Navigating the world of motor insurance can feel overwhelming. The sheer number of providers, policy options, and influencing factors makes finding the right coverage and the best price a significant undertaking. This guide aims to demystify the process of obtaining motor insurance quotes, empowering you to make informed decisions and secure the most suitable policy for your needs and budget.

From understanding the various types of motor insurance available – comprehensive, third-party, liability – to identifying the key factors impacting quote prices, such as age, driving history, and vehicle type, we’ll equip you with the knowledge to compare quotes effectively. We’ll also explore online platforms for obtaining quotes, highlighting the strengths and weaknesses of popular comparison websites and guiding you through the process of submitting accurate information for a precise quote.

Understanding the Search Intent Behind “Motor Insurance Quotes”

The search term “motor insurance quotes” reveals a user actively seeking information to make an informed decision about their vehicle insurance. Understanding the nuances behind this simple query requires analyzing the diverse needs and motivations driving these searches. The intent is rarely uniform; instead, it’s a spectrum of needs reflecting various life stages and circumstances.

The motivations behind searching for motor insurance quotes are multifaceted. Users may be seeking a new policy, renewing an existing one, comparing prices from different providers, or investigating specific coverage options. Their urgency and the level of detail required also vary significantly.

User Scenarios and Search Intents

Understanding the context behind a search is crucial. A user searching “cheap car insurance quotes” likely prioritizes price above all else, potentially accepting a more limited coverage package. Conversely, a user searching “comprehensive motor insurance quotes for classic cars” indicates a higher value placed on comprehensive protection for a specialized vehicle, suggesting a willingness to pay a premium for appropriate coverage.

Here are some examples illustrating the diversity of user scenarios and their corresponding search intents:

- Scenario: A young driver looking for their first car insurance. Intent: Finding affordable options with suitable coverage levels, possibly exploring options for discounts and driver training programs.

- Scenario: A seasoned driver renewing their policy. Intent: Comparing prices from their current provider with competitors, looking for better deals or enhanced coverage at a competitive price.

- Scenario: A business owner seeking insurance for a company vehicle. Intent: Finding policies that meet specific business needs, potentially including liability coverage and options for multiple drivers.

- Scenario: A driver involved in an accident needing to file a claim. Intent: Understanding their coverage and the claims process, potentially looking for quotes from providers specializing in accident claims.

Types of Motor Insurance Quotes

Users may be searching for various types of motor insurance quotes, each tailored to specific needs and risk profiles. The type of quote sought significantly influences the search intent and the information the user requires.

Understanding the different types of motor insurance is crucial for interpreting user search intent. For example, a search for “third-party only motor insurance quotes” suggests a focus on the minimum legal requirement, prioritizing affordability over extensive coverage. Conversely, “comprehensive motor insurance quotes” indicates a preference for broader protection, covering damage to the insured vehicle and third-party liabilities.

- Third-Party Only: This covers damage or injury caused to others, but not to the insured vehicle.

- Third-Party, Fire, and Theft: This adds coverage for fire and theft of the insured vehicle to third-party liability.

- Comprehensive: This offers the most extensive coverage, including damage to the insured vehicle, third-party liabilities, fire, theft, and other specified events.

Factors Influencing Motor Insurance Quote Prices

Getting a motor insurance quote involves more than just plugging in your details. Insurance companies use a complex calculation that considers several factors to assess your risk and determine your premium. Understanding these factors can help you make informed decisions and potentially secure a more favorable rate.

Several key elements contribute to the final cost of your motor insurance. These range from readily apparent factors like your age and driving history to less obvious ones such as the security features of your vehicle and even your location. The interplay of these factors can significantly impact the premium you pay.

