Navigating the world of car insurance can feel like driving through a fog. Numerous providers, varying coverage options, and fluctuating costs make finding the right policy a daunting task. This guide leverages the expertise of Consumer Reports, a trusted source for unbiased product evaluations, to illuminate the path towards securing optimal car insurance coverage tailored to your individual needs and budget.

We’ll delve into Consumer Reports’ methodology for evaluating car insurance providers, exploring the criteria they use, the weighting system employed, and the data sources they rely upon. This analysis will equip you with the knowledge to interpret their findings effectively and make informed decisions about your insurance policy. We’ll also examine recommended coverage levels, cost-influencing factors, and provide practical tips for securing affordable and comprehensive protection.

Consumer Reports’ Methodology for Car Insurance Evaluations

Consumer Reports, a highly respected non-profit organization, employs a rigorous methodology to evaluate car insurance providers. Their rankings are designed to help consumers make informed decisions based on a comprehensive assessment of factors beyond just price. The methodology prioritizes customer satisfaction and claims handling alongside financial strength, avoiding biases toward specific companies.

Consumer Reports’ ranking system considers several key criteria to provide a holistic view of insurance companies. These criteria are weighted to reflect their relative importance in the overall consumer experience.

Criteria Used in Consumer Reports’ Car Insurance Rankings

Consumer Reports utilizes a multi-faceted approach, considering both quantitative and qualitative data to arrive at its rankings. The criteria fall broadly into the categories of customer satisfaction, claims handling, and financial strength. Each of these categories is further broken down into specific metrics. For example, customer satisfaction is measured through surveys assessing factors like ease of communication, claims processing speed, and overall customer service experience. Claims handling is evaluated by examining the timeliness and fairness of claim settlements. Financial strength is determined through an analysis of the insurer’s financial stability and ability to meet its obligations.

Weighting System for Evaluation Factors

While Consumer Reports doesn’t publicly disclose the exact weighting of each factor in its proprietary algorithm, it’s understood that customer satisfaction holds significant weight. This reflects the organization’s focus on the consumer experience. Claims handling also plays a crucial role, as it directly impacts how customers perceive the insurer during a stressful time. Financial strength, though less directly experienced by the consumer, is critical for ensuring the long-term viability of the insurer and the security of policyholders. The weights are likely adjusted periodically based on evolving industry trends and consumer feedback. A hypothetical example might show customer satisfaction accounting for 40%, claims handling for 35%, and financial strength for 25% of the overall score, but these percentages are illustrative and not confirmed by Consumer Reports.

Data Sources for Consumer Reports’ Evaluations

Consumer Reports draws upon multiple sources for its data. A primary source is its own extensive annual customer surveys, which collect feedback from a large and diverse sample of car insurance policyholders. This provides direct insights into customer experiences. In addition, Consumer Reports analyzes data from state insurance departments, which provides information on claims handling and financial stability. Finally, Consumer Reports also utilizes publicly available financial information from insurance companies, including annual reports and regulatory filings, to assess their financial strength and solvency. The combination of these sources allows for a robust and well-rounded evaluation.

Comparison of Consumer Reports’ Methodology with Other Rating Agencies

| Provider | Methodology | Data Sources | Weighting System |

|---|---|---|---|

| Consumer Reports | Customer surveys, claims data analysis, financial strength assessment | Consumer surveys, state insurance departments, public financial filings | Proprietary, emphasizes customer satisfaction |

| AM Best | Financial strength rating based on quantitative analysis | Financial statements, regulatory filings | Proprietary, focused on financial metrics |

| J.D. Power | Customer satisfaction surveys and vehicle reliability data | Customer surveys, vehicle registration data | Proprietary, balances satisfaction and vehicle performance |

| NAIC (National Association of Insurance Commissioners) | Regulatory compliance and financial solvency monitoring | Insurance company filings, state regulatory data | Compliance-based, not a consumer-oriented rating |

Recommended Coverage Types Highlighted by Consumer Reports

Consumer Reports, a highly respected source for consumer advice, provides valuable insights into car insurance coverage. They don’t endorse specific insurers but offer guidance on selecting appropriate coverage levels to balance cost and protection. Understanding their recommendations can significantly impact your financial security in the event of an accident.

Choosing the right car insurance coverage involves carefully considering your individual needs and risk tolerance. Consumer Reports emphasizes the importance of having adequate coverage to protect yourself financially from unexpected events. This involves understanding the minimum requirements mandated by your state, as well as exploring the benefits of supplemental coverage.

