Securing affordable car insurance in California can feel like navigating a complex maze. Factors like driving history, vehicle type, location, and even credit score significantly impact premiums. This guide unravels the intricacies of the California car insurance market, empowering you to make informed decisions and find the best coverage at the most competitive price. We’ll explore various strategies for comparison shopping, identify potential discounts, and demystify the application process.

Understanding the nuances of California’s insurance landscape is key to saving money. From minimum coverage requirements to the benefits of bundling policies, we’ll provide a clear and concise overview, helping you avoid costly mistakes and secure the most suitable and affordable insurance plan for your needs. This guide serves as your roadmap to navigating the California car insurance market effectively and confidently.

Understanding California’s Car Insurance Market

California’s car insurance market is a complex landscape shaped by numerous factors, resulting in a wide range of premiums across the state. Understanding these influences is crucial for consumers seeking the most affordable coverage. This section will explore the key elements impacting car insurance costs, the types of coverage available, and the differences between minimum and recommended levels of protection.

Factors Influencing Car Insurance Costs in California

Several interconnected factors determine the cost of car insurance in California. These include the driver’s history (accident and violation record), the type and age of the vehicle, the location of residence (due to varying accident rates and crime statistics across different areas), the level of coverage selected, and the driver’s credit score (in some cases). Additionally, the insurer’s own risk assessment models and competitive pricing strategies play a significant role. For example, drivers with a history of accidents or traffic violations generally pay higher premiums than those with clean driving records. Similarly, insuring a high-performance sports car will typically cost more than insuring an economical sedan. Geographic location is a significant factor because insurers consider the frequency of accidents and theft in specific areas.

Types of Car Insurance Coverage Available in California

California offers various car insurance coverage options. Liability coverage is legally mandated and protects against financial responsibility for injuries or damages caused to others in an accident. This typically includes bodily injury liability and property damage liability. Uninsured/underinsured motorist coverage protects against drivers without sufficient insurance. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage covers damage from events like theft, fire, or vandalism. Medical payments coverage helps pay for medical bills resulting from an accident, regardless of fault. Personal injury protection (PIP) coverage, though not mandated, provides benefits for medical expenses and lost wages for you and your passengers.

Minimum Coverage Requirements Versus Recommended Coverage

California’s minimum liability coverage requirements are $15,000 for injury or death of one person, $30,000 for injury or death of multiple people in a single accident, and $5,000 for property damage. While meeting the minimum requirements is legally sufficient, it may not provide adequate protection in the event of a serious accident. Recommended coverage levels are significantly higher, often including much greater liability limits (e.g., $100,000/$300,000/$50,000 or higher) and comprehensive and collision coverage to protect your own vehicle. Choosing higher coverage limits protects you from substantial financial liability in case of a major accident involving significant injuries or property damage. The difference between minimum and recommended coverage can be substantial in terms of financial protection.

The Role of Driving History and Demographics in Determining Insurance Premiums

An individual’s driving history is a primary factor in determining insurance premiums. A clean driving record with no accidents or violations usually translates to lower premiums. Conversely, multiple accidents or traffic violations can lead to significantly higher premiums. Insurers also consider demographic factors, although their use is subject to regulations designed to prevent discrimination. Age is a factor, with younger drivers generally paying more due to higher accident rates. Credit history can also influence premiums in some cases, reflecting the insurer’s assessment of risk. For example, a young driver with a clean driving record might still pay a higher premium than an older driver with a similar record due to statistical accident rate differences.

Finding Affordable Insurance Options

Securing affordable car insurance in California requires a proactive approach. By understanding the market and employing effective comparison strategies, drivers can significantly reduce their premiums. This section Artikels key steps to finding the best value for your insurance needs.

Finding the most affordable car insurance involves diligent comparison shopping and understanding your personal risk profile. Several factors influence your premium, including your driving history, age, location, vehicle type, and coverage choices. Smart strategies can help you navigate this process and secure the best possible rates.

