Navigating the world of vehicle insurance can feel overwhelming, especially when faced with the task of obtaining the most suitable quote. Understanding the various factors influencing your premium, from your driving history to the type of vehicle you own, is crucial in securing the best possible coverage at a competitive price. This guide will demystify the process, empowering you to make informed decisions and find the perfect insurance plan.

We’ll explore the different types of coverage available, the key factors affecting quote prices, and effective strategies for comparing and negotiating premiums. By the end, you’ll possess the knowledge and tools necessary to confidently obtain a vehicle insurance quote that meets your needs and budget.

Factors Affecting Quote Prices

Several key factors influence the price you’ll receive for vehicle insurance. Understanding these factors can help you make informed decisions and potentially secure a more competitive premium. These factors are interconnected and often work in combination to determine your final quote.

Your insurance premium is a reflection of the perceived risk you present to the insurance company. The more risk you present, the higher your premium will likely be. This risk assessment is based on a variety of factors, which we’ll explore below.

Driving History

A clean driving record is crucial for obtaining favorable insurance rates. Accidents and traffic violations significantly increase your risk profile. For example, a driver with two at-fault accidents in the past three years will likely pay substantially more than a driver with a spotless record. The severity of the accidents also plays a role; a minor fender bender will have less impact than a serious collision resulting in significant property damage or injuries. Similarly, multiple speeding tickets or other moving violations will lead to higher premiums. Insurance companies often use a points system to track driving infractions, with each point increasing the cost of your insurance.

Age and Gender

Insurers consider age and gender as factors in determining risk. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates within this demographic. This is because younger drivers have less experience behind the wheel. Insurance companies often see a gradual decrease in premiums as drivers age and gain more experience. Gender can also play a role, although the impact varies by region and insurer. Historically, male drivers, especially young males, have been statistically associated with higher accident rates than female drivers.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance costs. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles typically come with lower insurance premiums. Features like safety technology (e.g., anti-lock brakes, airbags) can also influence premiums; vehicles with advanced safety features may qualify for discounts. The vehicle’s age and mileage are also considered; newer vehicles are usually more expensive to insure than older ones.

Location

Where you live plays a significant role in determining your insurance rates. Areas with high crime rates, frequent accidents, or severe weather conditions tend to have higher insurance premiums. Insurance companies analyze claims data for specific geographic areas to assess risk levels. For example, someone living in a densely populated urban area with a high incidence of car theft might pay more than someone residing in a rural area with lower crime rates.

Comparing Insurance Quotes

Receiving multiple vehicle insurance quotes is a crucial step in securing the best coverage at the most competitive price. Effectively comparing these quotes requires a systematic approach to ensure you’re making an informed decision. This involves understanding the nuances of coverage, deductibles, and hidden fees.

Effective Comparison Methods

A straightforward method for comparing quotes involves creating a spreadsheet or using a comparison website. List each insurer, their offered coverage, premium amount, deductible options, and any additional fees. This allows for a side-by-side comparison, highlighting key differences and making it easier to identify the most cost-effective and comprehensive option. Consider using a weighted scoring system, assigning points based on your priorities (e.g., lower premium, higher coverage limits). For example, you might assign 5 points for the lowest premium, 3 points for the next lowest, and 1 point for the highest. Do the same for coverage limits and other factors important to you. The insurer with the highest total score would be your top contender.

Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurer will pay for a covered claim. Higher limits generally lead to higher premiums but offer greater financial protection in case of a significant accident. Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but you’ll have to pay more if you file a claim. Carefully consider your risk tolerance and financial capacity when choosing these values. For example, a $500 deductible might be manageable for a minor accident, but a $2,500 deductible could be financially burdensome. Similarly, liability coverage limits of $100,000 might be sufficient in some states, but $300,000 or more might be necessary in others or for high-value assets.

Identifying Hidden Costs

Insurance quotes often omit additional fees. These can include administrative fees, policy processing fees, or fees for optional add-ons. Carefully review the fine print of each quote to identify these hidden costs. Some insurers might also charge based on factors like your credit score or driving history, impacting the final premium. For instance, a seemingly low initial quote might increase significantly after adding essential coverages or due to unforeseen fees.

Insurance Quote Review Checklist

Before making a decision, use this checklist:

- Coverage Types: Verify that all necessary coverage types (liability, collision, comprehensive, etc.) are included and meet your needs.

- Coverage Limits: Compare liability, uninsured/underinsured motorist, and medical payments coverage limits across quotes.

- Deductibles: Evaluate different deductible options and their impact on premiums.

- Premium Amount: Compare the total annual premium for each quote.

- Additional Fees: Check for administrative fees, processing fees, or other hidden costs.

- Discounts: Inquire about available discounts (e.g., good driver, multi-car, bundling).

- Customer Service: Research the insurer’s reputation for customer service and claims handling.

- Financial Stability: Consider the insurer’s financial strength and stability ratings.

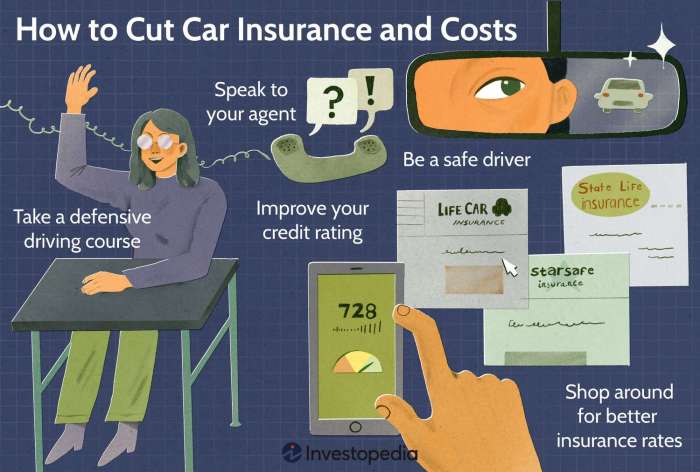

Obtaining the Best Quote

Securing the most competitive vehicle insurance quote involves a proactive approach and a thorough understanding of the market. By employing strategic techniques and leveraging available resources, you can significantly reduce your premiums and find the best coverage for your needs. This section Artikels effective strategies for obtaining the lowest possible insurance rates.

