Navigating the world of insurance can feel overwhelming, with its complex terminology and diverse offerings. This guide aims to demystify “my insurance,” exploring its various facets and providing clarity on common user needs and information-seeking behaviors. Whether you’re seeking information on health, auto, home, or life insurance, understanding your policy and its implications is crucial for financial security and peace of mind. We will explore the different stages of the insurance journey, from initial research to filing a claim, empowering you to make informed decisions.

We’ll delve into the common questions and concerns individuals have regarding their insurance coverage, providing clear and concise answers. This exploration will cover diverse insurance types, highlighting their unique aspects and the specific information individuals often seek. By the end, you’ll possess a more comprehensive understanding of your insurance needs and how to effectively manage your policies.

Understanding “My Insurance” – Defining the Scope

The term “my insurance” is deceptively simple. Its meaning depends heavily on context and the specific insurance policies an individual holds. It’s not a monolithic concept but rather a personalized umbrella encompassing various types of coverage. Understanding its scope requires examining the diverse landscape of insurance products and how individuals interact with them.

The phrase “my insurance” can refer to any number of insurance policies an individual owns. This includes, but is not limited to, health insurance, auto insurance, homeowners or renters insurance, life insurance, and potentially even umbrella insurance or specialized policies like travel insurance. The user’s interpretation will be directly influenced by their current needs and the specific policy they are referencing at that moment.

Common User Searches Related to “My Insurance”

Users searching for “my insurance” often have a specific goal in mind. This search term usually indicates a need for information or action related to their existing policies. The searches often reflect the urgency or type of information sought. For example, someone might search for “my insurance card” needing immediate access to their policy details for a doctor’s visit. Others may search for “my insurance claims” to check the status of a submitted claim or “my insurance policy details” for a more general review of their coverage. The specificity of the search directly reflects the user’s immediate need.

Contexts for Searching “My Insurance”

The context surrounding a search for “my insurance” is crucial in determining its intent. Someone needing immediate medical attention might search for “my insurance card” to quickly provide necessary information. Conversely, someone planning a major purchase, such as a house, might search for “my insurance coverage” to assess their existing home insurance limits. Someone experiencing a car accident might search for “my insurance information” to begin the claims process. The timing and circumstances surrounding the search significantly influence the user’s goals and the type of information they are seeking. For instance, a user preparing for a trip might search “my insurance travel coverage” to confirm their existing coverage adequately protects them abroad.

User Needs and Intentions

Understanding the motivations behind searches for “my insurance” is crucial for designing effective and user-friendly insurance platforms and services. Users seeking this information are generally looking for specific details about their existing policies or exploring options for new coverage. Their actions are driven by a range of needs and intentions, often intertwined with significant emotional undercurrents.

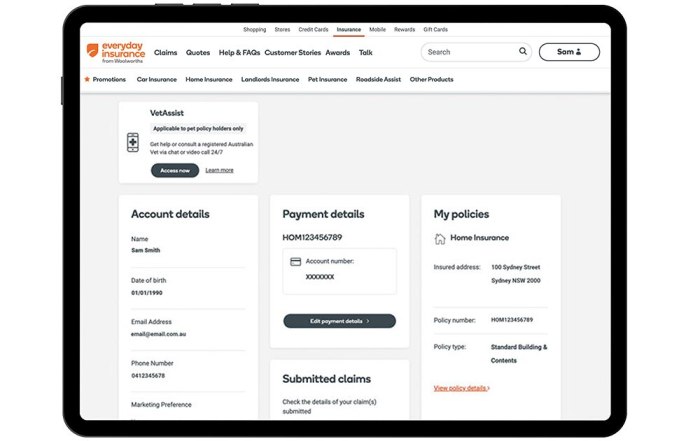

The primary need is typically access to information. This could involve checking policy details, reviewing coverage limits, understanding claims procedures, or managing payments. Beyond simple information retrieval, users might be actively seeking to make changes to their policy, file a claim, or compare their current coverage to alternative options. The specific intention shapes the user’s experience and the level of urgency they feel.

Emotional States Associated with Insurance Searches

Searching for “my insurance” often evokes strong emotional responses, varying widely depending on the context. Anxiety is a common feeling, particularly when facing a potential claim or unexpected financial burden. Frustration can arise from navigating complex policy documents, dealing with unhelpful customer service, or encountering unexpected limitations in coverage. Conversely, relief can be experienced when finding the necessary information quickly and efficiently, or when a claim is successfully processed. The emotional landscape is dynamic and highly dependent on the individual’s circumstances and the stage of their interaction with their insurance provider. For instance, a user checking their policy details might experience a neutral feeling, while someone filing a claim after a car accident is likely to be experiencing significant anxiety and stress.

