Navigating the world of home insurance can feel overwhelming. Understanding home insurance quotes is crucial to protecting your most valuable asset. This guide unravels the complexities of obtaining, comparing, and understanding home insurance quotes, empowering you to make informed decisions and secure the best coverage for your needs.

From understanding the factors influencing quote variations to selecting the right provider, we’ll explore every step of the process. We’ll delve into the intricacies of policy details, highlighting key terms and potential exclusions, and provide practical advice to ensure you’re fully protected. By the end, you’ll be equipped to confidently navigate the home insurance market and find a policy that provides peace of mind.

The Quote Process

Obtaining a home insurance quote is a straightforward process, but understanding the steps involved can make it more efficient. This section Artikels the typical steps, information needed, and how to compare quotes to find the best coverage for your needs. The goal is to help you navigate this process confidently and secure the most suitable home insurance policy.

Information Required for a Home Insurance Quote

Insurers need specific information to accurately assess your risk and provide a tailored quote. This typically includes details about your property, its location, and your personal circumstances. Providing accurate and complete information upfront will streamline the quoting process and avoid delays.

- Property Details: Address, year built, square footage, type of construction (e.g., brick, wood), number of stories, and any recent renovations or upgrades. Specific details about the property’s features, such as the presence of a security system or fire alarms, may also be requested.

- Coverage Needs: The level of coverage desired (e.g., dwelling coverage, personal property coverage, liability coverage). This helps determine the appropriate premium and policy limits.

- Personal Information: Your name, address, contact information, and claims history. Accurate claims history is crucial for accurate risk assessment.

- Location: Your property’s location influences the risk assessment due to factors like crime rates, natural disaster frequency (e.g., hurricanes, earthquakes), and fire risk.

Obtaining a Home Insurance Quote: A Step-by-Step Guide

The process of obtaining a home insurance quote generally involves these key steps. Following these steps will ensure a smooth and efficient process.

- Gather Necessary Information: Collect all the relevant information about your property and personal circumstances as Artikeld above. Having this readily available will speed up the application process.

- Contact Insurers: Contact multiple insurance providers either online through their websites or by phone. Many insurers offer online quote tools for convenience.

- Complete the Application: Fill out the online application or provide the necessary information to an insurance agent. Be accurate and thorough in your responses.

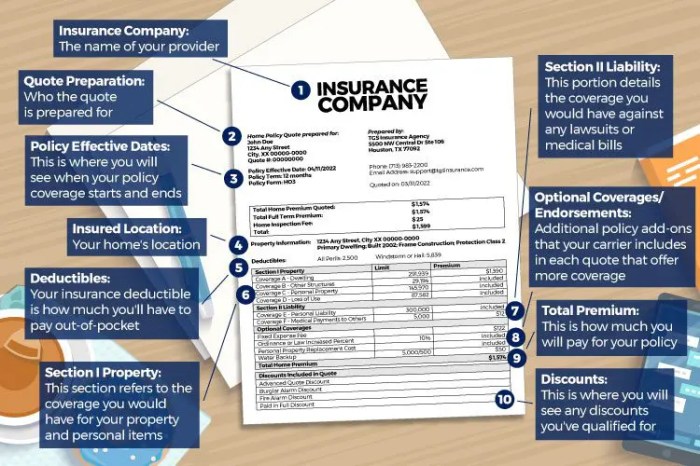

- Review the Quote: Carefully review the quote received, paying close attention to the coverage amounts, deductibles, and premium cost. Understand what is and isn’t covered.

Comparing Multiple Home Insurance Quotes

Comparing multiple quotes is essential to finding the best value for your money. Different insurers offer varying levels of coverage and pricing. Consider the following when comparing quotes:

- Coverage Amounts: Ensure the coverage amounts are sufficient to rebuild your home and replace your belongings in case of damage or loss.

- Deductibles: Higher deductibles generally result in lower premiums, but you’ll pay more out-of-pocket in case of a claim.

- Premium Costs: Compare the total annual premium cost across different insurers.

- Policy Features: Consider additional features offered, such as discounts for security systems or bundled policies.

