Securing affordable motorcycle insurance can feel like navigating a complex maze. Factors like your riding history, the type of bike you own, and even your location significantly impact the final premium. This guide unravels the mysteries of motorcycle insurance costs, offering practical strategies to find the best rates without compromising on essential coverage.

We’ll explore various insurance types, highlight crucial policy details, and reveal effective ways to lower your premiums. From understanding discounts and savings to mastering the art of comparing quotes, this guide empowers you to make informed decisions and secure the most cost-effective motorcycle insurance that meets your needs.

Defining “Cheapest Motorcycle Insurance”

Finding the cheapest motorcycle insurance isn’t simply about the lowest premium; it’s about finding the best value for your needs. The “cheapest” policy might offer minimal coverage, leaving you financially vulnerable in the event of an accident. Therefore, a thorough understanding of factors influencing cost and available coverage is crucial before making a decision.

Factors Influencing Motorcycle Insurance Costs

Several factors contribute to the overall cost of motorcycle insurance. These include your riding history (accidents, tickets), age and experience, the type of motorcycle you own, your location (urban areas tend to be more expensive), and the level of coverage you choose. Credit history can also play a role, as insurers often use it to assess risk. Finally, the insurer itself will have its own pricing structure.

Types of Motorcycle Insurance Coverage

Motorcycle insurance policies typically offer several levels of coverage. Liability coverage is the most basic, paying for damages or injuries you cause to others. Collision coverage pays for repairs to your motorcycle if you’re involved in an accident, regardless of fault. Comprehensive coverage protects against damage from events other than collisions, such as theft or vandalism. Uninsured/Underinsured Motorist coverage protects you if you’re hit by an uninsured or underinsured driver. Medical payments coverage helps pay for your medical bills following an accident.

Common Insurance Policy Add-ons and Their Impact on Price

Adding optional features to your policy can increase the premium but also provide greater protection. Examples include roadside assistance (covering towing and other emergency services), rental reimbursement (covering the cost of a rental motorcycle while yours is being repaired), and custom parts coverage (covering the cost of replacing aftermarket parts). Each add-on carries an additional cost, so carefully consider the potential benefits against the increased premium.

Cost Factors of Different Motorcycle Types

The type of motorcycle significantly impacts insurance costs. Generally, higher-performance motorcycles, like sportbikes, are considered riskier and therefore more expensive to insure than cruisers or scooters. This is due to their higher repair costs, greater potential for accidents, and higher theft risk.

| Motorcycle Type | Average Cost Factors | Repair Costs | Theft Risk |

|---|---|---|---|

| Sportbike | High performance, higher risk | High; specialized parts often expensive | High; desirable target for theft |

| Cruiser | Moderate performance, moderate risk | Moderate; parts generally easier to source | Moderate; less desirable than sportbikes |

| Scooter | Low performance, low risk | Low; parts relatively inexpensive and readily available | Low; less attractive to thieves |

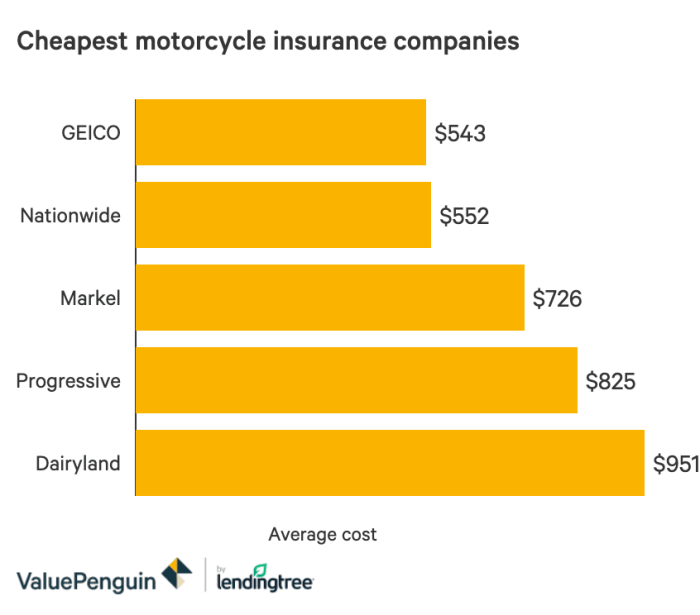

Finding Affordable Motorcycle Insurance Options

Securing affordable motorcycle insurance requires a proactive approach and a thorough understanding of the market. By employing effective comparison strategies and carefully reviewing policy details, riders can significantly reduce their insurance costs while maintaining adequate coverage. This section will Artikel practical steps to achieve this.

