Securing affordable auto insurance is a crucial step for responsible drivers. The convenience of quoting online has revolutionized the process, offering a transparent and efficient way to compare rates from various providers. This guide delves into the intricacies of online auto insurance quotes, exploring the user experience, influencing factors, and ultimately, helping you navigate the process to find the best coverage at the most competitive price.

From understanding your individual needs and comparing provider interfaces to analyzing the factors that impact your premium, we’ll break down each stage of obtaining an online auto insurance quote. We’ll also examine common pain points and suggest improvements for a smoother, more user-friendly experience. This comprehensive approach aims to empower you to make informed decisions about your auto insurance coverage.

Understanding the Search Intent

Understanding the motivations behind a search for “quote online auto insurance” is crucial for effectively reaching potential customers. The search query itself reveals a user actively seeking information and potentially a purchase, indicating a higher level of intent compared to more general searches. This intent can vary significantly based on individual circumstances and needs.

The primary driver behind this search is the desire for price comparison and convenience. Users are looking for a quick and easy way to obtain multiple auto insurance quotes without having to contact multiple companies individually. This saves time and effort, allowing for a more efficient decision-making process.

User Needs Associated with Online Auto Insurance Quotes

Users searching for online auto insurance quotes exhibit a range of needs. These needs often overlap and influence the overall search intent. Understanding these diverse needs allows for targeted marketing and content creation.

The core need is to find affordable auto insurance. This is often coupled with a need for comprehensive coverage, ensuring adequate protection against potential accidents and liabilities. Some users may prioritize specific features, such as roadside assistance or accident forgiveness, influencing their selection criteria beyond price alone. Others may be motivated by the need for a seamless and user-friendly online experience, valuing ease of navigation and quick quote generation. Finally, many users seek clarity and transparency in the quotes they receive, wanting to easily understand the coverage details and pricing structure.

Stages of the Customer Journey

The customer journey for online auto insurance quotes typically involves several distinct stages. These stages represent the progression of a user from initial awareness to potential purchase.

The initial stage is awareness. This is where the user recognizes the need for auto insurance or a new policy. This might be triggered by a new car purchase, policy renewal, or dissatisfaction with their current provider. The next stage is consideration. Here, the user actively searches for information, comparing options and researching different insurers. The search for “quote online auto insurance” falls squarely within this stage. The subsequent stage is decision. This involves evaluating the received quotes, comparing coverage options, and selecting a preferred provider. Finally, the action stage involves purchasing the chosen policy and completing the necessary paperwork. Understanding these stages allows for tailored messaging and targeted advertising at each point in the customer journey. For example, during the consideration stage, emphasizing ease of use and quick quote generation is key, while during the decision stage, highlighting specific coverage benefits and customer reviews becomes more relevant.

Competitor Analysis of Online Auto Insurance Providers

The online auto insurance market is fiercely competitive, with numerous providers vying for customers’ attention. Understanding the strengths and weaknesses of key competitors is crucial for any provider aiming for market share. This analysis compares three major players, focusing on their user interfaces, marketing strategies, and key features.

User Interface Comparison

A user-friendly website is paramount for online insurance providers. The ease of obtaining a quote directly impacts customer acquisition and retention. The following table compares the user interfaces of three leading online auto insurance providers.

| Provider Name | Website URL | Quote Process Ease | Overall User Experience |

|---|---|---|---|

| Progressive | www.progressive.com | Straightforward and intuitive; clear navigation and minimal required fields. | Positive; clean design, responsive across devices. Namely, the use of a progress bar during the quote process is helpful. |

| Geico | www.geico.com | Simple and efficient; quick quote generation with minimal clicks. | Generally positive; however, some users find the layout slightly cluttered, particularly on mobile devices. |

| State Farm | www.statefarm.com | Slightly more complex than Progressive or Geico; requires more information upfront. | Mixed reviews; while the site is comprehensive, the navigation could be improved for a smoother quote process. |

Marketing Strategies

Each provider employs distinct marketing strategies to reach its target audience. Progressive heavily utilizes advertising across various media, including television, radio, and digital platforms, often featuring memorable spokespeople and jingles. Geico focuses on humorous and memorable advertising campaigns, aiming for broad appeal. State Farm emphasizes its long-standing reputation and local agent network, building trust and brand loyalty. These differing approaches reflect each company’s brand identity and target market.

Key Features and Benefits

The features and benefits offered by each provider vary. Progressive offers a wide range of discounts and customizable coverage options. Geico emphasizes its low prices and quick, easy online quote process. State Farm highlights its comprehensive coverage, strong customer service, and established brand reputation. These distinctions allow each provider to cater to specific customer needs and preferences. For example, Progressive’s “Name Your Price® Tool” allows users to input a desired premium and see coverage options that fit within that budget. This is a key differentiator in a competitive market.