Comparing Car Insurance Quotes

Effectively comparing car insurance quotes requires a systematic approach. Begin by obtaining quotes from multiple insurers, ideally at least five to seven, to ensure a comprehensive comparison. Use online comparison tools, but also contact insurers directly to discuss specific needs and potential discounts. Pay close attention to the details of each quote, including deductibles, coverage limits, and any exclusions. Don’t just focus on the lowest price; consider the overall value and level of protection offered. Remember to keep consistent information across all quotes to ensure accurate comparisons.

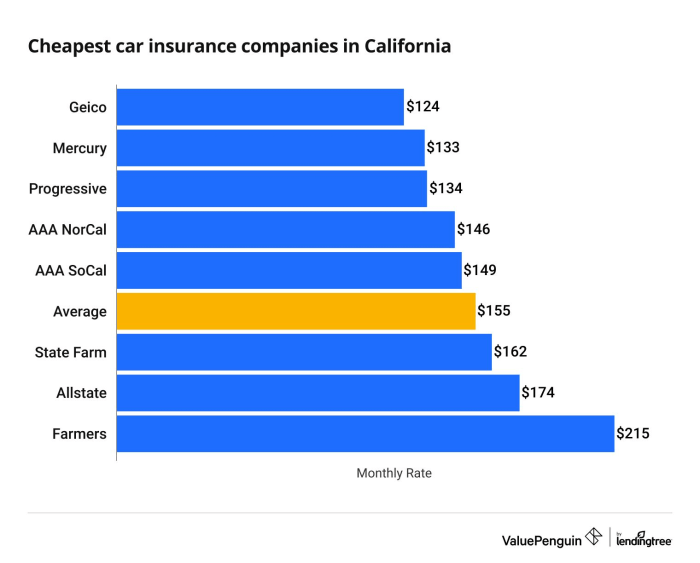

Reputable Car Insurance Companies in California

Many reputable car insurance companies operate within California. Choosing a company with a strong financial rating and a history of customer satisfaction is crucial. Consider factors such as claims handling processes, customer service responsiveness, and available discounts. Researching reviews and ratings from independent sources can provide valuable insights.

Comparison of Major Insurers

| Insurer | Average Annual Premium (Estimate) | Key Features | Customer Service Rating (Example) |

|---|---|---|---|

| Geico | $1200 – $1800 | Wide coverage options, strong online presence, bundling discounts | 4.5 stars |

| State Farm | $1100 – $1700 | Extensive agent network, various discounts, strong brand reputation | 4.2 stars |

| Progressive | $1300 – $1900 | Name Your Price® tool, customizable coverage options, accident forgiveness | 4 stars |

| USAA | $1000 – $1500 (Military members) | Excellent rates for military members and their families, strong financial stability | 4.7 stars |

*Note: Premium estimates are averages and vary significantly based on individual risk profiles. Customer service ratings are examples and may fluctuate.*

Bundling Car Insurance with Other Insurance Types

Bundling car insurance with other types of insurance, such as homeowners or renters insurance, often results in significant savings. Insurers frequently offer discounts for bundling policies, as it simplifies administration and reduces risk. However, it’s essential to compare the cost of bundled policies against purchasing them separately to ensure that the bundled discount outweighs any potential increase in individual policy costs. Carefully review the terms and conditions of bundled policies to understand any limitations or restrictions. For example, a significant increase in the home insurance premium might negate the benefit of bundling, even with a discount on the car insurance.

Factors Affecting Insurance Premiums

Several key factors influence the cost of car insurance in California. Understanding these factors can help you make informed decisions and potentially save money on your premiums. These factors interact in complex ways, so it’s not always possible to predict the exact cost, but understanding their individual impacts provides a valuable framework.

Vehicle Type and Age

The type and age of your vehicle significantly impact your insurance premium. Generally, newer cars are more expensive to insure due to higher repair costs and replacement values. Sports cars and other high-performance vehicles also tend to attract higher premiums because of their increased risk of accidents and theft. Conversely, older vehicles, while often cheaper to insure, may have higher repair costs relative to their value, potentially offsetting some of the initial savings. For example, insuring a new luxury SUV will be considerably more expensive than insuring a ten-year-old sedan of a more common make and model. The insurer considers factors like the vehicle’s safety features, repair history, and theft rate when determining premiums.