Key Factors Affecting Motor Insurance Premiums

Insurance companies analyze a range of factors to determine your risk profile. A higher risk profile generally translates to a higher premium. Conversely, a lower risk profile can result in lower premiums. The following table illustrates how different factors influence premium costs.

| Factor | Impact on Premium (Low/Medium/High) | Example | Explanation |

|---|---|---|---|

| Age of Driver | Medium/High (younger drivers); Low (older drivers) | A 20-year-old driver vs. a 50-year-old driver | Younger drivers statistically have higher accident rates, hence higher premiums. Older drivers, with more experience, often receive lower premiums. |

| Driving History | High (multiple accidents/convictions); Low (clean driving record) | Driver with three accidents in the past three years vs. a driver with a spotless record. | A history of accidents or driving violations significantly increases premiums, reflecting a higher perceived risk. A clean record indicates lower risk. |

| Vehicle Model and Year | Medium/High (high-performance/expensive cars); Low (older, less expensive cars) | A new sports car vs. a used family sedan. | High-performance and expensive cars are more costly to repair and often attract higher premiums due to the increased risk of theft and higher repair costs. |

| Location | Medium/High (high-crime areas); Low (low-crime areas) | Urban area with high theft rates vs. a rural area with low crime. | Insurance companies consider the risk of theft and accidents in your area when calculating premiums. Higher-risk areas generally lead to higher premiums. |

| Annual Mileage | Medium/High (high mileage); Low (low mileage) | Driving 20,000 miles annually vs. driving 5,000 miles annually. | The more you drive, the greater the chance of an accident, leading to higher premiums for higher annual mileage. |

| Security Features | Low (cars with advanced security systems); Medium/High (cars lacking security features) | Car with an alarm system, immobilizer, and tracking device vs. a car without these features. | Cars equipped with advanced security features reduce the risk of theft, leading to lower premiums. |

| No Claims Bonus (NCB) | Low (longer NCB history) | Driver with 5 years NCB vs. a new driver | A continuous record of not claiming on your insurance policy results in a significant discount on your premium. |

Finding and Comparing Motor Insurance Quotes Online

Finding the best motor insurance can feel overwhelming, but the internet has made the process significantly easier. Numerous online platforms offer convenient ways to compare quotes from multiple insurers, saving you time and potentially money. This section explores various online methods and platforms for obtaining quotes, highlighting the advantages and disadvantages of popular comparison websites.

Several methods exist for obtaining motor insurance quotes online. Directly visiting insurer websites is one approach, allowing you to input your details and receive a personalized quote. However, this requires visiting multiple websites, a time-consuming process. Alternatively, price comparison websites act as intermediaries, allowing you to compare quotes from various insurers simultaneously. Using a broker is another option; brokers act as intermediaries, helping you find suitable policies and often negotiating better deals. Finally, some insurers offer quotes through apps, providing a convenient mobile experience.

Online Quote Comparison Websites

Choosing the right online comparison website is crucial for finding the best motor insurance deal. Different websites partner with different insurers, leading to variations in the quotes offered. Below is a comparison of three major online quote comparison websites. Note that the specific insurers offered and the user experience can vary over time.

- Website A: Pros: Wide range of insurers, user-friendly interface, detailed policy information. Cons: May not always display the cheapest options first, limited customization options for certain searches.

- Website B: Pros: Often displays the cheapest options prominently, advanced search filters. Cons: Fewer insurers compared to Website A, interface can be slightly cluttered.

- Website C: Pros: Strong focus on customer reviews and ratings, clear comparison table. Cons: Limited search filters, less comprehensive policy details compared to others.

Checking Policy Details Before Commitment

Before committing to a motor insurance quote, meticulously reviewing the policy details is paramount. A seemingly low price might hide crucial exclusions or limitations. Key aspects to verify include:

- Cover type: Ensure the cover (third-party, third-party, fire and theft, or comprehensive) meets your needs and risk tolerance.

- Excess: Understand the amount you’ll have to pay towards any claim.

- Exclusions: Carefully read the exclusions to identify any circumstances where your claim might be rejected.

- Add-ons: Assess whether optional add-ons, such as breakdown cover or legal protection, are worthwhile and affordable.

