Many renters mistakenly believe their landlord’s insurance covers their belongings. This is a critical misunderstanding. Renter’s insurance offers a crucial safety net, protecting your personal possessions and providing liability coverage in unforeseen circumstances. Understanding the nuances of this often-overlooked policy can save you from significant financial hardship should the unexpected occur.

This comprehensive guide will explore the vital aspects of renter’s insurance, from understanding the different types of coverage to the process of filing a claim. We’ll delve into the factors influencing premium costs, offer tips for finding the right policy, and dispel common misconceptions surrounding this essential protection.

What is Renter’s Insurance?

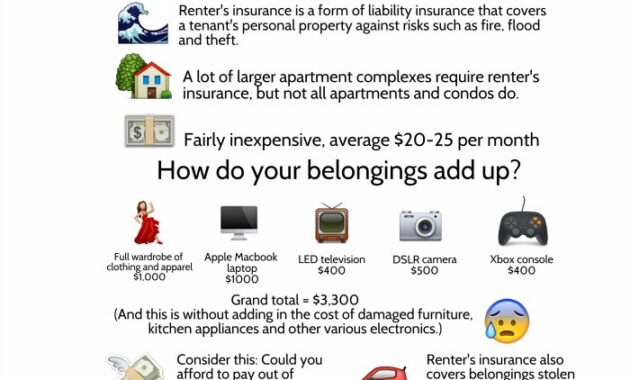

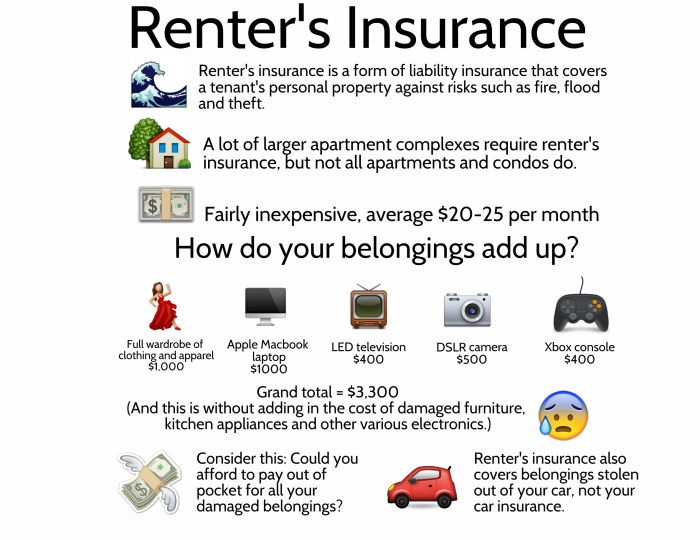

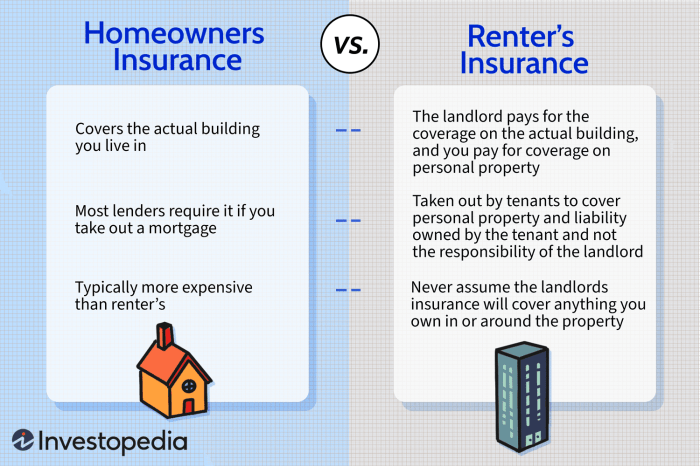

Renter’s insurance, also known as tenant’s insurance, is a relatively inexpensive insurance policy designed to protect your personal belongings and provide liability coverage while you’re renting an apartment, house, or other dwelling. It safeguards your possessions from various unforeseen events, offering peace of mind and financial security. Unlike homeowner’s insurance, which covers the structure of the building, renter’s insurance focuses on the contents within and your personal liability.

Renter’s insurance primarily serves to protect your personal property from damage or loss due to covered perils. This coverage extends to a wide range of situations, ensuring you’re not left financially burdened in the event of an unexpected incident. It also provides liability protection, shielding you from potential lawsuits arising from accidents that occur in your rented space.

Coverage Included in Renter’s Insurance Policies

A typical renter’s insurance policy includes several key types of coverage. These coverages work together to provide comprehensive protection for your personal belongings and your financial well-being.

Personal Property Coverage: This is the core of renter’s insurance, protecting your furniture, electronics, clothing, and other possessions against damage or loss from covered events like fire, theft, or vandalism. The policy typically sets a limit on the amount of coverage, often requiring an appraisal to accurately determine the value of your belongings.

