Navigating the complex world of insurance can be daunting. This guide delves into the crucial role of the National Association of Insurance Commissioners (NAIC) in ensuring fair and stable insurance markets. We’ll explore how NAIC insurance regulations impact both consumers and insurance companies, offering a clear understanding of this often-overlooked yet vital aspect of the industry.

From defining NAIC insurance and its scope to examining its impact on consumer protection and market stability, we aim to provide a comprehensive overview. We’ll explore the challenges faced by insurance companies in complying with NAIC regulations and the various ways consumers benefit from this regulatory framework. This exploration includes real-world examples and a look at future trends shaping the NAIC’s role.

NAIC’s Role in Insurance Regulation

The National Association of Insurance Commissioners (NAIC) plays a crucial role in fostering a stable and competitive insurance market across the United States. While not a federal regulatory body, its influence on state-level insurance regulations is significant, impacting consumer protection, insurer solvency, and the overall health of the insurance industry. The NAIC’s work primarily focuses on creating model laws and regulations that individual states can adopt, promoting consistency and reducing regulatory arbitrage.

NAIC’s Impact on Insurance Market Stability

The NAIC contributes to insurance market stability through the development and promotion of consistent regulatory standards. By encouraging states to adopt model laws addressing issues like solvency requirements, consumer protection, and market conduct, the NAIC minimizes regulatory disparities that could lead to unfair competition or weaken the financial stability of insurance companies. This consistency reduces the risk of insurers exploiting regulatory differences between states, thereby contributing to a more level playing field and a more resilient insurance market. For example, the NAIC’s work on reserving standards helps ensure insurers have adequate funds to meet future claims, protecting policyholders.

Key NAIC Regulations Affecting Insurance Companies

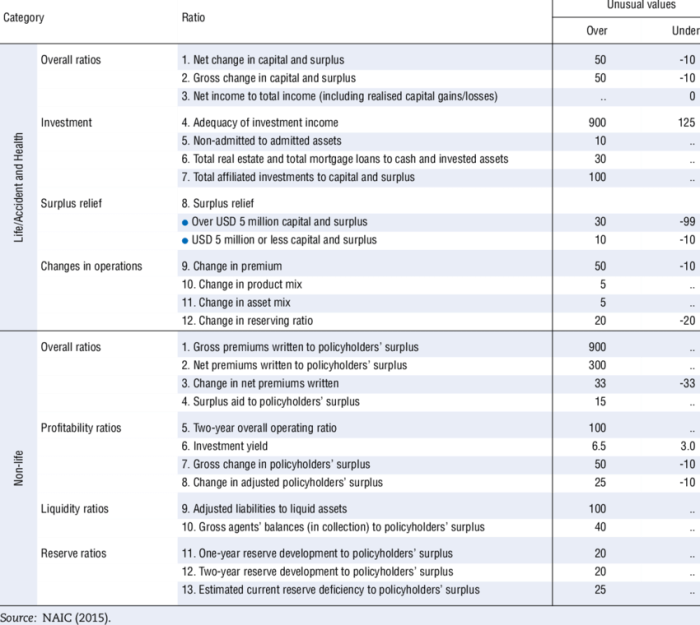

Several key NAIC regulations significantly impact insurance companies. These include, but are not limited to, the following: model laws related to insurer solvency (e.g., risk-based capital requirements), market conduct (e.g., standards for fair claims handling), and financial reporting (e.g., Annual Statement requirements). These regulations aim to ensure the financial stability of insurers, protect consumers from unfair practices, and provide transparency in the insurance market. Non-compliance can lead to significant penalties and sanctions imposed by individual states. For instance, failure to meet minimum capital requirements could result in regulatory intervention or even the suspension of an insurer’s license to operate.

Processes Involved in NAIC Insurance Regulation

The NAIC’s regulatory process is collaborative and iterative. It involves the development of model laws and regulations by various committees composed of state insurance commissioners. These models are then reviewed and potentially adopted by individual states. Each state retains the authority to modify or reject the NAIC models to suit its specific needs and circumstances. This process includes extensive stakeholder input from insurers, consumer advocates, and other interested parties. Once a state adopts a model, it becomes part of that state’s insurance code, enforceable through the state’s insurance department. The NAIC also facilitates information sharing and coordination among state regulators, fostering a more unified approach to supervision.

Comparison of NAIC and State-Level Insurance Regulations

While the NAIC develops model regulations, the actual regulation of insurance remains primarily a state function. This means that state insurance departments have the ultimate authority to enforce insurance laws within their jurisdictions. However, the widespread adoption of NAIC models creates a degree of harmonization across states, reducing regulatory fragmentation. Differences can still exist, though, reflecting the diverse needs and priorities of individual states. For example, one state might adopt a more stringent standard for consumer protection than another, even if both states use the same NAIC model as a foundation. This flexibility allows states to tailor regulations to their specific circumstances while benefiting from the NAIC’s work in establishing consistent baselines.

