Finding the right homeowners insurance can feel like navigating a maze. This guide demystifies the process, offering a clear understanding of how to obtain competitive quotes, compare coverage options, and ultimately secure the best protection for your most valuable asset: your home. We’ll explore the factors influencing premiums, the nuances of different policy types, and provide practical tips to make informed decisions.

From understanding the intricacies of policy wording to leveraging strategies for saving money, this comprehensive resource equips you with the knowledge to confidently navigate the world of homeowners insurance. We’ll break down complex terminology, offer actionable advice, and empower you to make choices that align with your specific needs and budget.

Understanding Homeowner Insurance Quotes

Homeowner insurance protects your most valuable asset – your home. Understanding the intricacies of homeowner insurance quotes is crucial for securing adequate coverage at a competitive price. This section will delve into the key components of homeowner insurance, factors influencing its cost, and the various types of coverage available.

Homeowner Insurance Defined and its Key Components

Homeowner insurance is a type of property insurance that covers losses and damages to a private residence. It typically includes coverage for the dwelling itself, other structures on the property (like a detached garage), personal belongings, and liability protection. Key components often include dwelling coverage (repairing or rebuilding your house), personal property coverage (replacing your possessions), liability coverage (protecting you from lawsuits), and additional living expenses (covering temporary housing if your home is uninhabitable). Some policies also offer additional coverages, such as flood or earthquake insurance (often purchased separately).

Factors Influencing Homeowner Insurance Costs

Several factors significantly impact the cost of homeowner insurance. These include the location of your home (risk of natural disasters, crime rates), the age and condition of your home (older homes may require more maintenance), the value of your home and belongings (higher value means higher premiums), the type of construction (brick homes are often considered less risky than wood-frame homes), your credit score (a higher score usually leads to lower premiums), and the amount of coverage you choose (more coverage equals higher premiums). Discounts may be available for features like security systems or fire suppression systems. For example, a home located in a hurricane-prone area will likely have higher premiums than a similar home in a less risky region. Similarly, a homeowner with excellent credit might receive a lower rate than someone with poor credit.

Types of Homeowner Insurance Coverage

Different types of homeowner insurance policies offer varying levels of coverage. The most common types are HO-3 (Special Form), HO-5 (Comprehensive Form), HO-4 (Renters Insurance), and HO-6 (Condominium Insurance). Each policy type offers a specific combination of coverage for dwelling, personal property, and liability. Understanding the nuances of each policy is essential for choosing the right coverage for your individual needs.

Comparison of Common Homeowner Insurance Policies

| Policy Type | Coverage Details | Typical Cost Factors | Advantages/Disadvantages |

|---|---|---|---|

| HO-3 (Special Form) | Covers dwelling and other structures against most perils; personal property covered against named perils. | Location, age of home, coverage amount, credit score. | Widely available, good balance of coverage and cost. May not cover all potential losses to personal property. |

| HO-5 (Comprehensive Form) | Covers both dwelling and personal property against all risks (except those specifically excluded). | Location, age of home, coverage amount, credit score, higher value of possessions. | Most comprehensive coverage available, provides peace of mind. Typically more expensive than HO-3. |

| HO-4 (Renters Insurance) | Covers personal property and liability for renters. | Value of personal belongings, location, coverage amount. | Affordable protection for renters’ possessions and liability. Does not cover the building itself. |

| HO-6 (Condominium Insurance) | Covers personal property and liability for condo owners; may cover interior structural elements. | Value of personal belongings, location, coverage amount, condo association’s master policy. | Protects condo owners’ personal property and liability; coverage for building structure is often limited. |

Obtaining Homeowner Insurance Quotes

Securing the right homeowner’s insurance involves more than just finding the cheapest policy. A thorough process of obtaining and comparing quotes from multiple providers is crucial to ensure you receive adequate coverage at a competitive price. This involves understanding your needs, researching insurers, and carefully analyzing the details of each quote.

