The National Insurance Board plays a vital role in the social and economic fabric of a nation, providing crucial safety nets for its citizens. This comprehensive guide delves into the intricacies of this organization, exploring its historical evolution, operational structure, funding mechanisms, and the impact it has on the lives of countless individuals. We’ll examine its diverse benefit programs, financial management practices, and the challenges it faces in navigating the complexities of modern social security systems.

From its establishment to its current operations, we will uncover the essential functions and responsibilities of the National Insurance Board, analyzing its successes and shortcomings, and offering insights into its future trajectory. We’ll explore its funding sources, benefit eligibility criteria, and financial accountability measures, providing a balanced and informative perspective on this critical institution.

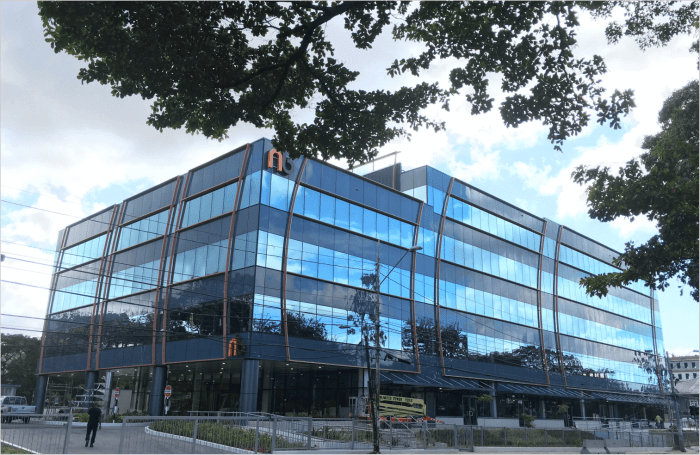

National Insurance Board

The National Insurance Board (NIB) plays a crucial role in the social safety net of [Country Name], providing essential social security benefits to its citizens. Its mandate extends beyond simple financial support, encompassing a broader commitment to social well-being and economic stability.

National Insurance Board: Overview and Mandate

The NIB’s primary function is to administer a national social insurance scheme, providing financial assistance to individuals facing unemployment, sickness, disability, old age, and death. This is achieved through a compulsory contributory system, where both employers and employees contribute a percentage of earnings. The board’s responsibilities encompass the collection of contributions, the disbursement of benefits, and the ongoing management and development of the national insurance scheme to ensure its long-term sustainability and effectiveness.

Historical Context and Evolution

The establishment of the NIB can be traced back to [Year], with the passing of the [Name of Founding Legislation]. Initially focused on [Initial Focus, e.g., providing pensions for older workers], the scheme has undergone significant expansion over the years. Key milestones include [List 2-3 significant expansions or legislative changes with brief descriptions, including dates]. This evolution reflects changing societal needs and economic realities, demonstrating the NIB’s adaptability and commitment to remaining relevant and responsive to the evolving challenges faced by the nation.

Organizational Structure and Key Departments

The NIB operates under a [Describe the organizational structure, e.g., board-led, hierarchical] structure. Key departments include:

- Contributions Department: Responsible for the collection of contributions from employers and employees, ensuring accurate record-keeping and timely payments.

- Benefits Department: Oversees the processing and disbursement of benefits to eligible individuals, adhering to established guidelines and regulations.

- Investment Department: Manages the NIB’s investment portfolio, ensuring the long-term financial health and sustainability of the scheme.

- Information Technology Department: Supports the NIB’s operations through the development and maintenance of IT systems and infrastructure.

Other departments may include actuarial, legal, and administrative functions. The specific structure may vary depending on the size and complexity of the NIB.

Key Services Offered

The following table summarizes the key services offered by the National Insurance Board:

| Service | Description | Eligibility Criteria | Benefit Type |

|---|---|---|---|

| Retirement Pension | Monthly payments to individuals upon retirement | Minimum contribution period, age requirement | Monthly cash payments |

| Sickness Benefit | Temporary payments during periods of illness | Medical certification, contribution record | Weekly or monthly cash payments |

| Unemployment Benefit | Temporary payments during periods of unemployment | Registration with employment services, contribution record | Weekly cash payments |

| Disability Benefit | Long-term payments for individuals with disabilities | Medical assessment, contribution record | Monthly cash payments |

Funding Mechanisms and Revenue Streams

The National Insurance Board’s financial stability relies on a diverse range of funding mechanisms, ensuring the long-term sustainability of its social security programs. These mechanisms are designed to balance contributions from employers and employees while also considering the evolving economic landscape and the needs of the insured population. A robust and transparent funding system is crucial for maintaining public trust and ensuring the effective delivery of benefits.