Stages of the User Journey

The user journey concerning “my insurance” can be broadly categorized into three key stages: pre-purchase, post-purchase, and claims. Pre-purchase involves researching and comparing different insurance options, understanding coverage details, and ultimately selecting a policy. This stage is often characterized by a high level of research and comparison, with users seeking the best value for their money and the most comprehensive coverage. Post-purchase involves managing the policy, making payments, reviewing policy documents, and understanding the terms and conditions. This stage is often characterized by a need for quick and easy access to policy information. Finally, the claims stage involves reporting an incident, providing necessary documentation, and navigating the claims process. This stage is typically associated with high levels of anxiety and a desire for clear and timely communication from the insurance provider. A successful claim resolution can lead to feelings of relief, while a difficult or protracted process can heighten frustration and anger. Understanding these emotional nuances across each stage allows for more empathetic and effective service design.

Information Seeking Behaviors

Understanding how users interact with their insurance information is crucial for designing a user-friendly and effective platform. This section details the typical information-seeking behaviors exhibited by individuals when accessing their insurance details online. We will categorize these needs and illustrate them with examples.

Categorization of User Information Needs

Users seeking information about “my insurance” generally fall into several distinct categories of needs. These needs are often intertwined, but understanding the primary driver helps in structuring the information architecture.

| User Need | Information Type | Source of Information | Potential User Action |

|---|---|---|---|

| Policy Overview | Policy number, coverage details (liability, collision, etc.), deductible, premium amount, policy start/end dates, named insured information. | Policy document (digital or physical), online account dashboard. | Reviewing policy details, understanding coverage limits, comparing with other policies (if applicable). |

| Claim Filing and Status | Claim filing process, required documentation, claim status updates, contact information for claim adjusters. | Website’s claims section, policy documents, dedicated claim portal, customer service representatives. | Initiating a claim, uploading documents, tracking claim progress, contacting claim adjusters for updates. |

| Payment and Billing | Payment due dates, payment methods (online, mail, etc.), payment history, outstanding balances, options for payment plans. | Online account dashboard, billing statements (digital or physical), customer service representatives. | Making payments, viewing payment history, setting up automatic payments, inquiring about payment options. |

| Contact Information | Phone numbers, email addresses, mailing addresses for customer service, claims departments, and other relevant departments. | Website’s contact page, policy documents, online account dashboard. | Contacting customer service for assistance, reporting an issue, requesting policy changes. |

| Policy Changes and Updates | Process for updating personal information (address, phone number), adding or removing drivers, changing coverage levels, canceling a policy. | Website’s policy management section, customer service representatives, policy documents. | Updating personal information, requesting coverage changes, canceling the policy. |

| Document Access | Access to policy documents (declarations page, endorsements), previous bills, claim history. | Online account dashboard, dedicated document portal. | Downloading policy documents, reviewing past claims, printing required documentation. |

| Understanding Coverage | Detailed explanations of coverage types, exclusions, and limitations. Examples of covered and non-covered scenarios. | Policy documents, website’s FAQs, customer service representatives. | Better understanding of policy benefits and limitations, making informed decisions regarding coverage needs. |

Exploring Different Insurance Types

Understanding the nuances of different insurance types is crucial for effectively managing your financial well-being. This section compares and contrasts the information needs associated with common insurance categories, providing a framework for understanding your “My Insurance” portal.

Health Insurance Information Needs

Health insurance, arguably the most critical type, requires detailed understanding of coverage specifics. Policyholders need clarity on premiums, deductibles, co-pays, out-of-pocket maximums, and the network of providers. Understanding pre-authorization procedures, exclusions, and limitations on specific treatments is also vital. Furthermore, information regarding prescription drug coverage, mental health benefits, and emergency care provisions is essential.