Finding the cheapest motorcycle insurance policy involves more than just clicking the first result. A strategic approach is key to securing the best value for your needs.

Comparing Motorcycle Insurance Quotes

Comparing quotes from multiple providers is crucial for finding the most affordable option. Don’t settle for the first quote you receive. Utilize online comparison websites, which allow you to input your information once and receive quotes from numerous insurers simultaneously. This saves time and effort. Additionally, contact insurers directly; some may offer discounts not advertised online. Pay close attention to the coverage offered at each price point – the cheapest policy might not provide the protection you need. Remember that comprehensive coverage, while more expensive, can be invaluable in the event of an accident.

Obtaining Motorcycle Insurance Quotes Online

Obtaining motorcycle insurance quotes online is a straightforward process. First, gather necessary information, including your driver’s license number, motorcycle details (make, model, year), and your riding history. Next, visit comparison websites or the websites of individual insurance companies. Enter your information accurately into the quote request forms. Be sure to specify the level of coverage you desire (liability only, comprehensive, etc.). Review the quotes carefully, comparing coverage details and premiums before making a decision. Remember to check the insurer’s reputation and customer reviews before committing. Finally, once you’ve chosen a policy, follow the insurer’s instructions to finalize your purchase.

Understanding Policy Terms and Conditions

Before purchasing any motorcycle insurance policy, meticulously review the terms and conditions. This includes understanding the coverage limits for liability, collision, and comprehensive coverage. Pay close attention to exclusions, which specify situations where coverage may not apply. Understand the deductible, the amount you’ll pay out-of-pocket before the insurance coverage kicks in. Familiarize yourself with the claims process, including how to file a claim and what documentation is required. Ignoring the fine print can lead to unexpected costs and complications in the event of an accident. Consider consulting with an insurance professional if you have any questions or uncertainties.

Factors Insurers Consider When Determining Premiums

Several factors influence the cost of motorcycle insurance. Insurers assess risk based on various elements. These include your riding experience (number of years riding, accident history), your age and gender (statistically, certain demographics have higher accident rates), your location (crime rates and accident frequency in your area), the type of motorcycle you own (powerful bikes often carry higher premiums), and your credit score (in some states, credit history is a factor in determining premiums). Your chosen coverage level (liability only versus comprehensive) also significantly impacts the premium. Maintaining a clean driving record and completing a motorcycle safety course can often lead to lower premiums. Insurers use complex algorithms to weigh these factors and calculate your individual risk profile. For example, a young rider with a powerful sportbike living in a high-crime area will likely pay significantly more than an older, experienced rider with a smaller, less powerful motorcycle in a safer area.

Discounts and Savings on Motorcycle Insurance

Securing affordable motorcycle insurance involves more than just comparing prices; it’s about understanding and leveraging the various discounts and savings opportunities available. Many factors influence your premium, and actively pursuing discounts can significantly reduce your annual cost.

Finding the cheapest motorcycle insurance often hinges on maximizing these savings. Insurance companies offer a range of discounts to incentivize safe riding practices and encourage long-term customer loyalty. By understanding these options and proactively meeting their requirements, you can substantially lower your premiums.

Common Motorcycle Insurance Discounts

Several common discounts are frequently offered by motorcycle insurance providers. These discounts can significantly reduce your overall insurance costs, making it more affordable to insure your bike. Understanding these discounts and how to qualify for them is crucial in finding the best deal.

