Progressive Insurance has carved a significant niche in the competitive insurance market, distinguishing itself through innovative technology, memorable marketing campaigns, and a customer-centric approach. This exploration delves into the multifaceted nature of Progressive, examining its brand identity, diverse product offerings, customer experiences, and strategic positioning within the industry landscape. We will analyze its marketing strategies, compare it to competitors, and assess its overall impact on the insurance sector.

From its quirky advertising featuring Flo to its technologically advanced Name Your Price® tool, Progressive consistently seeks to modernize the insurance experience. This analysis will uncover the key elements that contribute to Progressive’s success and explore areas for potential future growth and improvement.

Brand Identity and Messaging

Progressive Insurance has cultivated a distinct brand identity characterized by its playful yet informative approach to insurance marketing. This personality is largely built around memorable characters and relatable scenarios, creating a connection with consumers that transcends the often-dry nature of the insurance industry.

Progressive’s brand messaging focuses on simplifying the insurance process and empowering customers to make informed decisions. This contrasts sharply with more traditional insurance advertising that emphasizes fear and the potential consequences of not being insured. The company utilizes humor and straightforward communication to demystify insurance and make it more accessible.

Progressive’s Brand Personality and Marketing Conveyance

Progressive’s brand personality is best described as approachable, friendly, and helpful. This is conveyed through its long-running marketing campaigns featuring Flo, the bubbly and knowledgeable insurance agent, and Jamie, her perpetually exasperated counterpart. These characters embody the brand’s commitment to customer service and its goal of making insurance less daunting. The use of humor and relatable situations in their commercials further reinforces this approachable image, creating a sense of familiarity and trust with the audience. Their website and digital presence mirror this friendly tone, offering easy-to-navigate tools and resources.

Comparison of Progressive’s and Geico’s Brand Messaging

While both Progressive and Geico are known for their memorable advertising campaigns, their brand messaging differs significantly. Geico’s approach relies heavily on memorable jingles and quirky, often surreal humor. Their messaging emphasizes value and affordability, frequently highlighting their low rates. For example, their iconic gecko and cavemen commercials focus on the simple message of saving money. In contrast, Progressive’s messaging emphasizes customer service and control, using Flo to guide consumers through the insurance process and highlighting tools like the Name Your Price® Tool. This illustrates a fundamental difference: Geico focuses primarily on price, while Progressive prioritizes both price and customer experience.

Proposed Marketing Slogan for Progressive

“Progressive: Your Price, Your Choice, Your Peace of Mind.” This slogan emphasizes the customer’s agency and control, highlighting the Name Your Price® Tool and the overall sense of security that Progressive aims to provide.

Social Media Post Promoting Progressive’s Name Your Price® Tool

[Image Description: A vibrant, stylized graphic featuring Flo smiling next to a smartphone displaying the Name Your Price® tool interface. The background is a cheerful, pastel color palette.]

Caption: Tired of confusing insurance quotes? Take control with Progressive’s Name Your Price® Tool! Get a personalized quote that fits your budget in minutes. Click the link in our bio to get started! #NameYourPrice #ProgressiveInsurance #InsuranceMadeEasy #CarInsurance #SaveMoney

Progressive’s Products and Services

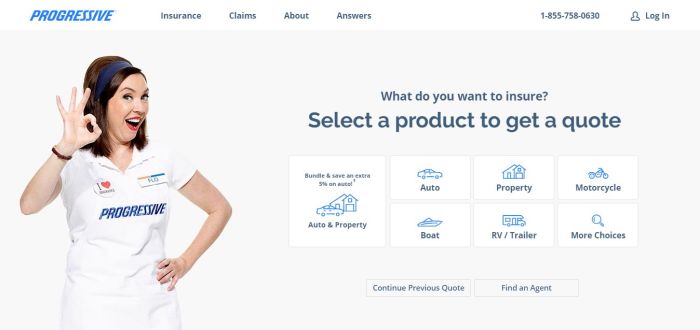

Progressive offers a comprehensive suite of insurance products designed to meet diverse customer needs, extending beyond its well-known auto insurance offerings. Their services are characterized by a strong emphasis on technological innovation and personalized customer experiences.

