Permanent life insurance policies offer a unique blend of financial security and long-term growth, setting them apart from their term-based counterparts. Understanding the nuances of these policies—from the various types available to the tax implications and potential risks—is crucial for making informed financial decisions. This guide delves into the intricacies of permanent life insurance, providing a clear and concise overview for those seeking a deeper understanding.

We’ll explore the core characteristics of permanent life insurance, examining the differences between whole life, universal life, and variable life policies. We’ll also analyze the factors affecting policy costs, the potential for cash value accumulation and its uses, and the various riders and add-ons available to customize your coverage. Finally, we’ll address the tax implications and potential risks, equipping you with the knowledge to choose a policy that aligns with your specific financial goals and risk tolerance.

Policy Costs and Benefits

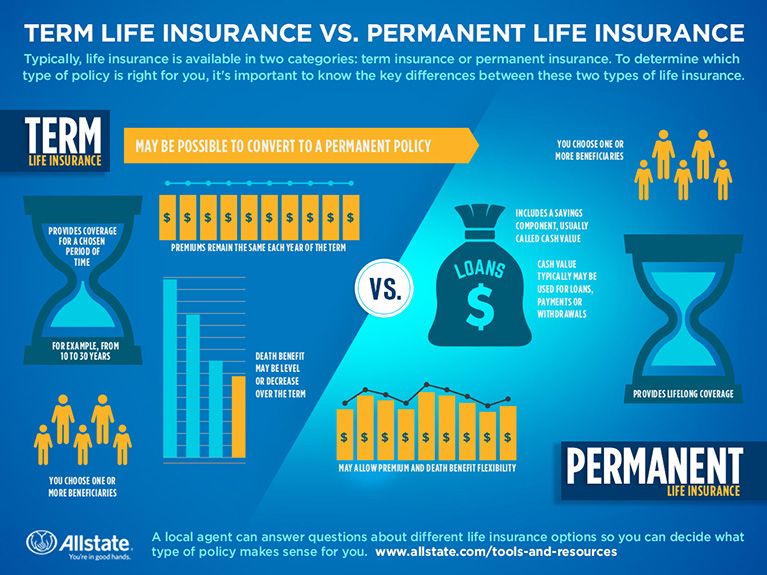

Permanent life insurance offers lifelong coverage, but understanding its cost and the potential benefits is crucial. The initial premium is higher than term life insurance, reflecting the ongoing coverage and cash value accumulation. However, this investment can offer significant financial advantages over time.

Factors Influencing Policy Costs

Several factors determine the cost of a permanent life insurance policy. Age is a primary driver; younger individuals generally receive lower premiums due to a lower risk of death. Health status plays a significant role; applicants with pre-existing conditions or unhealthy lifestyles may face higher premiums or even policy denial. The type of permanent life insurance (whole life, universal life, variable life) also affects cost, with whole life policies typically having more predictable premiums but potentially higher overall costs. The death benefit amount selected directly impacts premiums; a larger death benefit necessitates higher premiums. Finally, the policy’s features, such as riders (additional benefits), can influence the overall cost. For instance, adding a long-term care rider will increase the premium.

Cash Value Accumulation

Permanent life insurance policies build cash value over time. This cash value grows tax-deferred, meaning you don’t pay taxes on the growth until you withdraw it. The growth rate is influenced by several factors, including the policy’s type, the insurer’s investment performance (for variable life policies), and the premium payments made. A portion of each premium payment goes towards the death benefit, while the rest contributes to the cash value. This cash value acts as a savings vehicle, accumulating over the policy’s life.

Accessing and Utilizing Cash Value

Policyholders can access their cash value in several ways. They can borrow against it, receiving a loan secured by the policy’s cash value. Interest is typically charged on these loans, but it is usually lower than other loan options. Another option is to surrender the policy, receiving the accumulated cash value. However, this will terminate the death benefit coverage. Policyholders can also withdraw a portion of the cash value, but this can impact the death benefit and reduce the future growth of the cash value. In some cases, the policy may allow for systematic withdrawals, providing a regular income stream.