Liability Coverage: This protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. For instance, if a guest trips and falls, injuring themselves, liability coverage helps cover their medical expenses and any legal fees.

Additional Living Expenses Coverage: If a covered event makes your rental unit uninhabitable, this coverage helps pay for temporary housing, meals, and other necessary expenses while repairs or rebuilding takes place. This could be crucial if a fire forces you to relocate temporarily.

Situations Benefiting from Renter’s Insurance

Numerous scenarios highlight the importance of renter’s insurance. Consider these examples:

* Fire or Smoke Damage: A fire in your building could destroy all your belongings. Renter’s insurance would help replace them.

* Theft or Burglary: If your apartment is burglarized, your insurance will cover the stolen items.

* Water Damage: A burst pipe or a leaky roof could cause significant water damage to your belongings. Renter’s insurance would assist with the replacement or repair costs.

* Liability Claim: If a guest is injured in your apartment, liability coverage would help cover their medical expenses and legal fees.

Comparison: Renter’s vs. Homeowner’s Insurance

| Feature | Renter’s Insurance | Homeowner’s Insurance |

|---|---|---|

| Coverage Focus | Personal property and liability | Structure of the home, personal property, and liability |

| Building Coverage | None | Comprehensive coverage for the building itself |

| Cost | Generally less expensive | Generally more expensive |

| Liability Coverage | Included | Included |

Coverage Details

Renter’s insurance offers valuable protection for your personal belongings, providing financial compensation in case of loss or damage due to covered perils. Understanding the specifics of this coverage is crucial for ensuring you have adequate protection.

A typical renter’s insurance policy covers your personal property against a range of events, including fire, theft, vandalism, and certain weather-related incidents. However, coverage is usually subject to limitations, such as the actual cash value (ACV) of your items or a specified policy limit. This means you’ll likely receive compensation based on the item’s current value, minus depreciation, up to the maximum amount stated in your policy. Specific exclusions, like damage caused by floods or earthquakes (unless specifically added as endorsements), are also common.

Filing a Claim for Damaged or Stolen Property

Filing a claim typically involves contacting your insurance company immediately after the incident. You’ll need to provide detailed information about the loss or damage, including dates, times, and circumstances. Supporting documentation, such as police reports for theft or photos of damaged items, will significantly expedite the claims process. The insurer will then assess the claim, determining the extent of the damage and the applicable compensation based on your policy terms and the value of your possessions. Be prepared to provide proof of ownership, such as receipts or appraisals, especially for high-value items. The claims process can vary in length depending on the complexity of the situation and the insurer’s procedures. For instance, a straightforward claim for a stolen laptop might be processed within a few weeks, while a claim involving extensive damage from a fire could take longer.

Maintaining an Inventory of Personal Belongings

Maintaining a detailed inventory of your personal belongings is crucial for several reasons. First, it simplifies the claims process in the event of a loss or damage, allowing for quicker and more accurate assessment of your losses. Second, it serves as proof of ownership and value for your possessions, strengthening your claim and minimizing disputes with the insurance company. Finally, a well-maintained inventory can be beneficial for other purposes, such as tax purposes or estate planning.

Improving the Accuracy of a Personal Property Inventory

Creating an accurate inventory requires careful attention to detail. Consider using a combination of methods, such as taking photos or videos of each item, along with detailed descriptions including brand, model, purchase date, and estimated current value. For high-value items, consider obtaining professional appraisals. Organize your inventory logically, perhaps by room or category, and store it securely, both digitally and physically (in a safe deposit box or with a trusted friend or family member). Regularly update your inventory to reflect changes in your possessions, such as new purchases or discarded items. Consider using inventory software or apps designed to simplify the process. Remember, the more detailed your inventory, the smoother the claims process will be if you ever need to file a claim.

Coverage Details

Renter’s insurance offers more than just protection for your belongings; it also includes crucial liability coverage. This protects you from financial responsibility in the event you cause damage to someone else’s property or injure someone. Understanding this aspect of your policy is vital for peace of mind.

Liability coverage in a renter’s insurance policy safeguards you against financial losses resulting from accidents or incidents that occur within your rented property or as a result of your actions. It covers the costs associated with legal defense, settlements, and judgments awarded against you. This is particularly important because the cost of legal battles and potential settlements can quickly escalate beyond your personal means.

Liability Coverage Examples

Liability coverage comes into play in various scenarios. For instance, if a guest slips and falls in your apartment and suffers injuries, your liability coverage would help pay for their medical bills and any legal costs associated with a lawsuit. Similarly, if your dog bites a visitor, causing injury, your liability insurance will cover the associated expenses. If you accidentally damage your neighbor’s property, such as by causing a water leak that seeps into their apartment, this coverage can assist in paying for repairs.