Minimum Recommended Coverage Levels

Consumer Reports generally recommends meeting, at a minimum, your state’s legally mandated liability coverage. This typically includes bodily injury and property damage liability. These coverages protect you financially if you cause an accident that injures someone or damages their property. Failing to carry at least the minimum required liability insurance can result in significant financial penalties and legal ramifications. The specific minimum amounts vary widely by state; some states have considerably higher minimums than others. For example, a state might require a minimum of $25,000 per person/$50,000 per accident for bodily injury liability and $10,000 for property damage liability, while another might require much higher limits. It’s crucial to check your state’s requirements and understand the implications of insufficient coverage.

Benefits of Additional Coverage Options

While minimum liability coverage protects others involved in accidents you cause, it doesn’t protect you or your vehicle. Consumer Reports highlights the value of additional coverage options, such as comprehensive, collision, and uninsured/underinsured motorist coverage.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or hail. A benefit is peace of mind knowing your vehicle is protected against a wide range of unforeseen circumstances. A potential drawback is the higher premium compared to liability-only coverage. For example, if a tree falls on your car during a storm, comprehensive coverage would repair or replace your vehicle.

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. The benefit is protection for your vehicle even if you are at fault for the accident. A drawback is the increased cost. If you are involved in an accident where your car sustains damage, collision coverage will pay for repairs or replacement.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident caused by an uninsured or underinsured driver. The benefit is crucial protection in a situation where the other driver lacks sufficient coverage to compensate you for your injuries or vehicle damage. A potential drawback is the additional cost; however, the potential cost of medical bills or vehicle repairs without this coverage far outweighs the premium.

Cost-Benefit Ratio of Various Coverage Options

Consumer Reports emphasizes analyzing the cost-benefit ratio of each coverage option. The optimal balance depends on factors like the age and value of your vehicle, your driving record, and your financial situation. Generally, newer or more expensive vehicles warrant higher coverage levels, as the repair or replacement costs would be significantly greater. A driver with a clean driving record might qualify for lower premiums, while someone with multiple accidents or traffic violations might face higher costs. For older vehicles with lower value, the cost of comprehensive and collision coverage might outweigh the benefits, making liability-only coverage a more financially viable option. However, uninsured/underinsured motorist coverage remains valuable regardless of vehicle age or value, due to the significant risk of accidents with uninsured drivers. Consumer Reports’ analysis often involves comparing premiums from different insurers for various coverage levels to help consumers make informed decisions.

Factors Influencing Car Insurance Costs According to Consumer Reports

Several key factors significantly influence the cost of car insurance, as detailed by Consumer Reports. Understanding these factors can help consumers make informed decisions and potentially save money on their premiums. These factors interact in complex ways, and the overall cost is a result of a comprehensive risk assessment performed by insurance companies.

Driving History’s Impact on Insurance Premiums

A driver’s history is a primary determinant of insurance costs. Insurance companies meticulously track accidents, traffic violations, and even the number of claims filed. A clean driving record, characterized by an absence of accidents and tickets, typically results in lower premiums. Conversely, accidents and violations, especially serious ones like DUIs, lead to significantly higher premiums, reflecting the increased risk associated with such events. The severity and frequency of incidents are factored into the calculation, with multiple incidents leading to more substantial increases. For example, a driver with two at-fault accidents in the past three years would likely pay considerably more than a driver with a spotless record. Consumer Reports consistently emphasizes the importance of maintaining a clean driving record to secure favorable insurance rates.

Age and Location’s Influence on Car Insurance Costs

Age is another significant factor. Younger drivers, particularly those under 25, generally face higher premiums due to statistically higher accident rates within this demographic. As drivers age and gain experience, their premiums often decrease, reflecting the reduced risk they pose. Location also plays a crucial role, with premiums varying considerably depending on the state and even the specific zip code. Areas with high accident rates or crime levels tend to have higher insurance costs to reflect the increased likelihood of claims. For instance, a young driver living in a densely populated urban area with high crime rates will likely pay more than an older driver residing in a rural area with a low accident history. Consumer Reports data consistently highlights these geographic variations in insurance costs.

