Securing affordable and comprehensive renter’s insurance can feel overwhelming. Navigating the complexities of coverage, comparing quotes, and understanding policy details requires careful consideration. This guide simplifies the process, providing insights into obtaining the best renter’s insurance quotes tailored to your needs and budget, ultimately protecting your valuable possessions and peace of mind.

We’ll explore key factors influencing quote prices, including location, coverage amounts, and the reputation of insurance providers. We’ll also delve into the essential elements of a renter’s insurance policy, highlighting crucial terms, conditions, and common exclusions. By the end, you’ll be equipped to confidently compare quotes and choose a policy that offers optimal protection at a competitive price.

Understanding Renter’s Insurance

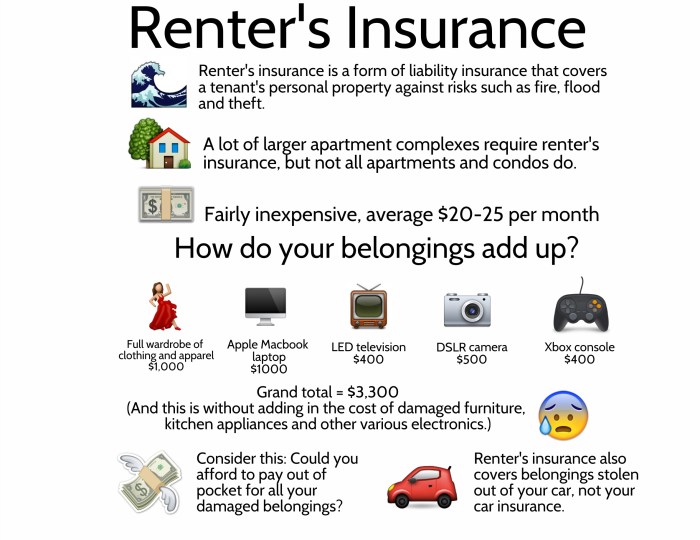

Renter’s insurance, often overlooked, provides crucial financial protection for renters against unforeseen events. It’s a relatively inexpensive policy that can safeguard your belongings and offer liability coverage, preventing significant financial hardship in the event of damage or loss. Understanding its components and benefits is essential for securing your personal assets and peace of mind.

Core Components of a Renter’s Insurance Policy

A typical renter’s insurance policy consists of several key components designed to cover various aspects of your tenancy. These components work together to offer comprehensive protection against a range of potential risks. The specific coverage details will vary depending on the insurer and chosen policy.

Personal Property Coverage

This component covers the loss or damage to your personal belongings, such as furniture, electronics, clothing, and other possessions. Coverage typically extends to theft, fire, water damage, and other specified perils. For instance, if a fire damages your apartment, your renter’s insurance would compensate you for the value of your lost or damaged possessions, up to the policy’s limit. It’s important to note that coverage often includes off-premises losses, meaning your belongings are protected even when they’re not in your apartment.

Liability Coverage

Liability coverage protects you from financial responsibility if someone is injured or their property is damaged on your premises, and you are deemed legally responsible. For example, if a guest trips and falls in your apartment, injuring themselves, your liability coverage would help pay for their medical expenses and any legal fees. This coverage is crucial as it can prevent significant financial burdens from lawsuits.

Additional Living Expenses Coverage

This coverage helps pay for temporary living expenses if your apartment becomes uninhabitable due to a covered event, such as a fire or a burst pipe. This could include hotel costs, meals, and other essential expenses while your apartment is being repaired or rebuilt. This ensures you have a safety net during a difficult time and reduces the financial stress associated with displacement.

Examples of Beneficial Situations

Renter’s insurance proves invaluable in several scenarios. Imagine a scenario where a burst pipe floods your apartment, damaging your furniture and electronics. Renter’s insurance would cover the cost of replacing these items. Similarly, if a fire breaks out in your building and destroys your possessions, your policy would compensate you for your losses. Another example is a theft; renter’s insurance will help you replace stolen items. Even a simple incident like a guest’s accidental damage to your property can be covered.

Cost-Benefit Ratio of Renter’s Insurance

The cost of renter’s insurance is generally quite low, often ranging from $15 to $30 per month, depending on location, coverage, and deductibles. Considering the potential costs of replacing lost or damaged belongings, or facing legal liabilities, the cost of the insurance is significantly outweighed by the benefits it provides. The peace of mind alone makes the relatively small premium a worthwhile investment. For example, replacing a laptop, a television, and furniture after a fire could cost thousands of dollars, far exceeding the annual cost of renter’s insurance. The potential savings far surpass the monthly premium.