Liability Coverage Limits

Standard renter’s insurance policies typically offer liability coverage limits ranging from $100,000 to $300,000. This means the insurance company will pay a maximum of this amount to cover claims against you. It’s important to note that these limits are not unlimited, and choosing a higher limit can provide greater financial protection, although it may result in a slightly higher premium. The specific limit will depend on the policy and the chosen coverage level.

Hypothetical Scenario: The Importance of Liability Protection

Imagine you’re hosting a party in your apartment. A guest trips over a rug you forgot to roll up and suffers a broken arm. Medical bills alone could exceed $10,000, and if the guest decides to sue you for negligence, legal fees and a potential settlement could easily reach tens of thousands of dollars. Without liability coverage, you would be personally responsible for these significant expenses, potentially leading to substantial financial hardship. However, with a renter’s insurance policy that includes $100,000 in liability coverage, the insurance company would cover these costs, protecting your financial well-being.

Cost and Factors Affecting Premiums

The cost of renter’s insurance varies significantly, influenced by a number of factors. Understanding these factors can help you secure the best coverage at a price that fits your budget. This section will explore the key elements that impact premiums and offer strategies for potentially reducing your costs.

Several key factors influence the price you pay for renter’s insurance. These factors are often considered by insurance companies when assessing risk and determining premiums. A thorough understanding of these elements can empower you to make informed decisions about your policy.

Factors Influencing Premium Costs

Insurance companies use a variety of factors to calculate your premium. These include your location, the value of your belongings, your credit score, your claims history, and the level of coverage you choose. A higher value of possessions, for example, will typically result in a higher premium because the insurer’s potential payout increases.

- Location: Premiums are higher in areas with higher crime rates or a greater risk of natural disasters (e.g., hurricanes, earthquakes, wildfires).

- Value of Possessions: The more valuable your belongings, the higher your premium. Accurate assessment of your possessions is crucial for adequate coverage and appropriate pricing.

- Credit Score: In many states, insurers use credit scores to assess risk. A higher credit score often translates to lower premiums.

- Claims History: A history of filing insurance claims can lead to higher premiums, reflecting a perceived higher risk.

- Coverage Level: Choosing higher coverage limits (for personal property, liability, etc.) will result in a higher premium. Balancing the desired coverage with affordability is key.

- Deductible: Selecting a higher deductible (the amount you pay out-of-pocket before your insurance coverage kicks in) will typically lower your premium. However, this means a larger upfront cost in the event of a claim.

Comparison of Premium Costs Across Providers

Premium costs vary considerably among different insurance providers. It’s essential to compare quotes from multiple companies to find the best value for your needs. Online comparison tools can streamline this process. Remember that the cheapest option isn’t always the best if it compromises coverage.

| Insurance Provider | Average Monthly Premium (Example) | Coverage Highlights |

|---|---|---|

| Provider A | $15 | Basic coverage, lower deductible options |

| Provider B | $20 | Higher liability limits, additional coverage options |

| Provider C | $18 | Mid-range coverage, good customer service reputation |

Note: These are example premiums and may not reflect actual costs. Premiums vary widely based on individual circumstances.

Ways to Lower Renter’s Insurance Premiums

Several strategies can help you reduce your renter’s insurance premiums without sacrificing essential coverage. These strategies involve careful planning and consideration of your policy details.

- Increase your deductible: A higher deductible means you pay more out-of-pocket in case of a claim, but it lowers your premium.

- Bundle policies: Some insurers offer discounts if you bundle renter’s insurance with other policies, such as auto insurance.

- Improve your credit score: A higher credit score can lead to lower premiums in many states.

- Install security systems: Installing security systems like alarms or security cameras can sometimes qualify you for discounts.

- Shop around and compare quotes: Get quotes from multiple insurers to find the most competitive rates.

Questions to Ask Insurance Providers

Asking the right questions is crucial when comparing renter’s insurance policies. This ensures you understand the coverage, limitations, and costs before committing to a policy.

- What are the specific coverage limits for personal property, liability, and additional living expenses?

- What is the deductible amount, and how does it affect my premium?

- What factors influence my premium, and how can I potentially lower it?

- What is the claims process like, and what documentation is required?

- Are there any discounts available, such as for bundling policies or security systems?

- What is the insurer’s customer service reputation and complaint resolution process?

Finding and Choosing a Policy

Selecting the right renter’s insurance policy can feel overwhelming, but a systematic approach simplifies the process. By understanding your needs and comparing options, you can find a policy that provides adequate protection at a reasonable price. This section will guide you through the steps involved in finding and choosing a suitable policy.