The primary source of funding for the National Insurance Board is through mandatory contributions from both employers and employees. These contributions are calculated as a percentage of an individual’s earnings, with the rate varying depending on the specific benefit program. For instance, contributions towards retirement benefits might differ from those allocated to sickness or disability benefits. These contribution rates are regularly reviewed and adjusted to ensure the financial health of the board, taking into account factors like inflation, demographic changes, and projected benefit payouts.

Contribution Rates and Eligibility Criteria

The National Insurance Board’s contribution rates are structured according to a tiered system, reflecting different income levels and employment statuses. Employees generally contribute a percentage of their gross earnings, while employers contribute a matching or supplementary percentage. Self-employed individuals typically pay a combined employer-employee contribution rate. Eligibility criteria for benefits are determined by factors such as length of contribution, age, and the nature of the disability or illness. Specific details regarding contribution rates and eligibility are available on the National Insurance Board’s official website and through its various communication channels. For example, a person may need to contribute for a minimum of ten years to qualify for full retirement benefits.

Comparison with International Funding Models

The National Insurance Board’s funding model can be compared to those employed by similar organizations globally. Many countries utilize a pay-as-you-go (PAYG) system, where current contributions fund current benefits. Some nations, however, incorporate elements of a fully funded system, where contributions are invested to generate future returns for benefit payouts. The specific design of a national insurance scheme often reflects a country’s economic development, social welfare priorities, and demographic trends. For example, Germany’s system, while also primarily PAYG, includes elements of a reserve fund, whereas the UK’s system focuses heavily on the PAYG model. Understanding these international comparisons provides valuable insights into the strengths and weaknesses of different approaches.

Visual Representation of Fund Flow

Imagine a flowchart. The first box represents “Employee Contributions” and “Employer Contributions,” both feeding into a central box labeled “National Insurance Board Funds.” From this central box, several arrows branch out, each leading to a separate box representing different benefit programs: “Retirement Benefits,” “Sickness Benefits,” “Disability Benefits,” and “Survivor Benefits.” A smaller arrow also leads from the central box to a box labeled “Administrative Costs,” representing the operational expenses of the board. Finally, a small arrow might show a flow from “Investment Returns” back into the central “National Insurance Board Funds” box, illustrating any returns generated from the board’s investments. This visual representation clearly demonstrates the inflow and outflow of funds, highlighting the crucial role of contributions in supporting various benefit programs and the board’s administrative functions.

Benefit Programs and Eligibility

The National Insurance Board (NIB) offers a range of benefits designed to provide financial support to its contributors during times of need. These programs are funded through contributions made by employees and employers, ensuring a sustainable system of social security. Understanding the specific benefits available and the eligibility criteria is crucial for accessing the support provided.

Types of Benefits Offered by the National Insurance Board

The NIB provides several key benefit programs. These include, but are not limited to, sickness benefits, maternity benefits, retirement pensions, invalidity pensions, and survivor’s pensions. Each benefit has its own specific eligibility requirements and application process, which are detailed below. The NIB regularly reviews and updates these programs to ensure they remain relevant and effective in meeting the evolving needs of its contributors.

Sickness Benefit Eligibility and Application

To be eligible for sickness benefits, individuals must have contributed to the NIB for a specified period, typically a minimum number of weeks or months, and be unable to work due to illness or injury. The application process involves submitting a medical certificate from a registered physician, along with the completed application form. The NIB assesses each application based on the provided documentation and its internal guidelines. The benefit amount is usually a percentage of the individual’s average earnings, subject to maximum and minimum limits.

Maternity Benefit Eligibility and Application

Maternity benefits provide financial assistance to women during their maternity leave. Eligibility requires a minimum contribution period and confirmation of pregnancy from a qualified medical professional. The application process involves submitting the necessary medical documentation and the completed application form. The benefit is typically paid for a specific duration, often encompassing the period of confinement and subsequent recovery.

