Navigating the world of insurance can be daunting, especially for renters juggling multiple financial priorities. This guide explores the increasingly popular option of bundling renters and car insurance, examining the potential benefits, various package types, and strategies for both consumers and insurance providers. We’ll delve into the specific needs of renters, highlighting how bundled policies can offer significant cost savings and streamlined convenience.

Understanding the unique financial circumstances and insurance requirements of renters is crucial. This analysis compares and contrasts the needs of renters versus homeowners, providing a clear picture of why bundled insurance is a compelling solution for many. We’ll then dissect different bundled packages, providing a practical framework for making informed decisions.

Understanding the Target Audience

Renters represent a significant portion of the car insurance market, possessing unique needs and characteristics that differ from homeowners. Understanding their profile is crucial for developing effective marketing and insurance products tailored to their specific circumstances.

Renters often face a different set of financial priorities and insurance considerations compared to homeowners. Their financial resources might be more constrained, influencing their choices regarding coverage levels and premium payments. Additionally, their lifestyle often impacts their insurance needs, such as the type of vehicle they own and their driving habits.

Typical Renter Profile and Car Ownership

Renters are a diverse group, but some common threads emerge regarding car ownership and insurance. Many renters are younger adults, perhaps recent graduates or young professionals, who may be leasing or financing their vehicles. They may also own older, less expensive vehicles compared to homeowners who might own more valuable assets. This influences their insurance needs, as the value of the vehicle directly impacts the cost of comprehensive and collision coverage. For example, a young renter leasing a compact car will have different insurance needs than a homeowner who owns a luxury SUV.

Demographics and Lifestyle Factors Influencing Car Insurance Choices

Several key demographic and lifestyle factors significantly influence a renter’s car insurance choices. Age is a major factor, with younger drivers typically paying higher premiums due to statistically higher accident rates. Location also plays a significant role; renters in urban areas with higher accident rates often face higher premiums than those in rural areas. Occupation can influence premiums, as some professions are considered higher risk. Lifestyle choices, such as commuting distance and driving habits (frequency of driving, type of driving), also impact the cost of insurance. For instance, a renter with a long daily commute might opt for higher liability coverage due to increased exposure to accidents.

Financial Considerations for Renters Purchasing Car Insurance

Financial constraints are often a primary concern for renters when choosing car insurance. Many prioritize affordability, looking for policies with lower premiums, even if it means accepting lower coverage levels. They may be more sensitive to payment options, favoring monthly installments over annual payments. The availability of discounts, such as good driver discounts or bundling options with other insurance products (like renters insurance), can significantly influence their decision-making process. For example, a renter on a tight budget might opt for state-minimum liability coverage to reduce premiums, while a renter with more disposable income might opt for comprehensive coverage.

Comparing Insurance Needs of Renters Versus Homeowners

While both renters and homeowners need car insurance, their overall insurance needs differ significantly. Homeowners often carry higher liability limits to protect their property and assets. They might also opt for more comprehensive coverage for their vehicles due to the higher value of their possessions. Renters, on the other hand, may focus more on liability coverage, protecting themselves from financial repercussions in the event of an accident. The lack of homeowner’s insurance means they don’t need to worry about insuring their dwelling, leaving more of their budget for car insurance, though often still on a tighter budget. The key difference lies in the extent of assets needing protection; homeowners have more to protect, while renters’ primary concern is personal liability and vehicle protection.

Benefits of Bundling Renters and Car Insurance

Bundling your renters and car insurance policies can offer significant advantages, primarily through cost savings and increased convenience. This strategy simplifies your insurance management while potentially saving you money compared to maintaining separate policies. Let’s explore the key benefits in detail.

One of the most compelling reasons to bundle is the potential for substantial cost savings. Insurance companies often offer discounts when you purchase multiple policies from them. These discounts can range from a few percentage points to a much more significant reduction in your overall premium, depending on the insurer and your specific circumstances. The savings stem from the efficiencies gained by the insurer in managing a single customer with multiple policies. Administrative costs are reduced, and the risk assessment process is streamlined.

Cost Savings Associated with Bundled Policies

The exact amount you save by bundling will vary. Factors influencing the discount include your credit score, driving history, claims history, the type of coverage you select for both policies, and the insurer itself. However, many insurers advertise savings of 10-15% or even more when bundling renters and auto insurance. For example, a hypothetical renter paying $300 annually for renters insurance and $800 annually for car insurance might see a combined premium of $950 with a 15% bundle discount, resulting in a $150 annual saving.