Vehicle Type and Value’s Role in Determining Premiums

The type and value of the vehicle are also key factors in determining insurance costs. Generally, sports cars and other high-performance vehicles command higher premiums due to their increased potential for accidents and higher repair costs. Luxury vehicles, even if not high-performance, also tend to have higher premiums due to their greater value and more expensive repair bills. Conversely, smaller, less expensive vehicles typically attract lower premiums. The vehicle’s safety features, such as anti-lock brakes and airbags, also play a role, with vehicles equipped with advanced safety technologies potentially qualifying for discounts. Consumer Reports frequently analyzes the insurance costs associated with different vehicle makes and models, providing valuable insights for consumers.

| Factor | Impact on Cost | Example | Consumer Reports’ Data Point |

|---|---|---|---|

| Driving History | Clean record = lower cost; accidents/violations = higher cost | Two at-fault accidents: significantly higher premiums compared to a clean record. | Studies show at-fault accidents can increase premiums by 40% or more. |

| Age | Younger drivers (under 25): higher premiums; older drivers: lower premiums | 20-year-old driver: higher premium than a 40-year-old driver with similar driving history. | Premiums often peak in the early 20s and gradually decrease with age. |

| Location | High accident/crime rates = higher premiums; low accident/crime rates = lower premiums | Urban area with high crime: higher premiums than a rural area with low crime. | Significant variations in premiums exist across states and zip codes. |

| Vehicle Type & Value | High-performance/luxury vehicles: higher premiums; smaller, less expensive vehicles: lower premiums | Sports car: higher premium than a compact car, even with similar driving history. | Vehicle type and value are major factors in calculating the cost of collision and comprehensive coverage. |

Consumer Reports’ Analysis of Specific Insurance Providers

Consumer Reports regularly assesses major car insurance providers, analyzing their performance across various key metrics to help consumers make informed decisions. Their evaluations go beyond simple price comparisons, incorporating factors such as customer satisfaction, claims handling efficiency, and the overall ease of doing business with the insurer. This analysis summarizes their findings, highlighting both strengths and weaknesses of prominent companies.

Summary of Consumer Reports’ Ratings for Major Car Insurance Companies

Consumer Reports’ ratings are not static and change over time based on their ongoing surveys and data analysis. However, a general overview can be provided based on their typical evaluation methodology. They often categorize companies based on overall score, factoring in the above-mentioned metrics. High-scoring companies frequently demonstrate superior customer service, efficient claims processing, and competitive pricing. Conversely, lower-scoring companies might struggle in one or more of these areas. Note that specific rankings vary from year to year.

Categorization of Insurance Providers Based on Strengths and Weaknesses

Providers are often categorized into tiers reflecting their overall performance. A “Top Performer” tier might include companies consistently scoring highly across all metrics. A “Mid-Range” tier would encompass companies with some strengths and some weaknesses, possibly excelling in one area but lagging in another (e.g., excellent customer service but higher-than-average pricing). A “Needs Improvement” tier would include companies consistently receiving lower scores, indicating significant issues in customer satisfaction, claims handling, or pricing. Specific company names are omitted here as rankings fluctuate.

Examples of Positive and Negative Experiences Reported by Consumer Reports’ Subscribers

Consumer Reports compiles feedback from its subscribers, providing valuable insights into real-world experiences. Positive experiences often involve praise for efficient claims processing – a subscriber might detail how a claim was settled quickly and fairly, with minimal hassle. Conversely, negative experiences often center around poor customer service – a subscriber might describe difficulties contacting customer support, lengthy wait times, or feeling unfairly treated during a claim. Another common complaint involves unexpected price increases or difficulties understanding policy terms and conditions.

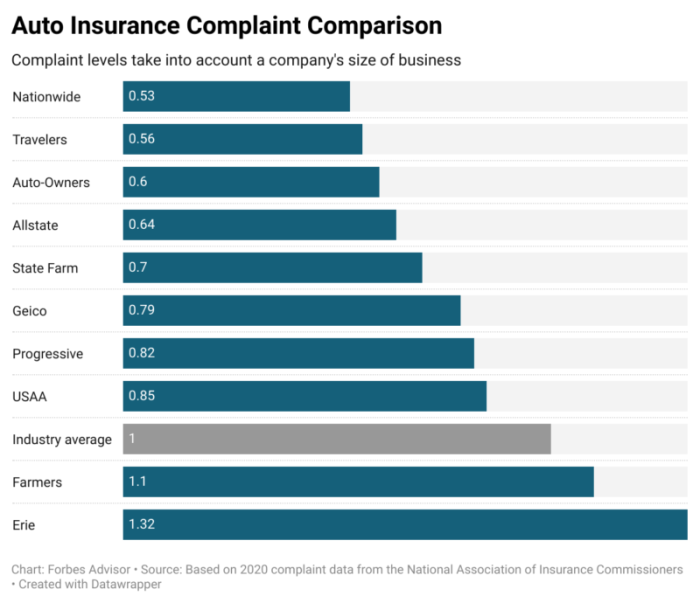

Visual Representation of Provider Performance

A bar chart could effectively compare top-rated providers across key metrics. The horizontal axis would list the names of three top-rated providers (Provider A, Provider B, Provider C, for example). The vertical axis would represent the score (e.g., 0-100), with different colored bars representing each metric: Customer Satisfaction (blue), Claim Handling (green), and Pricing (orange).