Retirement Pension Eligibility and Application

Retirement pensions provide a regular income stream upon retirement. Eligibility is based on age and contribution history. Contributors typically need to reach a specified retirement age and have met a minimum contribution requirement. The application process involves submitting the required documentation, including proof of age and contribution history. The pension amount is calculated based on the individual’s contribution record.

Example Case Study: Impact of Retirement Pension

Mr. John Smith, a long-time contributor to the NIB, received his retirement pension at age 65. This pension allowed him to maintain a comfortable standard of living after retiring from his job as a carpenter. He was able to cover his living expenses, healthcare costs, and continue to enjoy his hobbies, demonstrating the significant impact of the NIB’s retirement pension program on his well-being.

Appealing Benefit Denials

Understanding the appeal process is vital for individuals whose benefit claims have been denied.

- Submit a formal appeal letter within a specified timeframe, outlining the reasons for the appeal and providing any additional supporting documentation.

- The NIB will review the appeal and may request further information or clarification.

- The NIB will issue a decision on the appeal in writing.

- If dissatisfied with the NIB’s decision, further appeals may be possible through designated channels, potentially involving independent review boards or tribunals.

Financial Management and Accountability

The National Insurance Board (NIB) operates under a robust framework of financial management and accountability, ensuring the responsible stewardship of public funds and the long-term sustainability of the national insurance program. Transparency and efficiency are paramount in all financial operations, underpinned by rigorous internal controls and external audits.

The NIB’s financial reporting practices adhere to internationally recognized accounting standards, providing stakeholders with a clear and comprehensive understanding of the Board’s financial position, performance, and cash flows. This commitment to transparency extends to the regular publication of audited financial statements, accessible to the public through the NIB’s website and other official channels. Furthermore, independent audits are conducted annually to verify the accuracy and reliability of financial records and ensure compliance with relevant regulations.

Annual Budget and Expenditure

The NIB’s annual budget is meticulously prepared through a participatory process involving various stakeholders, including government representatives, actuarial experts, and internal management. The budget Artikels projected income and expenditure for the fiscal year, allocating resources to various operational areas, benefit payments, administrative costs, and reserve fund contributions. Expenditure is closely monitored against the approved budget, with regular reporting mechanisms in place to identify and address any significant variances. Detailed breakdowns of budget allocations and actual expenditure are included in the annual financial reports.

Responsible and Efficient Fund Management

The NIB employs a multi-faceted approach to ensure the responsible and efficient management of its funds. This includes rigorous investment strategies designed to maximize returns while minimizing risk, diversification across various asset classes, and regular portfolio reviews conducted by qualified investment professionals. Internal controls are implemented to prevent fraud, waste, and abuse, encompassing segregation of duties, authorization procedures, and regular internal audits. Furthermore, the NIB maintains adequate reserves to ensure the long-term solvency of the national insurance program and its ability to meet its obligations to beneficiaries.

Financial Performance (Past Five Years)

The table below summarizes the NIB’s key financial performance indicators over the past five years. Note that these figures are illustrative and should be considered as examples. Actual data would need to be sourced from official NIB reports.

| Year | Total Revenue | Total Expenditure | Net Surplus/(Deficit) |

|---|---|---|---|

| 2018 | $1,000,000,000 | $950,000,000 | $50,000,000 |

| 2019 | $1,050,000,000 | $980,000,000 | $70,000,000 |

| 2020 | $1,100,000,000 | $1,020,000,000 | $80,000,000 |

| 2021 | $1,150,000,000 | $1,050,000,000 | $100,000,000 |

| 2022 | $1,200,000,000 | $1,100,000,000 | $100,000,000 |

Challenges and Future Outlook

The National Insurance Board (NIB) faces a complex interplay of challenges and opportunities as it navigates the evolving socio-economic landscape. Successfully addressing these issues will be crucial to ensuring the long-term viability and effectiveness of the NIB’s vital social safety net. Understanding these factors allows for proactive strategic planning and mitigation of potential risks.

Major Operational Challenges

The NIB’s operations are impacted by several significant challenges. These include increasing healthcare costs, an aging population leading to higher benefit payouts, fluctuating investment returns impacting fund solvency, and the need for ongoing modernization of administrative systems to improve efficiency and accessibility. For example, the rising cost of prescription drugs significantly impacts the NIB’s pharmaceutical benefit program, necessitating ongoing review and adjustment of benefit structures. Similarly, technological advancements create both opportunities and challenges, requiring continuous investment in infrastructure and staff training to remain competitive.