Potential Cash Value Growth

The following table illustrates potential cash value growth under different scenarios, assuming a $100,000 death benefit and various annual premium payments. These are illustrative examples and actual results will vary based on policy type, insurer performance, and other factors. It’s crucial to consult with a financial advisor for personalized projections.

| Scenario | Annual Premium | Year 10 Cash Value (Estimate) | Year 20 Cash Value (Estimate) |

|---|---|---|---|

| Conservative Growth | $2,000 | $15,000 | $40,000 |

| Moderate Growth | $3,500 | $28,000 | $85,000 |

| Aggressive Growth | $5,000 | $45,000 | $150,000 |

Choosing the Right Permanent Life Insurance Policy

Selecting the right permanent life insurance policy is a crucial financial decision, impacting your family’s financial security for years to come. It’s not a one-size-fits-all solution; the ideal policy depends heavily on your individual circumstances, financial goals, and risk tolerance. Understanding the key factors involved ensures you make an informed choice that aligns with your needs.

Factors to Consider When Selecting a Permanent Life Insurance Policy

Several key factors influence the selection of an appropriate permanent life insurance policy. These factors should be carefully weighed against your individual circumstances and long-term financial objectives. Failing to consider these elements can lead to an unsuitable policy that doesn’t adequately meet your needs.

- Death Benefit Amount: Determine the appropriate death benefit to cover your family’s needs in the event of your passing. This should account for outstanding debts, funeral expenses, and ongoing living expenses for your dependents. Consider factors like mortgage payments, children’s education costs, and spousal support.

- Policy Type: Permanent life insurance encompasses several types, including whole life, universal life, and variable universal life. Each has unique features regarding cash value accumulation, premium flexibility, and investment options. Understanding these differences is essential to choosing a policy that aligns with your financial goals and risk tolerance.

- Premium Payments: Evaluate your budget and ability to consistently make premium payments. Permanent life insurance premiums are typically higher than term life insurance, so ensuring affordability is paramount. Consider whether you prefer level premiums (consistent throughout the policy’s life) or flexible premiums (allowing adjustments based on your financial situation).

- Cash Value Accumulation: Permanent policies build cash value over time, which can be accessed through loans or withdrawals. Consider the rate of cash value growth and the potential tax implications associated with accessing these funds. This is particularly important if you plan to use the cash value for future financial needs, such as retirement.

- Insurance Company Reputation and Financial Strength: Choose a reputable insurance company with a strong financial rating. This ensures the insurer can fulfill its obligations and pay out death benefits when needed. Researching the insurer’s history and financial stability is crucial to mitigating risk.

Assessing Individual Needs and Financial Goals

A thorough assessment of your individual needs and financial goals is fundamental to selecting the right permanent life insurance policy. This involves considering your current financial situation, future aspirations, and the potential impact of unforeseen events on your family’s financial well-being. Ignoring this step can lead to a policy mismatch, leaving you inadequately protected.

For example, a young family with a mortgage and young children will have vastly different insurance needs than a retired couple with no dependents. The younger family might require a higher death benefit to cover long-term financial obligations, while the retired couple may prioritize a policy with a smaller death benefit and focus on leveraging the cash value component for supplemental income.

Step-by-Step Guide for Selecting a Suitable Policy

Selecting a suitable permanent life insurance policy involves a structured approach to ensure you make an informed decision. This systematic process minimizes the risk of choosing an inappropriate policy and maximizes the likelihood of securing adequate coverage.

- Determine your needs: Assess your family’s financial obligations and future goals. Calculate the death benefit required to cover these needs.

- Research policy types: Understand the differences between whole life, universal life, and variable universal life insurance policies.

- Obtain quotes: Contact multiple insurers to obtain quotes for different policy types.

- Compare quotes: Carefully compare the premiums, death benefits, cash value growth rates, and other policy features.

- Review policy details: Thoroughly review the policy documents before making a final decision.

- Seek professional advice: Consult with a financial advisor to ensure the chosen policy aligns with your overall financial plan.