For example: Provider A might have a Customer Satisfaction score of 90, Claim Handling of 85, and Pricing of 75. Provider B could show 80, 90, and 80 respectively. Provider C might have scores of 75, 80, and 90. This visual representation would clearly highlight each provider’s relative strengths and weaknesses across the three key areas, allowing for easy comparison and consumer insight. The chart’s title would be “Comparison of Top-Rated Car Insurance Providers.” Each bar would be clearly labeled with the provider’s name and the corresponding score for each metric. A legend would explain the color-coding of the bars.

Tips for Consumers Based on Consumer Reports’ Findings

Consumer Reports provides valuable insights into the car insurance market, empowering consumers to make informed decisions and secure the best possible coverage at a reasonable price. By understanding their findings and applying the strategies Artikeld below, you can significantly improve your car insurance experience. This section offers practical advice for navigating the complexities of car insurance and achieving savings.

Effectively utilizing Consumer Reports’ data requires a proactive approach to insurance management. This involves understanding your needs, actively comparing quotes, and regularly reviewing your policy to ensure it continues to meet your evolving circumstances. Failing to do so could lead to overpaying for unnecessary coverage or, conversely, being underinsured in the event of an accident.

Strategies for Negotiating Lower Premiums

Negotiating lower premiums is often possible, and Consumer Reports emphasizes the importance of this step. Don’t be afraid to contact your insurer and discuss your options. Many factors influence your premium, and by highlighting positive aspects of your driving record, or exploring discounts for bundling policies, you can often secure a more favorable rate. For instance, maintaining a clean driving record for several years is often rewarded with lower premiums. Similarly, bundling your car insurance with homeowners or renters insurance can frequently lead to significant savings. Furthermore, inquire about discounts for safety features in your vehicle, such as anti-theft devices or advanced driver-assistance systems. Finally, consider paying your premium in full annually; insurers often offer discounts for this payment method.

A Step-by-Step Guide for Comparing Insurance Quotes Effectively

Comparing quotes is crucial for finding the best value. Start by identifying your needs – liability, collision, comprehensive, etc. – then obtain quotes from at least three different insurers. Use online comparison tools, but also contact insurers directly to ensure you get personalized quotes. Make sure you’re comparing apples to apples; ensure the coverage levels are identical across all quotes. Carefully review the policy details of each quote, paying close attention to deductibles and coverage limits. Don’t just focus on the price; consider the insurer’s reputation and customer service ratings as reported by organizations like Consumer Reports. Finally, document all quotes and compare them side-by-side to identify the best option that balances price and coverage.

The Importance of Regularly Reviewing and Adjusting Insurance Coverage

Your insurance needs can change over time. A regular review – ideally annually, or whenever significant life changes occur – is essential. Life changes such as getting married, buying a new car, or moving to a different location can all affect your insurance needs and premiums. Reviewing your policy allows you to adjust coverage levels to reflect your current circumstances and ensure you are neither overpaying nor underinsured. Consider the value of your vehicle and its potential replacement cost; ensure your coverage limits adequately reflect this. Similarly, evaluate the deductibles on your policy; a higher deductible may lower your premium, but it also means you’ll pay more out-of-pocket in the event of a claim. Regular review allows for optimal balance between cost and coverage.

Last Word

Ultimately, securing the right car insurance coverage involves a careful consideration of your individual circumstances, risk tolerance, and budget. By understanding Consumer Reports’ evaluation methodology and applying the practical tips Artikeld in this guide, you can confidently navigate the complexities of car insurance and obtain a policy that offers both comprehensive protection and value for your money. Remember to regularly review and adjust your coverage as your needs and circumstances evolve.

General Inquiries

What is the difference between liability and comprehensive coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Comprehensive coverage protects your own vehicle against damage from non-collision events like theft, vandalism, or weather.

How often should I review my car insurance policy?

It’s recommended to review your policy at least annually, or whenever there’s a significant life change (e.g., new car, change in driving habits, move to a new location).

Can I negotiate my car insurance premiums?

Yes, many insurers are open to negotiation. Shop around for quotes and use them as leverage to negotiate a lower rate with your current provider.

What factors does Consumer Reports NOT consider in their ratings?

While Consumer Reports considers many factors, their methodology may not encompass every aspect relevant to every consumer. Specific discounts offered, customer service experiences beyond claims handling, and the insurer’s financial stability beyond claim-paying ability might not be explicitly weighted.