Progressive’s auto insurance policies are known for their customizable options and competitive pricing. Policyholders can choose from a range of coverage levels to suit their individual risk profiles and budgetary constraints. Beyond the standard liability and collision coverage, Progressive offers additional options like comprehensive coverage (for damage not caused by collisions), uninsured/underinsured motorist protection, and roadside assistance.

Progressive’s Auto Insurance Policy Features and Benefits

Key features and benefits of Progressive’s auto insurance policies include Name Your Price® Tool, which allows customers to select a price point and see coverage options that fit their budget; Snapshot®, a usage-based insurance program that rewards safe driving habits with lower premiums; and 24/7 claims support, providing assistance whenever needed.

Types of Insurance Offered by Progressive

Progressive provides a variety of insurance products beyond auto insurance. The table below Artikels some of the key offerings.

| Insurance Type | Coverage Details | Key Features | Target Audience |

|---|---|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Roadside Assistance | Name Your Price®, Snapshot®, 24/7 claims support | Car owners |

| Homeowners Insurance | Dwelling, Personal Property, Liability, Additional Living Expenses | Customizable coverage options, competitive pricing | Homeowners |

| Renters Insurance | Personal Property, Liability | Affordable protection for renters’ belongings | Renters |

| Motorcycle Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Specialized coverage for motorcycles | Motorcycle owners |

Progressive’s Pricing Compared to a Major Competitor (e.g., State Farm)

While precise pricing varies based on individual factors (location, driving history, vehicle type, etc.), a general comparison can highlight key differences in Progressive’s and State Farm’s pricing structures.

- Emphasis on Usage-Based Insurance: Progressive heavily promotes its Snapshot® program, potentially leading to lower premiums for safe drivers compared to State Farm’s more traditional methods.

- Name Your Price® Tool: Progressive’s Name Your Price® tool offers a unique approach, allowing customers to set a budget and see available coverage options, whereas State Farm’s pricing may be less transparent in this regard.

- Discounts: Both companies offer discounts (e.g., for bundling policies, safe driving), but the specific discounts and eligibility criteria may differ.

- Overall Cost: In some cases, Progressive may offer lower premiums due to its usage-based model and focus on online services, while State Farm might be more competitive in certain situations based on factors like regional market dominance and customer demographics.

Progressive’s Use of Technology

Progressive leverages technology to enhance customer experience and streamline operations. This includes mobile apps for managing policies, filing claims, and accessing digital ID cards; online tools for obtaining quotes, comparing coverage options, and making payments; and telematics programs like Snapshot® that utilize data to personalize pricing and promote safe driving.

Customer Experience and Reviews

Understanding customer experiences is crucial for assessing Progressive’s performance and identifying areas for improvement. Analyzing customer reviews across various platforms provides valuable insights into their perceptions of the company’s services and overall satisfaction.

Customer feedback reveals a complex picture, with both positive and negative experiences reported. While many praise Progressive’s ease of use and digital tools, others express frustration with certain aspects of the claims process and customer service interactions.

Common Themes in Customer Reviews

A review of online feedback reveals several recurring themes in customer experiences with Progressive Insurance. These themes offer a comprehensive overview of both positive and negative aspects of the company’s services.

- Positive Experiences: Many customers appreciate Progressive’s user-friendly website and mobile app, specifically highlighting the ease of managing policies, making payments, and accessing digital documents. The Name Your Price® Tool is frequently cited as a positive feature, allowing customers to customize their coverage and premiums.

- Negative Experiences: Conversely, some customers report difficulties navigating the claims process, citing lengthy wait times, confusing paperwork, and perceived unresponsiveness from customer service representatives. Issues with claim settlements and communication breakdowns are also frequently mentioned.

- Pricing and Value: Customer feedback often reflects a mixed perception of Progressive’s pricing. While some find the Name Your Price® Tool helpful in finding affordable coverage, others feel the premiums are higher than competitors for comparable coverage.

Progressive’s Customer Service Channels and Effectiveness

Progressive offers a variety of customer service channels, each designed to cater to different customer preferences and needs. The effectiveness of these channels varies depending on the specific issue and the customer’s experience.

- Website and Mobile App: Progressive’s online platforms offer 24/7 access to policy information, payment options, and basic customer support resources. While generally well-regarded for ease of use, complex issues may require contacting customer service directly.

- Phone Support: Phone support is available during standard business hours. Wait times can vary significantly depending on the time of day and the complexity of the issue. Some customers report long wait times and difficulties reaching a representative with the necessary expertise.

