Unexpected events can disrupt lives, leaving renters facing displacement and significant financial burdens. Renters insurance, specifically its loss of use coverage, acts as a crucial safety net during such times. This comprehensive guide explores the intricacies of this often-overlooked yet vital aspect of renters insurance, detailing its coverage, limitations, and the claims process. Understanding loss of use coverage empowers renters to make informed decisions and protect their financial well-being in the face of unforeseen circumstances.

We will delve into the specifics of what constitutes a covered event, the extent of financial assistance provided, and the steps involved in successfully filing a claim. We’ll also address common misconceptions and highlight factors that can influence the amount of compensation received. By the end, you’ll have a clear understanding of how this critical coverage works and how to maximize its benefits.

Defining Renters Insurance Loss of Use Coverage

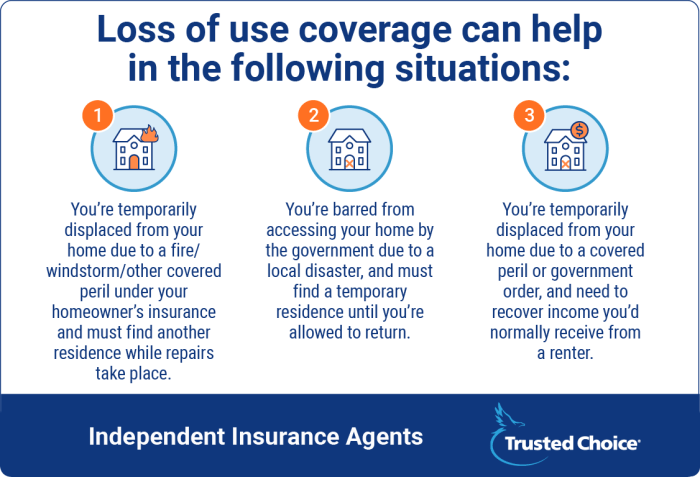

Renters insurance loss of use coverage, sometimes called additional living expenses (ALE) coverage, is a crucial component of a comprehensive renters insurance policy. It protects you financially from the added costs associated with finding alternative living arrangements and maintaining your lifestyle after a covered loss makes your rental unit uninhabitable. This coverage bridges the gap between your normal living expenses and the disruption caused by an unforeseen event.

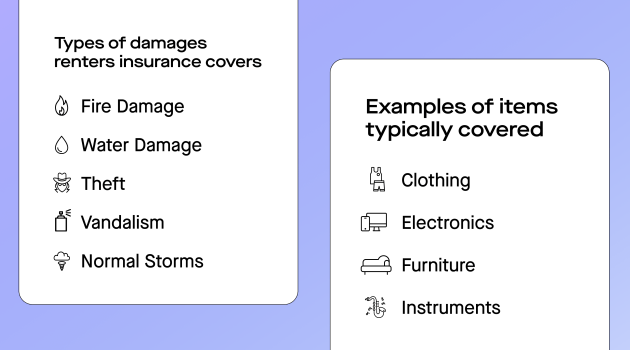

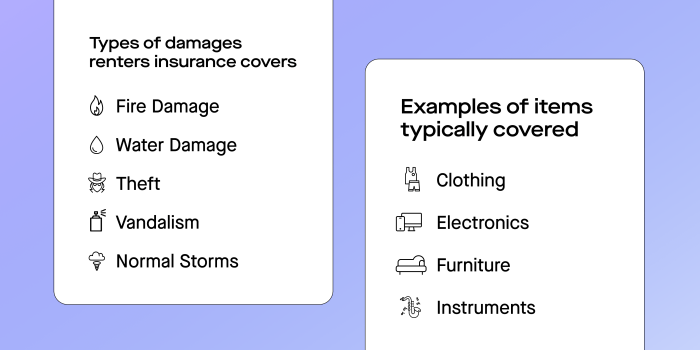

Loss of use coverage applies when your rental property becomes uninhabitable due to a covered peril, as specified in your policy. Common covered perils include fire, smoke damage, vandalism, theft resulting in significant damage, and sometimes, even events like burst pipes or severe weather damage (depending on your specific policy and endorsements). The key is that the damage must render your home temporarily unfit for living. This doesn’t necessarily mean total destruction; even significant damage requiring extensive repairs could trigger this coverage.