Factors Affecting Renter’s Insurance Quotes

Several key factors influence the cost of renter’s insurance. Understanding these elements can help you make informed decisions and potentially secure a more affordable policy. This section will explore the primary drivers of price variation in renter’s insurance quotes.

Location’s Impact on Premiums

Your location significantly impacts your renter’s insurance premium. Areas with higher crime rates, a greater frequency of natural disasters (like hurricanes, earthquakes, or wildfires), or a higher cost of living generally command higher premiums. Insurance companies assess risk based on historical claims data for specific geographic areas. For example, a coastal apartment in a hurricane-prone region will likely be more expensive to insure than an apartment in a low-risk inland location. The higher the perceived risk, the higher the premium.

Coverage Amounts and Their Influence on Cost

The amount of coverage you choose directly affects your premium. Higher coverage limits for personal belongings and liability protection will naturally result in higher premiums. This is because the insurance company is assuming a greater financial responsibility. For instance, choosing a $100,000 coverage limit for your belongings will cost more than a $50,000 limit, reflecting the increased potential payout in case of a loss. It’s crucial to strike a balance between adequate protection and affordability.

Pricing Variations Among Insurance Providers

Different insurance providers utilize varying algorithms and risk assessment models, leading to price differences for seemingly identical coverage. Each company has its own underwriting criteria and pricing structures. Comparing quotes from multiple providers is essential to find the most competitive rate. For example, one company might weigh crime statistics more heavily than another, while another might focus more on the age of the building. Shopping around ensures you’re not overpaying.

| Factor | Impact | Example |

|---|---|---|

| Location | Higher risk areas (crime, natural disasters) lead to higher premiums. | Coastal apartment in hurricane zone vs. inland apartment. |

| Coverage Amount | Higher coverage limits for belongings and liability result in higher premiums. | $100,000 coverage vs. $50,000 coverage for personal property. |

| Insurance Provider | Different companies have different pricing structures and risk assessments. | Company A quotes $20/month, Company B quotes $25/month for the same coverage. |

| Deductible | Higher deductible leads to lower premium, but higher out-of-pocket costs in case of a claim. | $500 deductible vs. $1000 deductible. |

Obtaining Renter’s Insurance Quotes

Securing the best renter’s insurance requires comparing quotes from multiple providers. This involves a systematic approach to ensure you’re getting the most comprehensive coverage at the most competitive price. The process, while seemingly daunting, can be streamlined with a clear understanding of the steps involved.

The Process of Obtaining Quotes from Different Insurance Companies

Obtaining renter’s insurance quotes typically involves contacting individual insurance companies directly, either online or by phone, and providing them with necessary information about your rental property and belongings. Many companies offer online quote tools, allowing for a quick and convenient comparison. This approach offers flexibility and control over the selection process. Alternatively, you can contact independent insurance agents who can provide quotes from multiple insurers simultaneously, simplifying the comparison process. Remember to be prepared to provide accurate information about your apartment or house, its location, the value of your belongings, and your desired coverage limits.

Comparing Quotes from Various Providers: A Step-by-Step Guide

A systematic approach to comparing quotes is crucial to finding the best policy. The following steps Artikel a structured method:

- Gather Quotes: Collect at least three to five quotes from different insurers. Utilize online quote tools and contact agents to broaden your options.

- Standardize Information: Ensure all quotes cover the same level of liability and personal property coverage. Note any differences in deductibles.

- Analyze Coverage Details: Carefully review each policy’s coverage details, paying close attention to exclusions and limitations. Compare the specifics of what’s included in each policy.

- Compare Premiums: Once you have comparable quotes, focus on the premium costs. Consider the overall cost, including any additional fees or discounts.

- Evaluate Customer Service: Consider the reputation of each insurer and their customer service responsiveness. Look for online reviews or ratings.

- Read Policy Documents: Before making a final decision, carefully review the full policy documents of your top choices to fully understand the terms and conditions.

A Flowchart Illustrating the Process of Obtaining and Comparing Renter’s Insurance Quotes

Imagine a flowchart. It would begin with a box labeled “Start.” The next box would be “Gather Information (Address, belongings value, etc.).” This would branch to two boxes: “Obtain Quotes Online” and “Contact Insurance Agents.” Both branches lead to a box labeled “Collect Quotes.” From there, the process moves to “Compare Coverage and Premiums.” This box leads to “Analyze Customer Service and Reviews.” Finally, the process ends with a box labeled “Choose Policy,” followed by “End.”