- Email Support: Email support provides a written record of communication, which can be helpful for complex or sensitive issues. Response times can vary, and email may not be the most efficient channel for urgent matters.

Filing a Claim with Progressive: A Flowchart

The following flowchart illustrates a simplified version of the claim filing process with Progressive. The actual process may vary depending on the type of claim and specific circumstances.

[Imagine a flowchart here. The flowchart would begin with “Incident Occurs,” branching to “Report Claim Online/App” and “Report Claim by Phone.” Both branches would lead to “Claim Assessment,” followed by “Documentation Required” (e.g., police report, photos). This would branch to “Claim Approved” and “Claim Denied/Further Investigation.” “Claim Approved” leads to “Settlement,” while “Claim Denied/Further Investigation” leads to “Appeal Process” and “Final Decision.”]

Progressive’s Handling of Customer Complaints and Feedback

Progressive utilizes various methods to address customer complaints and feedback. These methods aim to resolve issues efficiently and improve customer satisfaction.

- Direct Response to Complaints: Progressive generally responds to customer complaints directly through the channel in which the complaint was submitted (e.g., phone, email). The response may involve investigating the issue, offering an apology, and providing a resolution.

- Social Media Monitoring: Progressive actively monitors social media platforms for customer feedback and complaints. Publicly addressing concerns on social media can demonstrate responsiveness and transparency.

- Customer Surveys: Progressive regularly conducts customer surveys to gather feedback on various aspects of their services. This data is used to identify areas for improvement and inform business decisions.

- Example: A customer complaining about a delayed claim settlement might receive a direct response from a representative explaining the delay, apologizing for the inconvenience, and outlining the steps being taken to expedite the process. A partial refund or other compensation might also be offered as a gesture of goodwill.

Marketing Strategies and Campaigns

Progressive’s marketing success is largely attributed to its consistent and innovative approach, cleverly blending humor, memorable characters, and relatable scenarios to connect with its target audience. This strategy stands out in a competitive insurance market, fostering brand recognition and positive customer perception. The company’s campaigns consistently demonstrate a deep understanding of consumer behavior and preferences.

Progressive’s use of humor and memorable characters is a cornerstone of its marketing strategy. The iconic Flo, the perpetually helpful and slightly quirky insurance agent, has become a cultural phenomenon. Her relatable personality and witty interactions with customers (and sometimes even other characters) make Progressive’s commercials both entertaining and informative. This approach moves beyond simple product promotion, creating a genuine connection with viewers and making Progressive a brand they enjoy engaging with. The use of humor also helps to demystify the often-complex world of insurance, making it more approachable and less intimidating.

Progressive’s “Name Your Price” Campaign and its Impact

The “Name Your Price” tool, heavily promoted in Progressive’s advertising campaigns, has significantly impacted the company’s market share and customer acquisition. This campaign highlights the tool’s ease of use and empowers consumers to find insurance policies that fit their individual budgets and needs. Television commercials showcase diverse customer scenarios, demonstrating the flexibility and personalization offered by the “Name Your Price” tool. The campaign’s success can be measured by increased website traffic to the “Name Your Price” tool, higher policy sales, and improved customer satisfaction ratings. This targeted approach, emphasizing consumer control and transparency, differentiates Progressive from competitors who might focus more on traditional sales methods.

Comparison of Progressive’s Marketing Approach with Geico

Progressive and Geico, two major players in the auto insurance market, employ distinct yet equally effective marketing strategies. While Progressive relies heavily on memorable characters and humorous scenarios, Geico often uses catchy jingles and quirky animal mascots, such as the gecko. Both companies effectively use television advertising, but their creative approaches differ significantly. Progressive’s campaigns tend to be more character-driven and scenario-based, while Geico’s commercials are often shorter, punchier, and rely more on memorable sound and visual elements. Both strategies have proven successful in reaching a wide audience and building strong brand recognition, demonstrating that there is more than one path to marketing success in the insurance industry.

Mock-up of a Progressive Print Advertisement

The advertisement would feature a vibrant, slightly whimsical illustration of Flo standing next to a sleek, modern car. Flo would be depicted in her signature uniform, with a friendly and approachable expression. She would be holding a tablet displaying the “Name Your Price” tool interface. The background would be a bright, sunny cityscape, suggesting a feeling of optimism and ease.