- Renewal terms: Understand how the premium will change at renewal and the terms for cancelling the policy.

Failing to thoroughly check these details can lead to unexpected costs or inadequate coverage in the event of an accident or incident. Taking the time to understand the policy’s fine print is a crucial step in securing the best and most appropriate motor insurance for your needs.

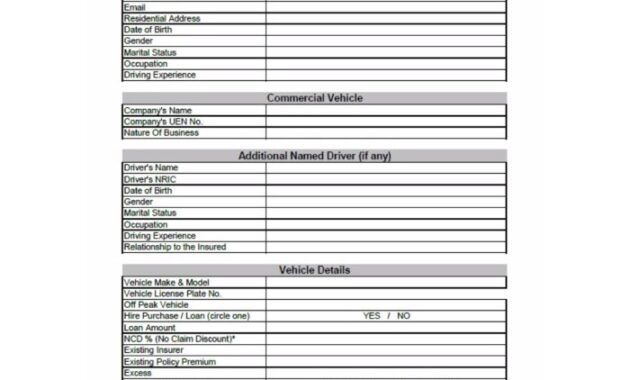

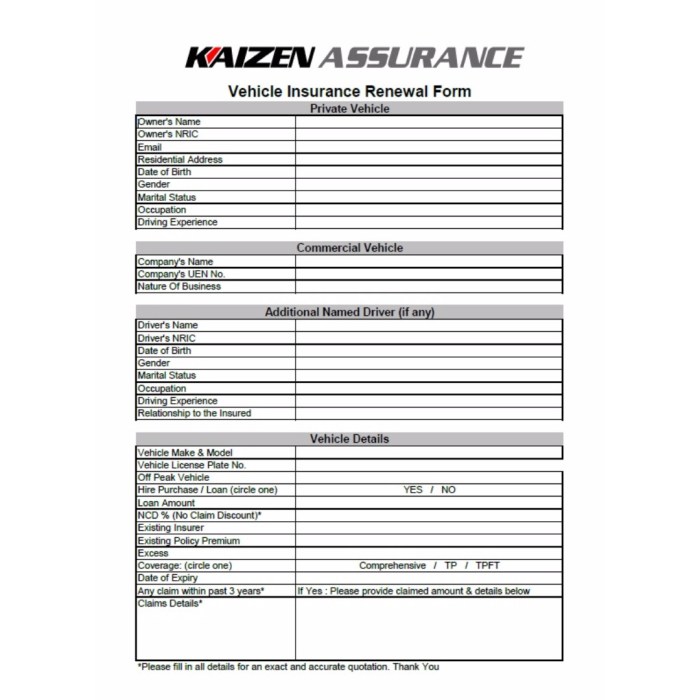

Key Information to Provide When Requesting a Quote

Obtaining an accurate motor insurance quote requires providing comprehensive and precise information about yourself, your vehicle, and your driving history. The more detail you provide, the more accurate and competitive the quote will be. Failing to do so could result in an inaccurate quote or even policy rejection later on.

Providing accurate information is crucial for a smooth and efficient quote process. Insurers use this data to assess risk and determine the appropriate premium. Incomplete or incorrect information can lead to delays, higher premiums, or even the refusal of coverage. Therefore, it is essential to approach the quote request process with meticulous attention to detail.

Essential Information for Accurate Motor Insurance Quotes

Insurers need specific information to calculate your premium. This typically includes details about the policyholder, the vehicle, and the driving history. Missing any of this information will likely delay the process or lead to an incomplete quote.

- Policyholder Information: Full name, date of birth, address, contact details (phone number and email address), driving license number and issuing authority, occupation.

- Vehicle Information: Make, model, year of manufacture, vehicle identification number (VIN), engine size, estimated annual mileage, and whether the vehicle is used for business purposes.

- Driving History: Full driving license history, including details of any accidents, convictions, claims, or driving offenses in the past five years (or as specified by the insurer). This information is critical in determining risk assessment.