Best Practices for Effectively Navigating the Quote Comparison Process

To optimize your quote comparison, consider these practices:

- Maintain Accuracy: Provide accurate information consistently across all quote requests to ensure apples-to-apples comparisons.

- Prioritize Needs: Determine your coverage needs before requesting quotes to focus on policies that align with your priorities.

- Utilize Online Tools: Leverage online comparison tools to streamline the process and save time.

- Ask Questions: Don’t hesitate to clarify any uncertainties with insurance providers before making a decision.

- Check for Discounts: Inquire about potential discounts, such as bundling with other insurance policies or security system installations.

Understanding Policy Details

Before committing to a renter’s insurance policy, meticulously reviewing the policy documents is crucial. Understanding the specifics of your coverage will ensure you’re adequately protected and avoid unpleasant surprises in the event of a claim. This section will highlight key aspects to consider.

Key Terms and Conditions

A standard renter’s insurance policy includes several key terms and conditions that define your coverage. These terms dictate what is and isn’t covered, the extent of coverage, and your responsibilities as the policyholder. For example, the policy will clearly state the coverage limits for personal property, liability, and additional living expenses. It will also Artikel the process for filing a claim, including the necessary documentation and reporting timelines. The policy will specify the types of perils covered (e.g., fire, theft, wind damage) and any exclusions. Furthermore, it will detail the policy’s cancellation clause, explaining the circumstances under which the policy can be terminated by either the insurer or the policyholder. Understanding these conditions ensures you know exactly what protection you’re purchasing.

Common Exclusions and Limitations

Renter’s insurance policies typically exclude certain events or types of damage. Understanding these exclusions is vital to avoid false expectations. Common exclusions often include damage caused by floods, earthquakes, and acts of war. Specific exclusions can vary depending on the insurer and the specific policy. There might also be limitations on the amount of coverage for certain items, such as jewelry or electronics. For example, a policy might have a sub-limit on the amount it will pay for a single piece of jewelry, regardless of its overall value. Similarly, there might be limitations on coverage for certain types of losses, such as gradual damage or wear and tear. A thorough review of the policy document will identify these specific exclusions and limitations, allowing for informed decision-making.

Deductible and Coverage Limits

The deductible and coverage limits are two critical elements that define the financial responsibilities of both the insurer and the policyholder. The deductible is the amount you, the policyholder, are responsible for paying out-of-pocket before the insurance coverage kicks in. For instance, if your deductible is $500 and you suffer a $2,000 loss, you would pay the first $500, and the insurance company would cover the remaining $1,500. Coverage limits, on the other hand, represent the maximum amount the insurance company will pay for a covered loss. If your personal property coverage limit is $10,000, and you suffer a loss exceeding that amount, you will be responsible for the difference. Understanding both the deductible and coverage limits allows you to assess the financial implications of choosing a particular policy and select a plan that aligns with your budget and risk tolerance. For example, a higher deductible typically leads to lower premiums, while a higher coverage limit provides greater protection but may come with higher premiums. Careful consideration of these factors is essential in selecting a suitable policy.

Illustrative Scenarios

Understanding renter’s insurance is best achieved through real-world examples. The following scenarios illustrate both covered and uncovered losses, the importance of liability coverage, and the financial benefits of having insurance.

Covered Loss and Claims Process

Imagine Sarah, a renter in a city apartment, experiences a burst pipe during a severe winter storm. The resulting water damage severely affects her furniture, electronics, and personal belongings. Because she has renter’s insurance with a policy that includes water damage coverage, she files a claim. The claims process typically involves reporting the incident to her insurance company, providing documentation (photos of the damage, receipts for damaged items), and cooperating with an adjuster’s assessment of the damage. After the adjuster’s inspection, Sarah receives compensation to replace or repair her damaged belongings, up to her policy’s coverage limits. The process might take several weeks, depending on the extent of the damage and the insurance company’s procedures.

Uncovered Loss

Consider Mark, who lives in the same apartment building as Sarah. He leaves his apartment door unlocked while he’s at work. Upon returning, he discovers his apartment has been burglarized, and valuable electronics and jewelry are missing. While Mark has renter’s insurance, his policy has a clause requiring him to take reasonable precautions to secure his property. Because he left his door unlocked, his claim for the stolen items is likely to be denied, as the loss is considered to be a result of his negligence.

Benefits of Adequate Liability Coverage

Let’s say David, another renter in the building, accidentally starts a fire in his kitchen while cooking. The fire spreads, causing significant damage not only to his apartment but also to those of his neighbors, including Sarah’s. If David has adequate liability coverage in his renter’s insurance policy, the insurance company will cover the costs of repairing or replacing Sarah’s damaged belongings, as well as any medical expenses she might incur due to the fire. Without sufficient liability coverage, David would be personally responsible for these potentially substantial costs.

