Navigating the world of auto insurance in California can feel like driving through a dense fog. Premiums vary wildly, and finding the most affordable option requires understanding a complex interplay of factors. This guide cuts through the confusion, offering a clear path to securing the best possible rate without sacrificing essential coverage. We’ll explore key elements influencing your premium, highlight strategies for cost reduction, and empower you to make informed decisions about your auto insurance.

From understanding the different types of coverage and how discounts can significantly impact your overall cost to identifying the key factors that insurance companies consider – such as your driving history, vehicle type, and location – we’ll equip you with the knowledge to confidently compare providers and secure the most affordable auto insurance that meets your needs. We’ll also delve into the fine print, helping you avoid hidden costs and ensure you’re fully protected.

Defining “Most Affordable”

Finding the most affordable auto insurance in California requires a nuanced understanding of several factors. It’s not simply about the lowest advertised price; the best policy for you depends on your individual circumstances and risk profile. The “most affordable” policy is the one that offers the necessary coverage at a price you can comfortably afford while adequately protecting you financially in the event of an accident.

Factors Influencing Auto Insurance Cost in California

Several key factors determine the cost of your California auto insurance. These include your driving record (accidents, tickets, and DUI convictions significantly increase premiums), age and driving experience (younger, less experienced drivers generally pay more), vehicle type and value (sports cars and luxury vehicles are more expensive to insure), location (insurance rates vary by zip code due to crime rates and accident frequency), and credit history (in many states, including California, your credit score can impact your premiums). Additionally, the amount and type of coverage you choose directly affects the overall cost.

Types of Auto Insurance Coverage and Price Variations

California requires minimum liability coverage, but you can purchase additional coverage for greater protection. Liability coverage pays for damages and injuries you cause to others. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage covers damage from events like theft, fire, or vandalism. Liability coverage is generally the least expensive, while comprehensive and collision coverage are more costly. The higher the coverage limits you choose (e.g., higher liability limits), the higher your premium will be. For example, a policy with $15,000 liability coverage will be considerably cheaper than one with $100,000 liability coverage.

Impact of Discounts on Overall Cost

Many insurance companies offer discounts to lower your premium. These discounts can significantly reduce the overall cost. Common discounts include good driver discounts (for drivers with clean driving records), multi-vehicle discounts (for insuring multiple vehicles with the same company), multi-policy discounts (for bundling auto and home insurance), and safe driver discounts (for using telematics devices or participating in defensive driving courses). For instance, a good driver discount might reduce your premium by 10-20%, while a multi-vehicle discount could save you an additional 15-25%. These discounts can add up, making a substantial difference in your final cost.

Comparison of Common Coverage Options and Average Cost Ranges

| Coverage Type | Description | Average Annual Cost Range | Notes |

|---|---|---|---|

| Liability | Covers injuries and damages you cause to others | $300 – $800 | Minimum coverage required in California |

| Uninsured/Underinsured Motorist | Protects you if hit by an uninsured driver | $100 – $300 | Highly recommended |

| Collision | Covers damage to your car regardless of fault | $200 – $600 | Optional, but valuable for newer vehicles |

| Comprehensive | Covers damage from non-collision events (theft, fire, etc.) | $150 – $400 | Optional, but recommended for added protection |

*(Note: These are average ranges and actual costs will vary depending on individual factors. These figures are estimates and may not reflect current market rates.)*

Identifying Key Factors Affecting Premiums

Securing the most affordable auto insurance in California involves understanding the various factors that influence premium calculations. These factors are not always transparent, but grasping their impact allows for better informed decision-making and potentially lower costs. This section details some of the key elements affecting your insurance rates.

Driver Demographics and Driving History

Your age and driving record significantly impact your insurance premium. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. Conversely, older drivers with clean records often qualify for lower rates due to their lower risk profile. Similarly, your driving history plays a crucial role. Accidents, traffic violations (such as speeding tickets or DUIs), and at-fault collisions directly increase your premium. The severity and frequency of these incidents further influence the rate increase. For example, a single speeding ticket might result in a modest increase, while a DUI conviction could lead to a substantially higher premium, or even policy cancellation. Maintaining a clean driving record is paramount to securing affordable insurance.

Vehicle Type and Features

The type of vehicle you drive is a major determinant of your insurance cost. Sports cars, luxury vehicles, and high-performance models generally command higher premiums due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles typically result in lower premiums. Vehicle features also influence rates. Safety features like anti-lock brakes (ABS), airbags, and electronic stability control (ESC) can lower your premium as they demonstrate a reduced risk of accidents and injuries. Conversely, vehicles with expensive aftermarket modifications might increase your premium due to the higher cost of repairs. For example, a customized pickup truck with enhanced off-road capabilities might be considered higher risk than a standard model.