Covered Expenses Under Loss of Use Coverage

Loss of use coverage typically reimburses you for reasonable and necessary expenses incurred while your rental unit is being repaired or rebuilt. This includes a range of expenses designed to help you maintain a similar standard of living to what you had before the damage occurred. The insurer will usually pay for these expenses up to a specified limit, often a percentage of your coverage amount.

- Temporary Housing: This could cover hotel bills, rent for a temporary apartment, or even short-term stays with family or friends (with receipts showing additional expenses incurred).

- Meals: If you are displaced, the additional costs of eating out rather than cooking at home can be covered.

- Transportation: Expenses related to getting to and from work, appointments, and essential errands while your home is uninhabitable, such as increased fuel costs or public transportation fares.

- Storage: Costs associated with storing your belongings while your apartment is being repaired.

It’s important to note that the specific expenses covered and the limits of coverage will vary depending on your individual policy and the specific circumstances of the loss. It is crucial to review your policy carefully to understand exactly what is covered.

Comparison with Other Renters Insurance Components

Loss of use coverage is distinct from other aspects of renters insurance. While personal property coverage compensates for the value of your damaged or stolen belongings, loss of use coverage addresses the disruption to your life caused by the damage to your dwelling. Liability coverage, on the other hand, protects you against lawsuits if someone is injured on your property. Loss of use is specifically focused on the additional expenses you incur due to the inability to live in your home. It’s a vital safety net that helps minimize the financial strain of an unexpected event.

Coverage Limits and Exclusions

Understanding the limitations and exclusions of renters insurance loss of use coverage is crucial for accurately assessing the protection it offers. While this coverage can provide financial assistance during displacement, it’s not unlimited and specific circumstances may result in denied claims. This section details typical coverage limits, situations leading to claim denials, and common policy exclusions.

Coverage Limit Restrictions

Renters insurance loss of use coverage typically has a set limit, often a percentage of your total coverage amount, usually ranging from 20% to 30%. This means if your policy covers $100,000 in personal property, your loss of use coverage might be capped at $20,000 to $30,000. This limit covers additional living expenses, such as temporary housing, meals, and transportation, incurred while your dwelling is uninhabitable due to a covered peril. The actual amount varies by insurer and policy. Factors such as the specific cause of damage and the length of the displacement period also play a role in determining the final payout. It’s vital to review your policy documents to understand your specific coverage limits.

Examples of Denied Loss of Use Claims

Loss of use claims can be denied for various reasons. For example, if the damage to your dwelling is caused by a peril explicitly excluded in your policy (such as flood damage without a flood endorsement), your claim for additional living expenses will likely be denied. Similarly, if the damage is deemed to be the result of your negligence or intentional actions, coverage might be refused. Another example would be if you fail to take reasonable steps to mitigate your losses, such as delaying necessary repairs or failing to seek temporary housing when available. Claims are also often denied if the insured fails to provide sufficient documentation to support their expenses.

Common Exclusions in Loss of Use Coverage

Many policies exclude certain situations from loss of use coverage. Common exclusions include damage caused by gradual deterioration, normal wear and tear, or events excluded in the main policy, such as earthquakes or floods (unless specifically covered by endorsements). Intentional acts, such as self-inflicted damage, are typically excluded. Additionally, losses resulting from a violation of the policy terms or conditions, such as failing to notify the insurance company promptly of a loss, can lead to claim denials. Furthermore, coverage may be limited or excluded for certain types of temporary housing, such as luxury accommodations exceeding a reasonable cost for similar housing in the area.