Cost Comparison: Replacing Damaged Belongings

Scenario 1: Without Insurance

Imagine a fire damages Lisa’s apartment, destroying a laptop worth $1500, a $500 television, and $1000 worth of clothing. Replacing these items would cost her $3000 out-of-pocket.

Scenario 2: With Insurance

If Lisa had renter’s insurance with a $1000 deductible and a coverage limit sufficient to cover the losses, she would only need to pay the $1000 deductible. The insurance company would cover the remaining $2000, significantly reducing her financial burden. The actual cost savings would depend on the specific policy details and the deductible amount.

Finding Reliable Insurance Providers

Choosing the right renter’s insurance provider is crucial for ensuring your belongings are adequately protected. A reliable provider offers not only competitive rates but also dependable service and financial stability, guaranteeing your claim will be handled efficiently and fairly should the need arise. Carefully evaluating potential providers based on specific criteria is essential to finding the best fit for your needs and budget.

Finding a trustworthy renter’s insurance provider involves a thorough assessment of their financial strength, customer service reputation, and policy offerings. Ignoring this step could lead to difficulties filing claims or dealing with unexpected policy changes. A comprehensive approach to provider selection ensures peace of mind knowing your insurance coverage is secure and reliable.

Provider Ratings and Reviews

Checking provider ratings and reviews from independent sources is paramount in evaluating the reliability of an insurance provider. These assessments offer insights into the experiences of other customers, providing valuable information about the provider’s claims processing speed, customer service responsiveness, and overall policy satisfaction. Sites such as the Better Business Bureau (BBB), J.D. Power, and independent review platforms like Yelp and Google Reviews offer a wealth of consumer feedback, allowing potential customers to make informed decisions. Look for consistent positive feedback across multiple platforms to identify trustworthy providers. Pay close attention to negative reviews to understand potential areas of concern. For example, a consistently low rating for claim processing speed might indicate potential issues with receiving timely assistance in case of an emergency.

Resources for Finding Reputable Providers

Several resources can assist in identifying reputable renter’s insurance providers. Independent rating agencies like A.M. Best provide financial strength ratings for insurance companies, indicating their ability to pay claims. Consumer advocacy groups, such as the National Association of Insurance Commissioners (NAIC), offer resources and information on consumer rights and complaint resolution processes. Comparison websites, while often focusing on price, can also provide information about provider ratings and customer reviews. Utilizing these resources in conjunction allows for a more comprehensive evaluation of potential insurers. For example, a comparison website might list several companies with competitive pricing, but checking their ratings on A.M. Best will reveal their financial stability, helping you make an informed decision.

Information to Look for When Researching Insurance Companies

When researching insurance companies, several key pieces of information should be considered. This includes the company’s financial strength rating from agencies like A.M. Best, which indicates their ability to meet their financial obligations. Customer reviews and ratings from various sources provide valuable insights into the company’s customer service, claims handling process, and overall policyholder experience. The company’s history and length of time in business offer an indication of their stability and experience in the industry. Finally, the details of their specific policies, including coverage options, deductibles, and exclusions, are essential to understand before making a decision. For example, a company with a high A.M. Best rating and positive customer reviews suggests a reliable and trustworthy provider. Conversely, a company with a low rating and numerous negative reviews should raise concerns.

Closing Summary

Finding the right renter’s insurance doesn’t have to be a daunting task. By understanding the factors that influence quotes, diligently comparing options from reputable providers, and carefully reviewing policy details, you can secure comprehensive coverage that aligns with your individual needs and budget. Remember, proactive planning and informed decision-making are key to safeguarding your belongings and financial well-being.

FAQ Corner

What is the average cost of renter’s insurance?

The average cost varies significantly based on location, coverage amount, and the insurer. Expect to pay anywhere from $15 to $30 per month.

Can I get renter’s insurance if I have a pet?

Yes, but the cost may increase depending on the type and breed of pet. Some insurers may have restrictions on certain breeds.

What is not covered by renter’s insurance?

Common exclusions include damage caused by floods, earthquakes, and intentional acts. Always review the specific policy details for a complete list of exclusions.

How long does it take to get a renter’s insurance quote?

Most insurers provide quotes instantly online. However, the time it takes to fully process and finalize a policy may vary.

How often should I review my renter’s insurance policy?

It’s advisable to review your policy annually, or whenever you experience significant life changes, such as acquiring valuable possessions or moving to a new location.