Progressive term life insurance offers a unique approach to life insurance coverage, adapting to the changing needs of policyholders over time. Unlike traditional level term policies with fixed premiums, progressive term insurance features premiums that adjust periodically, often increasing over the policy’s duration. This dynamic approach can be particularly advantageous for individuals anticipating growing financial responsibilities, such as a growing family or increasing business obligations. This guide delves into the intricacies of progressive term life insurance, examining its benefits, drawbacks, and suitability for various life stages.

We will explore how premiums are adjusted, the factors influencing these adjustments, and the potential long-term financial implications. We’ll also compare progressive term insurance to other life insurance options, helping you determine if this type of policy aligns with your individual needs and risk tolerance. By understanding the nuances of progressive term life insurance, you can make informed decisions to secure your financial future.

Defining Progressive Term Life Insurance

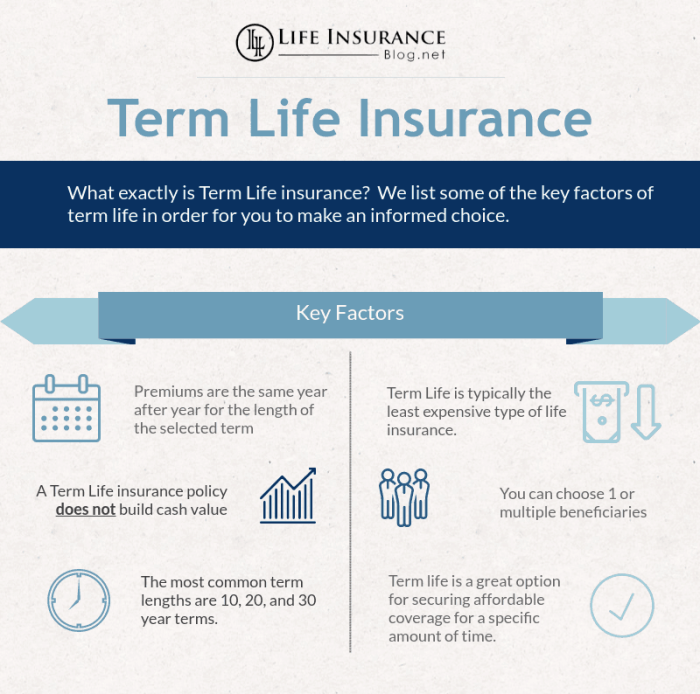

Progressive term life insurance offers a unique approach to life insurance coverage, adapting to the changing needs of policyholders over time. Unlike traditional term life insurance, which maintains a fixed death benefit and premium throughout the policy term, progressive term insurance increases the death benefit periodically, usually annually or every few years, while premiums also adjust accordingly. This structure aims to provide growing coverage to match potential increases in income, family responsibilities, or the rising cost of living.

Progressive term life insurance’s core features include a gradually increasing death benefit, premiums that rise to reflect the increasing coverage, and a predetermined policy term, similar to traditional term life insurance. The increase in the death benefit is typically a fixed percentage or a set dollar amount each year. It’s important to note that the exact terms and conditions vary significantly between insurance providers.

Progressive Term versus Traditional Term Life Insurance

The key difference between progressive and traditional term life insurance lies in the death benefit and premium structure. Traditional term life insurance provides a level death benefit and a fixed premium for the entire policy term. The death benefit remains constant, and so does the premium, making it predictable and straightforward. In contrast, progressive term life insurance offers a steadily increasing death benefit, which is mirrored by a gradually increasing premium. This makes the premium less predictable than a traditional level term policy. The increased death benefit in a progressive policy aims to help maintain the purchasing power of the death benefit over time, offsetting the effects of inflation.

Premium Structures: Progressive versus Level Term

Progressive term life insurance premiums increase over time to reflect the growing death benefit. This contrasts with level term life insurance, where premiums remain constant throughout the policy term. For example, a 20-year progressive term policy might start with a $500,000 death benefit and a $500 annual premium. Each year, the death benefit could increase by 5%, and the premium might also rise by a similar percentage. In a comparable level term policy, the death benefit would remain at $500,000, and the premium would remain constant at a potentially higher rate than the initial premium of the progressive policy. The choice between these two structures depends heavily on individual financial circumstances and long-term projections.

