Securing your pet’s health is paramount, and understanding the landscape of nationwide pet insurance is crucial for responsible pet ownership. This guide delves into the intricacies of various plans, helping you navigate the complexities of coverage, costs, and claims processes to make an informed decision that best suits your furry friend’s needs and your budget.

From comparing providers and coverage options to understanding the claims process and choosing the right plan, we aim to provide a clear and concise overview of nationwide pet insurance. We’ll explore factors influencing premiums, analyze cost-effectiveness, and illustrate real-world scenarios to highlight the benefits and potential drawbacks of comprehensive coverage.

Nationwide Pet Insurance Coverage

Choosing the right pet insurance can feel overwhelming, given the variety of providers and coverage options available. Understanding the differences between plans is crucial for securing adequate protection for your beloved companion. This section will compare major nationwide providers, outlining their coverage levels, pricing structures, and common exclusions. We’ll also clarify waiting periods and the various types of coverage available.

Comparison of Nationwide Pet Insurance Providers

The pet insurance market offers a range of plans, each with its own strengths and weaknesses. Direct comparison is key to finding the best fit for your pet and your budget. Note that specific details, including pricing, can change, so always check the provider’s website for the most up-to-date information.

| Provider | Coverage Levels | Pricing Structure | Exclusions |

|---|---|---|---|

| Provider A (Example: Trupanion) | Accident-only, Accident & Illness | Monthly premiums based on breed, age, and location; deductible options available. | Pre-existing conditions, routine care (e.g., vaccinations), breeding, and some hereditary conditions. |

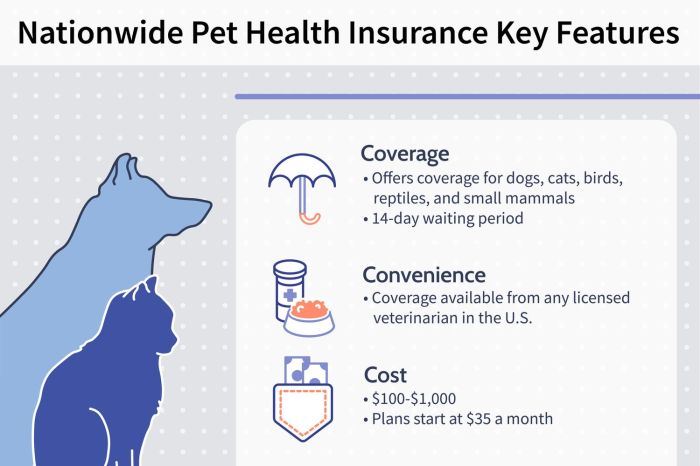

| Provider B (Example: Nationwide) | Accident-only, Accident & Illness, Wellness | Monthly premiums based on breed, age, and location; various deductible and reimbursement options. | Pre-existing conditions, experimental treatments, and some breed-specific conditions. |

| Provider C (Example: Healthy Paws) | Accident & Illness | Monthly premiums based on breed, age, and location; deductible options available. | Pre-existing conditions, routine care, and some hereditary conditions. |

Waiting Periods for Coverage

Waiting periods are a standard feature of pet insurance policies. These periods dictate the time you must wait after policy activation before certain types of coverage become effective. Understanding these timelines is vital to ensure you’re not left unexpectedly responsible for costs during a crucial period.

- Accident Coverage: Typically, a short waiting period, often 24 hours, applies before accident coverage begins.

- Illness Coverage: Waiting periods for illness coverage are generally longer, ranging from 14 to 30 days. This allows the insurer to assess the pet’s health history and avoid covering pre-existing conditions.

- Wellness Coverage (if applicable): Some policies offer wellness coverage, which may have its own separate waiting period, often similar to illness coverage.

Types of Pet Insurance Coverage

Pet insurance policies are designed with varying levels of coverage to meet diverse needs and budgets. Understanding the differences between these plans is key to selecting the appropriate level of protection for your pet.

- Accident-Only: This covers veterinary expenses related to accidents, such as broken bones or injuries from falls. It does not cover illnesses.

- Accident and Illness: This comprehensive coverage encompasses both accidents and illnesses, offering broader protection against unexpected veterinary costs.

- Wellness Plans (Optional Add-on): Many providers offer optional wellness add-ons, covering routine care like vaccinations, dental cleanings, and preventative medications. These are usually separate from accident and illness coverage.