Convenience Factors Offered by Bundled Services

Beyond the financial benefits, bundling significantly enhances convenience. The most obvious advantage is simplified billing. Instead of juggling multiple payments and due dates, you’ll receive a single bill for both your renters and car insurance, reducing the risk of missed payments and late fees. Furthermore, a streamlined claims process is often a part of bundled services. If you experience a covered loss under either policy, dealing with a single insurer simplifies the reporting and processing of your claim.

Examples of Successful Bundled Insurance Programs Targeting Renters

Many major insurance companies actively promote bundled renters and car insurance packages. While specific program details vary, the core benefit – reduced premiums and simplified administration – remains consistent across different insurers. For instance, some insurers offer online platforms that allow renters to easily compare bundled packages and obtain quotes, highlighting the potential savings and outlining the specific terms and conditions of their bundled policies. These programs often incorporate features designed to make the entire process more user-friendly for renters.

Comparison of Bundled versus Separate Policies

While bundling offers numerous advantages, it’s essential to consider potential drawbacks. You might not always find the absolute lowest price for each individual policy by bundling. Sometimes, separate policies from different insurers might offer slightly lower premiums for one or both types of coverage. However, the convenience and potential savings associated with bundled policies often outweigh this minor disadvantage for many renters. Careful comparison shopping, considering both bundled and separate options, is crucial to making an informed decision.

Types of Bundled Insurance Packages for Renters

Bundling your renters and car insurance can offer significant savings and convenience. Different insurers offer various packages tailored to different needs and budgets. Understanding the available options is crucial to finding the best fit for your individual circumstances. This section details the common types of bundled packages available, highlighting coverage specifics and estimated cost ranges.

Bundled Package Options and Coverage Details

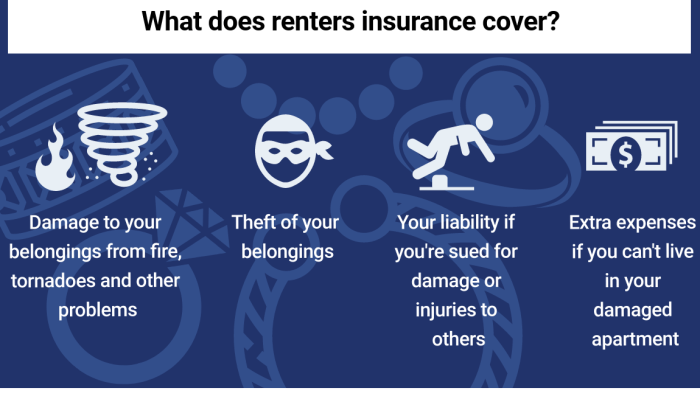

Renters and car insurance bundles typically offer a range of coverage options, combining the essential protection of renters insurance with the necessary coverage for your vehicle. The specific coverage details and costs will vary depending on your location, insurer, and the specifics of your policy.

| Policy Type | Coverage Details | Estimated Cost Range (Annual) |

|---|---|---|

| Basic Bundle | Renters insurance with liability coverage for personal belongings and liability for accidents in your rented property. Car insurance with liability coverage only. | $500 – $1000 |

| Standard Bundle | Renters insurance with liability and personal property coverage. Car insurance with liability, collision, and comprehensive coverage. | $1000 – $1500 |

| Premium Bundle | Renters insurance with high liability limits and comprehensive personal property coverage, including valuable items. Car insurance with high liability limits, collision, comprehensive, and potentially uninsured/underinsured motorist coverage. May include roadside assistance. | $1500 – $2500+ |

Add-on Options for Bundled Packages

Many insurers offer add-on options to customize your bundled package further. These additions provide enhanced coverage or added convenience.

For example, renters insurance add-ons might include coverage for specific high-value items (jewelry, electronics), increased liability limits, or coverage for additional living expenses if your rental becomes uninhabitable. Car insurance add-ons could include things like roadside assistance, rental car reimbursement, or gap insurance (covering the difference between your car’s value and what your loan is worth in case of a total loss). The availability and cost of these add-ons will vary depending on your insurer and the specific coverage. Remember to carefully review the details of any add-ons before purchasing them to ensure they align with your needs and budget. A comprehensive comparison of different insurers’ offerings will help you identify the best value for your money.

Marketing and Sales Strategies for Bundled Insurance

Successfully marketing and selling bundled renters and car insurance requires a multi-faceted approach focusing on the unique needs and preferences of renters. A well-structured campaign can effectively communicate the value proposition and drive conversions.

Marketing Campaign Targeting Renters

This campaign will leverage digital channels and strategic partnerships to reach the target audience. The core message will emphasize the convenience, cost savings, and comprehensive protection offered by bundled policies. Visual elements will depict a stress-free lifestyle, secured by the peace of mind that comes with comprehensive insurance coverage. The campaign will use a consistent brand identity across all platforms, maintaining a professional yet approachable tone.

