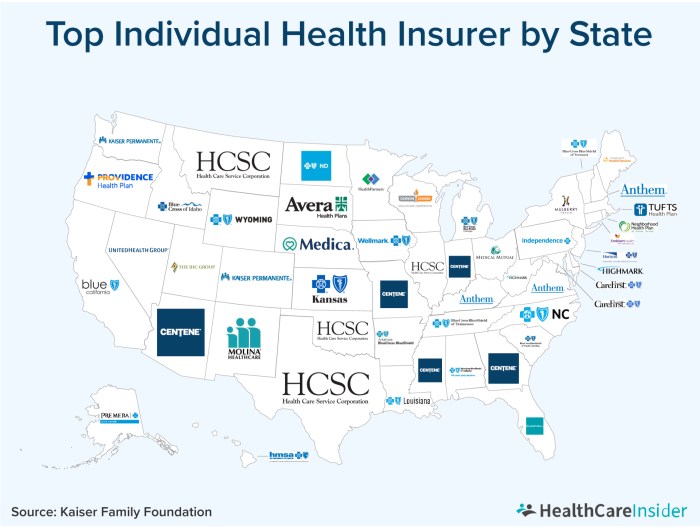

Plan Offerings and Network Variations

The range of health insurance plans offered on each state marketplace is influenced by the number and types of insurers participating. Some states may have a wider variety of plans from multiple insurance providers, leading to greater choice in terms of premiums, deductibles, and network coverage. Conversely, states with fewer participating insurers may offer less plan diversity, potentially limiting consumer options. For example, while Michigan might offer plans from Blue Cross Blue Shield of Michigan and other national carriers, a smaller state might primarily feature plans from one or two regional insurers, leading to less competitive pricing and potential limitations in provider networks. The breadth and depth of the provider networks associated with each plan also vary across states, affecting access to specific doctors and hospitals.

Eligibility Criteria and Medicaid Expansion

Eligibility for marketplace plans and subsidies is largely determined by federal guidelines, but states play a role in expanding Medicaid eligibility. States that have expanded Medicaid under the ACA generally have higher rates of insured individuals. The eligibility criteria for subsidies, based on income, remain consistent across states, but the impact of Medicaid expansion on the overall insured population creates a significant difference in who utilizes the marketplace versus Medicaid. For instance, individuals in states that expanded Medicaid may find themselves eligible for Medicaid rather than marketplace subsidies, leading to different enrollment pathways and coverage options.

Financial Assistance and Subsidy Variations

While the federal government provides significant financial assistance through tax credits and cost-sharing reductions, the effective level of assistance can vary depending on state-specific factors. These factors include the average cost of insurance in the state and the income levels of the population. A state with a higher average cost of insurance may see consumers receive larger tax credits to offset their premiums, even if the income thresholds for eligibility remain the same. States also differ in the resources they dedicate to assisting consumers in navigating the marketplace and applying for financial aid. Some states provide more extensive outreach and enrollment assistance programs than others, potentially affecting the number of individuals who successfully obtain subsidies.

Impact of Healthcare Reform on the Marketplace

The Affordable Care Act (ACA), enacted in 2010, fundamentally reshaped the landscape of healthcare in the United States, significantly impacting the Michigan Health Insurance Marketplace. This reform introduced numerous changes, affecting enrollment, plan offerings, and access to affordable healthcare for Michigan residents. The subsequent years have witnessed a dynamic interplay of legislative adjustments, market responses, and evolving consumer needs, all of which have influenced the Marketplace’s trajectory.

The ACA’s core tenets, such as the individual mandate (since repealed), guaranteed issue and community rating provisions, and the expansion of Medicaid eligibility, created a new framework for health insurance. These provisions aimed to increase coverage and affordability, though their effects have been complex and varied.

Enrollment Numbers and Plan Offerings

The ACA’s implementation led to a substantial increase in enrollment in the Michigan Health Insurance Marketplace during its initial years. Many previously uninsured individuals gained access to coverage through the marketplace’s subsidies and expanded eligibility criteria. However, enrollment figures have fluctuated since then, influenced by factors such as changes in the individual mandate, economic conditions, and ongoing political debates surrounding the ACA. The number of participating insurance plans has also seen variations, reflecting market competition and insurer decisions regarding profitability and risk assessment. For example, in the early years following the ACA’s passage, a significant increase in the number of insurers participating in the marketplace was observed, leading to a wider selection of plans for consumers. However, in subsequent years, some insurers withdrew from certain markets due to financial challenges, resulting in a reduction in plan choices in some areas.

Impact on Access to Affordable Healthcare

The ACA’s impact on access to affordable healthcare in Michigan is a multifaceted issue. While the marketplace and its subsidies have made coverage more accessible for many low- and moderate-income individuals, significant challenges remain. The cost of healthcare, including premiums, deductibles, and co-pays, continues to be a barrier for some, despite the availability of financial assistance. Furthermore, the availability of affordable plans in certain geographic areas or for individuals with specific health conditions can be limited. For instance, while the ACA aimed to increase coverage for individuals with pre-existing conditions, some insurers might offer plans with higher premiums or limited networks in areas with a higher concentration of individuals with these conditions. This illustrates the complexities of achieving equitable access to affordable healthcare across all demographics and geographic regions within the state.