Comparison of Coverage Limits Across Providers

The following table illustrates potential variations in loss of use coverage limits offered by different insurance providers. Note that these are examples and actual limits may vary based on individual policy details and coverage options.

| Insurance Provider | Loss of Use Coverage Limit (as % of total coverage) | Maximum Daily Allowance for Additional Living Expenses | Notes |

|---|---|---|---|

| Provider A | 20% | $100 | May offer higher limits with additional coverage options. |

| Provider B | 30% | $150 | Limits subject to policy terms and conditions. |

| Provider C | 25% | $125 | Specific exclusions apply. |

| Provider D | 22% | $75 | Lower limits, but potentially lower premiums. |

Claim Process and Documentation

Filing a renters insurance loss of use claim involves several key steps to ensure a smooth and efficient process. Understanding these steps and gathering the necessary documentation beforehand will significantly expedite the claim’s resolution. This section details the process and provides examples of required documentation.

The first step is to report the incident to your renters insurance company as soon as reasonably possible. This is typically done via phone or online through your insurer’s portal. Provide them with a concise account of the event that led to your displacement, including dates, times, and a brief description of the damage. The insurer will then guide you through the next steps, which usually involve assigning a claims adjuster.

Claim Filing Steps

The steps involved in filing a loss of use claim are generally straightforward. However, prompt action and accurate information are crucial for a successful outcome. The specific steps might vary slightly depending on your insurance provider, but the general process remains consistent.

- Report the incident promptly to your insurance company.

- Provide a detailed account of the event, including dates, times, and a description of the damage that caused your displacement.

- Cooperate fully with the assigned claims adjuster. This includes providing requested documentation and answering questions truthfully and completely.

- Maintain accurate records of all communication with your insurer, including dates, times, and names of individuals contacted.

- Submit all required documentation promptly.

- Follow up on the claim’s progress as needed, keeping in mind reasonable timeframes for processing.

Necessary Documentation

Providing comprehensive documentation is vital for a successful loss of use claim. This documentation serves as evidence to support your claim and helps expedite the process. The following list includes examples of common supporting documents.

- Police report (if applicable, especially in cases of theft or vandalism).

- Photos and/or videos of the damaged property, showing the extent of the damage.

- Lease agreement, demonstrating your tenancy and rental payments.

- Receipts for temporary housing expenses (hotel bills, rental agreements for temporary housing).

- Receipts for additional living expenses (food, transportation, etc., exceeding your normal spending).

- Documentation of any lost income due to the displacement (e.g., missed work days).

Document Checklist for Loss of Use Claim

This checklist summarizes the essential documents to ensure you are prepared when filing your claim. Having these documents organized will streamline the process and minimize delays.

| Document Type | Description |

|---|---|

| Incident Report | Detailed account of the event leading to displacement |

| Police Report (if applicable) | Official police report documenting the incident |

| Lease Agreement | Proof of tenancy and rental payments |

| Photos/Videos of Damage | Visual evidence of the damage |

| Temporary Housing Receipts | Documentation of temporary accommodation expenses |

| Additional Living Expense Receipts | Receipts for expenses exceeding normal spending |

| Lost Income Documentation | Proof of income loss due to displacement |

Claim Processing Timeframe

The timeframe for processing a loss of use claim can vary depending on several factors, including the complexity of the claim, the availability of documentation, and the insurance company’s workload. While there’s no fixed timeframe, most claims are processed within a few weeks to a few months. However, complex claims involving significant damage or disputes may take longer.

For example, a straightforward claim with readily available documentation might be processed within a few weeks, whereas a claim involving a lengthy legal battle or significant property damage could take several months. It’s important to maintain open communication with your insurance adjuster throughout the process to understand the expected timeframe and address any delays.

Factors Affecting Loss of Use Coverage

Several factors influence the amount paid out under a renter’s insurance loss of use policy. Understanding these factors is crucial for policyholders to accurately assess their coverage and prepare for potential displacement. The calculation isn’t simply a matter of adding up expenses; it involves a complex interplay of policy terms, the specifics of the event, and the duration of the displacement.