Sample Marketing Materials

Brochure: A visually appealing tri-fold brochure could feature a headline like “Protect Your Life, Simplify Your Finances: Renters & Car Insurance Bundled.” The inside panels would detail the benefits of bundling (e.g., discounted rates, streamlined billing, comprehensive coverage), showcase various bundled package options with clear pricing, and include a strong call to action with contact information and a website URL. Images would depict secure homes, reliable vehicles, and happy, relaxed individuals. The brochure would utilize a clean, modern design and easily digestible bullet points.

Social Media Posts: Social media campaigns will use engaging visuals and concise messaging. Examples include: “Renters insurance + car insurance = peace of mind and savings! Learn more: [link to website]” (accompanied by an image of a person happily driving their car near a comfortable apartment building). Another post might highlight a specific benefit: “Bundle and save up to 15%! Get a free quote today: [link to quote request form].” Posts would be scheduled strategically throughout the week to maximize reach. Interactive elements, such as polls and quizzes, could be incorporated to increase engagement.

Effective Channels for Reaching Renters

Reaching renters effectively requires a strategic blend of online and offline channels.

- Online Advertising: Targeted ads on social media platforms (Facebook, Instagram, TikTok) and search engines (Google) can effectively reach renters based on demographics, location, and online behavior. Retargeting campaigns can also be implemented to re-engage users who have previously interacted with the brand’s website or social media pages.

- Partnerships with Rental Agencies: Collaborating with rental agencies allows for direct access to a large pool of potential customers. This could involve co-branded marketing materials, exclusive offers for renters, or even integrating insurance options directly into the rental application process.

- Email Marketing: Collecting email addresses through website forms and partnerships allows for targeted email campaigns promoting bundled insurance. These emails can highlight special offers, explain the benefits of bundling, and provide links to online quote tools.

- Influencer Marketing: Partnering with relevant influencers (e.g., lifestyle bloggers, financial advisors) can increase brand awareness and reach a wider audience of renters.

Pricing Strategies for Bundled Insurance

Several pricing strategies can be employed for bundled insurance products.

- Percentage Discount: Offer a fixed percentage discount on the combined price of renters and car insurance when purchased together. For example, a 10% discount on the total premium.

- Tiered Pricing: Create different bundled packages with varying levels of coverage and discounts. This allows customers to choose the package that best fits their needs and budget.

- Value-Added Bundles: Include additional benefits in bundled packages, such as roadside assistance, identity theft protection, or discounts on other services. This adds value and incentivizes customers to choose the bundled option.

- Dynamic Pricing: Adjust prices based on factors such as customer risk profile, location, and claims history. This approach allows for more accurate pricing and can incentivize safer driving and responsible renter behavior.

Illustrative Examples of Bundled Insurance Programs

Bundling renters and car insurance offers significant cost savings and convenience for many individuals. The following examples illustrate how different bundled packages can cater to diverse renter profiles and their specific insurance needs. Each package is designed to provide comprehensive coverage while remaining affordable and accessible.

The “Starter” Package: For Young Renters and First-Time Car Owners

This package is ideal for young renters (ages 18-25) who are new to renting and car ownership. It prioritizes essential coverage at an affordable price point, recognizing that this demographic may have limited budgets but still require crucial protection.

This package includes:

- Renters insurance with $10,000 personal property coverage and $100,000 liability coverage.

- Liability-only car insurance with minimum state-required coverage.

Pricing: Approximately $75 per month. This pricing reflects the lower coverage limits and the relatively lower risk associated with younger drivers with limited driving experience. The bundled discount is approximately 10% compared to purchasing the policies separately. This encourages responsible driving behavior and provides a safety net for unforeseen events.

The “Family” Package: For Families with Children and Multiple Vehicles

Designed for families with children and potentially multiple vehicles, this package emphasizes comprehensive coverage and peace of mind. It acknowledges the higher risk associated with larger families and multiple drivers.

This package includes:

- Renters insurance with $25,000 personal property coverage, $300,000 liability coverage, and additional coverage for valuable items.

- Comprehensive car insurance for two vehicles, including collision, comprehensive, and uninsured/underinsured motorist coverage.

Pricing: Approximately $200 per month. The higher price reflects the increased coverage limits and the higher risk profile of families with multiple vehicles and drivers. The bundled discount is approximately 15%, reflecting the value of combining multiple policies. This package provides a strong safety net in case of accidents or property damage, offering valuable protection for the entire family.

The “Luxury” Package: For High-Net-Worth Renters with Premium Vehicles

This package caters to high-net-worth renters who own luxury vehicles and valuable possessions. It offers extensive coverage and superior protection for their assets.