Pricing and Cost Factors

Understanding the cost of pet insurance is crucial for responsible pet ownership. Several factors contribute to the final premium, and it’s important to consider these when choosing a plan. Premiums aren’t static; they can change over time, impacting your budget. Comparing the cost of insurance against the potential expense of unexpected veterinary bills helps determine the financial viability of coverage.

Factors Influencing Pet Insurance Premiums

Numerous factors influence the cost of your pet’s insurance premium. These factors are carefully assessed by insurance providers to determine the level of risk associated with insuring your pet. A higher-risk pet will generally result in a higher premium.

| Factor | Impact on Cost | Example |

|---|---|---|

| Breed | Certain breeds are predisposed to specific health issues, leading to higher premiums. | A pedigree German Shepherd might cost more to insure than a mixed-breed dog due to a higher risk of hip dysplasia. |

| Age | Younger pets generally have lower premiums than older pets, as the risk of illness and injury increases with age. | A kitten will typically have a lower premium than a senior cat. |

| Location | The cost of veterinary care varies geographically. Areas with higher veterinary costs may result in higher premiums. | Premiums in a major city with high veterinary costs might be higher than in a rural area. |

| Pre-existing Conditions | Conditions present before the policy’s start date are usually not covered, but their presence can influence future premium increases. | A dog with a pre-existing knee injury might not be covered for that specific condition, and the insurer may adjust the premium based on the potential for related issues. |

| Coverage Level | Higher coverage limits and more comprehensive plans typically result in higher premiums. | A plan with a high annual limit and coverage for alternative therapies will cost more than a basic accident-only plan. |

Premium Increases Over Time

Pet insurance premiums can increase over time, much like other types of insurance. This is often due to factors like inflation, changes in veterinary care costs, and claims experience. Annual increases are common, but the percentage varies depending on the insurer and the specific policy. For example, a policy might see a 5-10% increase annually. Insurers may also adjust premiums based on your pet’s age and claim history. A pet with multiple claims may see a larger increase than a pet with no claims.

Cost-Effectiveness of Pet Insurance vs. Out-of-Pocket Payment

Determining whether pet insurance is cost-effective requires careful consideration. Paying out-of-pocket for veterinary care can lead to significant expenses, especially for unexpected illnesses or injuries. Conversely, pet insurance offers protection against these high costs, but comes with monthly premiums.

Consider this hypothetical scenario: Imagine your dog requires emergency surgery costing $5,000. Without insurance, you would bear this entire cost. With insurance, you might pay a deductible (e.g., $250) and a co-pay (e.g., 20%), leaving you with a significantly smaller out-of-pocket expense. However, you would have paid monthly premiums throughout the year. The cost-effectiveness depends on the frequency and severity of veterinary care needed. A healthy pet might see premiums exceed the total veterinary costs over several years, while a pet with chronic health issues might find insurance to be financially advantageous.

Choosing the Right Plan

Selecting the right Nationwide pet insurance plan requires careful consideration of several key factors to ensure you receive adequate coverage at a price that fits your budget. Understanding the different plan options and their associated costs is crucial for making an informed decision that best protects your pet’s health and your financial well-being.

Navigating the world of pet insurance can feel overwhelming, but focusing on a few key aspects will simplify the process. By understanding your pet’s specific needs and comparing different plans, you can find the best fit for your furry friend.

Key Factors to Consider When Selecting a Plan

Several crucial factors influence the cost and comprehensiveness of your pet insurance plan. Carefully evaluating these elements is essential for choosing a policy that aligns with your pet’s health needs and your financial capabilities. Failing to do so could lead to inadequate coverage or unexpectedly high out-of-pocket expenses.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles mean higher premiums but lower out-of-pocket costs when you need to file a claim. For example, a $100 deductible means you’ll pay the first $100 of veterinary expenses before your insurance begins to reimburse you.

- Reimbursement Percentage: This is the percentage of eligible veterinary expenses your insurance will cover after you’ve met your deductible. Common reimbursement percentages range from 70% to 90%. A higher percentage means a greater portion of your expenses will be covered, but it typically comes with a higher premium.