The process of obtaining homeowner insurance quotes involves contacting multiple insurance providers, either directly or through online comparison tools. Each provider will request specific information about your property and your coverage requirements to generate a personalized quote. This information will then allow you to compare quotes effectively and make an informed decision.

Comparing Homeowner Insurance Quotes

Effectively comparing quotes requires a detailed analysis beyond simply looking at the premium amount. Factors such as coverage limits, deductibles, and policy exclusions must be considered. A lower premium might mean inadequate coverage, leaving you financially vulnerable in case of a significant loss. A side-by-side comparison using a spreadsheet or a dedicated comparison tool can greatly assist in this process. Consider using a consistent set of criteria for comparison across all quotes to ensure fairness and ease of analysis.

Understanding Policy Exclusions and Limitations

Policy exclusions specify what events or damages are not covered by the insurance policy. These exclusions can vary significantly between insurers and policies. Common exclusions might include flooding, earthquakes, or specific types of damage. Similarly, limitations define the extent of coverage for certain events. For example, a policy might limit coverage for jewelry or other valuable items. Carefully reviewing the policy documents to understand these exclusions and limitations is crucial to avoid unexpected financial burdens in the event of a claim. Ignoring these details can have serious financial repercussions.

A Step-by-Step Guide to Obtaining Homeowner Insurance Quotes

Before beginning your search, gather essential information about your property, including its age, square footage, location, and any relevant upgrades or renovations. You should also determine your desired coverage amounts for dwelling, personal property, liability, and additional living expenses.

- Identify Potential Insurers: Research and select several reputable insurance companies operating in your area. Consider using online comparison websites to quickly gather quotes from multiple providers.

- Request Quotes: Contact each insurer and request a quote, providing all the necessary information about your property and coverage needs. Many insurers offer online quote request forms for convenience.

- Compare Quotes Carefully: Once you receive your quotes, compare them side-by-side, paying close attention to premium amounts, coverage limits, deductibles, and, most importantly, policy exclusions and limitations.

- Review Policy Documents: Before making a decision, carefully review the full policy documents from your top choices. Don’t hesitate to ask questions if anything is unclear.

- Choose a Policy: Select the policy that best balances cost and coverage based on your individual needs and risk tolerance.

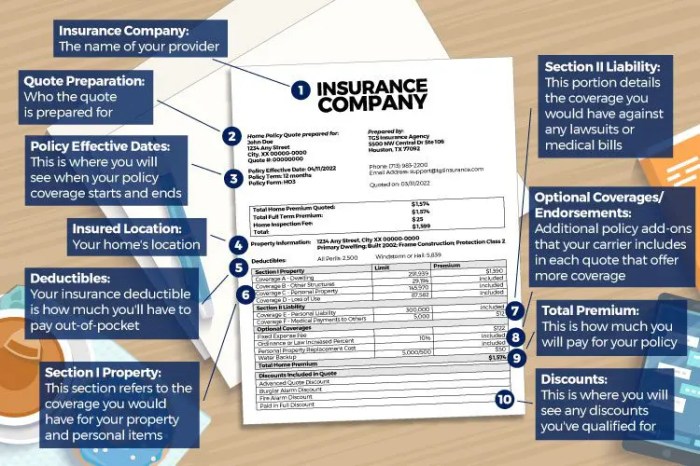

Reading and Understanding a Homeowner Insurance Quote

Receiving a homeowner’s insurance quote can feel overwhelming due to the specialized terminology and detailed information presented. Understanding the key components and verifying their accuracy is crucial to ensuring you have adequate coverage at a fair price. This section will guide you through the process of deciphering your quote.

Common Terms and Jargon in Homeowner Insurance Quotes

Homeowner insurance quotes utilize specific terminology. Familiarizing yourself with these terms is essential for a comprehensive understanding. For example, “dwelling coverage” refers to the cost to rebuild your home; “personal property coverage” protects your belongings; “liability coverage” protects you against lawsuits; and “additional living expenses” cover temporary housing if your home becomes uninhabitable due to a covered event. Other common terms include deductibles (the amount you pay out-of-pocket before insurance coverage begins), premiums (your regular payments), and endorsements (add-ons to your policy for specific coverage needs). Understanding these basic terms will significantly improve your ability to interpret the quote.