Beneficial Scenarios for Progressive Term Life Insurance

Progressive term life insurance can be particularly beneficial in situations where individuals anticipate their financial responsibilities or income to increase over time. For instance, a young professional starting a family may find this type of policy advantageous. As their income grows and their family expands, the increasing death benefit helps ensure their loved ones are adequately protected against financial hardship. Similarly, entrepreneurs whose businesses are experiencing rapid growth might also benefit, as the increasing coverage aligns with their increasing net worth and business liabilities. Another scenario where this type of policy could be beneficial is for individuals expecting significant salary increases over the policy term. The increasing death benefit can help maintain the policy’s value relative to their growing income.

Premium Adjustments and Growth

Progressive term life insurance offers a unique approach to life insurance coverage, adjusting premiums over the policy’s term. Unlike traditional term life insurance with fixed premiums, progressive policies reflect changes in your risk profile over time. This approach can result in both lower initial premiums and potential increases as you age. Understanding how these premiums adjust is crucial to making an informed decision.

Premium adjustments in a progressive term life insurance policy are typically based on a pre-defined schedule Artikeld in the policy contract. These adjustments are not arbitrary; they are usually tied to actuarial tables and reflect the increasing likelihood of a claim as the policyholder ages. The insurer uses statistical models to predict the probability of death at various ages and adjusts premiums accordingly. While the initial premium may be lower than a comparable traditional term policy, it will gradually increase over time.

Factors Influencing Premium Increases

Several factors contribute to the magnitude of premium increases in progressive term life insurance. Age is the most significant factor, as the risk of mortality increases with age. Health status can also play a role, although less directly than in traditional underwriting. While initial underwriting is performed, significant health changes during the policy term typically do not trigger mid-term premium increases in most progressive policies. However, some policies may incorporate a review clause that could allow for adjustments based on significant changes. Finally, economic conditions and interest rates can indirectly influence the insurer’s pricing models, potentially impacting premium adjustments.

Examples of Potential Premium Growth Scenarios

Consider a 20-year progressive term life insurance policy with a $500,000 death benefit. The initial annual premium might be $500. Over the next five years, premiums might increase incrementally, perhaps reaching $600 annually. Between years 5 and 10, the increase might accelerate, potentially reaching $800 annually due to the increased risk associated with advancing age. In the final 10 years, premiums could rise further, possibly reaching $1200 annually. These figures are illustrative; the actual increase will depend on the specific policy and the insurer’s pricing model. Another scenario could show a slower increase, perhaps reaching only $900 annually after 20 years, reflecting a policy with a different pricing structure. The key is to review the policy’s specific premium schedule before purchase.

Comparison of Premium Growth Rates Across Various Progressive Term Policies

| Policy | Initial Annual Premium | Year 5 Premium | Year 10 Premium | Year 20 Premium |

|---|---|---|---|---|

| Policy A | $500 | $600 | $800 | $1200 |

| Policy B | $550 | $650 | $750 | $900 |

| Policy C | $450 | $550 | $700 | $1100 |

| Policy D | $600 | $700 | $850 | $1000 |

Benefits and Drawbacks

Progressive term life insurance offers a unique blend of affordability and increasing coverage, making it an attractive option for some, but not necessarily for all. Understanding both its advantages and disadvantages is crucial before making a decision. This section will explore the key benefits and potential drawbacks, considering suitability across different life stages and comparing it to alternative life insurance products.

Advantages of Progressive Term Life Insurance

Progressive term life insurance primarily appeals to individuals anticipating increased financial responsibilities over time. The key benefit lies in the steadily increasing death benefit, mirroring the potential growth in financial obligations like a growing family or increasing business value. This allows policyholders to maintain adequate coverage without needing to purchase new policies or significantly increase premiums later on. Furthermore, the premiums remain relatively stable, offering predictability in budgeting for life insurance costs. This contrasts with traditional term life insurance where coverage remains constant throughout the policy term.