Types of Insurance Regulated by the NAIC

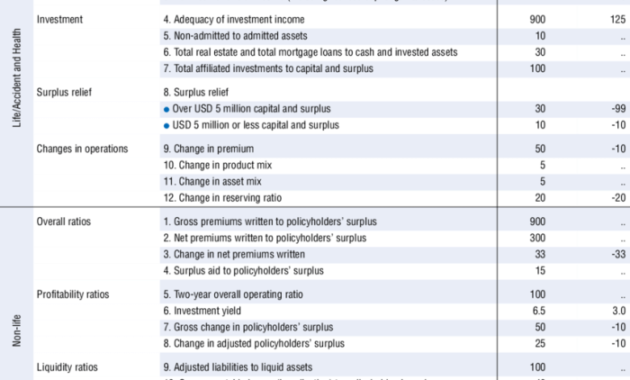

The NAIC’s influence extends across various insurance lines. The following table provides a summary:

| Insurance Type | Key Regulatory Aspects | Potential Consumer Impacts | Examples of NAIC Model Laws/Regulations |

|---|---|---|---|

| Auto Insurance | Minimum liability coverage, uninsured/underinsured motorist coverage, rate regulation | Affordable premiums, protection against financial losses from accidents | Model Unfair Claims Settlement Practices Act |

| Homeowners Insurance | Property coverage requirements, flood insurance requirements, rate regulation | Protection against property damage, affordable premiums | Model Act for the Regulation of Insurance Rates |

| Health Insurance | Minimum benefit requirements (in states with state-based exchanges), rate regulation (prior to ACA), market conduct standards | Access to affordable health coverage, protection against unfair practices | Model Health Insurance Rate Review Act |

| Life Insurance | Minimum reserve requirements, suitability of sales practices, disclosure requirements | Financial security for beneficiaries, protection against mis-selling | Model Act for the Regulation of Life Insurance Rates |

Impact of NAIC on Insurance Companies

The National Association of Insurance Commissioners (NAIC) plays a significant role in shaping the insurance industry landscape. Its model laws and regulations, while aiming for uniformity and consumer protection, present both opportunities and challenges for insurance companies operating across multiple states. Compliance demands considerable resources and strategic adaptation.

NAIC regulations profoundly influence insurance company operations, impacting various aspects from product development to financial reporting. The complexities inherent in navigating a patchwork of state-level regulations, often harmonized but not entirely uniform through NAIC initiatives, necessitate significant investment in compliance infrastructure and expertise.

Challenges Faced by Insurance Companies Due to NAIC Regulations

The sheer volume and complexity of NAIC model laws and regulations present a major hurdle. Keeping abreast of changes, ensuring consistent implementation across different states, and adapting internal processes to comply with evolving standards require significant time, effort, and financial resources. Furthermore, the interpretation and application of these regulations can vary across states, leading to inconsistencies and potential legal risks. For smaller insurance companies with limited resources, this can be particularly challenging, potentially hindering their growth and competitiveness.

Effects of NAIC Regulations on Insurance Company Operations

NAIC regulations directly affect several key operational areas. Underwriting processes may need adjustments to meet specific requirements related to risk assessment and pricing. Product development cycles can be lengthened as companies navigate the approval processes in various states. Claims handling procedures must adhere to specific guidelines regarding investigation, settlement, and reporting. Furthermore, significant investment in technology and data management is often necessary to comply with reporting and record-keeping requirements. This includes systems for maintaining accurate financial records, managing customer data, and ensuring compliance with data privacy regulations.

Examples of Insurance Company Adaptation to NAIC Standards

Many insurance companies proactively adapt to NAIC standards through various strategies. Investing in sophisticated compliance software helps automate processes, track regulatory changes, and ensure accurate reporting. Developing internal expertise in regulatory compliance, through dedicated teams or external consultants, is crucial for interpreting and implementing complex rules. Some companies adopt a centralized compliance function to ensure consistency across all their operations. Furthermore, many companies engage in active participation in NAIC working groups and committees, contributing to the development of future regulations and influencing the regulatory landscape. This proactive approach allows them to anticipate changes and incorporate them into their operations more smoothly.

Financial Implications of NAIC Compliance for Insurance Companies

Compliance with NAIC regulations entails significant financial costs. These include the expenses associated with legal and consulting fees, software investments, training programs for employees, and the administrative overhead of managing compliance processes. The costs can vary considerably depending on the size and complexity of the insurance company, the number of states in which it operates, and the specific regulations involved. Non-compliance can lead to significant penalties, including fines, legal actions, and reputational damage, making proactive compliance a cost-effective strategy in the long run. For example, a failure to adequately address cybersecurity concerns, as addressed by several NAIC model laws, could result in substantial financial losses from data breaches and subsequent legal liabilities.