Breakdown of a Typical Homeowner Insurance Quote Document

A typical homeowner insurance quote is structured in sections providing a clear overview of the proposed coverage and associated costs. Generally, you’ll find sections detailing the coverage amounts for your dwelling, other structures (like a detached garage), personal property, liability, and additional living expenses. A separate section will Artikel the premiums, deductibles, and any additional fees or charges. The quote may also include information about your policy’s effective date, cancellation terms, and contact information for the insurance provider. Finally, a summary section will usually present a concise overview of your total estimated annual cost.

Verifying the Accuracy and Completeness of a Quote

Before accepting a homeowner’s insurance quote, it’s crucial to verify its accuracy and completeness. Carefully review all sections, ensuring the coverage amounts align with your home’s value and your personal belongings’ worth. Confirm the accuracy of your address, the listed structures, and any additional features you’ve specified. Compare deductibles and premiums across multiple quotes from different insurers to find the most suitable option for your needs and budget. If anything seems unclear or inaccurate, contact the insurance provider to clarify before finalizing your decision. It’s advisable to document all communication with the insurer, including email exchanges and phone calls.

Sample Homeowner Insurance Quote

Policy Number: 123456789

Policyholder: John Doe

Address: 123 Main Street, Anytown, USA

Effective Date: October 26, 2024

Coverage Summary:

Dwelling Coverage: $300,000

Other Structures: $30,000

Personal Property: $150,000

Liability Coverage: $300,000

Additional Living Expenses: $30,000

Premium Information:

Annual Premium: $1,200

Deductible: $1,000

Payment Plan: Monthly installments of $100

Important Notes:

This is a sample quote and may not reflect actual coverage or pricing. Please contact your insurance provider for a personalized quote.

Bundling Homeowner’s Insurance

Bundling homeowner’s insurance with other insurance policies, such as auto insurance, is a common strategy employed by many to potentially reduce their overall insurance costs. This practice offers several advantages, but it’s crucial to weigh these benefits against potential drawbacks before making a decision.

Bundling typically involves purchasing multiple insurance policies from the same insurer. This allows the insurer to streamline administrative processes and potentially offer discounts to customers who consolidate their insurance needs. However, it’s important to compare bundled rates against the cost of individual policies from different insurers to ensure that the bundled option is truly the most cost-effective choice.

Cost Savings Associated with Bundled Policies

The primary benefit of bundling is the potential for significant cost savings. Insurers often offer discounts ranging from 5% to 25% or more when you bundle your homeowner’s and auto insurance policies. These discounts reflect the reduced administrative costs and increased customer loyalty associated with bundled policies. The exact amount of savings will vary depending on the insurer, the types of coverage selected, and the individual’s risk profile. It’s not guaranteed that bundling will always be cheaper; a thorough comparison is essential.

Calculating Potential Savings with a Hypothetical Example

Let’s consider a hypothetical example. Suppose Sarah pays $1200 annually for homeowner’s insurance and $800 annually for auto insurance with separate insurers. If she bundles these policies with a company offering a 15% discount on the combined premium, the calculation would be as follows:

Combined premium without discount: $1200 + $800 = $2000

Discount amount: $2000 x 0.15 = $300

Bundled premium: $2000 – $300 = $1700

In this scenario, Sarah would save $300 annually by bundling her insurance policies. This represents a significant reduction in her overall insurance expenses. However, it’s crucial to note that this is just a hypothetical example, and actual savings will vary.

Finding Bundled Insurance Options

Finding bundled insurance options that meet specific needs involves comparing quotes from multiple insurers. It’s recommended to obtain quotes from at least three different companies to ensure a competitive comparison. Consider the following tips:

Use online comparison tools: Many websites allow you to compare quotes from multiple insurers simultaneously, simplifying the process.