Disadvantages and Limitations of Progressive Term Life Insurance

While offering attractive features, progressive term life insurance is not without its drawbacks. The steadily increasing death benefit does not necessarily translate to a proportionally increasing premium. The premium growth rate might outpace the increase in the death benefit, especially if the policyholder’s health deteriorates or interest rates rise. This could lead to a situation where the policy becomes more expensive than anticipated. Another potential disadvantage is the complexity of the policy structure, which might be less straightforward to understand compared to simpler term life insurance options. Finally, the suitability of this type of policy might be limited based on individual circumstances and financial goals.

Suitability of Progressive Term Life Insurance for Different Life Stages

Young adults starting families or establishing careers might find progressive term life insurance particularly beneficial. The steadily increasing death benefit can align with the growing financial responsibilities associated with raising children, purchasing a home, and increasing debt. However, for older individuals nearing retirement, where financial obligations may decrease, a traditional term life insurance policy or a whole life policy might be more appropriate. The optimal choice depends on individual circumstances and risk tolerance. For example, a young couple expecting their first child might find the increasing coverage of a progressive term policy ideal, whereas someone nearing retirement may prefer a fixed-coverage term policy to cover end-of-life expenses.

Comparison with Other Types of Life Insurance

Progressive term life insurance offers a middle ground between the affordability of traditional term life insurance and the lifelong coverage of whole life insurance. Traditional term life insurance offers fixed coverage at a fixed premium for a specific term, after which the policy expires. Whole life insurance provides lifelong coverage, but premiums are typically higher. Universal life insurance offers flexibility in premiums and death benefits, but its complexity and potential for higher costs can make it less attractive than progressive term life insurance for some. The best choice depends on the individual’s financial situation, risk tolerance, and long-term goals. For instance, someone with a limited budget but anticipating increasing financial obligations might prefer progressive term life insurance over whole life, while someone with significant wealth might opt for whole life insurance for its lifelong coverage.

Policy Features and Options

Progressive term life insurance policies, while offering straightforward death benefit protection, often include customizable features to better suit individual needs. Understanding these options is crucial for tailoring a policy that provides optimal coverage and value. These features can significantly impact the overall cost and benefits received.

Available Riders and Add-ons

Many progressive term life insurance providers offer a range of riders and add-ons that enhance the core policy. These supplemental benefits can address specific concerns or life events. Common examples include accidental death benefit riders (doubling or tripling the death benefit in case of accidental death), critical illness riders (providing a lump-sum payout upon diagnosis of a specified critical illness), and term conversion options (allowing the policyholder to convert to a permanent life insurance policy without a medical exam, within a specified timeframe). The availability and cost of these riders vary by insurer and policy.

Applying for and Obtaining a Progressive Term Life Insurance Policy

The application process typically begins with an online quote or a consultation with an insurance agent. This involves providing personal information, health history, and lifestyle details. The insurer then assesses the risk and provides a personalized quote. If the applicant accepts the offer, they will need to complete a formal application and potentially undergo a medical examination. Once the application is approved, the policy is issued, and coverage begins on the effective date. The entire process can take several weeks, depending on the insurer and the complexity of the application.

Essential Policy Documents and Information

It’s vital to carefully review all policy documents upon receiving them. Understanding the policy’s terms and conditions is crucial for making informed decisions.

- Policy Summary: A concise overview of the policy’s key features, benefits, and costs.

- Policy Contract: The legally binding agreement outlining the terms and conditions of the insurance coverage.

- Premium Schedule: A detailed schedule outlining premium payment amounts and due dates.

- Beneficiary Designation Form: The document specifying the individuals or entities who will receive the death benefit upon the insured’s death.

Maintaining accurate contact information with the insurance provider is also crucial for receiving important updates and communications.

Hypothetical Policy Illustration

Let’s consider a hypothetical 30-year-old male applying for a 20-year progressive term life insurance policy with a $500,000 death benefit. Assume the initial annual premium is $1,500. The policy includes an annual premium increase of 3% compounded annually.

| Year | Age | Annual Premium | Death Benefit |

|---|---|---|---|

| 1 | 30 | $1,500 | $500,000 |

| 5 | 35 | $1,740 | $500,000 |

| 10 | 40 | $2,023 | $500,000 |

| 20 | 50 | $2,735 | $500,000 |

Note: This is a simplified illustration. Actual premiums and benefit payouts may vary depending on the insurer, policy features, and the insured’s health and lifestyle. The 3% annual increase is a hypothetical example and actual increases may differ based on the specific policy and the insurer’s pricing model. This illustration is for illustrative purposes only and does not constitute a formal quote.