- Optional Extras: Details of any additional drivers, desired coverage levels (comprehensive, third-party, fire, and theft, etc.), and any optional add-ons such as breakdown cover.

Completing an Online Quote Form

Most insurers offer online quote forms for convenience. These forms typically guide you through the necessary fields, often with helpful prompts and explanations. It’s vital to carefully review each section before submitting the form. Ensure that all entries are accurate and complete, double-checking for typos or errors. For example, entering the wrong date of birth could lead to an incorrect risk assessment. Similarly, providing an inaccurate mileage estimate can affect the premium calculation significantly.

Consequences of Providing Inaccurate Information

Providing inaccurate information on your motor insurance application can have serious consequences. These can range from receiving a higher premium than you should be paying to your insurance policy being invalidated if a claim is made. In some cases, it may even lead to legal action against you for fraud. Always be honest and transparent when providing information to your insurer. For instance, failing to disclose a previous accident could lead to your claim being rejected if you were at fault in a future accident. This could leave you with substantial financial burdens.

Understanding Policy Terms and Conditions

Your motor insurance policy is a legally binding contract. Understanding its terms and conditions is crucial to ensuring you’re adequately protected and to avoid disputes later. Failing to grasp key aspects can lead to unexpected costs or inadequate coverage in the event of an accident or claim.

Motor insurance policies contain a variety of terms and conditions, many of which are standardized across the industry but can vary in specifics depending on your insurer and the type of policy you choose. It is essential to carefully read and understand these terms before signing the policy document.

Common Policy Terms and Definitions

Several common terms frequently appear in motor insurance policies. Understanding these is fundamental to comprehending your coverage and limitations.

- Excess/Deductible: This is the amount you’ll have to pay towards the cost of a claim before your insurer covers the rest. For example, if your excess is $500 and your repair bill is $1500, you pay $500, and the insurer pays $1000.

- Third-Party Liability: This covers the cost of damage or injury you cause to others in an accident. It does not cover damage to your own vehicle.

- Comprehensive Cover: This offers broader protection, including damage to your own vehicle caused by accidents, theft, fire, or vandalism, in addition to third-party liability.

- No-Claims Bonus (NCB): This is a discount on your premium offered for each year you remain claim-free. The discount percentage usually increases with the number of claim-free years.

- Policy Period: The duration for which your insurance policy is valid, typically one year.

- Incurred But Not Reported (IBNR) Claims: These are claims that have occurred but haven’t yet been reported to the insurer. This is an important concept for insurers in calculating reserves.

Scenarios Highlighting the Importance of Understanding Policy Terms

Understanding your policy’s terms is not merely a formality; it can significantly impact your financial well-being in case of an incident.

- Scenario 1: Incorrectly Assessed Excess: If you are involved in an accident and fail to understand your excess amount, you might be surprised by the unexpected out-of-pocket expenses.

- Scenario 2: Unclear Coverage Limits: Suppose your policy has a limited liability cover, and you cause a significant accident resulting in substantial damages exceeding your policy limit. You would then be personally liable for the difference.

- Scenario 3: Misunderstanding of Exclusions: Many policies exclude specific types of damage or circumstances. For instance, driving under the influence of alcohol or drugs may void your coverage, leaving you with substantial financial burdens.

A Guide to Interpreting Policy Documents

Reading a motor insurance policy can seem daunting, but a systematic approach can make it more manageable.

- Read the Summary: Most policies begin with a summary outlining key features and coverages. This provides a high-level overview before diving into the details.

- Focus on Key Sections: Pay close attention to sections detailing coverage limits, excesses, exclusions, and the claims process.

- Use a Dictionary: If you encounter unfamiliar terms, consult a dictionary or glossary of insurance terms to clarify their meaning.

- Don’t Hesitate to Ask: If anything remains unclear, contact your insurer or insurance broker for clarification. They are there to help you understand your policy.