Contact insurers directly: Reach out to insurers directly to inquire about bundled options and discuss your specific coverage needs.

Review policy details carefully: Before committing to a bundled policy, carefully review the terms and conditions of each policy to ensure they meet your requirements. Pay close attention to coverage limits, deductibles, and exclusions.

Negotiate: Don’t hesitate to negotiate with insurers to try and secure a better rate, especially if you have a clean driving record and a history of responsible homeownership.

Illustrative Examples of Homeowner Insurance Scenarios

Understanding homeowner insurance quotes becomes clearer when we examine specific scenarios. Two hypothetical homeowners, with differing circumstances, will illustrate how various factors influence insurance costs and coverage.

Homeowner Scenario One: Suburban Family

This scenario involves the Miller family, residing in a modest, two-story suburban home valued at $350,000. Their home is located in a relatively safe neighborhood with a low crime rate and minimal risk of natural disasters like floods or wildfires. The Millers have a standard mortgage and possess average personal belongings. Their primary concerns are standard coverage for damage to their home and possessions, liability protection in case of accidents on their property, and protection against theft. Their insurance quote reflects these lower risks, resulting in a relatively affordable premium. The quote might include a $250,000 dwelling coverage, $125,000 personal property coverage, and $300,000 liability coverage. The estimated annual premium would be around $1,200.

Homeowner Scenario Two: Coastal Property Owner

In contrast, consider Ms. Jones, who owns a beachfront property valued at $800,000. Her home is located in a coastal area prone to hurricanes and flooding. The home is also more luxurious, containing significantly more valuable personal belongings. Ms. Jones’ higher risk profile necessitates broader coverage and higher premiums. Her insurance quote would likely include significantly higher dwelling coverage, perhaps $700,000, to account for the property’s value and potential for extensive damage. Similarly, personal property coverage would need to be substantially increased to reflect the value of her belongings. She would also need flood insurance, a separate policy, which adds considerable expense. Liability coverage would also be higher due to the increased potential for accidents on her property. Her annual premium could easily exceed $5,000, possibly reaching $7,000 or more, depending on the specific coverage levels and deductible chosen.

Comparison of Insurance Quotes

A visual representation of the differences would show two bars. The first, representing the Millers, would be significantly shorter, indicating a lower annual premium of approximately $1,200. The second bar, representing Ms. Jones, would be considerably taller, showing a much higher annual premium of $5,000 to $7,000. Beneath each bar, a breakdown of coverage amounts (dwelling, personal property, liability) would illustrate the disparity in the extent of protection. The Millers’ coverage would be considerably less than Ms. Jones’, reflecting the difference in property value, location, and risk factors. The visual would clearly demonstrate how significantly higher risk translates into substantially increased insurance costs.

Last Word

Securing adequate homeowners insurance is a crucial step in protecting your financial investment and peace of mind. By understanding the factors that influence premiums, diligently comparing quotes, and carefully reviewing policy details, you can confidently select a policy that provides comprehensive coverage at a competitive price. Remember, proactive planning and informed decision-making are key to ensuring you have the right protection in place.

Questions Often Asked

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the depreciated value of damaged property, while replacement cost coverage pays for the cost of replacing the damaged property with new, similar items, regardless of depreciation.

How often should I review my homeowners insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes in your property, such as renovations or additions.

What impact does my credit score have on my insurance premium?

In many states, insurers consider credit scores when determining premiums. A higher credit score generally results in lower premiums.

Can I get a discount for having security systems installed in my home?

Yes, many insurers offer discounts for security systems such as alarms, security cameras, and fire suppression systems.

What happens if I file a claim and my premiums increase?

While filing a claim can sometimes lead to a premium increase, the extent of the increase depends on several factors, including the type and cost of the claim. It’s important to weigh the cost of the claim against the potential increase in premiums.