Driving Record

Your driving history is a critical factor in determining your insurance rates. Accidents and traffic violations significantly increase premiums. Multiple accidents or serious offenses, such as driving under the influence (DUI), can lead to substantially higher premiums or even policy cancellation. The severity and frequency of incidents are key considerations. For instance, a single minor fender bender might result in a moderate premium increase, whereas a DUI conviction could lead to a dramatic surge in costs. Maintaining a clean driving record is crucial for securing affordable insurance.

Coverage Levels

The level of coverage you choose directly impacts your premium. Liability coverage, which protects others in case you cause an accident, is typically required by law in California. However, adding collision and comprehensive coverage, which protect your own vehicle, increases your premium. Collision coverage pays for repairs or replacement if your car is damaged in an accident, regardless of fault. Comprehensive coverage covers damage from events other than collisions, such as theft, vandalism, or natural disasters. Choosing higher coverage limits for liability also increases the premium, but offers greater protection in the event of a significant accident. Balancing the level of coverage with your budget is essential.

Credit Score and Location

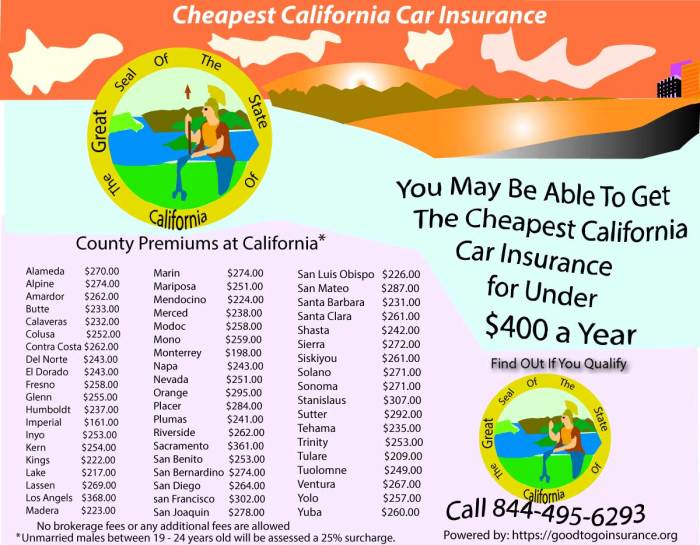

In many states, including California, your credit score can influence your insurance rates. Insurers often use credit-based insurance scores to assess risk. A higher credit score generally correlates with lower premiums, while a lower score can result in higher premiums. The rationale is that individuals with good credit are statistically less likely to file claims. Your location also plays a significant role. Areas with higher rates of accidents and theft tend to have higher insurance premiums due to the increased risk for insurers. Living in a high-crime area or a region with frequent accidents will likely result in a higher premium compared to a safer, lower-risk area.

Discounts and Savings Opportunities

Securing the most affordable car insurance in California often involves leveraging available discounts. Many companies offer a range of savings opportunities, potentially significantly reducing your premium. Understanding these discounts and how to qualify for them is crucial in minimizing your insurance costs.

California’s competitive insurance market means companies actively compete for customers by offering various discounts. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other positive attributes. By understanding these opportunities and actively pursuing them, you can substantially lower your overall insurance costs.

Common Car Insurance Discounts in California

Several common discounts are widely offered by California car insurance providers. These discounts can be stacked, meaning you can qualify for multiple discounts simultaneously, resulting in even greater savings. It’s always advisable to contact your insurer or compare quotes from different companies to see which discounts apply to your specific situation.

- Good Driver Discount: Awarded for maintaining a clean driving record, typically free of accidents and traffic violations for a specified period (e.g., 3-5 years).

- Safe Driver Discount/Telematics Programs: Many insurers use telematics devices or smartphone apps to monitor driving behavior. Safe driving habits (e.g., consistent speeds, avoiding harsh braking) often result in lower premiums.