- Safe Rider Discounts: Many insurers offer discounts to riders who complete a certified motorcycle safety course. These courses demonstrate your commitment to safe riding practices, reducing your perceived risk as a policyholder. For example, the Motorcycle Safety Foundation (MSF) offers such courses, and successful completion often leads to a discount.

- Multi-Policy Discounts: Bundling your motorcycle insurance with other types of insurance, such as auto or homeowner’s insurance, with the same provider often results in a significant discount. This is because insurers reward loyalty and the reduced administrative costs associated with managing multiple policies for a single customer.

- Good Rider Discounts: Maintaining a clean driving record, free of accidents and traffic violations, significantly impacts your motorcycle insurance premium. Insurance companies view a history of safe driving as a lower risk, leading to lower premiums. A spotless record can result in substantial savings over time.

- Anti-theft Device Discounts: Installing anti-theft devices on your motorcycle, such as a GPS tracker or alarm system, can reduce your insurance premium. These devices deter theft, lowering the insurer’s risk and justifying a discount.

- Mature Rider Discounts: Some insurers offer discounts to riders over a certain age (typically 50 or older), reflecting the statistical lower accident rate among older riders.

Benefits of Bundling Motorcycle Insurance

Bundling your motorcycle insurance with other insurance policies, such as auto or homeowner’s insurance, is a strategic way to reduce your overall insurance costs. This practice, often referred to as multi-policy discounts, is a common offering from most major insurance companies.

The benefits extend beyond simply receiving a discount. Managing all your insurance needs through a single provider often simplifies the process, offering convenience and streamlined communication. Having a single point of contact for all your insurance needs can be invaluable, especially during claims processing. The savings often outweigh the minor inconvenience of dealing with only one insurer. For example, a 10% discount on both your auto and motorcycle insurance could result in substantial savings annually.

Rider Experience and Safety Courses

Rider experience and the completion of safety courses are significant factors influencing motorcycle insurance premiums. Insurance companies assess risk based on a rider’s history and training.

Experienced riders with a proven track record of safe riding tend to receive lower premiums. This is because their experience reduces the perceived risk to the insurer. Similarly, completing a motorcycle safety course demonstrates a commitment to safe riding practices, which translates into lower premiums. The discount offered varies by insurer and the specific course completed. For instance, completing an MSF Basic RiderCourse can often lead to a 10-15% discount.

Reducing Motorcycle Insurance Costs

Several strategies can help reduce your motorcycle insurance costs. These strategies often involve making informed choices and proactively managing your risk profile.

- Shop around and compare quotes: Obtain quotes from multiple insurers to compare prices and coverage options. This ensures you are getting the best possible deal.

- Maintain a clean driving record: Avoid accidents and traffic violations to maintain a low-risk profile with insurers.

- Consider your coverage needs carefully: Choose the appropriate coverage level that meets your needs without overspending on unnecessary coverage.

- Increase your deductible: A higher deductible can lead to lower premiums, but consider your financial capacity to cover a potential claim.

- Pay your premiums on time: Prompt payment often avoids late fees and can improve your standing with the insurer.

- Explore discounts: Actively look for discounts such as safe rider, multi-policy, and anti-theft device discounts.

Understanding Insurance Policy Details

Choosing the cheapest motorcycle insurance is only half the battle. Understanding the specifics of your policy is crucial to ensuring you’re adequately protected. This section will clarify key policy elements, the claims process, and scenarios where coverage is vital.

A standard motorcycle insurance policy typically includes several key components: coverage limits, deductibles, and the types of liability coverage. Understanding these aspects is vital for making informed decisions and ensuring you’re adequately protected in the event of an accident or incident.

Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurer will pay for covered losses. These limits are usually expressed as a per-accident amount and an aggregate limit (the total amount payable over the policy period). For example, a policy might have a $100,000 bodily injury liability limit per accident and a $300,000 aggregate limit. This means the insurer will pay up to $100,000 for injuries caused in a single accident, and a maximum of $300,000 for all accidents during the policy year. Property damage liability limits function similarly, specifying the maximum payout for damages to another person’s vehicle or property. Deductibles are the amount you must pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible means higher premiums but less out-of-pocket expense in the event of a claim.