Several key aspects determine the final loss of use payout. These include the policy’s coverage limits, the type of covered peril causing the displacement, the length of the displacement period, and any additional expenses incurred as a direct result of the covered event. It’s important to note that the insurer’s assessment of the reasonableness of expenses plays a significant role.

Length of Displacement and Payout Amount

The duration of the displacement directly impacts the loss of use payout. Loss of use coverage typically provides a daily or monthly allowance for additional living expenses. A longer displacement period, therefore, results in a higher payout, up to the policy’s overall limit. For example, a fire that renders a renter’s apartment uninhabitable for a week will result in a smaller payout compared to a flood that necessitates a six-month relocation. The insurance company will usually require receipts and documentation to verify the expenses.

Impact of Different Event Types on Coverage

Different types of events can influence the loss of use payout in several ways. While the policy covers the additional living expenses regardless of the cause (provided it’s a covered peril), the extent of the damage and the time required for repairs or rebuilding can vary significantly. A fire might require extensive repairs, leading to a longer displacement and higher payout, whereas a smaller, localized event like a burst pipe might lead to a shorter displacement and a smaller payout. The insurer will assess the situation individually, considering the specific circumstances of the event.

Factors Increasing or Decreasing Coverage

Understanding the factors that can influence your loss of use coverage is essential for maximizing your protection. Here are some factors that might affect your payout:

- Policy Limits: Higher policy limits translate to higher potential payouts for loss of use. Choosing a policy with adequate coverage is crucial.

- Type of Dwelling: Finding suitable temporary housing might be more expensive in certain areas or for specific housing types. This cost difference may impact the payout amount.

- Family Size: Larger families will naturally incur higher additional living expenses, potentially increasing the payout.

- Pre-existing Conditions: Pre-existing conditions within the property that contributed to the damage might influence the claim, possibly leading to a reduction in the payout or denial of the claim entirely.

- Timely Reporting: Promptly reporting the incident to the insurance company is crucial to expedite the claim process and ensure you receive the appropriate benefits.

- Documentation: Thorough documentation of expenses, including receipts and invoices, is essential for supporting the claim and maximizing the payout.

Illustrative Scenarios

Understanding how renters insurance loss of use coverage applies in different situations is crucial. The following scenarios illustrate various outcomes, highlighting the complexities and nuances of this coverage.

Full Compensation Scenario

Imagine Sarah, a renter whose apartment building suffers a devastating fire, rendering it uninhabitable for six months. Her personal belongings are destroyed, and she is forced to find temporary housing. Her renters insurance policy has a loss of use coverage of $10,000, with a monthly limit of $1,667. The additional living expenses Sarah incurs (hotel, meals, transportation) during the six months total $9,000. Her insurance company fully compensates her for these expenses under her loss of use coverage, as the amount falls well within the policy limits. This demonstrates a scenario where the coverage fully protects her against financial hardship caused by the displacement.

Partial Applicability Scenario

John’s apartment experiences water damage due to a burst pipe in the building. The damage is significant enough that he is displaced for two months while repairs are made. His renters insurance policy provides $5,000 in loss of use coverage. However, John decides to stay with family for the first month, incurring minimal additional expenses. In the second month, he rents a furnished apartment for $2,000. His claim for $2,000 is approved, representing the portion of his additional living expenses covered by the policy. The insurance company only covers expenses directly related to the displacement, and not the entire policy limit.

Denied Claim Scenario

Maria’s apartment building undergoes scheduled renovations, resulting in temporary displacement for three months. Maria attempts to claim loss of use coverage for her additional living expenses during this period. However, her claim is denied. This is because loss of use coverage typically does not apply to situations where the displacement is planned or foreseeable, as opposed to a sudden and unforeseen event like a fire or flood. The renovations were announced well in advance, making the displacement preventable through proactive planning.