- Annual Limit: This is the maximum amount your insurance will pay out in a policy year. While some plans offer unlimited coverage, many have annual limits. It’s crucial to choose a limit that’s appropriate for your pet’s breed, age, and health history. A healthy young dog might require a lower annual limit than an older dog with pre-existing conditions.

- Waiting Periods: Be aware of waiting periods before coverage begins for specific conditions, such as accidents or illnesses. These periods can vary depending on the insurer and the type of coverage.

Reimbursement Methods: Actual vs. Percentage

Understanding the different ways pet insurance companies reimburse veterinary expenses is vital for making an informed decision. Two common methods are reimbursement of actual expenses and reimbursement of a percentage of expenses. Choosing the right method depends on your risk tolerance and financial situation.

Reimbursement of Actual Expenses: This method reimburses you for the exact amount you paid for eligible veterinary services. This offers more predictability, but the premiums may be higher.

Reimbursement of a Percentage of Expenses: This method reimburses a specific percentage (e.g., 80%) of the eligible veterinary expenses, after the deductible is met. This can lead to lower premiums but might result in higher out-of-pocket costs.

The Importance of Reading the Fine Print

Before committing to a Nationwide pet insurance plan, meticulously review the policy documents. Understanding the terms and conditions, exclusions, and limitations is crucial to avoid unexpected costs or disputes later. Pay close attention to details such as pre-existing conditions, waiting periods, and specific exclusions. For example, some plans may exclude certain breeds or conditions from coverage. Contacting Nationwide directly to clarify any ambiguities is always recommended.

Benefits and Drawbacks of Nationwide Coverage

Choosing pet insurance involves careful consideration of various factors, and the scope of coverage is paramount. Nationwide pet insurance plans offer a distinct set of advantages and disadvantages compared to regional or state-specific options. Understanding these nuances is crucial for making an informed decision that best suits your pet’s needs and your budget.

Nationwide coverage offers unparalleled convenience and flexibility. This is particularly beneficial for pet owners who frequently travel with their animals or who might relocate. A seamless transition of coverage, without the need to search for a new provider in a new location, provides peace of mind. This eliminates the hassle of finding a new insurer, potentially navigating different coverage options and potentially facing gaps in coverage during the transition.

Advantages of Nationwide Pet Insurance

The primary benefit of nationwide coverage lies in its portability. This means your pet’s insurance remains valid regardless of your location within the country. This is a significant advantage for pet owners who travel extensively or relocate frequently. For instance, a family moving from New York to California would not experience any interruption in their pet’s coverage with a nationwide provider. Another key advantage is the consistent level of care and access to veterinary professionals across a wide network. Nationwide insurers typically have established relationships with veterinary clinics across the country, simplifying the process of seeking treatment for your pet. This consistent network ensures a smoother claims process, regardless of location.

Drawbacks of Nationwide Pet Insurance

While offering significant advantages, nationwide pet insurance policies may have some limitations. One potential drawback is the possibility of slightly higher premiums compared to regional plans. This is because nationwide insurers must account for the varying costs of veterinary care across different states and regions. For example, the cost of veterinary care in a major metropolitan area might be significantly higher than in a rural area, impacting the overall premium calculation. Another potential limitation could be the breadth of the network of participating veterinarians. While extensive, it might not encompass every veterinary clinic in every location, especially in remote areas. This could potentially mean needing to travel a further distance to access a provider within the insurer’s network.

Weighing Benefits and Drawbacks

To make an informed decision, pet owners should carefully assess their individual circumstances. Factors to consider include the frequency of travel, the likelihood of relocation, and the importance of consistent access to veterinary care across different locations. If you frequently travel with your pet or anticipate moving to different states, the convenience and portability of nationwide coverage outweigh the potential higher premiums. Conversely, if you reside in a specific region and rarely travel, a regional plan might offer comparable coverage at a potentially lower cost. A thorough comparison of plans, including coverage details, premium costs, and the network of participating veterinarians, is essential before making a final decision.

Illustrative Examples of Pet Insurance Scenarios

Understanding how pet insurance works in practice can be helpful when deciding whether or not to purchase a policy. The following scenarios illustrate potential costs associated with different pet health events and how Nationwide pet insurance might cover them. Remember that specific coverage will depend on the chosen plan and policy details.