- Premium Costs and Payment Options

- Deductible and Co-pay Amounts

- Network of Covered Providers and Hospitals

- Prescription Drug Coverage Details

- Coverage for Preventative Care

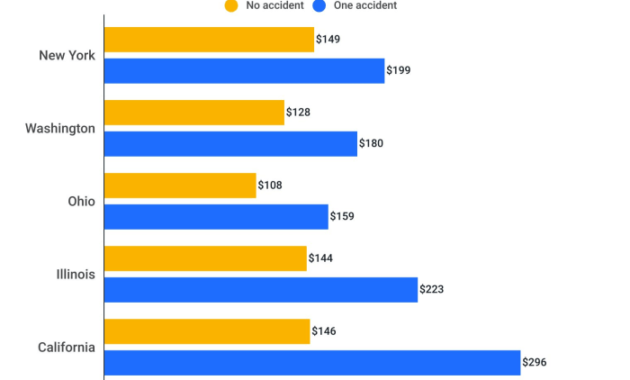

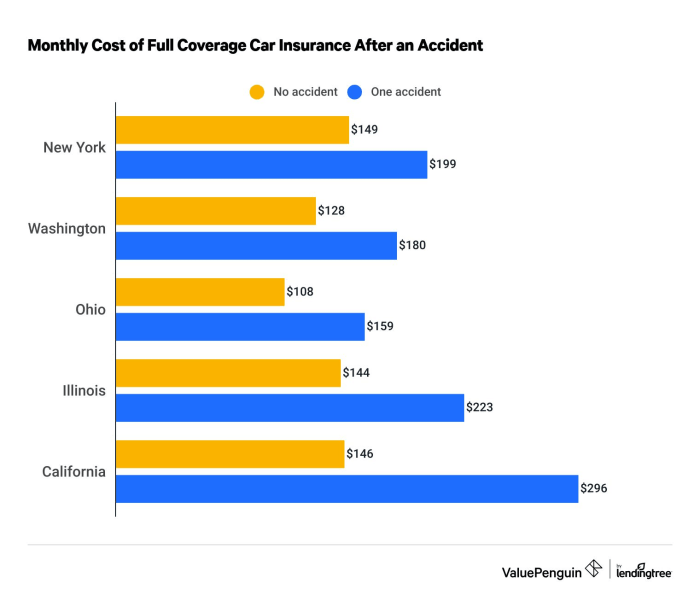

Auto Insurance Information Needs

Auto insurance focuses on protecting against financial losses from accidents or damage to your vehicle. Key information needs include liability coverage limits, collision and comprehensive coverage details, uninsured/underinsured motorist protection, and rental car reimbursement options. Understanding the claims process, including reporting procedures and settlement timelines, is equally important. Policyholders also need to know about discounts available (e.g., safe driving, bundling with other insurance).

- Liability Coverage Limits

- Collision and Comprehensive Coverage Details

- Uninsured/Underinsured Motorist Coverage

- Rental Car Reimbursement Options

- Claims Process and Procedures

Home Insurance Information Needs

Home insurance protects your property against damage or loss from various perils. Information needs revolve around coverage amounts for the structure and its contents, liability protection for accidents occurring on the property, and coverage for additional living expenses in case of displacement. Understanding the policy’s exclusions (e.g., flood, earthquake) and the claims process is essential. Information on deductibles and premium amounts is also crucial.

- Coverage Amounts for Structure and Contents

- Liability Coverage Limits

- Additional Living Expenses Coverage

- Policy Exclusions and Limitations

- Deductible and Premium Amounts

Life Insurance Information Needs

Life insurance provides financial security for beneficiaries after the policyholder’s death. The key information need centers around the death benefit amount, policy type (term, whole, universal), premium payments, and beneficiary designations. Understanding the policy’s terms, conditions, and any riders (additional coverage options) is vital. Policyholders also need to review the process for making changes to the policy, such as beneficiary updates or increasing coverage.

- Death Benefit Amount

- Policy Type and Features

- Premium Payment Options

- Beneficiary Designation and Management

- Policy Riders and Add-ons

Visual Representation of Information

Effective visual aids significantly improve understanding and retention of complex insurance information. Clear diagrams and infographics can simplify processes and policy details, making them more accessible to policyholders.

Filing an Insurance Claim: A Step-by-Step Infographic

This infographic would visually represent the claim process using a flowchart-style diagram. The process begins with a clearly labeled “Incident Occurs” box, depicted as a large circle or square. Arrows then lead to subsequent boxes representing each stage. These stages include: “Report the Incident (Contacting the Insurance Company),” depicted with an image of a phone and a person talking; “Gather Necessary Documentation” (documents, photos, etc. shown as small icons within the box); “Submit the Claim” (an online form or physical document being submitted is illustrated); “Claim Review and Investigation” (a magnifying glass over a document); “Claim Approval or Denial” (a checkmark or an ‘X’ icon respectively); and finally, “Payment/Settlement” (depicted with a check or bank transfer icon). Each stage would be clearly labeled, and short, concise descriptions could accompany each visual element. The overall design would use a clean, easy-to-follow layout with a consistent color scheme for better clarity.

Insurance Policy Document Components: A Visual Guide

The illustration would depict a stylized insurance policy document, possibly opened to reveal its key sections. The layout would resemble a typical document, with clear headings and sections. A key would be included to explain each section. The top section would show the policyholder’s information (name, address, policy number), displayed in a clearly defined box. Below that, a large section would be dedicated to “Coverage Details,” subdivided into smaller boxes representing different types of coverage (e.g., liability, collision, comprehensive, etc. for car insurance). Each smaller box would contain a brief description of the coverage and its limits. Another section, clearly labeled “Exclusions,” would list common exclusions using bullet points and easily understandable language. A “Premium Information” section would detail payment amounts, due dates, and payment methods. Finally, a “Contact Information” section would provide the insurer’s contact details, including phone numbers and addresses. The visual style would use color-coding to differentiate between sections, making it easy to locate specific information at a glance. The overall design aims for a clean, uncluttered look to avoid overwhelming the viewer.