Comparing Policy Quotes from Different Insurers

Comparing policy quotes from different insurers is crucial to finding the most suitable and cost-effective permanent life insurance policy. This involves a systematic comparison of various policy features and not solely focusing on the premium amount. Failing to adequately compare quotes could result in overpaying for inadequate coverage.

When comparing quotes, consider factors such as the death benefit, premium amounts, cash value growth potential, policy fees, and the insurer’s financial strength rating. Use a standardized comparison sheet to organize the information and facilitate a clear understanding of the differences between policies. Remember that the lowest premium doesn’t always equate to the best value. A slightly higher premium might offer significantly better coverage or cash value growth potential in the long run.

Risks and Considerations

Permanent life insurance, while offering lifelong coverage and cash value accumulation, presents certain risks and considerations that potential policyholders should carefully evaluate before purchasing a policy. Understanding these potential drawbacks is crucial for making an informed decision that aligns with your financial goals and risk tolerance.

Policy Terms and Conditions

Thorough comprehension of your policy’s terms and conditions is paramount. These documents detail the specifics of your coverage, including death benefits, cash value accumulation, fees, and limitations. Overlooking crucial clauses can lead to unexpected costs or reduced benefits. For example, a clause might restrict the ability to access cash value in certain situations, or impose penalties for missed premium payments. It is advisable to carefully review the policy documents with a financial advisor or seek clarification on any unclear aspects before signing the contract.

Impact of Fluctuating Interest Rates on Cash Value Growth

The cash value component of permanent life insurance policies often grows based on the interest rate credited by the insurance company. These rates can fluctuate significantly, impacting the overall growth of your cash value. Periods of low interest rates can result in slower cash value growth, while higher rates can accelerate it. For instance, if the credited interest rate drops from 4% to 2%, the annual growth of your cash value will be noticeably reduced. Therefore, understanding the potential impact of interest rate fluctuations is important for realistic expectations regarding cash value accumulation. It’s also important to note that many policies have minimum guaranteed interest rates, providing a floor to protect against extremely low market rates.

Surrender Charges for Early Policy Termination

Early termination of a permanent life insurance policy usually incurs surrender charges. These fees are designed to compensate the insurance company for administrative costs and potential losses associated with the premature termination of the contract. Surrender charges are typically highest in the early years of the policy and gradually decrease over time. For example, a policy might impose a 10% surrender charge in the first year, decreasing by 1% annually until it reaches zero after ten years. This means that withdrawing your cash value early can significantly reduce the amount you receive. Careful consideration of the surrender charge schedule is vital before making any decisions regarding early policy termination.

Last Point

Choosing the right permanent life insurance policy is a significant financial decision requiring careful consideration of your individual needs and long-term objectives. By understanding the diverse policy types, their associated costs and benefits, and the potential tax implications, you can navigate the complexities of permanent life insurance with confidence. Remember to consult with a qualified financial advisor to tailor a policy that optimally protects your family’s future and aligns with your financial aspirations.

FAQ Guide

What is the difference between guaranteed and non-guaranteed cash value?

Guaranteed cash value refers to a minimum amount promised by the insurer to grow in your policy, while non-guaranteed cash value fluctuates based on market performance and investment choices within the policy.

Can I borrow against my permanent life insurance policy’s cash value?

Yes, most permanent life insurance policies allow you to borrow against the accumulated cash value. However, interest will accrue on the loan, and failure to repay could impact your policy’s benefits.

What happens if I stop paying premiums on my permanent life insurance policy?

If premiums are not paid, the policy may lapse, resulting in the loss of coverage and potential forfeiture of the cash value, depending on the policy type and terms.

How does the death benefit work in a permanent life insurance policy?

The death benefit is a fixed sum paid to your beneficiaries upon your death. This amount remains consistent throughout the policy’s duration, unlike term life insurance, which expires after a set period.

What are surrender charges?

Surrender charges are fees imposed if you cancel your policy before a specified period. These fees are designed to compensate the insurer for the administrative costs and potential losses associated with early termination.