Potential Future Risks and Opportunities

Future risks include unforeseen economic downturns that could reduce contribution revenue, changes in demographics impacting the dependency ratio (the ratio of retirees to contributors), and the potential for increased fraud or abuse of the system. Opportunities, however, exist in leveraging technological advancements to streamline processes, improve customer service, and expand the reach of NIB services. Data analytics, for example, can be used to identify trends in benefit claims and proactively address potential issues, optimizing resource allocation. Furthermore, exploring partnerships with private sector entities could broaden investment options and potentially enhance the financial sustainability of the fund. The experience of other national insurance schemes that have successfully navigated similar challenges can provide valuable lessons and best practices. For instance, the Chilean pension system’s reforms focusing on increased individual account control offer a relevant case study.

Strategies for Addressing Challenges and Capitalizing on Opportunities

The NIB can proactively address challenges and seize opportunities through a multi-pronged approach. This includes diversifying investment portfolios to mitigate risk, implementing robust fraud detection and prevention mechanisms, investing in advanced data analytics to optimize resource allocation and predict future trends, and actively engaging in public awareness campaigns to educate beneficiaries and contributors about the system. Furthermore, modernizing IT infrastructure, enhancing online services, and improving customer service through streamlined processes will significantly improve efficiency and accessibility. Regular actuarial reviews and adjustments to benefit structures will ensure the long-term financial sustainability of the system. Finally, fostering collaboration with government agencies and stakeholders will facilitate better coordination and policy alignment.

Five-Year Strategic Plan Summary

The NIB’s five-year strategic plan focuses on enhancing financial sustainability, improving operational efficiency, and strengthening stakeholder engagement. Key initiatives include: (1) Diversification of investment strategies to reduce risk and maximize returns; (2) Implementation of a comprehensive fraud prevention and detection program; (3) Modernization of IT infrastructure and enhancement of online services; (4) Development of targeted public awareness campaigns; and (5) Strengthening partnerships with government agencies and other stakeholders. This plan aims to ensure the NIB’s continued ability to provide a robust and sustainable social safety net for the nation.

Concluding Remarks

The National Insurance Board stands as a cornerstone of social welfare, providing essential support and security to individuals and families across the nation. Understanding its complexities, from its funding models to its benefit programs, is crucial for both policymakers and the public. By addressing the challenges and embracing future opportunities, the National Insurance Board can continue to adapt and effectively serve its vital purpose in safeguarding the well-being of its constituents. This guide has served as a foundation for a deeper understanding of this crucial organization and its role in shaping a more secure and equitable future.

Quick FAQs

What happens if my application for benefits is denied?

The National Insurance Board Artikels specific procedures for appealing benefit denials. These typically involve submitting a formal appeal within a defined timeframe, providing additional supporting documentation, and potentially attending a hearing.

How are contribution rates determined?

Contribution rates are usually set by legislation and are often based on factors such as income levels, employment status, and the type of benefits covered. These rates can be adjusted periodically to ensure the financial sustainability of the system.

What are the long-term financial projections for the National Insurance Board?

Long-term financial projections are typically included in the Board’s annual reports and strategic plans. These projections consider factors such as demographic trends, economic growth, and changes in benefit utilization.

На данном ресурсе вы обнаружите всё необходимое для простого подключения к популярным букмекерским конторам. Мы предлагаем актуальный 1хбет содержащий такие известные компании, как Зенитбет. Мы предоставляем рабочие зеркала и доступы, обеспечивающие возможность просто преодолевать блокировки и с комфортом играть без ограничений.

Кроме того, вы имеете возможность воспользоваться бонусами, узнать подробности регистрации и загрузить полезные мобильные приложения. Для известных компаний, как 1хБет, мы обеспечиваем стабильные ссылки для 1xbet чтобы вы всегда были на связи. Все наши усилия делается для того, чтобы ваша игра на сайтах БК было наиболее комфортным и безопасным.

