Understanding New Jersey’s insurance code system is crucial for both insurers and consumers. This intricate framework governs everything from policy coverage and premiums to regulatory compliance and consumer rights. This guide will unravel the complexities of these codes, providing a clear and accessible pathway to navigate this often-confusing landscape.

From the hierarchical structure and key components of the codes to practical guidance on locating and interpreting them, we aim to empower you with the knowledge needed to confidently engage with New Jersey’s insurance regulations. We’ll explore the impact of these codes on both insurers, who must adhere to strict compliance standards, and consumers, who benefit from crucial protections and clear understanding of their policies.

Understanding New Jersey Insurance Codes

New Jersey’s insurance code is a complex system designed to regulate the insurance industry within the state. Understanding its structure and organization is crucial for navigating insurance regulations, ensuring compliance, and effectively utilizing insurance-related resources. This section will detail the hierarchical structure, categories, and examples within the New Jersey insurance code system.

Hierarchical Structure of New Jersey Insurance Codes

The New Jersey insurance code isn’t structured as a simple, linear list. Instead, it employs a hierarchical system, organizing regulations into broader categories and then further subdividing them into more specific subcategories. This layered approach allows for a granular level of control and specificity in addressing various aspects of insurance practices. The top-level categories often relate to broad insurance types (like property and casualty, life insurance, or health insurance), while subsequent levels address specific aspects within those types (such as coverage limits, claims procedures, or agent licensing). This structure allows for efficient searching and retrieval of relevant information.

Categories and Subcategories within the New Jersey Insurance Code

The New Jersey insurance code encompasses numerous categories and subcategories. Broad categories typically include Property and Casualty Insurance, Life and Health Insurance, and other specialized areas like Workers’ Compensation or Unfair Claims Settlement Practices. Within each of these broad categories, further subcategories address specific aspects. For example, within Property and Casualty Insurance, you might find subcategories dealing with automobile insurance, homeowner’s insurance, commercial insurance, or professional liability insurance. Each subcategory contains detailed regulations regarding policy requirements, claim procedures, and other relevant details.

Examples of New Jersey Insurance Codes and Corresponding Insurance Types

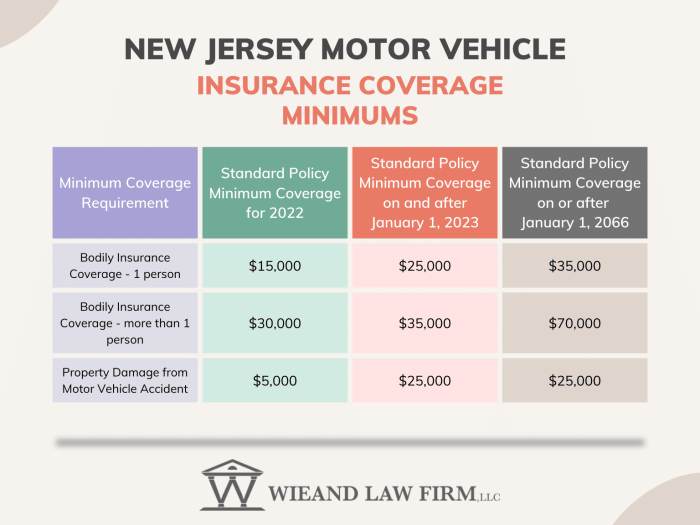

Several specific codes exist within the New Jersey insurance code, each corresponding to a particular insurance type or regulatory aspect. For instance, codes related to automobile insurance will dictate minimum coverage requirements, while codes related to health insurance will address mandated benefits and enrollment processes. The specific codes themselves are often referenced within official documents and regulatory filings. Precise code numbers can vary over time due to updates and revisions to the code.

Examples of New Jersey Insurance Codes, Descriptions, and Related Legislation

| Code Type | Description | Related Legislation (Illustrative Examples) |

|---|---|---|

| Auto Insurance (Example) | Minimum liability coverage requirements for passenger vehicles. | N.J.S.A. 39:6A-3, N.J.S.A. 17:28-1.1 |

| Homeowner’s Insurance (Example) | Regulations concerning dwelling coverage, personal property coverage, and liability coverage for homeowners. | N.J.S.A. 17:22-1 et seq. |

| Health Insurance (Example) | Mandated benefits and enrollment processes under the New Jersey Health Insurance Market. | N.J.S.A. 17B:27-1 et seq. (Referencing relevant sections pertaining to specific mandates) |

| Workers’ Compensation (Example) | Regulations governing employer responsibilities and employee benefits in case of work-related injuries. | N.J.S.A. 34:15-1 et seq. |

*Note: These are illustrative examples and do not represent a complete list. Always consult the official New Jersey Insurance Department website and relevant statutes for the most current and accurate information.*

Key Components of New Jersey Insurance Codes

Understanding New Jersey insurance codes requires familiarity with their core components. These components, when correctly interpreted, define the scope of coverage, determine policyholder rights, and ensure regulatory compliance. Their interaction shapes the overall meaning and application of insurance policies within the state.