Future Trends and Challenges

The Michigan Health Insurance Marketplace, like all healthcare marketplaces, faces a dynamic landscape shaped by evolving demographics, technological advancements, and shifting political priorities. Understanding these trends and challenges is crucial for ensuring the marketplace’s continued effectiveness in providing affordable and accessible healthcare to Michigan residents. Predicting the future with certainty is impossible, but analyzing current trends allows us to anticipate potential hurdles and opportunities.

The long-term sustainability of the marketplace hinges on several factors, including consistent enrollment, adequate funding, and effective administration. Maintaining a healthy balance between affordability and comprehensive coverage is a constant challenge that requires proactive adjustments to market dynamics and regulatory frameworks.

Potential Policy Changes and Their Impacts

Policy changes at both the state and federal levels significantly influence the marketplace’s operation and accessibility. For example, changes to federal subsidies or the availability of Medicaid expansion could dramatically affect enrollment numbers and the overall financial stability of the marketplace. State-level regulations regarding insurer participation and benefit mandates also play a critical role in shaping the marketplace’s offerings and cost structures. The Affordable Care Act (ACA) itself remains a subject of ongoing debate and potential revision, with implications for the marketplace’s future. For instance, a reduction in federal funding for outreach and enrollment assistance could hinder access to coverage for vulnerable populations. Conversely, expansion of eligibility criteria could lead to increased enrollment and demand.

Projected Enrollment Fluctuations and Their Causes

Enrollment in the Michigan Health Insurance Marketplace is subject to various factors, including economic conditions, public health crises (such as pandemics), and changes in the cost of healthcare. Economic downturns, for instance, might lead to increased enrollment as individuals lose employer-sponsored coverage. Conversely, periods of economic prosperity might see a decrease in enrollment as people secure employment with health benefits. Public health emergencies can also significantly impact enrollment patterns, as demonstrated by the increased demand for coverage during the COVID-19 pandemic. Furthermore, changes in the availability and affordability of plans offered on the marketplace directly affect enrollment numbers. For example, if premiums increase significantly, fewer individuals may be able to afford coverage, resulting in lower enrollment.

Technological Advancements and Their Influence on Access and Affordability

Technological advancements, such as the increasing use of telehealth and online enrollment platforms, offer opportunities to improve access to care and streamline the enrollment process. However, these advancements also present challenges, particularly regarding digital literacy and equitable access to technology. Ensuring that all residents, regardless of their technological proficiency or geographic location, can navigate the marketplace and access necessary resources is paramount. Furthermore, the integration of artificial intelligence and machine learning could potentially improve the efficiency of the marketplace, such as through personalized recommendations and fraud detection. However, these technologies must be implemented responsibly and ethically to avoid exacerbating existing inequalities.

Sustaining Marketplace Affordability

Maintaining affordability is a central challenge for the Michigan Health Insurance Marketplace. This requires a multi-pronged approach, including addressing the rising costs of healthcare, expanding access to preventive care, and fostering competition among insurers. Strategies such as negotiating lower drug prices and promoting value-based care could help contain costs and improve affordability. Government subsidies and financial assistance programs are also crucial in ensuring that individuals and families can afford the coverage they need. The ongoing debate surrounding the balance between cost containment and comprehensive benefits will continue to shape the marketplace’s long-term financial sustainability.

Conclusive Thoughts

Securing affordable and comprehensive health insurance is a cornerstone of well-being. The Michigan Health Insurance Marketplace offers a pathway to this goal, providing a range of plans and financial assistance to meet diverse needs. By understanding the marketplace’s features, processes, and available resources, Michigan residents can confidently navigate the system and access the healthcare coverage they require. This guide serves as a valuable tool in that journey, empowering individuals to make informed choices and secure their health future.

Questions Often Asked

What happens if I miss the open enrollment period?

You may be able to enroll in a qualified health plan outside of the open enrollment period if you experience a qualifying life event, such as marriage, divorce, birth of a child, or job loss. Contact the marketplace for details.

Can I keep my current doctor if I switch plans?

Not necessarily. The network of doctors and hospitals covered by each plan varies. Check the plan’s provider directory to confirm your doctor’s participation before enrolling.

What if I can’t afford my premiums even with subsidies?

Several resources may be available to assist with affordability challenges. Explore options such as payment plans, cost-sharing reduction programs, or community assistance programs. Contact the marketplace for guidance.

How do I appeal a decision regarding my eligibility for subsidies?

The marketplace has an appeals process. Detailed instructions on how to file an appeal are usually available on their website. You should carefully review the reasons for the denial and gather any supporting documentation.

На данном ресурсе можно найти огромный выбор премиальной фирменной одежды от известных брендов по привлекательным ценам.

https://vladtoday.ru/news/2024-08-05-anton-ponkrashov-o-perehode-v-dinamo-iz-vladivostoka/