Addressing Common User Concerns

Understanding your insurance policy can sometimes feel overwhelming. This section aims to clarify common concerns and questions regarding coverage, premiums, and claims processes. We’ve compiled concise explanations to help you navigate these areas with greater confidence.

Premium Costs and Factors Influencing Them

Many people wonder what factors affect their insurance premiums. Several elements contribute to the final cost. These include your age, driving history (for auto insurance), location, the type of coverage you choose, and the value of the insured item. For example, a young driver with a history of accidents will generally pay more for car insurance than an older driver with a clean record. Similarly, a home in a high-risk area for theft or natural disasters will likely have a higher homeowner’s insurance premium than a similar home in a lower-risk area.

“Your premium is calculated based on a risk assessment, considering various factors specific to you and your situation.”

Understanding Policy Coverage and Exclusions

It’s crucial to understand exactly what your insurance policy covers and, equally important, what it doesn’t. Policies often have specific exclusions, detailing situations or events not covered. For instance, flood damage may not be included in a standard homeowner’s policy; separate flood insurance would be required. Carefully reviewing your policy documents and asking your insurer for clarification on anything unclear is vital.

“Thoroughly understanding your policy’s coverage and exclusions prevents unexpected financial burdens in the event of a claim.”

Filing a Claim and the Claim Process

The claims process can be daunting, but understanding the steps involved makes it less stressful. Typically, you’ll need to report the incident promptly to your insurer, provide necessary documentation (such as police reports or medical records), and cooperate with the investigation. The insurer will then assess the claim and determine the amount of coverage. The timeframe for claim resolution can vary depending on the complexity of the claim.

“Reporting your claim promptly and providing all necessary documentation will expedite the claims process.”

Renewing Your Policy and Making Changes

Renewing your insurance policy is a routine process, but you might need to make changes to your coverage. This could involve adjusting coverage limits, adding or removing drivers (for auto insurance), or updating information about your property (for homeowner’s insurance). Contacting your insurer well before your renewal date allows ample time to discuss changes and ensure your policy remains suitable for your needs.

“Regularly review your policy to ensure it aligns with your current circumstances and needs.”

Summary

Ultimately, understanding “my insurance” is a continuous process of learning and adaptation. Regularly reviewing your policies, understanding your coverage, and knowing how to file a claim are essential steps towards financial preparedness. This guide serves as a foundational resource, equipping you with the knowledge to navigate the complexities of insurance with confidence. Remember, proactive engagement with your insurance provider can prevent future headaches and ensure you’re adequately protected.

Query Resolution

What happens if I don’t pay my insurance premium on time?

Late payments can result in penalties, suspension of coverage, or even policy cancellation. Contact your insurer immediately if you anticipate difficulties making a timely payment to explore options.

How do I choose the right insurance coverage for my needs?

Consider your risk tolerance, assets to protect, and budget. Compare quotes from different providers, read policy details carefully, and consult with an insurance professional if needed to determine the best fit.

What is the claims process?

The claims process varies by insurer and policy type. Generally, it involves reporting the incident, providing necessary documentation, and cooperating with the insurer’s investigation. Your policy documents should detail the specific steps.

Can I change my insurance policy mid-term?

Policy changes are possible, but they may involve fees or adjustments to your premiums. Contact your insurer to discuss your options and any potential implications.

アイムジャグラーEX

ガロゴールドインパクト 裏ボタン

大当たりの瞬間は、心臓がドキドキします。興奮が何とも言えません。

三國志

https://www.ja-securities.jp/?ArticlesID=27502779.html

サウンドエフェクトが迫力満点で、プレイ中に盛り上がります。特にバトル時が楽しい。

黃金守護神(特殊大賞燈);

k8 招待コード

CR 聖戦士ダンバイン

麻雀物語

HEY!エリートサラリーマン鏡

e ぱちんこソードアート・オンラインK12

https://www.ja-securities.jp/?ArticlesID=27533389.html

友人と一緒にプレイすることで、楽しさが倍増します。共に喜ぶ瞬間が嬉しい。

紫イミソーレ(4発1)

https://www.ja-securities.jp/?ArticlesID=27531729.html

プレイ中の雰囲気が楽しく、長時間楽しむことができます。快適な空間が魅力です。

黄門ちゃま喝

https://www.ja-securities.jp/?ArticlesID=27459789.html

パチンコは、日常のストレスを忘れさせてくれる最高の娯楽です。リラックスできます。