Geographic Location in California

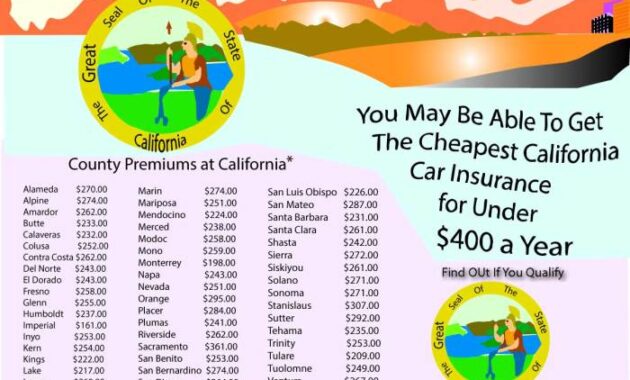

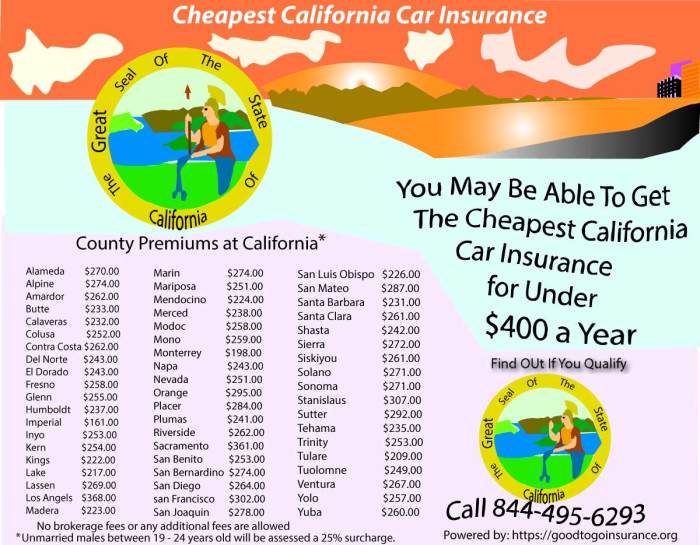

California’s diverse geography and population density lead to significant variations in insurance rates across different regions. Areas with high crime rates, frequent accidents, and higher vehicle theft rates typically have higher insurance premiums. Urban areas generally have higher rates than rural areas due to increased traffic congestion and the higher probability of collisions. Coastal areas might also have higher premiums due to factors such as increased property values and the potential for damage from natural disasters. For instance, insurance in Los Angeles, a densely populated city with high traffic, will likely be more expensive than insurance in a smaller, less populated rural town in Northern California.

Insurance Company Pricing Models

Different insurance companies utilize varying pricing models, leading to differences in premiums for the same driver and vehicle. Some companies emphasize risk assessment based on extensive data analysis, while others may focus on broader demographic factors. Understanding these models is crucial for comparison shopping. Companies may also offer different discounts, such as safe driver discounts, multi-vehicle discounts, or discounts for bundling home and auto insurance. Comparing quotes from multiple insurers is essential to identify the most affordable option that meets your specific needs. This requires carefully reviewing policy details beyond just the quoted premium, ensuring you’re comparing apples to apples in terms of coverage and deductibles.

Exploring Insurance Company Options

Choosing the right auto insurance provider is crucial for securing affordable coverage in California. Several factors influence your premium, and understanding the strengths and weaknesses of different companies will help you make an informed decision. This section explores major insurers, their typical customer bases, and coverage offerings to guide your selection process.

Major Auto Insurance Providers in California

California boasts a competitive auto insurance market with numerous providers. Understanding their distinct offerings and customer profiles is vital for selecting the best fit. The following list presents some of the most prominent companies, though this is not an exhaustive list.

Below is a brief overview of some major auto insurance providers in California. Note that specific offerings and pricing can vary significantly based on individual factors.

| Company | Typical Customer Profile | Coverage Offerings | Average Cost Estimation (Annual) |

|---|---|---|---|

| State Farm | Broad range of drivers, known for strong customer service. | Comprehensive, collision, liability, uninsured/underinsured motorist, and various add-ons. | $1200 – $2000 (This is a broad range and varies greatly based on factors like driving history, vehicle, and location) |

| Geico | Often attracts younger drivers and those seeking online convenience. | Standard coverage options, with a focus on digital tools and streamlined processes. | $1000 – $1800 (This is a broad range and varies greatly based on factors like driving history, vehicle, and location) |

| Progressive | Appeals to a wide range of drivers, emphasizing personalized pricing and bundled options. | Comprehensive coverage options, including usage-based insurance programs. | $1100 – $1900 (This is a broad range and varies greatly based on factors like driving history, vehicle, and location) |

| Farmers Insurance | Strong presence in rural areas, known for local agents and personalized service. | Comprehensive coverage options with a focus on personal service and local representation. | $1300 – $2200 (This is a broad range and varies greatly based on factors like driving history, vehicle, and location) |

Utilizing Online Comparison Tools

Online comparison tools offer a convenient way to explore different insurance quotes simultaneously. These tools typically require you to input personal information, such as your driving history, vehicle details, and desired coverage levels. The tools then generate quotes from multiple insurers, allowing for easy side-by-side comparison.