Several factors contribute to obtaining the best quote. Understanding these factors empowers you to make informed decisions and negotiate effectively with insurance providers. These factors include careful comparison shopping, leveraging discounts, and understanding your own risk profile.

Strategies for Securing Competitive Quotes

Finding the best vehicle insurance quote requires diligent comparison shopping. Don’t settle for the first quote you receive. Obtain quotes from multiple insurers, ensuring you’re comparing apples to apples—meaning the same coverage levels across providers. Utilize online comparison tools, which allow you to input your information once and receive multiple quotes simultaneously. This streamlines the process and saves you considerable time.

Negotiating Insurance Premiums

Negotiating your insurance premium can be surprisingly effective. Armed with quotes from competing insurers, you can leverage this information to negotiate a lower rate with your current provider or a prospective one. Highlight the lower rates you’ve received elsewhere and emphasize your loyalty if you’ve been a long-term customer. Be polite but firm in your negotiation, clearly stating your willingness to switch providers if a satisfactory rate isn’t offered.

Benefits of Bundling Insurance Policies

Bundling your home and auto insurance policies with the same provider often results in significant savings. Insurers frequently offer discounts for bundling, recognizing the reduced risk associated with insuring multiple policies for the same customer. This discount can substantially lower your overall premium cost, making it a financially advantageous strategy.

Switching Insurance Providers

Switching insurance providers is a straightforward process. Begin by obtaining quotes from several companies, comparing coverage and pricing. Once you’ve chosen a new provider, notify your current insurer of your intent to cancel your policy. Be sure to confirm the cancellation date and obtain proof of cancellation to avoid any lapse in coverage. Your new insurer will guide you through the necessary steps to transfer your coverage.

Illustrative Examples

Understanding how various factors influence your car insurance quote can be clearer with specific examples. Let’s look at how different driver profiles and vehicle choices impact the final cost.

This section provides two illustrative examples: a comparison of high-risk versus low-risk driver insurance quotes, followed by a comparison of quotes for different vehicle types. These examples use hypothetical data for illustrative purposes and should not be considered definitive pricing. Actual quotes will vary depending on the specific insurer and location.

High-Risk vs. Low-Risk Driver Insurance Quotes

Consider two drivers, both 30 years old, living in the same city, and with similar driving experience (5 years). Driver A, a high-risk driver, has three speeding tickets in the past two years, one at-fault accident, and a DUI conviction three years ago. Driver B, a low-risk driver, has a clean driving record with no accidents or violations. Both drivers are insuring the same make and model of a 2018 Honda Civic.

Driver A’s high-risk profile results in a significantly higher insurance premium. His history of accidents and violations signals a higher probability of future claims to the insurance company. Let’s assume his annual premium is approximately $2,500. In contrast, Driver B’s clean driving record allows for a lower-risk classification, resulting in a much lower annual premium of approximately $1,000. This difference highlights the substantial impact of driving history on insurance costs. The difference in premiums ($1,500) reflects the increased risk the insurer assumes by covering Driver A.

Insurance Quotes for Different Vehicle Types

The type of vehicle you insure also significantly impacts your insurance premium. Generally, vehicles with higher repair costs, greater theft risk, and a higher propensity for accidents command higher premiums.

Let’s compare annual insurance quotes for three different vehicle types, assuming the same driver profile (low-risk driver as described above):

* Sedan (e.g., Honda Civic): Estimated annual premium: $1,000. Sedans generally fall into a mid-range category for insurance costs due to their relatively low repair costs and average accident rates.

* SUV (e.g., Honda CRV): Estimated annual premium: $1,200. SUVs typically have higher premiums than sedans due to their larger size, potentially higher repair costs, and involvement in more severe accidents.

* Truck (e.g., Ford F-150): Estimated annual premium: $1,500. Trucks often have the highest insurance premiums because of their high repair costs, greater potential for damage in accidents, and higher theft rates. The higher power and size also contribute to the higher risk profile.

Last Recap

Finding the right vehicle insurance quote involves careful consideration of multiple factors and a proactive approach to comparison and negotiation. By understanding the intricacies of coverage types, identifying key influencing factors, and utilizing effective comparison strategies, you can confidently secure a policy that offers comprehensive protection without breaking the bank. Remember to regularly review your policy and consider adjusting coverage as your needs evolve.

FAQ Corner

What is a lapse in insurance coverage, and how does it affect my quote?

A lapse in coverage refers to a period where your vehicle wasn’t insured. Insurance companies view this negatively, often leading to higher premiums as it suggests increased risk.

Can I get a quote without providing my driving history?

No, your driving history is a critical factor in determining your risk profile and therefore your premium. Insurance companies require this information to assess your likelihood of making a claim.

How often should I review my insurance policy?

It’s recommended to review your policy at least annually, or whenever there’s a significant life change (e.g., new car, change in address, addition of a driver). This ensures your coverage remains appropriate for your circumstances.

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident.

какой впн скачать для ютуба