Illustrating the Process of Claiming

Making a motor insurance claim can feel daunting, but understanding the process can significantly reduce stress. This section Artikels the steps involved, necessary documentation, and effective communication strategies to ensure a smooth claim experience. Remember, prompt and accurate reporting is crucial for a successful outcome.

The claim process generally involves several key stages, from initial notification to final settlement. Each stage requires specific actions and documentation, and timely completion is essential to avoid delays.

Claim Notification and Initial Reporting

Following an accident or incident covered by your policy, promptly notify your insurance provider. This typically involves contacting their claims hotline, often available 24/7. Provide initial details, such as the date, time, location, and a brief description of the incident. You should also provide your policy number and contact information. Failure to promptly report the incident could impact your claim.

Gathering Necessary Documentation

Collecting the necessary documentation is vital for a swift claim resolution. This typically includes:

- A completed claim form provided by your insurer.

- Copies of your driver’s license and vehicle registration.

- Police report (if applicable, especially in accidents involving injuries or significant property damage).

- Photographs and videos documenting the damage to your vehicle and the accident scene.

- Details of any witnesses, including their names and contact information.

- Medical reports and bills (if injuries are involved).

- Repair estimates from reputable garages.

The specific documentation required may vary depending on the nature and severity of the incident. It’s always advisable to gather as much relevant information as possible.

Claim Assessment and Investigation

After receiving your initial notification and documentation, your insurer will assess your claim. This may involve an investigation, including reviewing the documentation provided, contacting witnesses, and potentially inspecting the damaged vehicle. This stage can take several days or even weeks, depending on the complexity of the claim.

Claim Settlement

Once the investigation is complete, your insurer will determine the extent of their liability and offer a settlement. This may involve repairing your vehicle, providing compensation for medical expenses, or paying out for other losses as covered by your policy. You may need to negotiate the settlement amount if you believe it’s insufficient. Agreement on the settlement concludes the claim process.

Effective Communication with Your Insurance Provider

Maintaining clear and consistent communication with your insurer is crucial throughout the entire claim process. Respond promptly to requests for information and be prepared to provide further clarification if needed. Keep records of all communication, including dates, times, and the names of individuals you spoke with. Polite and professional communication can significantly contribute to a positive claim experience. For instance, if there’s a delay, politely inquire about the status of your claim, rather than demanding immediate action.

Visual Representation of the Claim Process

“`

Stage 1: Incident Occurs

|

V

Stage 2: Notify Insurer (within 24-48 hours)

|

V

Stage 3: Gather Documentation (police report, photos, etc.)

|

V

Stage 4: Insurer Assessment & Investigation (days to weeks)

|

V

Stage 5: Claim Settlement (negotiation may be required)

|

V

Stage 6: Claim Finalized

“`

Wrap-Up

Finding the perfect motor insurance quote requires careful consideration of your individual needs and a thorough understanding of the market. By carefully weighing the factors influencing premium costs, utilizing online comparison tools effectively, and meticulously reviewing policy terms and conditions, you can confidently secure a policy that offers comprehensive coverage at a competitive price. Remember, accurate information is crucial throughout the process, ensuring a smooth experience from quote request to claim settlement.

Expert Answers

What is the difference between comprehensive and third-party motor insurance?

Comprehensive insurance covers damage to your own vehicle and liability for damage to others. Third-party insurance only covers damage or injury caused to other parties involved in an accident.

How long does it typically take to get a motor insurance quote?

Online quotes are usually instantaneous. However, quotes requiring more detailed assessments might take a few hours or a day.

Can I get a quote without providing my driving history?

No, your driving history is a crucial factor in determining your risk profile and therefore your premium. Accurate information is essential.

What happens if I provide inaccurate information when applying for a quote?

Inaccurate information can lead to your policy being invalidated, resulting in difficulties claiming in the event of an accident.

Can I cancel my motor insurance quote?

Most online quotes are non-binding, meaning you can cancel them without penalty before formally accepting a policy.