The following sections detail the essential elements of New Jersey insurance codes and their significance in defining insurance coverage, impacting policy interpretation, and ensuring regulatory compliance.

Definitions and Key Terms

New Jersey insurance codes utilize precise definitions for key terms. These definitions are crucial for interpreting policy language and resolving disputes. For example, the definition of “insured” might specify whether family members are included under a policy, while the definition of “accident” might delineate events covered under an auto policy. Inconsistencies or ambiguities in these definitions can lead to legal challenges and varying interpretations of policy coverage. Understanding these precise definitions is paramount for both insurers and policyholders.

Coverage Provisions

This section Artikels the specific types of coverage offered under a particular insurance policy. It clearly details what events, losses, or damages are covered and the extent of that coverage. For instance, in a homeowner’s insurance policy, this section would detail coverage for fire damage, theft, liability, and other specified perils. The specificity of these provisions is vital in determining whether a particular claim falls within the policy’s scope. Ambiguities in coverage provisions often lead to disputes and litigation.

Exclusions and Limitations

Insurance policies contain clauses that explicitly exclude certain events, losses, or circumstances from coverage. These exclusions are carefully worded to define what is *not* covered by the policy. Similarly, limitations on coverage specify conditions that might restrict the amount or type of compensation payable. For example, a flood exclusion would prevent coverage for damages caused by flooding, regardless of other policy provisions. Understanding these exclusions and limitations is crucial for both insurers and policyholders to avoid misunderstandings and disputes.

Policy Conditions and Obligations

This component Artikels the responsibilities and obligations of both the insurer and the insured. It may detail requirements for reporting claims, cooperating with investigations, or maintaining certain conditions to keep the policy in force. For example, a condition might require the insured to promptly notify the insurer of any accidents or incidents. Failure to comply with these conditions could jeopardize coverage or lead to policy cancellation. These provisions maintain fairness and transparency within the insurance contract.

Dispute Resolution Procedures

New Jersey insurance codes often include provisions detailing how disputes between insurers and policyholders are to be resolved. These may Artikel procedures for mediation, arbitration, or litigation. Understanding these procedures is crucial for navigating disputes efficiently and effectively. Knowing the available dispute resolution mechanisms allows for a more informed approach to resolving coverage disagreements.

Penalties for Non-Compliance

The codes also stipulate penalties for non-compliance with regulations. These penalties may include fines, license suspension, or other legal actions against insurers who fail to meet regulatory requirements. These penalties serve to ensure insurers adhere to the standards set by the state, thereby protecting policyholders and maintaining the stability of the insurance market. The severity of these penalties emphasizes the importance of regulatory compliance.

Locating and Interpreting New Jersey Insurance Codes

Navigating New Jersey’s insurance regulations requires understanding where to find and how to interpret the relevant codes. This section provides a practical guide to accessing and utilizing this crucial information. The official sources are vital for ensuring accuracy and compliance.

Official Resources for New Jersey Insurance Codes

The primary source for New Jersey insurance codes is the New Jersey Department of Banking and Insurance (DOBI). Their website serves as a central repository for all relevant statutes, regulations, and bulletins. The DOBI website is regularly updated to reflect changes in legislation and regulatory interpretations. Additionally, access to the New Jersey Legislature’s website provides access to the official statutes, allowing for verification of the most up-to-date legal language. Using these official resources ensures that you are working with the most current and accurate information.

Locating Specific Insurance Codes

Finding a specific code requires a systematic approach. Begin by identifying the type of insurance (e.g., auto, home, health) and the specific aspect of coverage you need to research (e.g., liability limits, exclusions). Then, use the DOBI website’s search function, entering s related to your search. For example, searching for “auto insurance liability limits” will likely yield relevant regulations. If the search is unfruitful, try refining your search terms, using more specific s. The New Jersey Legislature website offers a similar search functionality using the same strategy.