Examples of popular comparison websites include but are not limited to The Zebra, Insurify, and NerdWallet. Remember to compare not only price but also coverage details and customer reviews before making a decision. Using these tools can significantly reduce the time and effort involved in finding the most affordable option for your needs.

For example, if you input your information into The Zebra, you might receive quotes ranging from $1000 to $2500 annually from different companies. This wide range highlights the importance of comparing multiple options and carefully considering your individual circumstances.

Strategies for Lowering Insurance Costs

Securing affordable auto insurance in California requires a proactive approach. By implementing several strategies, drivers can significantly reduce their premiums and maintain comprehensive coverage. Understanding the factors influencing your rates empowers you to make informed decisions and potentially save hundreds of dollars annually.

Maintaining a Good Driving Record

A clean driving record is arguably the most significant factor in determining your auto insurance premium. Insurance companies view drivers with a history of accidents and traffic violations as higher risks. Each incident, such as a speeding ticket or at-fault accident, increases your risk profile, leading to higher premiums. Conversely, maintaining a spotless driving record demonstrates responsible behavior and significantly lowers your risk profile, resulting in lower premiums. For example, a driver with a history of three accidents within five years will likely pay considerably more than a driver with no accidents. Companies often offer discounts for drivers who maintain accident-free periods of three to five years or longer.

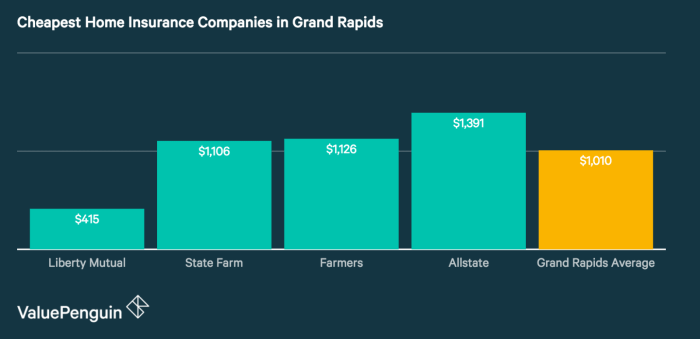

Bundling Insurance Policies

Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, is a common strategy to achieve significant cost savings. Many insurance companies offer discounts for bundling multiple policies, as it simplifies their administration and reduces the overall risk. The discount percentage varies by company and the specific policies bundled, but savings can often reach 10% or more. For instance, a driver who bundles their auto insurance with a homeowners policy might see a 15% reduction in their overall premium compared to purchasing each policy separately.

Improving Credit Score

In many states, including California, insurance companies consider your credit score when determining your auto insurance rates. A higher credit score often translates to lower premiums, as it indicates financial responsibility. While the exact impact varies by insurer, a good credit score can result in substantial savings. Improving your credit score involves responsible financial practices, such as paying bills on time, keeping credit utilization low, and avoiding new credit applications unnecessarily. For example, a driver with an excellent credit score (750 or above) might qualify for a significantly lower premium compared to a driver with a poor credit score (below 600). It is important to note that this practice is subject to state regulations and some states prohibit the use of credit scores for insurance rating.

Understanding Policy Details and Fine Print

Securing the most affordable auto insurance in California is only half the battle. Understanding the details of your chosen policy is equally crucial to ensure you receive the coverage you need when you need it. Failing to carefully review your policy can lead to unexpected costs and inadequate protection.

The fine print of your auto insurance policy contains vital information that dictates your coverage. Overlooking critical details can leave you financially vulnerable in the event of an accident or other covered incident. Understanding exclusions, limitations, and potential hidden fees is essential for making an informed decision and avoiding unpleasant surprises.

Common Policy Exclusions and Limitations

Auto insurance policies don’t cover everything. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence. Limitations often involve specific dollar amounts for coverage, such as the maximum payout for a particular claim. For instance, a policy might have a $500 deductible for collision damage, meaning you pay the first $500 before the insurance company covers the rest. Understanding these limitations is key to avoiding disappointment when filing a claim. Furthermore, geographical limitations might restrict coverage to specific areas. Policies might also exclude certain types of vehicles or exclude coverage for certain drivers.