Considerations for Consumers

Choosing the right progressive term life insurance policy requires careful consideration of several factors to ensure it aligns with your individual needs and financial goals. Understanding the policy’s nuances and long-term implications is crucial for making an informed decision.

Selecting Policy Duration and Coverage Amount

Determining the appropriate policy duration and coverage amount is paramount. Policy duration should reflect the period you need life insurance coverage, often aligning with mortgage repayment periods, child-rearing years, or until retirement. Coverage amount should be sufficient to replace your income and cover outstanding debts and future expenses for your dependents in the event of your untimely death. Consider factors such as your current income, outstanding debts (mortgage, loans), future education costs for children, and your spouse’s earning potential. For example, a family with a significant mortgage and young children might require a higher coverage amount and longer duration than a single individual with minimal debt. A financial advisor can assist in calculating an appropriate coverage amount based on your specific circumstances.

Comparing Progressive Term Life Insurance Offers

Comparing different progressive term life insurance offers involves a systematic approach. Focus on key factors such as the premium growth rate, the overall cost of the policy over its term, the insurer’s financial strength and claims-paying history, and the policy’s specific features and riders. Obtain quotes from multiple insurers and compare them side-by-side, paying close attention to the fine print. Websites dedicated to insurance comparisons can be a valuable resource. For instance, comparing a policy with a 2% annual premium increase to one with a 3% increase will reveal a significant difference in long-term cost, even if the initial premiums are similar.

Understanding Policy Terms and Conditions

Thoroughly reviewing the policy’s terms and conditions is non-negotiable. Pay close attention to the definitions of covered events, exclusions, limitations, and the process for filing a claim. Understanding the renewal terms, including any limitations on renewability or changes in premium rates, is crucial. Look for clauses regarding policy cancellations, surrender values, and any applicable waiting periods. A lack of understanding could lead to unforeseen financial burdens or denied claims. For instance, a policy might exclude coverage for certain pre-existing conditions or activities, impacting its overall value.

Assessing Long-Term Financial Implications

Assessing the long-term financial implications requires considering the escalating premiums over the policy’s duration. Project the premium payments over the entire term to understand the total cost. Factor this cost into your overall financial planning, ensuring it aligns with your budget and other financial goals. Use financial planning tools or consult a financial advisor to model the impact of these increasing premiums on your future financial health. For example, a policy with a seemingly low initial premium might become prohibitively expensive later in its term, impacting your ability to meet other financial obligations.

Closing Notes

Progressive term life insurance presents a compelling alternative to traditional level term policies, offering flexibility and adaptability to changing life circumstances. While premium increases are a key feature, careful consideration of individual financial projections and risk tolerance can determine its suitability. Understanding the advantages and disadvantages, along with a thorough comparison to other insurance types, empowers consumers to make informed choices that best protect their families and financial well-being. Ultimately, securing adequate life insurance coverage is a crucial aspect of responsible financial planning, and progressive term insurance provides a valuable option for those who seek a tailored approach.

Popular Questions

What factors influence premium increases in progressive term life insurance?

Several factors can influence premium increases, including age, health status, and the insurer’s risk assessment. The specific terms and conditions of your policy will Artikel the details.

Can I cancel a progressive term life insurance policy?

Yes, you can usually cancel a progressive term life insurance policy, but there may be penalties or surrender charges depending on the policy terms and how long you’ve held it.

How does progressive term life insurance compare to whole life insurance?

Progressive term insurance offers temporary coverage with adjustable premiums, while whole life insurance provides permanent coverage with a cash value component. The best choice depends on your financial goals and risk tolerance.

What happens if I miss a premium payment on my progressive term life insurance?

Missing a premium payment can lead to a lapse in coverage. Your policy may have a grace period, but you should contact your insurer immediately to avoid losing coverage.