- Multi-Car Discount: Insuring multiple vehicles under the same policy usually leads to a discount on each vehicle’s premium.

- Multi-Policy Discount: Bundling car insurance with other types of insurance, such as homeowners or renters insurance, from the same company often provides a discount.

- Good Student Discount: Students maintaining a certain GPA (usually a B average or higher) may qualify for this discount.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can lower premiums, demonstrating a commitment to safe driving practices.

- Vehicle Safety Features Discount: Cars equipped with anti-theft devices, airbags, anti-lock brakes, and other safety features often qualify for discounts.

- Payment Plan Discount: Paying your premium in full upfront, rather than in installments, may result in a discount.

Qualifying for and Applying for Discounts

The process of obtaining discounts varies slightly between insurance companies, but generally involves providing necessary documentation to support your eligibility. This often includes proof of a clean driving record (DMV records), academic transcripts (for good student discounts), and completion certificates for defensive driving courses.

Many insurers now offer online portals or mobile apps where you can easily update your information and apply for discounts. It’s always best to proactively inform your insurer of any changes that might make you eligible for additional discounts, such as a new car with advanced safety features or completing a defensive driving course.

Calculating Potential Savings

Calculating potential savings requires knowing the percentage discount offered for each applicable discount and your current premium. For example, if your current premium is $1200 annually and you qualify for a 10% good driver discount and a 5% multi-car discount, the calculation would be:

$1200 * 0.10 = $120 (Good Driver Discount)

$1200 * 0.05 = $60 (Multi-Car Discount)

$120 + $60 = $180 (Total Discount)

$1200 – $180 = $1020 (New Premium)

This illustrates a potential savings of $180 annually. Remember that these are just examples; the actual savings will depend on the specific discounts offered and your individual circumstances.

Improving Driving Habits to Lower Premiums

Beyond specific discounts, consistently demonstrating safe driving habits can influence your premiums over time. Insurance companies often adjust premiums based on your driving record. Adopting these practices can positively impact your insurance costs.

- Maintain a clean driving record by avoiding accidents and traffic violations.

- Drive defensively and avoid aggressive driving behaviors like speeding and tailgating.

- Regularly maintain your vehicle to prevent mechanical issues that could lead to accidents.

- Consider enrolling in a defensive driving course to further enhance your driving skills and potentially earn a discount.

- Use a telematics program if offered by your insurer and strive for a high safety score.

Navigating the Insurance Application Process

Securing affordable car insurance in California involves understanding and successfully navigating the application process. This process, while potentially seeming complex, can be streamlined with careful preparation and attention to detail. The following steps will guide you through obtaining a quote and securing your coverage.

Obtaining a Car Insurance Quote

To obtain a car insurance quote, you’ll typically interact with an insurance company either directly through their website or by contacting an agent. Online quote tools often require you to input basic information about yourself, your vehicle, and your driving history. Contacting an agent allows for a more personalized experience and the opportunity to ask clarifying questions. Regardless of the method, the process generally involves several key steps: providing personal details, describing your vehicle, disclosing your driving record, and specifying your coverage needs. The insurer will then use this information to generate a customized quote.

Information Requested During the Application Process

Insurance companies require comprehensive information to assess risk and determine appropriate premiums. This information typically includes personal details such as your name, address, date of birth, and driver’s license number. Information about your vehicle, including the year, make, model, and VIN, is also essential. Crucially, your driving history, including any accidents, traffic violations, and prior insurance claims, will significantly impact your premium. Finally, you will need to specify the coverage levels you desire, such as liability, collision, and comprehensive coverage. Some companies may also ask about your occupation, the purpose for which you use your vehicle, and the number of miles you drive annually.