Comparing Policy Options from Different Providers

Several insurance companies offer renter’s insurance, each with varying coverage options and pricing structures. Directly comparing quotes from multiple providers is crucial to securing the best value. Online comparison tools can streamline this process, allowing you to input your details and receive multiple quotes simultaneously. Remember to carefully review the specifics of each quote, paying close attention to coverage limits, deductibles, and exclusions. Consider contacting the insurance companies directly to clarify any uncertainties. For example, comparing quotes from State Farm, Allstate, and Lemonade might reveal significant differences in premiums for similar coverage levels.

Key Elements to Consider When Selecting a Policy

Choosing a renter’s insurance policy involves careful consideration of several key factors. The most important is the level of coverage needed. This depends on the value of your possessions. You should create a detailed inventory of your belongings to accurately assess their worth. Another critical factor is the deductible, which represents the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but it also means a larger upfront cost in case of a claim. Consider your financial capacity to absorb a potential deductible when making this choice. Finally, the reputation and financial stability of the insurance provider are essential considerations. Choose a company with a strong track record of claims handling and customer service.

Essential Features Checklist for Renter’s Insurance

Before committing to a policy, use this checklist to ensure it meets your needs:

- Personal Property Coverage: This covers the cost of replacing or repairing your belongings in case of theft, fire, or other covered perils. Ensure the coverage limit is sufficient to replace all your possessions at their current value.

- Liability Coverage: This protects you against lawsuits if someone is injured on your property or you damage someone else’s property. A minimum of $100,000 is generally recommended.

- Additional Living Expenses (ALE): This covers temporary housing and living expenses if your apartment becomes uninhabitable due to a covered event, such as a fire.

- Medical Payments to Others: This covers medical expenses for guests injured on your property, regardless of fault.

- Endorsements or Riders: Consider adding endorsements for specific valuable items, such as jewelry or electronics, to increase coverage beyond the standard policy limits.

Filing a Claim

Filing a renter’s insurance claim can seem daunting, but understanding the process can make it significantly less stressful. The key is to act promptly and provide accurate information to your insurance provider. A smooth and efficient claims process relies on clear communication and thorough documentation.

The process generally involves reporting the incident, providing necessary documentation, and cooperating with the adjuster’s investigation. Your insurance company will have specific procedures, often Artikeld in your policy documents or on their website. Remember to always refer to your policy for the most accurate and up-to-date information regarding your specific coverage and claims procedures.

Required Documentation

Providing comprehensive documentation is crucial for a successful claim. This helps expedite the process and ensures you receive the appropriate compensation. Missing documents can delay the process, so it’s best to gather everything you can as soon as possible.

Examples of documentation that might be needed include a police report (for theft or vandalism), photos or videos of the damaged property, receipts for damaged or stolen items, and a detailed description of the incident. You may also need to provide your insurance policy details and any relevant communication with your landlord. If you have renters insurance, it is important to retain records of your policy documents, and maintain detailed inventory of your belongings for future claims purposes. This can be done via photos, videos, and detailed spreadsheets of your possessions with estimated values.

Claim Resolution Steps

The claim resolution process involves several steps, from initial reporting to final settlement. The timeline can vary depending on the complexity of the claim and the insurance company’s efficiency. Open communication with your insurer throughout the process is vital.

Following these steps will help ensure a smoother claims process:

- Report the incident promptly: Contact your insurance provider as soon as possible after the incident occurs. Most policies have a timeframe for reporting, so acting quickly is essential.

- Provide initial information: Give your insurer a detailed account of the incident, including the date, time, and location. Describe the extent of the damage or loss.

- Gather documentation: Collect all relevant documentation, such as photos, receipts, and police reports.

- Cooperate with the adjuster: An adjuster will be assigned to your claim. Cooperate fully with their investigation, providing any requested information or access to your property.

- Review the claim settlement: Once the adjuster completes their investigation, they will provide a settlement offer. Review this carefully and contact your insurer if you have any questions or concerns.

Final Thoughts

Securing renter’s insurance is a proactive step towards safeguarding your financial well-being. By understanding the coverage options, carefully comparing policies, and knowing how to file a claim, you can effectively mitigate risks and enjoy peace of mind knowing your belongings and liability are protected. Don’t wait for a disaster to strike – take control of your financial future and invest in renter’s insurance today.

Questions and Answers

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) compensates you for the depreciated value of your belongings, while replacement cost coverage pays for the cost of replacing items with new ones, regardless of depreciation.

Does renter’s insurance cover damage caused by my negligence?

Generally, yes, but the specifics depend on your policy. For example, if you accidentally damage a neighbor’s apartment, your liability coverage would likely help.

Can I get renter’s insurance if I live in a shared apartment or house?

Yes, you can typically obtain a policy even if you share your living space. The coverage will protect your personal belongings and liability.

How much renter’s insurance do I need?

The amount of coverage you need depends on the value of your belongings. It’s recommended to create a detailed inventory to determine the appropriate coverage amount.