Interpreting New Jersey Insurance Codes

New Jersey insurance codes are written in legal language, which can be dense and challenging to decipher. However, understanding the structure and common terminology is crucial. Codes often include sections detailing definitions of key terms, followed by specific rules and requirements. Pay close attention to the definitions section to understand the meaning of terms used throughout the code. Always read the entire relevant section, as a single phrase or sentence may significantly alter the interpretation. When in doubt, consult with a legal professional specializing in insurance law for clarification.

Determining Coverage Limits and Exclusions Using Insurance Codes

Once you’ve located the relevant code, carefully review the sections addressing coverage limits and exclusions. Coverage limits define the maximum amount the insurer will pay for a covered claim. Exclusions specify circumstances or situations where coverage does not apply. For example, a section might state that “liability coverage for auto insurance does not extend to injuries sustained while operating a vehicle under the influence of alcohol.” This exclusion clearly defines a situation where coverage would be denied, regardless of other factors. Another example might define liability limits as “$50,000 per person, $100,000 per accident.” This clarifies the maximum payment amounts for different scenarios. Understanding these limits and exclusions is essential for both insurers and policyholders to accurately assess risk and coverage.

New Jersey Insurance Codes and Regulatory Compliance

New Jersey’s insurance codes serve as a crucial framework for maintaining stability and fairness within the state’s insurance market. These codes establish minimum standards for insurers, protecting consumers and ensuring the solvency of insurance companies. Understanding these codes and adhering to them is paramount for all entities operating within the New Jersey insurance landscape.

The New Jersey Department of Banking and Insurance (DOBI) is responsible for enforcing these codes. The DOBI’s role includes licensing insurers, reviewing their financial stability, investigating consumer complaints, and taking action against non-compliant entities. The codes themselves cover a wide range of aspects, from policy language and underwriting practices to claims handling and consumer protection.

Consequences of Non-Compliance

Failure to comply with New Jersey insurance codes can result in a range of serious consequences for insurers. These consequences can include significant financial penalties, license suspension or revocation, legal action from aggrieved consumers, and reputational damage that can severely impact an insurer’s business. The severity of the penalty is often dependent on the nature and extent of the violation, as well as the insurer’s history of compliance. For instance, a minor, unintentional oversight might result in a warning or a small fine, while repeated or egregious violations could lead to much more severe repercussions.

Regulatory Frameworks for Different Insurance Types

New Jersey’s regulatory framework varies slightly depending on the type of insurance involved. For example, regulations for auto insurance are more stringent due to the high volume of claims and the potential for significant financial impact. The regulations governing health insurance are particularly complex, reflecting the intricate nature of healthcare financing and the significant protections afforded to consumers under the Affordable Care Act (ACA). Life insurance regulations focus heavily on consumer protection, ensuring transparency in policy terms and adequate financial reserves. While the overarching goal of maintaining consumer protection and market stability remains consistent across all insurance types, the specific regulations are tailored to the unique risks and characteristics of each sector.

Common Regulatory Violations and Penalties

The following is a list of common regulatory violations related to New Jersey insurance codes and their associated penalties. These penalties can range from administrative fines to criminal charges, depending on the severity and intent of the violation.

- Unfair claims practices: Delaying or denying legitimate claims, failing to investigate claims thoroughly, or engaging in other unfair practices can result in substantial fines and potential legal action. Penalties can include significant fines, mandated restitution to consumers, and even license suspension or revocation.

- Misrepresentation or fraud: Making false or misleading statements in insurance applications or advertisements can lead to severe penalties, including fines, imprisonment, and the permanent revocation of an insurer’s license. This could involve misrepresenting policy terms or making false claims about the financial stability of the insurer.

- Failure to maintain adequate reserves: Insurers are required to maintain sufficient financial reserves to meet their obligations. Failure to do so can result in regulatory intervention, including orders to increase reserves, and potentially even insolvency proceedings.

- Violation of consumer protection laws: New Jersey has strong consumer protection laws in the insurance industry. Violations of these laws, such as failing to provide timely responses to consumer inquiries or engaging in discriminatory practices, can result in significant fines and other penalties.

- Improper use of confidential information: Insurers handle sensitive consumer information, and the improper use or disclosure of this information is a serious violation that can result in substantial fines and legal action. This includes situations where an insurer might inappropriately share customer data with third parties or fail to adequately secure this data against unauthorized access.