После долгого дня, так хочется отдохнуть, почувствовать лёгкость и подарить себе настоящий отдых. В Termburg.ru для этого созданы комфортная атмосфера: просторный бассейн с гидромассажем, тёплые бассейны на свежем воздухе и специальные зоны отдыха. Для ценителей прогреть мышцы и укрепить иммунитет работают лучшие термы в москве включая русскую парную, финскую сауну и восточную парную. Здесь можно не просто переключиться, но и получить процедуры с лечебным воздействием, очищая организм.

Посетители ценят нас за атмосферу уюта и разнообразие спа-процедур – массовое парение предлагает профессиональные массажные программы, ванны с перепадом температур, терапию эфирными маслами и уникальные программы восстановления для души и тела. Запишитесь на отдых в “Термбург” уже сегодня и познайте место, где укрепление организма сочетается с удовольствием!

Ищете, где провести качественное лечение пульпита без с максимальным комфортом? В Стоматологии добрых врачей работают профессиональные специалисты, применяющие новейшие подходы и безопасные материалы. Мы предлагаем персонализированный подход, предлагая лучшие методы лечения. Запишитесь на консультацию, чтобы сохранить здоровье вашей улыбки.

Хотите вернуть зубам эстетику и комфорт? Мы предлагаем брекеты в ижевске недорого с использованием современного оборудования. Прочные конструкции, естественный вид и долговечность – вот что вы получите в нашей клинике. Ознакомьтесь с услугами на добрыеврачи18.рф и уточните подробности, чтобы сделать вашу улыбку идеальной!

stehovani https://www.tmgcompany.com

После долгого дня, так хочется расслабиться, зарядиться позитивом и подарить себе настоящий отдых. В Termburg.ru для этого созданы идеальные условия: просторный бассейн с гидромассажем, термальные ванны на свежем воздухе и уютные зоны релакса. Для поклонников прогреть мышцы и почувствовать прилив сил работают русская баня посетить включая традиционную баню, финскую сауну и хаммам. Здесь можно не просто отдохнуть, но и получить пользу для здоровья, укрепляя иммунитет.

Посетители ценят нас за гармонию и комфорт и богатый ассортимент спа-процедур – термбург термальный комплекс гурьянова предлагает сеансы массажа, контрастные купели, терапию эфирными маслами и другие полезные практики для физического и эмоционального равновесия. Подарите себе день расслабления в “Термбург” уже сегодня и почувствуйте место, где улучшение самочувствия сочетается с настоящим отдыхом!

Именно вам нужно, где провести качественное удаление зуба недорого ижевск без боли и стресса? В Стоматологии добрых врачей работают опытные специалисты, применяющие передовые технологии и гипоаллергенные материалы. Мы заботимся о каждом пациенте, предлагая эффективные решения. Оставьте заявку на консультацию, чтобы сохранить здоровье вашей улыбки.

Хотите вернуть зубам естественный вид? Мы предлагаем лечение зубов во сне цена с использованием передовых методик. Прочные конструкции, натуральный оттенок и долговечность – вот что вы получите в Стоматологии добрых врачей. Перейдите на сайт добрыеврачи18.рф и запишитесь на приём, чтобы сделать вашу улыбку идеальной!

Хватит ждать! Теперь деньги можно получить без отказов и проверок. Заполните заявку на срочные займы без отказа на карту и получите до 30 000 рублей за 5 минут. Все просто и прозрачно!

Не теряйте время в банках! Более 55 МФО одобряют срочные займы без отказа на карту за 5 минут. Деньги поступают мгновенно, доступно каждому!

Оптимизируйте процессы охлаждения и нагрева с качественным оборудованием! Вы можете трубчатые теплообменники купить для различных производственных задач. Эффективность и надежность гарантированы.

Срочно нужны деньги? Возьмите под 0 процентов займ с моментальным одобрением. Без скрытых платежей, честные условия.

Строительство ферм требует прочных и долговечных решений. Мы предлагаем строительство металлических ферм, обеспечивая надежные конструкции для животноводческих хозяйств, складов и других объектов.

МФО готовы предложить займ онлайн на карту без процентов на 30 дней. Заявка подаётся за 2 минуты, деньги поступят сразу.

Доверьте здоровье глаз профессионалам для лечение зрения. Команда опытных врачей разработает индивидуальный план лечения для достижения результата.