Minor Injury: Paw Pad Laceration

This scenario details a common, relatively minor injury and the associated costs.

| Cost Item | Estimated Cost | Nationwide Coverage (Example) |

|---|---|---|

| Veterinary Examination | $75 | Covered (subject to deductible and co-insurance) |

| Wound Cleaning and Dressing | $50 | Covered (subject to deductible and co-insurance) |

| Pain Medication | $25 | Covered (subject to deductible and co-insurance) |

| Total Cost | $150 | Portion covered, depending on plan specifics. Out-of-pocket cost would likely be significantly reduced. |

Major Illness: Diagnosis and Treatment of Cancer

This scenario illustrates a significant illness and the substantial financial implications.

| Cost Item | Estimated Cost | Nationwide Coverage (Example) |

|---|---|---|

| Initial Diagnostic Tests (bloodwork, X-rays) | $500 | Covered (subject to deductible and co-insurance) |

| Biopsy and Pathology | $300 | Covered (subject to deductible and co-insurance) |

| Chemotherapy Treatments (multiple sessions) | $4000 | Covered (subject to deductible, co-insurance, and annual limits, if applicable) |

| Medication | $500 | Covered (subject to deductible and co-insurance) |

| Total Cost | $5300 | A substantial portion would likely be covered, significantly reducing out-of-pocket expenses, although the annual limit might influence the final reimbursement. |

Preventative Care: Annual Wellness Exam

This scenario shows the coverage for routine preventative care.

| Cost Item | Estimated Cost | Nationwide Coverage (Example) |

|---|---|---|

| Annual Physical Exam | $75 | May be partially or fully covered depending on the plan. Some plans offer wellness add-ons. |

| Vaccinations | $50 | May be partially or fully covered depending on the plan. Some plans offer wellness add-ons. |

| Fecal Exam | $35 | May be partially or fully covered depending on the plan. Some plans offer wellness add-ons. |

| Total Cost | $160 | Coverage varies greatly depending on the chosen plan and whether wellness care is included. |

Financial Impact Illustration

The illustration would consist of three bar graphs, one for each scenario. Each graph would have two bars: one representing the total cost without insurance and the other representing the out-of-pocket cost with insurance.

Minor Injury: The “without insurance” bar would be short, representing $150. The “with insurance” bar would be significantly shorter, reflecting the reduced out-of-pocket cost after the deductible and co-insurance are applied.

Major Illness: The “without insurance” bar would be very tall, representing $5300. The “with insurance” bar would still be substantial but significantly shorter, demonstrating the considerable financial protection offered by insurance. The difference in height between the two bars would highlight the significant cost savings.

Preventative Care: The “without insurance” bar would be of moderate height, representing $160. The “with insurance” bar’s height would depend on the specific plan; it could be significantly shorter if wellness care is covered, or similar in height if not. The visual would clearly show the potential cost savings from a plan with wellness coverage. The color scheme could use a bright, positive color for the “with insurance” bar and a more muted, less positive color for the “without insurance” bar to emphasize the benefit of insurance. A clear legend would identify each bar.

Final Thoughts

Choosing the right nationwide pet insurance plan requires careful consideration of your pet’s specific needs, your financial capabilities, and a thorough understanding of policy details. By weighing the benefits of nationwide coverage against potential limitations and understanding the claims process, you can confidently select a plan that provides peace of mind and financial protection for your beloved companion. Remember to always read the fine print and ask questions to ensure complete clarity before committing to a policy.

FAQ Explained

What is the average cost of nationwide pet insurance?

The cost varies greatly depending on factors like pet breed, age, location, pre-existing conditions, and chosen coverage level. Expect monthly premiums ranging from $20 to $100 or more.

Can I get pet insurance for a senior pet?

Yes, but premiums will generally be higher for older pets due to increased health risks. Some providers may have age limits or may exclude pre-existing conditions that developed before the policy started.

What is a waiting period in pet insurance?

A waiting period is a timeframe after policy activation before coverage begins for specific conditions (e.g., 14 days for accidents, longer for illnesses). This prevents people from buying insurance right before a known problem.

What documents do I need to file a claim?

Typically, you’ll need the original veterinary bill, a completed claim form, and possibly a treatment summary from your veterinarian.

Are there any exclusions in nationwide pet insurance policies?

Yes, common exclusions include pre-existing conditions, certain breeds prone to specific health issues, and elective procedures (unless specifically covered in your plan).