Impact of New Jersey Insurance Codes on Consumers

New Jersey’s insurance codes significantly impact consumers by establishing a framework for fair practices, consumer protection, and market regulation. These codes influence the types of insurance available, the costs associated with coverage, and the avenues for redress in case of disputes. Understanding these impacts is crucial for making informed decisions about insurance coverage.

New Jersey insurance codes affect consumer rights and protections in several key ways. They mandate specific disclosures from insurers, ensuring transparency in policy terms and conditions. Consumers are afforded the right to challenge insurance company decisions and have access to the Department of Banking and Insurance (DOI) for dispute resolution. The codes also prohibit unfair or deceptive practices by insurers, protecting consumers from manipulative sales tactics or unreasonable denials of claims. For example, the codes dictate specific timelines for claim processing and response to consumer inquiries, preventing undue delays.

Consumer Access to Insurance and Premium Costs

The impact of New Jersey insurance codes extends to the availability and affordability of insurance. The codes aim to ensure fair competition among insurers, which ideally leads to a wider range of coverage options and more competitive premiums. However, factors like risk assessment and market conditions also play a significant role in premium pricing. The codes attempt to balance consumer protection with the financial viability of insurance companies. Regulations regarding underwriting practices, for example, prevent discriminatory pricing based on factors unrelated to risk. State-mandated minimum coverage levels, while potentially increasing premiums slightly, guarantee a baseline level of protection for consumers.

Resources for Understanding and Utilizing New Jersey Insurance Codes

Consumers have several resources available to understand and utilize New Jersey insurance codes effectively. The Department of Banking and Insurance (DOI) website provides a wealth of information, including summaries of key regulations, frequently asked questions, and consumer guides. The DOI also offers assistance in resolving insurance-related complaints and disputes. Independent consumer advocacy groups may offer additional support and educational resources, providing unbiased information and guidance. Finally, consulting with an insurance professional can help consumers navigate the complexities of insurance codes and choose the most suitable coverage for their needs.

Infographic: Key Consumer Benefits of New Jersey Insurance Codes

The infographic would be visually appealing and easy to understand, using a combination of icons, short text, and a clear layout.

Visual Elements: The infographic would feature a central image, perhaps a shield representing consumer protection, surrounded by four distinct sections, each with a relevant icon and concise explanation.

Section 1: Icon: A magnifying glass. Text: “Transparency & Disclosure”. Brief explanation: Insurers must clearly explain policy terms and conditions.

Section 2: Icon: A scale of justice. Text: “Fair Claims Handling”. Brief explanation: Codes ensure timely and fair processing of claims.

Section 3: Icon: A handshake. Text: “Consumer Protections”. Brief explanation: Protects against unfair or deceptive insurance practices.

Section 4: Icon: A phone with a speech bubble. Text: “Dispute Resolution”. Brief explanation: Provides avenues to resolve complaints and disputes with insurers.

The overall design would utilize a clean, modern aesthetic with a color scheme that conveys trust and reliability, such as blues and greens. The font would be easy to read and the text concise, making the infographic readily accessible and understandable to a broad audience.

End of Discussion

Mastering New Jersey’s insurance codes is essential for ensuring compliance, protecting consumer rights, and fostering a transparent insurance market. By understanding the structure, components, and practical applications of these codes, both insurers and consumers can navigate the system effectively. This guide serves as a valuable resource for anyone seeking to confidently engage with this vital aspect of New Jersey’s regulatory environment. Remember to always consult official sources for the most up-to-date information.

Answers to Common Questions

What happens if an insurer violates New Jersey insurance codes?

Penalties for non-compliance can range from fines and license suspension to legal action, depending on the severity of the violation.

Where can I find a complete list of all New Jersey insurance codes?

The New Jersey Department of Banking and Insurance website is the primary source for official insurance codes and regulations.

Are there specific codes for different types of insurance (e.g., auto, health)?

Yes, New Jersey’s insurance code system is categorized by insurance type, with specific codes and regulations applying to each.

How often are New Jersey insurance codes updated?

Codes are updated periodically to reflect changes in legislation and industry practices. Regularly checking the official sources is recommended.

Can I get help understanding a specific New Jersey insurance code?

The New Jersey Department of Banking and Insurance offers resources and may provide assistance in interpreting complex codes.