This package includes:

- Renters insurance with $50,000 personal property coverage, $500,000 liability coverage, and replacement cost coverage for personal belongings.

- Comprehensive car insurance for one premium vehicle, including collision, comprehensive, uninsured/underinsured motorist coverage, and roadside assistance.

Pricing: Approximately $350 per month. The high price reflects the extensive coverage and the value of the insured assets. The bundled discount is approximately 20%, providing significant savings on premium coverage. This package provides maximum protection for high-value assets and ensures peace of mind for those with significant financial investments.

Addressing Potential Challenges and Risks

Offering bundled renters and car insurance presents several unique challenges that insurers must carefully consider and mitigate to ensure profitability and customer satisfaction. These challenges stem from the complexities of underwriting two distinct products, navigating regulatory landscapes, and managing potential risks associated with combined policies.

Underwriting complexities arise from the need to assess risk across two very different product lines. Renters insurance primarily covers personal property and liability, while car insurance focuses on vehicle damage and liability. Accurately assessing the combined risk profile of a customer requires sophisticated modeling and data analysis to avoid underpricing or overpricing the bundled package. This is further complicated by the need to account for varying risk factors in different geographic locations and demographic groups.

Underwriting Complexities and Mitigation Strategies

Effective risk assessment for bundled products requires leveraging advanced data analytics and predictive modeling techniques. Insurers can utilize machine learning algorithms to analyze vast datasets encompassing customer demographics, property location, driving history, and claims history to create more accurate risk profiles. This allows for more precise pricing and minimizes the likelihood of adverse selection, where higher-risk individuals disproportionately choose bundled options. Furthermore, clear and transparent underwriting guidelines, consistently applied across all bundled products, are crucial for maintaining fairness and avoiding inconsistencies. Regular audits of underwriting practices are also essential to identify and rectify any potential biases or inaccuracies in the risk assessment process.

Regulatory Hurdles and Compliance Strategies

The insurance industry is heavily regulated, and offering bundled products may involve navigating a complex web of state-specific regulations. Different states have varying requirements for renters and car insurance, which can complicate the design and implementation of bundled offerings. Insurers must ensure their bundled products comply with all applicable regulations in each state where they operate. This necessitates close collaboration with legal and compliance teams to stay abreast of regulatory changes and maintain compliance across all jurisdictions. Proactive engagement with state insurance departments can help insurers understand specific requirements and avoid potential penalties. Maintaining detailed records of compliance activities is also critical for demonstrating adherence to regulations during audits or investigations.

Examples of Successful Risk Management in Bundled Insurance

Several major insurers have successfully addressed similar challenges in the past by implementing robust risk management frameworks. For instance, many companies have invested heavily in data analytics and predictive modeling to improve the accuracy of their risk assessments. Others have developed specialized underwriting guidelines and training programs to ensure consistent application of underwriting standards across different product lines and geographic regions. By leveraging technology and expertise, these insurers have managed to successfully offer bundled products while maintaining profitability and minimizing their exposure to risk. One example could be a company that developed a proprietary algorithm to analyze telematics data from connected cars, integrating this data into their renters insurance risk assessment to offer more personalized and accurate pricing for bundled packages. This demonstrated a proactive approach to leveraging technology to manage risks associated with bundled products.

Last Recap

Bundling renters and car insurance presents a compelling proposition for both renters seeking financial efficiency and insurance providers looking to expand their market reach. By carefully considering the target audience, crafting effective marketing strategies, and addressing potential challenges, insurers can successfully leverage this opportunity. Ultimately, the success of these bundled packages hinges on providing comprehensive coverage, competitive pricing, and a seamless customer experience that simplifies the complexities of insurance management for renters.

FAQ Guide

What happens if I move during my bundled policy term?

Most insurers allow for address changes within the policy term, but it’s crucial to notify them promptly to ensure your coverage remains valid and accurate. There might be a small administrative fee.

Can I bundle my renters insurance with other types of insurance besides car insurance?

Some insurers offer broader bundles, potentially including things like pet insurance or umbrella liability coverage. The availability of these options will depend on the specific insurer and their policy offerings.

How do discounts for bundled policies compare to discounts for safe driving?

Discounts vary widely between insurers. Often, bundled policy discounts are stacked with other discounts, such as those for safe driving or bundling multiple vehicles. It’s best to compare quotes from different providers to determine the overall savings.

What if I don’t own a car but rent one occasionally? Can I still benefit from a bundled policy?

Some insurers offer options for occasional car rental coverage within renters insurance policies, even without a primary vehicle. This is usually an add-on feature, so check the policy details.