Illustrative Example

This section details a hypothetical insurance claim scenario involving a NAIC-regulated insurer to illustrate how the NAIC’s regulatory framework impacts claim resolution. The example focuses on a common type of insurance and a typical claim process, highlighting the insurer’s responsibilities and the potential role of the NAIC.

Auto Insurance Claim: A Hypothetical Scenario

Imagine Sarah, a resident of California, is involved in a car accident. She holds an auto insurance policy with “Sunshine State Insurance,” a company regulated by the California Department of Insurance (a member of the NAIC). During the accident, Sarah’s vehicle sustains significant damage, and she suffers minor injuries requiring medical attention. Sunshine State Insurance is notified of the claim, and an adjuster is assigned to investigate. The adjuster inspects Sarah’s vehicle, reviews the police report, and obtains medical records documenting her injuries. The adjuster then makes an initial assessment of the damages and the medical expenses. Sunshine State Insurance offers Sarah a settlement of $15,000 to cover the vehicle repair and medical bills. Sarah believes this amount is insufficient, citing additional medical expenses and the diminished value of her car after the accident. She believes a fair settlement should be closer to $22,000.

The Insurer’s Response and the Role of the NAIC

Sunshine State Insurance reviews Sarah’s counter-offer and supporting documentation. They maintain their initial offer, citing their own independent assessment of the damages and medical expenses. Sarah, unsatisfied with the response, considers her options. The NAIC’s regulatory framework, specifically the model laws and regulations adopted by various state insurance departments, plays a crucial role here. The NAIC’s model laws promote fair claim practices, requiring insurers to act in good faith and to provide a reasonable explanation for their claim decisions. These laws also Artikel procedures for appealing claim denials or disputes. Sarah could, therefore, file a complaint with the California Department of Insurance, citing Sunshine State Insurance’s failure to provide a fair settlement. The California Department of Insurance, as a member of the NAIC, would investigate Sarah’s complaint, reviewing the claim file, evaluating the evidence, and assessing whether Sunshine State Insurance adhered to the relevant regulations and acted in good faith. The department might mediate between Sarah and Sunshine State Insurance, facilitating a negotiated settlement. If mediation fails, the department could take further action, potentially issuing a cease-and-desist order or imposing fines on Sunshine State Insurance if violations are found. The NAIC’s involvement, through its model laws and the actions of state insurance departments, ensures a level playing field and protects policyholders from unfair or unreasonable claim practices.

NAIC’s Regulatory Framework Influence on Claim Resolution

The NAIC’s influence on the claim resolution process is significant. The model laws and regulations set minimum standards for claim handling, ensuring consistency and fairness across different states. These standards include requirements for timely processing of claims, prompt investigation of claims, and clear communication with policyholders. The NAIC also promotes the use of alternative dispute resolution mechanisms, such as mediation and arbitration, to resolve claim disputes efficiently and cost-effectively. By establishing these standards and promoting best practices, the NAIC significantly influences the overall fairness and transparency of the insurance claim process, protecting policyholders’ rights and promoting consumer confidence in the insurance industry. The NAIC’s influence extends to ensuring that insurance companies are financially solvent and can meet their obligations to policyholders, further contributing to a stable and reliable insurance market.

Concluding Remarks

The NAIC plays a pivotal role in maintaining a stable and consumer-friendly insurance market. By setting standards, promoting transparency, and addressing emerging challenges, the NAIC ensures that insurance companies operate responsibly and that consumers are protected. Understanding the NAIC’s influence is key to navigating the insurance landscape confidently and effectively. This guide serves as a foundational resource for anyone seeking a deeper comprehension of NAIC insurance and its impact.

Questions Often Asked

What does NAIC stand for?

NAIC stands for the National Association of Insurance Commissioners.

How does the NAIC differ from state insurance departments?

While state departments regulate insurance within their borders, the NAIC develops model laws and regulations that states can adopt, promoting consistency across jurisdictions. The NAIC doesn’t directly regulate insurers; that’s the role of individual state departments.

Can I file a complaint directly with the NAIC?

No. The NAIC doesn’t handle individual consumer complaints. You should file complaints with your state’s insurance department.

Are all insurance types regulated by the NAIC?

Most major insurance lines are subject to NAIC model regulations, although the specific implementation varies by state. Some niche insurance products may have less NAIC oversight.

Where can I find more information about NAIC insurance regulations?

The NAIC website (naic.org) is an excellent resource for information on regulations, model laws, and consumer resources.