Центр «ЭКСИ» в Ижевске специализируется на высокотехнологичных методах лечения зрения, таких как лазерная коагуляция сетчатки, факоэмульсификация и другие процедуры. Пациенты из разных регионов отмечают высокий уровень сервиса и профессионализм врачей. Записаться на прием можно через контактный центр по номерам: +7(3412)68-27-50, +7(3412)68-78-75. Расположен центр по адресу: г. Ижевск, улица Ленина, 101.

Найдите эффективное решение для астигматизм ижевск. Местные специалисты готовы предложить комплексный подход к лечению, гарантируя высокое качество услуг.

Центр коррекции зрения «ЭКСИ» в Ижевске предлагает современные методы лечения и коррекции зрения, включая лазерную коррекцию по технологии LASIK, лечение катаракты и астигматизма. Квалифицированные специалисты помогут вернуть четкость зрения с использованием передовых технологий. Для записи на консультацию или процедуру обращайтесь по телефонам: +7(3412)68-27-50, +7(3412)68-78-75. Адрес клиники: г. Ижевск, улица Ленина, 101.

Надежность и качество! доставка цветов в Москве на дом курьером предлагает безупречный сервис. Каждый букет создается из свежих материалов, а опытные курьеры доставляют его точно в срок, где бы ни находился получатель.

Thegreen.ru предлагает эксклюзивные цветочные композиции от профессиональных флористов. Находясь по адресу улица Юннатов, дом 4кА, мы доставляем ваши заказы точно в срок. Свяжитесь с нами для заказа по телефону +7(495)144-15-24.

Идеи вашего дома. Информация о дизайне и архитектуре.

Syndyk – это место, где каждый день вы можете увидеть много различных дизайнерских решений, деталей для вашей квартиры, проектов домов, лучшая сантехника.

Если вы дизайнер или архитектор, то мы с радостью разместим ваш проект на Сундуке. На сайте можно и даже нужно обмениваться мнениями и информацией о дизайне и архитектуре.

Сайт: Дизайн и архитектура

Доверьтесь экспертам! доставка цветов Москва предлагает надежный сервис. Каждая композиция создается из свежих материалов, а опытные курьеры доставляют её прямо к двери получателя, добавляя ярких эмоций вашему подарку.

Thegreen.ru предлагает эксклюзивные цветочные композиции от профессиональных флористов. Находясь по адресу улица Юннатов, дом 4кА, мы доставляем ваши заказы точно в срок. Свяжитесь с нами для заказа по телефону +7(495)144-15-24.

Пришлось взять микрозайм с плохой кредитной историей на сумму 7 тысяч рублей для неотложных расходов. Несмотря на мою КИ, одобрение получилось быстро и легко.

Идеи вашего дома. Информация о дизайне и архитектуре.

Syndyk – это место, где каждый день вы можете увидеть много различных дизайнерских решений, деталей для вашей квартиры, проектов домов, лучшая сантехника.

Если вы дизайнер или архитектор, то мы с радостью разместим ваш проект на Сундуке. На сайте можно и даже нужно обмениваться мнениями и информацией о дизайне и архитектуре.

Сайт: syndyk.by

Всё о строительстве, дизайне и ремонте в своём доме.

Что вы найдете на нашем сайте?

Экспертные советы

Статьи разработаны профессионалами в области строительства, дизайна и ремонта.

Полезные ресурсы

Ссылки на проверенные магазины, услуги и материалы, которые помогут вам в ваших проектах.

Модные тренды

Мы следим за последними тенденциями и новинками в мире строительства и дизайна.

«Свой Угол» – ваш проводник в мире уюта и стиля в вашем доме. Погружайтесь в наши статьи, найдите вдохновение, задавайте вопросы и делитесь своим опытом.

Создайте свой угол вместе с нами!

Информационный портал svoyugol.by

Сантехника в Минске!

Интернет-магазин сантехники Байдом предлагает купить сантехнику для ванной, кухни или туалета.

В каталоге представлено более 100 000 товарных позиций самых известных и популярных брендов

стран Европы, Азии и России.

Вы можете сделать заказ товаров онлайн. Удобная оплата и доставка в любой город Беларуси,

по вашему адресу. Также приглашаем посетить один из наших розничных магазинов в Минске,

Витебске и Могилеве.