Interaction with Other Coverage Types Scenario

David’s apartment is burglarized, resulting in the theft of valuable electronics and personal belongings. His renters insurance covers the replacement cost of his stolen items (property coverage) and also covers his temporary hotel expenses while his apartment is secured (loss of use coverage). The loss of use coverage supplements the property coverage, providing financial assistance for both the replacement of his belongings and the additional living expenses incurred due to the incident. This illustrates how different coverage types within a renters insurance policy can work together to provide comprehensive protection.

Additional Considerations

Understanding the intricacies of your renters insurance policy, specifically the loss of use coverage, is crucial for navigating unexpected events. Proactive understanding minimizes stress and maximizes potential reimbursements during a challenging time. This section explores key aspects to consider before and during a claim.

Understanding Policy Details Before an Incident

Thoroughly reviewing your policy before a covered incident occurs is paramount. This allows you to fully grasp the extent of your coverage, including the specific limits for loss of use, any applicable deductibles, and the precise definition of covered events. Familiarizing yourself with the claims process Artikeld in your policy will also expedite the process should you need to file a claim. Ignoring these details can lead to misunderstandings and delays in receiving benefits. For instance, a policy might specifically exclude loss of use due to certain types of events, such as those caused by a tenant’s negligence, whereas other policies might have broader coverage.

The Role of the Insurance Adjuster

The insurance adjuster plays a pivotal role in processing your loss of use claim. They will investigate the circumstances of the incident, assess the damage, and determine the extent of your eligible expenses. It is crucial to cooperate fully with the adjuster, providing all necessary documentation promptly. This includes proof of residency, receipts for temporary housing, and documentation of additional living expenses. Adjusters are trained to evaluate claims based on the policy terms and applicable laws, ensuring a fair and accurate assessment of your losses. Any disputes should be addressed in a professional and documented manner.

Impact of Policy Upgrades or Add-ons

Upgrading your renters insurance policy or adding specific endorsements can significantly impact your loss of use coverage. For example, an increased coverage limit for loss of use can provide more financial protection in the event of a major incident. Adding endorsements for specific perils, such as flood or earthquake damage (typically not covered in standard policies), can also extend your protection. Consider your individual risk factors and financial circumstances when deciding on policy upgrades or add-ons. A higher premium might be justified by the increased level of protection afforded, especially for those living in high-risk areas.

Tips for Maximizing Loss of Use Coverage Benefits

To maximize your benefits, maintain meticulous records of all expenses incurred due to the covered incident. This includes receipts for temporary housing, meals, transportation, and any other reasonable and necessary expenses. Document everything thoroughly, as this evidence is crucial for supporting your claim. Promptly notify your insurance company of the incident and follow their instructions carefully. Consider keeping a detailed log of communication with your adjuster. Cooperating fully and providing comprehensive documentation will greatly improve the likelihood of a smooth and successful claim process. Finally, understanding your policy limits allows you to budget accordingly and potentially explore supplemental options if your loss of use expenses exceed the coverage.

Summary

Securing adequate renters insurance, including robust loss of use coverage, is a proactive step towards financial security. While unforeseen events are inherently unpredictable, understanding the intricacies of your policy allows you to navigate challenging situations with greater confidence. By carefully reviewing policy details, maintaining proper documentation, and understanding the claims process, renters can effectively leverage loss of use coverage to mitigate the financial impact of displacement following a covered event. Remember, a well-informed renter is a well-protected renter.

Q&A

What constitutes a “covered event” for loss of use coverage?

Typically, covered events include fire, smoke damage, vandalism, and other perils specified in your policy. Specific exclusions vary by insurer, so review your policy carefully.

How long does loss of use coverage typically last?

The duration varies depending on the policy and the extent of repairs needed to make your dwelling habitable. It usually covers a reasonable period for repairs or relocation.

Can I use loss of use coverage for a hotel stay?

Yes, loss of use coverage often covers temporary living expenses, including hotels, provided it’s a reasonable and necessary expense due to the covered event.

What if my claim is denied?

If your claim is denied, carefully review the reasons provided by your insurer. You may have grounds for appeal or need to consult with an attorney.