Filing a Claim

The claims process generally involves reporting the incident to your insurer as soon as possible. This often includes providing details of the accident, including date, time, location, and involved parties. You’ll likely need to provide police reports, witness statements, and photographs of the damage. The insurer will then investigate the claim to determine liability and the extent of the damages. Once the investigation is complete, the insurer will either approve or deny your claim, and if approved, will process the payment according to your policy’s terms and conditions. This process can vary depending on the insurer and the complexity of the claim.

Examples of Situations Requiring Motorcycle Insurance Coverage

Motorcycle insurance is essential for various scenarios. Consider these examples:

- Accident causing injury to another person: If you’re at fault in an accident causing injuries to another rider or a pedestrian, your liability coverage will help pay for their medical expenses and other related costs.

- Damage to another vehicle or property: If you cause damage to another person’s car, motorcycle, or property, your property damage liability coverage will help cover the repair or replacement costs.

- Damage to your own motorcycle: Comprehensive coverage protects your motorcycle against damage from events like theft, vandalism, or fire, regardless of fault. Collision coverage covers damage resulting from a collision with another vehicle or object.

- Medical expenses from an accident: Uninsured/underinsured motorist coverage can help pay for your medical expenses if you’re injured in an accident caused by an uninsured or underinsured driver.

Comparison of Liability Coverage Types

Different insurers offer varying levels of liability coverage. Understanding these differences is vital in selecting the right policy for your needs and risk profile.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for injuries you cause to others. |

| Property Damage Liability | Covers damages to another person’s vehicle or property that you cause. |

| Uninsured/Underinsured Motorist Bodily Injury | Covers your medical expenses and other losses if you’re injured by an uninsured or underinsured driver. |

| Uninsured/Underinsured Motorist Property Damage | Covers damages to your motorcycle if you’re involved in an accident with an uninsured or underinsured driver. |

Factors Influencing Motorcycle Insurance Premiums

Several key factors significantly impact the cost of motorcycle insurance. Understanding these elements allows riders to make informed decisions and potentially secure more affordable coverage. These factors often interact, creating a complex calculation of your individual risk profile.

Age and Riding Experience

Age and riding history are strongly correlated with insurance premiums. Younger riders, particularly those with limited or no riding experience, are statistically more likely to be involved in accidents. Insurance companies reflect this increased risk by charging higher premiums. Conversely, experienced riders with clean driving records often qualify for lower rates, demonstrating a lower likelihood of claims. For example, a 20-year-old with a learner’s permit will likely pay substantially more than a 50-year-old with 30 years of accident-free riding.

Location

Geographic location plays a crucial role in determining insurance costs. Areas with higher rates of motorcycle accidents, theft, or vandalism will generally have higher insurance premiums. Urban areas, for instance, often present greater risks compared to rural settings, leading to increased costs. The density of traffic, the prevalence of crime, and even the climate can influence insurance rates.

Credit History

Surprisingly, credit history can influence motorcycle insurance premiums. Insurance companies often use credit-based insurance scores to assess risk. A good credit history generally suggests responsible financial behavior, which insurers associate with a lower likelihood of claims. Conversely, a poor credit history might lead to higher premiums, reflecting a perceived increased risk. This is because individuals with poor credit may be more likely to have difficulty paying premiums or making timely claims settlements.

Driving Record

A clean driving record is essential for securing affordable motorcycle insurance. Accidents, traffic violations, and DUI convictions significantly increase premiums. Each incident reflects an increased risk profile, leading to higher costs. The severity and frequency of past driving infractions heavily influence the final premium. For instance, a speeding ticket might result in a modest increase, while a DUI conviction could lead to a substantial premium hike or even policy cancellation.