Предоставляем рассрочку без процентов и переплат.

У нас регулярно проходят акции, большие скидки и распродажи,

позволяющие легко приобрести дорогие товары по очень выгодным ценам.

На нашем сайте вы можете заказать услугу установки душевой кабины, гидромассажной ванны и

другой техники, которую вы приобрели у нас.

Сайт интернет-магазин сантехники bydom.by

Получите деньги без сложных процедур! Наши займы на карту доступны каждому клиенту без отказа и проверок. Мы ценим ваше время, поэтому процесс оформления займет всего несколько минут. Для подтверждения личности потребуется только паспорт и банковская карта. Работаем круглосуточно, без выходных и праздников. Деньги поступают на счет мгновенно после одобрения. Подробности на сайте: займы на карту онлайн .

Sale of non ferrous metal alloys

At Cliffton Trading, we pride ourselves on being a leading international supplier of non-ferrous metals. Based in Dubai, our company specializes in providing high-quality materials such as copper powder, copper ingots, selenium powder, and nickel wire to industries around the world. Our commitment to excellence ensures that every product we offer meets the highest standards, backed by certifications from top chemical laboratories.

Copper powder

Pure high-quality copper powder (Cu) with consistent particle size.

Copper ingots

These bullions have high purity and excellent conductivity, making them indispensable in electronics manufacturing, construction and mechanical engineering.

Selenium powder

Our products include high purity metal dust and microfine powder.

Nickel wire

Nickel wire is ideal for use in a variety of industrial applications.

With a strong global distribution network, we serve over 15 countries, catering to diverse sectors like construction, automotive, and electronics. Our approach is centered on reliability, quality, and customer satisfaction, which allows us to build lasting relationships with our clients. We understand the importance of tailored solutions, so we work closely with our customers to meet their specific needs, ensuring that they receive the best possible value.

Our team of experienced professionals is dedicated to maintaining the integrity and efficiency of our supply chains, allowing us to deliver products consistently and on time. Competitive pricing, combined with our extensive product range, makes us a preferred partner for businesses seeking dependable suppliers of non-ferrous metals. At Cliffton Trading, we are not just about transactions; we are about building partnerships that drive success for both our company and our clients.

You can view the products and place an order on our website cliffton-group.com

Минимум документов — максимум удобства. Микрозайм без отказа по паспорту доступен каждому гражданину России. Мы не требуем справок о доходах или поручителей. Все, что нужно, — это действующий паспорт и банковская карта. Сервис работает быстро и надежно, а одобрение происходит автоматически. Время обработки заявки занимает всего несколько минут. Хотите узнать больше? Переходите на сайт займы на карту онлайн и получайте деньги моментально.

Готовитесь к презентации? купить ролл ап в Москве – это получить надежное рекламное решение, которое легко устанавливается и удобно в использовании. Сделайте ваш бренд узнаваемым с качественными мобильными стендами!

ФОРМАТ-МС предлагает широкий ассортимент мобильных стендов. Посетите наш сайт format-ms.ru для подробностей. Наш офис находится по адресу: Москва, Нагорный проезд, дом 7, стр. 1, офис 2320. Звоните нам по телефону +7(499)390-19-85.

Доска бесплатных объявлений «Tapnu.ru»

Информация на нашем сайте постоянно обновляется посетителями ежедневно из самых

различных регионов России и других Стран.

«Tapnu.ru» очень понятный сервис для любого пользователя, любого возраста.

Удобный сайт для подачи бесплатных и платных объявлений.

Покупатели и продавцы связываются друг с другом напрямую, без посредников,

что в конечном итоге позволяет сэкономить и деньги, и драгоценное время.

Премиум размещение стоит совсем недорого.