The headline would read: “Find Your Perfect Coverage. Your Price. Your Way.” Below the headline, a smaller tagline would state: “Get a quote with Progressive’s Name Your Price® Tool.” The body copy would be concise and informative, emphasizing the ease and convenience of using the online tool. A call to action would encourage readers to visit the Progressive website or call a toll-free number to get a quote. The Progressive logo would be prominently displayed in the lower right corner, along with the “Name Your Price®” logo. The overall design would be clean, modern, and visually appealing, reflecting the brand’s image of innovation and customer-centricity.

Competitive Landscape and Market Position

Progressive occupies a significant position within the highly competitive US auto insurance market. Its success stems from a blend of innovative strategies, technological advancements, and a customer-centric approach. Understanding its market share and competitive landscape is crucial to assessing its overall performance and future prospects.

Progressive’s market share fluctuates but consistently places it among the top auto insurers in the United States. Precise figures vary depending on the reporting agency and the year, but it consistently competes with the largest players for market leadership. This strong market presence reflects the effectiveness of its marketing, product offerings, and operational efficiency.

Progressive’s Main Competitors and Their Attributes

Progressive faces stiff competition from several established players in the insurance industry. Analyzing their strengths and weaknesses provides a clearer picture of Progressive’s competitive positioning. Key competitors include State Farm and Geico, both known for their extensive brand recognition and established customer bases.

State Farm boasts a vast network of agents providing personalized service, a significant strength for customers preferring in-person interactions. However, its technological advancements lag behind Progressive’s in areas such as online quoting and telematics-based pricing. Geico, on the other hand, is renowned for its low-cost advertising and straightforward pricing models, attracting price-sensitive consumers. However, its customer service reputation is sometimes criticized as less personalized compared to competitors with a larger agent network.

Progressive’s Competitive Advantages

Progressive differentiates itself through several key competitive advantages. Its Name Your Price® tool empowers customers to actively participate in the pricing process, leading to greater transparency and customer satisfaction. The company’s robust usage of telematics, through its Snapshot® program, allows for personalized pricing based on individual driving behavior, rewarding safe drivers with lower premiums. This data-driven approach enhances both profitability and customer loyalty. Furthermore, Progressive’s investment in technology and digital platforms provides a seamless and convenient customer experience, particularly appealing to younger demographics accustomed to online transactions.

Comparative Analysis of Insurance Offerings

The following table compares key features of Progressive’s insurance offerings with those of State Farm and Geico. Note that specific pricing and coverage options can vary based on location, individual risk profiles, and chosen policy details.

| Feature | Progressive | State Farm | Geico |

|---|---|---|---|

| Pricing Model | Name Your Price®, telematics-based discounts | Agent-driven, traditional pricing | Simple, largely online, competitive pricing |

| Customer Service | Online, phone, and some agent support | Extensive agent network, personalized service | Primarily online and phone support |

| Technology Integration | Strong emphasis on online tools, telematics (Snapshot®) | Moderate level of online capabilities | Strong online presence, but less emphasis on telematics |

| Coverage Options | Comprehensive range of auto, home, and other insurance products | Broad range of insurance products | Primarily auto insurance, with some other options |

Ultimate Conclusion

In conclusion, Progressive Insurance’s success stems from a strategic blend of innovative technology, engaging marketing, and a focus on customer satisfaction. While facing stiff competition, its ability to adapt to evolving consumer needs and leverage technological advancements positions it favorably within the market. The company’s continued commitment to enhancing its services and refining its marketing strategies suggests a promising trajectory for future growth and continued dominance in the insurance industry.

Quick FAQs

What types of insurance does Progressive offer besides auto insurance?

Progressive offers a range of insurance products including home, motorcycle, boat, and RV insurance, among others.

How does Progressive’s Name Your Price® tool work?

The Name Your Price® tool allows customers to set a budget for their car insurance and Progressive will find policies that match their price range.

Does Progressive offer discounts?

Yes, Progressive offers various discounts, including those for good driving records, bundling policies, and installing safety features in vehicles.

What is Progressive’s claims process like?

Progressive offers various methods for filing a claim, including online, by phone, and through their mobile app. The specific process may vary depending on the type of claim.