Tips for Completing the Application Accurately and Efficiently

Accuracy is paramount when completing your car insurance application. Inaccurate information can lead to delays in processing or even policy denial. Before beginning, gather all necessary documents, including your driver’s license, vehicle registration, and prior insurance information. Carefully review each question and provide truthful and complete answers. If you are unsure about any aspect of the application, contact the insurance company directly for clarification. Taking your time and double-checking your responses will ensure a smoother application process. Consider using a checklist to track your progress and ensure you haven’t missed any crucial details.

Making Changes to an Existing Policy

Once you have a policy, you may need to make changes. This could include updating your address, adding a driver to your policy, or changing your coverage levels. Most insurance companies provide straightforward methods for making these changes. You can typically do so online through your policyholder account, by phone, or by mail. It’s essential to notify your insurer promptly of any changes to ensure your coverage remains accurate and up-to-date. Failing to do so could leave you underinsured or even without coverage in the event of an accident. Be prepared to provide relevant documentation to support any changes you request, such as proof of address or a driver’s license for a new driver.

Illustrative Examples

Understanding how various factors influence car insurance costs can be clarified through hypothetical scenarios. Let’s examine two drivers with differing profiles to illustrate this point.

Let’s consider two drivers, both residing in Los Angeles, California. Driver A is a 30-year-old with a clean driving record, driving a Honda Civic, and employed as a software engineer. Driver B is a 22-year-old with two speeding tickets in the past three years, driving a high-performance BMW, and employed part-time as a barista. Both maintain minimum liability coverage as required by California law.

Driver Profiles and Insurance Costs

Driver A’s profile presents several factors contributing to lower insurance premiums. His age, clean driving record, and the type of vehicle he drives are all considered low-risk factors by insurance companies. His stable employment also contributes positively to his risk assessment. Conversely, Driver B’s profile displays multiple high-risk factors. His younger age, less stable employment, and poor driving record significantly increase his risk profile in the eyes of insurers. The type of vehicle he drives, a high-performance BMW, is also associated with a higher likelihood of accidents and thus higher repair costs. Consequently, Driver B can expect to pay considerably more for car insurance than Driver A. While precise figures vary by insurer, Driver A might pay around $1000 annually, while Driver B could easily pay double or even triple that amount, perhaps $2500-$3000 or more annually.

Driving Record and Insurance Premium Relationship

The following text describes a bar graph illustrating the relationship between driving record and insurance premiums.

The horizontal axis represents the number of at-fault accidents and moving violations in the past three years. The vertical axis represents the annual insurance premium. The graph shows a clear upward trend. A bar representing zero incidents shows a relatively low premium. Each subsequent bar, representing one, two, or three incidents, shows a progressively higher premium. The difference between the premium for a driver with a clean record and a driver with three incidents is substantial, highlighting the significant impact of driving record on insurance costs. The graph visually emphasizes that maintaining a clean driving record is crucial for keeping insurance premiums low. For instance, the bar for “0 incidents” might be at $800, while the bar for “3 incidents” could reach $2000 or more, depending on other factors. The visual clearly communicates that each negative incident on a driving record results in a considerable increase in insurance cost.

Final Wrap-Up

Finding the most affordable car insurance in California requires diligent research and a strategic approach. By understanding the factors influencing premiums, comparing quotes from multiple providers, and taking advantage of available discounts, you can significantly reduce your insurance costs without compromising necessary coverage. Remember, proactive comparison shopping and a keen awareness of your individual circumstances are your best allies in securing the most cost-effective and comprehensive car insurance policy.

Question & Answer Hub

What is the minimum car insurance coverage required in California?

California mandates minimum liability coverage of 15/30/5, meaning $15,000 for injuries per person, $30,000 for injuries per accident, and $5,000 for property damage.

Can I get car insurance without a driver’s license?

Generally, no. Most insurers require a valid driver’s license to issue a policy. However, some specialized policies might exist for specific circumstances; it’s best to contact insurers directly to inquire.

How often can I change my car insurance policy?

You can typically change your policy at any time. However, there might be penalties or changes in rates depending on the timing and specific terms of your policy.

What happens if I don’t have car insurance in California?

Driving without insurance in California is illegal and carries significant penalties, including fines, license suspension, and potential vehicle impoundment.