Сайт бесплатных объявлений «Tapnu.ru»

https://flashparade.ru/wp-includes/jks/novogodnie_filmu_onlayn_smotret_besplatno_v_horoshem_kachestve.html кино полосатый рейс смотреть бесплатно в хорошем качестве

http://www.newlcn.com/pages/news/filmu_141.html не знаю что посмотреть из фильмов посоветуйте

http://vip-barnaul.ru/includes/pages/onlayn_filmu___komfort_i_dostupnost_v_mire_kinematografa.html как спалось на английском перевод

http://neoko.ru/images/pages/filmu_onlayn__komfortnuy_sposob_naslazghdatsya_kino.html планета кенгуру иваново официальный сайт каталог

http://devec.ru/Joom/pgs/filmu_144.html песня из сериала гром в раю

http://alexey-savrasov.ru/records/articles/filmu_o_poiske_sokrovish_besplatno.html смотреть фильмы онлайн по рейтингу

http://kib-net.ru/news/pgs/filmu_pro_piratov__zahvatuvaushiy_mir_morskih_priklucheniy.html кино новинки которые вышли 2024

http://www.zoolife55.ru/pages/multfilmu_pro_loshadey__chem_oni_pokorili_zriteley_.html сайты где можно скачать фильмы и сериалы бесплатно и без регистрации

http://www.nonnagrishaeva.ru/press/pages/luchshie_filmu_na_temu_boevuh_iskusstv.html фильм на вечер интересный с захватывающим сюжетом

https://rossahar.ru/rynok/pgs/igru_na_dvoih__ogon_i_voda.html игры на двоих онлайн в браузере

https://veimmuseum.ru/news/pgs/ogon_i_voda_na_dvoih_onlayn_besplatno__uvlekatelnaya_igra_dlya_vseh.html играть вега микс три в ряд бесплатно онлайн в хорошем качестве бесплатно

http://svidetel.su/jsibox/article/index.php?ogon_i_voda_onlayn___uvlekatelnoe_prikluchenie_dlya_vseh.html стандофф 2 играть без скачивания на телефон

http://tankfront.ru/axis/pages/?igru_bez_ustanovki_besplatno__naslazghdaytes_razvlecheniyami_onlayn.html играть в игры шутеры от первого лица онлайн бесплатно без регистрации

https://www.colonoscopy.ru/PHPMailer/?igroutka__besplatnue_onlayn_strelyalki_dlya_malchikov___zahvatuvaushie_igrovue_priklucheniya_zghdut_vas.html игра где нужно выживать на острове

https://mytaganrog.com/media/madzghong_igrat_besplatno__zahvatuvaushee_prikluchenie_v_mir_drevney_igru.html играть игры онлайн бесплатно и без регистрации мини игры русский бильярд

https://ma.by/docs/pages/?igru_na_73.html gfer1 пасьянс играть бесплатно 4 масти

https://cofe.ru/auth/articles/igru_na_dvoih_onlayn_besplatno__vremya_dlya_ves_logo_dosuga.html игры по сети на пиратке скачать

https://www.amnis.ru/ajax/articles/?igru_risovat_onlayn__tvorchestvo_na_konchikah_palcev.html игры на двоих на пк бесплатные в стиме

https://tj-service.ru/news/?igru_onlayn_besplatno__gde_poigrat_.html игры по сети на пк бесплатные

https://sorvachev.com/code/pages/igru_io__zahvatuvaushie_srazgheniya_za_vuzghivanie.html обучающие программы для детей на компьютере

https://offroadmaster.com/rotator/articles/?igru_na_dvoih_onlayn___veselo__uvlekatelno_i_udobno.html викторина онлайн бесплатно без регистрации вопросы и ответы

https://billionnews.ru/templates/artcls/index.php?igru_na_74.html щенок раскраска для детей 3 4 лет

http://khomus.ru/lib/pages/igru_dlya_malchikov_onlayn_besplatno_bez_registracii.html сиреноголовый мультик для детей смотреть онлайн

https://trial-tour.ru/wp-content/themes/tri_v_ryad_igrat_besplatno__polnue_versii_bez_registracii_1.html игра собери три в ряд играть онлайн бесплатно

http://spbsseu.ru/page/pages/mir_onlayn_igr_dlya_malchikov__razvlechenie_i_razvitie.html симулятор открытия кейсов в cs go yandex

http://peling.ru/wp-content/pages/mir_priklucheniy__ogon_i_voda___igra_s_ogonkom.html тест какая ты ведьма с магией

https://www.snabco.ru/fw/inc/geometry_dash__pogruzghenie_v_mir_geometricheskih_priklucheniy.html скачать игру тачки быстрые как молния

https://blotos.ru/news/tri_v_ryad__igrayte_onlayn_besplatno_i_bez_registracii.html игры бесплатно без регистрации без скачивания играть онлайн