Motorcycle Make, Model, and Year

The type of motorcycle you ride also impacts your insurance costs. High-performance motorcycles, typically those with larger engines and higher speeds, are often considered riskier to insure due to their potential for greater damage in accidents and higher repair costs. The make, model, and year of the motorcycle all contribute to the assessment of its value and the potential cost of repairs or replacement, directly affecting your premium. For example, a new, high-performance sportbike will likely cost more to insure than an older, standard model.

| Rider Profile | Age | Riding Experience (Years) | Approximate Premium Increase/Decrease (%) |

|---|---|---|---|

| Young, Inexperienced Rider | 20 | 0 | +50% to +100% |

| Experienced Rider, Clean Record | 45 | 20 | -20% to -40% |

| Rider with Minor Accidents | 30 | 5 | +10% to +30% |

| Rider with DUI Conviction | 35 | 10 | +100% to +200% or Policy Cancellation |

Illustrative Examples of Motorcycle Insurance Costs

Understanding the wide range of motorcycle insurance costs requires examining both low-cost and high-cost scenarios. These examples illustrate how various factors influence the final premium. Remember that these are hypothetical examples and actual costs will vary based on numerous individual circumstances.

Low-Cost Motorcycle Insurance Policy Scenario

Imagine a 35-year-old rider, Sarah, with a clean driving record for over 10 years, insuring a used Honda Rebel 300. She lives in a rural area with a low crime rate and chooses a liability-only policy with a high deductible. Sarah’s low premium reflects several factors: her excellent driving history, the lower risk associated with her motorcycle type and her location, and her selection of minimal coverage with a higher deductible. Her annual premium might be around $250-$350. This lower cost is a direct result of her minimizing risk factors in the eyes of the insurance company.

High-Cost Motorcycle Insurance Policy Scenario

Conversely, consider Mark, a 22-year-old rider with two speeding tickets in the past year, insuring a high-performance Harley-Davidson Sportster. He lives in a large city with a high rate of motorcycle theft. He opts for full coverage with a low deductible. Mark’s high premium is a result of several factors: his young age (statistically higher risk), his less-than-perfect driving record, the higher value and riskier nature of his motorcycle, his location, and his choice of comprehensive coverage with a low deductible. His annual premium could easily exceed $1500, possibly even reaching $2000 or more. This demonstrates how multiple high-risk factors significantly increase insurance costs.

Hypothetical Motorcycle Insurance Policy Details

Let’s examine a hypothetical policy for a 2018 Yamaha R6. The policyholder is a 40-year-old with a clean driving record residing in a suburban area. The policy includes:

* Liability Coverage: $100,000 bodily injury and $50,000 property damage per accident.

* Uninsured/Underinsured Motorist Coverage: $50,000 bodily injury.

* Comprehensive Coverage: Covers damage from events like theft or vandalism.

* Collision Coverage: Covers damage from accidents.

* Deductible: $500 for both comprehensive and collision.

The annual premium for this policy, based on these factors, might be approximately $800-$1000. This premium reflects a balance between coverage levels and risk factors. A higher deductible would lower the premium, while adding additional coverage, such as roadside assistance, would increase it. The specific cost will depend on the insurance company and the precise details of the policy.

Final Thoughts

Finding the cheapest motorcycle insurance isn’t just about the lowest price; it’s about finding the right balance between affordability and comprehensive coverage. By understanding the factors influencing premiums, actively comparing quotes, and leveraging available discounts, you can significantly reduce your insurance costs while ensuring you’re adequately protected on the road. Remember, a little research can go a long way in saving you money and peace of mind.

FAQ Explained

What is the difference between liability and comprehensive motorcycle insurance?

Liability insurance covers damages you cause to others. Comprehensive coverage protects your motorcycle from damage due to incidents like theft or accidents, regardless of fault.

How does my credit score affect my motorcycle insurance premium?

In many states, insurers consider your credit score as an indicator of risk. A higher credit score often translates to lower premiums.

Can I get motorcycle insurance if I have a DUI on my record?

Yes, but it will likely be significantly more expensive. Insurers view DUIs as high-risk factors.

What is an SR-22 form, and do I need one?

An SR-22 is a certificate of insurance proving you maintain the minimum required liability coverage. It’s often required after serious driving violations.