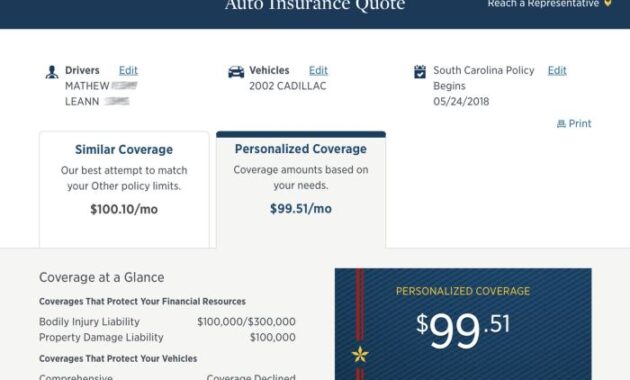

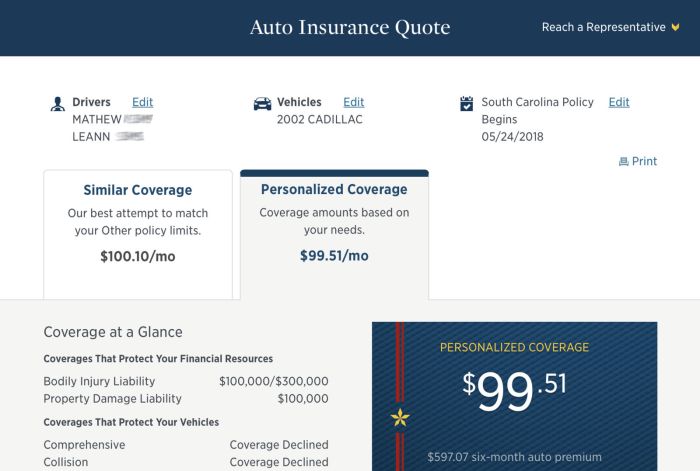

Analyzing the Quote Process

The online auto insurance quote process, while seemingly straightforward, involves several key steps that significantly impact the customer experience. A smooth, efficient process can lead to increased conversions and customer satisfaction, while a cumbersome one can result in lost leads and negative brand perception. Understanding the nuances of this process is crucial for optimizing online insurance offerings.

The typical steps involved in obtaining an online auto insurance quote generally follow a predictable pattern, although variations exist depending on the insurer. This typically begins with the initial interaction with the insurer’s website, followed by data entry, quote generation, and review. However, subtle differences in the execution of each step can greatly affect the overall user experience.

Typical Steps in the Online Auto Insurance Quote Process

The typical online auto insurance quote process usually involves these steps: initial website interaction (finding the quote tool), providing vehicle information (year, make, model, VIN), entering driver information (age, driving history, address), selecting coverage options (liability, collision, comprehensive), reviewing the quote, and finally, purchasing the policy. Each of these steps presents opportunities for improvement.

Potential Pain Points in the Online Quoting Process

Several factors can create friction during the online quoting process. For example, overly complex forms requiring excessive personal information can deter users. Long loading times or confusing navigation can also frustrate customers. Furthermore, a lack of transparency in pricing or coverage options can lead to distrust and abandonment. Inaccurate or incomplete quote information, or the inability to easily compare quotes from multiple providers on a single platform, can also cause significant problems. Finally, technical glitches or website errors can interrupt the process entirely, leading to frustration and a negative customer experience. For example, a user might encounter an error message during the submission of their application, preventing them from receiving a quote. This situation highlights the importance of robust error handling and user-friendly interface design.

Improvements to Streamline the Quote Process and Enhance User Experience

To improve the online quote process, insurers should focus on simplifying forms, reducing the number of required fields, and improving website speed and responsiveness. Implementing clear and concise language, offering interactive tools to help users understand coverage options, and providing real-time feedback during form completion can enhance user experience. Furthermore, incorporating features such as quote comparison tools, allowing users to easily save and retrieve quotes, and offering multiple payment options can increase conversion rates. Finally, providing excellent customer support options, including live chat or phone support, to address user queries or issues encountered during the process can significantly improve user satisfaction and build trust. For instance, a progress bar clearly indicating the completion stage of the quote request could help alleviate user anxiety and provide a sense of control. Additionally, integrating user-friendly tools like auto-population of data from driver’s licenses can significantly reduce the time required to complete the form.

Factors Influencing Insurance Quotes

Securing affordable auto insurance involves understanding the key factors that influence your premium. These factors are carefully considered by insurance companies to assess risk and ultimately determine the cost of your policy. This section details those factors and how they are presented during the online quoting process.

Several interconnected elements contribute to the final price you see on your online auto insurance quote. These factors are not equally weighted, and their impact varies depending on the insurer and your specific circumstances. The online quoting process typically guides you through each factor, allowing you to see how changes affect your potential premium in real-time.

Driver Characteristics

Your personal characteristics as a driver significantly impact your insurance quote. Insurance companies use this data to assess your risk profile.

- Age: Younger drivers generally pay higher premiums due to statistically higher accident rates. Older, more experienced drivers often receive discounts.