Potential Hidden Fees and Surcharges

Beyond the premium, several hidden fees or surcharges can increase your overall cost. These might include administrative fees, late payment penalties, or fees for adding or changing coverage. Some companies might also impose surcharges based on your driving record, age, or the type of vehicle you insure. For example, a young driver with a history of accidents might face higher premiums and surcharges compared to an older driver with a clean record. Carefully reviewing the policy document for any such additional charges is crucial to manage your budget effectively.

Questions to Ask Insurance Providers

Before committing to a policy, it’s vital to clarify any uncertainties. Asking direct questions can prevent misunderstandings and ensure you’re fully informed.

- What specific events or situations are explicitly excluded from coverage?

- What are the limits on liability, collision, and comprehensive coverage?

- What is the deductible for each type of coverage, and how does it affect my out-of-pocket expenses?

- Are there any additional fees or surcharges that might apply to my policy?

- What is the process for filing a claim, and what documentation will I need to provide?

- What are the options for resolving disputes or disagreements regarding coverage?

- What is the company’s customer service process, and how can I contact them if I have questions or need assistance?

Illustrative Examples of Cost-Saving Scenarios

Understanding the potential savings in auto insurance requires examining specific situations. The following examples illustrate how different factors can significantly impact your premium. Remember that these are illustrative and actual costs will vary depending on your specific circumstances and insurer.

Full Coverage vs. Liability-Only Coverage

The difference between full coverage and liability-only insurance can be substantial. Full coverage protects your vehicle in accidents, regardless of fault, while liability-only covers damages you cause to others. Let’s consider a hypothetical scenario: A 30-year-old driver with a clean driving record in a mid-sized sedan in Los Angeles might pay approximately $1,500 annually for full coverage. The same driver with liability-only coverage could see their premium reduced to roughly $800 per year, representing a savings of $700. This significant difference highlights the trade-off between comprehensive protection and cost. The decision hinges on your risk tolerance and the value of your vehicle.

Impact of Adding a Teen Driver

Adding a teen driver to an existing policy dramatically increases premiums due to their higher accident risk. Imagine the same 30-year-old driver from the previous example adding a 16-year-old son to their policy. Their annual premium could jump from $1,500 to $2,800, a $1,300 increase. This underscores the importance of considering the added cost when a teenager begins driving. Strategies like defensive driving courses for the teen can mitigate this increase, as discussed later.

Effect of Driver’s Safety Course Completion

Completing a state-approved driver safety course can demonstrably lower insurance premiums. Let’s assume our 30-year-old driver receives a speeding ticket, resulting in a premium increase of $200. By completing a defensive driving course, they could potentially reduce or even eliminate this surcharge, saving them the extra $200. Many insurers offer discounts for completing these courses, demonstrating a tangible benefit of proactive driver education.

Premium Costs for Different Vehicle Types

A bar graph visually comparing premium costs would effectively illustrate this point. The horizontal axis would list vehicle types (e.g., Sedan, SUV, Pickup Truck, Sports Car). The vertical axis would represent annual premium cost in dollars. The bars would show that a sedan might have the lowest premium (e.g., $1200), followed by an SUV (e.g., $1500), then a pickup truck (e.g., $1800), with a sports car exhibiting the highest premium (e.g., $2500). This visual representation clearly demonstrates how the type of vehicle significantly impacts insurance costs due to factors like repair costs and theft risk. The differences in premium costs are directly correlated to the vehicle’s inherent risk profile.

Epilogue

Securing the most affordable auto insurance in California doesn’t have to be an overwhelming task. By understanding the factors influencing premiums, leveraging available discounts, and carefully comparing providers, you can significantly reduce your costs without compromising necessary coverage. Remember to always read your policy carefully and ask clarifying questions before committing to any plan. Armed with this knowledge, you can confidently navigate the insurance landscape and find the best fit for your budget and driving needs.

Q&A

What is the minimum required auto insurance coverage in California?

California requires minimum liability coverage of 15/30/5 ($15,000 for injury to one person, $30,000 for injuries to multiple people, and $5,000 for property damage).

Can I get car insurance without a driver’s license?

Generally, no. Most insurers require a valid driver’s license to issue a policy.

How often can I expect my car insurance rates to change?

Rates can change annually, or even more frequently depending on your driving record, claims history, and changes in the insurance market.

What is SR-22 insurance?

SR-22 insurance is proof of financial responsibility required by the DMV in certain situations, such as after a DUI or serious accident. It verifies you maintain the minimum required liability coverage.