Flowchart: Obtaining and Accepting a Home Insurance Quote

Imagine a flowchart with these boxes and connecting arrows:

Box 1: Gather Information (Property details, coverage needs, personal info) –> Box 2: Contact Insurers (Online or phone) –> Box 3: Complete Application –> Box 4: Receive Quotes –> Box 5: Compare Quotes (Coverage, Deductibles, Premiums) –> Box 6: Choose a Policy –> Box 7: Accept and Pay –> Box 8: Receive Policy Documents

This visual representation clearly illustrates the sequential steps involved in the entire process. Each step is dependent on the successful completion of the previous one, leading to the final acquisition of the home insurance policy.

Decoding the Fine Print

Understanding your home insurance policy’s details is crucial for ensuring you’re adequately protected. While the quote process focuses on price, the fine print dictates the actual coverage you receive. This section will clarify common terms, exclusions, and best practices for reviewing your policy.

Common Terms and Conditions

Home insurance policies utilize specific terminology. Familiarizing yourself with these terms is essential for comprehending your coverage. For instance, “actual cash value” (ACV) refers to the replacement cost of your property minus depreciation, while “replacement cost” covers the full cost of repairing or replacing damaged items without deducting for depreciation. Understanding the difference between these valuation methods significantly impacts your claim payout. Another key term is “deductible,” the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles mean higher premiums. Finally, “liability coverage” protects you financially if someone is injured on your property or if your actions cause damage to someone else’s property.

Examples of Exclusions and Limitations

Insurance policies often exclude specific events or types of damage. Common exclusions include damage caused by floods, earthquakes, or acts of war. These are usually covered by separate, specialized policies. Limitations may restrict the amount of coverage for certain items, such as jewelry or valuable collections. For example, a policy might cap the coverage for jewelry at a specific amount, regardless of its actual value. Another common limitation is the coverage for specific types of damage within a peril. For instance, while a policy may cover wind damage, it may have limitations on the amount covered for damage caused by wind-driven rain. Understanding these exclusions and limitations is vital to avoid surprises during a claim.

Best Practices for Reviewing Policy Documents

Thoroughly reviewing your policy is paramount. Don’t just skim it; take your time to understand each section. Start by reading the summary of coverage, then delve into the detailed policy wording. Pay close attention to the definitions of key terms, as well as the exclusions and limitations. If anything is unclear, contact your insurance provider for clarification. Don’t hesitate to ask questions; it’s better to understand your coverage completely before needing to file a claim. Consider using a highlighter to mark important sections, and keep a copy of your policy in a safe, easily accessible place.

Common Policy Exclusions and Their Implications

| Exclusion | Description | Example | Implication |

|---|---|---|---|

| Flood | Damage caused by overflowing water bodies. | Damage to your home during a hurricane surge. | Requires separate flood insurance. |

| Earthquake | Damage caused by seismic activity. | Cracks in your foundation after an earthquake. | Requires separate earthquake insurance. |

| Acts of War | Damage caused by acts of war or terrorism. | Damage to your home from a bomb blast. | Generally not covered by standard home insurance. |

| Neglect | Damage resulting from failure to maintain your property. | Roof collapse due to lack of maintenance. | Claim may be denied. |

| Intentional Damage | Damage caused deliberately by the policyholder. | Setting fire to your own home. | Claim will be denied. |

Final Thoughts

Securing adequate home insurance is a critical step in responsible homeownership. By carefully considering the factors influencing premiums, comparing quotes from various providers, and thoroughly understanding your policy details, you can confidently protect your investment and your family. Remember, a well-informed decision today translates to financial security and peace of mind for years to come. Take the time to understand your options, and choose a policy that aligns perfectly with your individual needs and circumstances.

Expert Answers

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the replacement cost minus depreciation, while replacement cost covers the full cost of replacing damaged property without considering depreciation.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever there are significant changes to your home or possessions (e.g., renovations, additions, major purchases).

Can I get a home insurance quote without providing my social security number?

While some initial information can be gathered without a social security number, it will likely be required to finalize the quote and obtain a policy.

What happens if I make a claim and my premium increases?

Premium increases after a claim are common, but the extent of the increase varies depending on the insurer and the nature of the claim.

What is an umbrella insurance policy, and should I consider it?

An umbrella policy provides additional liability coverage beyond your existing home and auto insurance. It’s worth considering if you have significant assets to protect.