- Driving History: Accidents, traffic violations, and DUI convictions significantly increase premiums. A clean driving record usually results in lower rates.

- Credit Score: In many states, insurers consider credit history as an indicator of risk. A higher credit score often translates to lower premiums.

- Driving Experience: Years of driving experience are often correlated with lower accident rates, leading to lower premiums.

Vehicle Information

The type of vehicle you drive is a key factor in determining your insurance cost. Online quote systems usually request specific details about your car.

- Year, Make, and Model: Newer cars are generally more expensive to repair, resulting in higher premiums. The make and model also affect the cost due to safety ratings and repair costs.

- Vehicle Value: The value of your vehicle impacts the cost of collision and comprehensive coverage. More expensive cars require higher premiums for these coverages.

- Safety Features: Cars equipped with advanced safety features like anti-lock brakes, airbags, and electronic stability control often qualify for discounts.

Coverage Choices

The level of coverage you choose directly impacts your premium. Online quote tools usually provide a clear breakdown of coverage options and their associated costs.

- Liability Coverage: This covers damages or injuries you cause to others. Higher liability limits result in higher premiums.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault. Higher deductibles lower premiums.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events (e.g., theft, vandalism). Higher deductibles lower premiums.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. This coverage is often available at various limits.

Location

Your location influences your insurance rate due to variations in accident rates and crime statistics. Online quote tools typically require your address to determine this factor.

- Geographic Location: Areas with higher accident rates or theft rates tend to have higher insurance premiums.

- Parking Location: Storing your vehicle in a garage typically results in lower premiums than street parking due to reduced risk of theft or vandalism.

Impact of Changes on the Quote

Online quote systems are designed to show the impact of changes in real-time. For example, increasing your liability coverage limit will immediately increase your premium. Conversely, selecting a higher deductible will typically lower your premium for collision and comprehensive coverage. Similarly, adding safety features to your vehicle profile might result in a discount.

Visual Representation of Data

Data visualization is crucial for understanding the complexities of online auto insurance quotes. By presenting data graphically, we can identify trends and patterns that might otherwise be missed in raw numerical data. This allows for a more intuitive understanding of how factors like age, location, and driving history influence insurance premiums.

A useful visual representation of the distribution of insurance quotes across different demographics could be a grouped bar chart. The horizontal axis would represent the different demographic groups, such as age ranges (e.g., 18-25, 26-35, 36-45, 46-55, 55+), gender (male, female), and location (urban, suburban, rural). The vertical axis would represent the average insurance quote in dollars. Each demographic group would have multiple bars representing different average quote amounts based on driving history (e.g., clean record, one at-fault accident, multiple accidents). This would allow for a clear comparison of average quote costs across various demographic segments and driving history, revealing potential disparities or trends. For instance, we might observe higher average quotes for younger drivers with less driving experience or those residing in urban areas with higher accident rates. The bars could be color-coded to enhance readability and easily highlight specific trends.

Online Auto Insurance Quote Process Flowchart

A flowchart provides a clear, step-by-step illustration of the online auto insurance quote process. This visual representation is beneficial for both insurance providers and consumers. Providers can use it to optimize their processes, while consumers can better understand what information is needed and what to expect during the quote generation process.

The flowchart would begin with a “Start” node. The subsequent steps would include: 1) Entering basic information (name, address, date of birth); 2) Specifying vehicle details (make, model, year); 3) Providing driving history (accidents, violations, driving experience); 4) Selecting coverage options (liability, collision, comprehensive); 5) Answering additional questions (e.g., garaging location, daily commute distance); 6) Reviewing the quote details; 7) Submitting the application; and 8) Receiving the quote. Each step would be represented by a rectangle, with arrows connecting them to show the sequential flow. Decision points, such as choosing coverage levels, could be represented by diamonds. The flowchart would conclude with an “End” node. This visual guide simplifies the process, making it easily understandable for users navigating the online platform. The use of clear and concise labels on each step would further enhance the clarity and user-friendliness of the flowchart.

Final Review

Obtaining an online auto insurance quote needn’t be a daunting task. By understanding the process, comparing providers, and considering the various factors that influence premiums, you can effectively secure the best coverage for your needs. Remember to carefully review policy details and compare quotes from multiple providers before making a final decision. Empowered with the right information, you can confidently navigate the online auto insurance landscape and find the perfect policy.

FAQs

What information do I need to get an online auto insurance quote?

Typically, you’ll need your driver’s license information, vehicle details (year, make, model), address, and driving history. Some providers may ask for additional information.

Are online auto insurance quotes binding?

No, online quotes are generally not binding. They provide an estimate of your potential premium, and the final price may vary slightly after a full application review.

Can I get a quote without providing my personal information?

Most providers require some personal information to generate a personalized quote. However, some may offer a preliminary estimate based on general information.

How often should I compare auto insurance quotes?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change (e.g., new car, change of address, improved driving record).