Finding affordable and comprehensive renters insurance can feel overwhelming. Navigating the world of online quotes, comparing coverage options, and understanding policy details requires careful consideration. This guide simplifies the process, empowering you to secure the right renters insurance policy with confidence, all from the convenience of your computer.

We’ll walk you through obtaining renters insurance online quotes, exploring key factors that influence pricing, and helping you choose a policy that perfectly matches your needs and budget. From understanding the benefits of coverage to filing a claim, we’ll cover everything you need to know to protect your valuable possessions.

Understanding Renter’s Insurance

Renter’s insurance, often overlooked, provides crucial financial protection for your belongings and liability in the event of unforeseen circumstances. It’s a relatively inexpensive way to safeguard yourself against significant losses and peace of mind knowing you’re covered. This section will detail the key benefits, coverage options, and variations in renters insurance policies.

Key Benefits of Renters Insurance

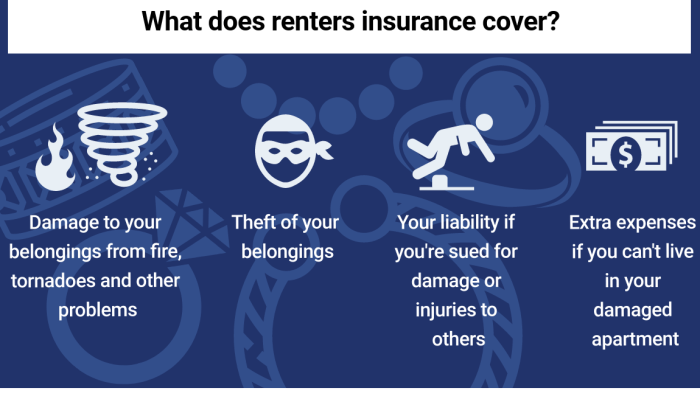

Renters insurance offers several significant advantages. Primarily, it protects your personal possessions from damage or theft, whether caused by fire, theft, vandalism, or even natural disasters (depending on your policy). Beyond personal property coverage, it also provides liability protection, shielding you from financial responsibility if someone is injured on your property. Furthermore, many policies include additional living expenses coverage, providing temporary housing and related costs if your rental unit becomes uninhabitable due to a covered event. This financial cushion can prevent significant financial hardship during a difficult time.

Typical Coverage Included in a Standard Renters Insurance Policy

A standard renters insurance policy typically includes several key coverages. Personal property coverage protects your belongings against loss or damage. Liability coverage protects you financially if someone is injured on your property or you damage someone else’s property. Additional living expenses coverage helps pay for temporary housing and other expenses if your rental unit becomes uninhabitable. Some policies may also include medical payments coverage for injuries to guests on your property. The specific details and limits of these coverages will vary depending on the policy and insurer.

Comparison of Different Renters Insurance Policies

Renters insurance policies aren’t all created equal. The level of coverage and the associated premiums can vary significantly depending on several factors including the value of your possessions, your location, and the chosen deductible. For example, some policies offer higher coverage limits for personal belongings, while others may provide broader liability protection. Similarly, policies with higher deductibles will generally have lower premiums, but you’ll pay more out-of-pocket in the event of a claim. It’s essential to carefully compare policies to find one that suits your individual needs and budget.

Renters Insurance Coverage Options and Price Ranges

The following table provides a general comparison of coverage options and price ranges. Note that these are estimates and actual costs will vary based on individual factors.

| Coverage Type | Coverage Amount (Example) | Deductible (Example) | Approximate Monthly Premium Range |

|---|---|---|---|

| Personal Property | $10,000 | $500 | $15 – $30 |

| Liability | $100,000 | N/A | Included in most policies |

| Additional Living Expenses | $2,000 | $500 | Included in most policies |

| Medical Payments | $1,000 | N/A | Often included, may increase premium slightly |

Obtaining Online Quotes

Getting a renters insurance quote online is a straightforward process designed to save you time and effort. Many companies offer quick and easy online quote tools, allowing you to compare coverage options and prices within minutes. This approach empowers you to make informed decisions about your insurance needs based on your specific circumstances.

The process typically involves providing basic information about yourself, your rental property, and your belongings. This information is then used to generate a personalized quote reflecting your individual risk profile.

The Process of Getting an Online Renters Insurance Quote

Obtaining an online quote usually begins with visiting the insurance company’s website. You’ll be prompted to complete a form requesting details such as your address, the value of your possessions, and desired coverage amounts. Once you submit this information, the system will calculate a preliminary quote, often within seconds. You can then review the details of the policy, including coverage limits, deductibles, and premiums. Many insurers offer multiple coverage options to tailor the policy to your specific needs. For example, you might choose to add coverage for liability or valuable items.

Tips for Finding the Best Online Quotes

Comparing multiple quotes from different insurers is crucial to securing the best value for your money. Begin by identifying several reputable companies operating in your area. Look for companies with positive customer reviews and strong financial ratings. Remember to consider not only the price but also the breadth and quality of coverage offered. Pay attention to deductibles, which represent the amount you’ll pay out-of-pocket before the insurance kicks in. A higher deductible will usually result in a lower premium, and vice-versa. Additionally, carefully examine the specific items included and excluded from the coverage. Some policies may have limitations on certain types of property or events. For example, flooding might be excluded from standard coverage.

Potential Pitfalls to Avoid When Seeking Online Quotes

One potential pitfall is focusing solely on price. While cost is important, don’t compromise on coverage. A cheaper policy with inadequate coverage could leave you financially vulnerable in the event of a loss. Another potential issue is failing to accurately assess the value of your belongings. Underestimating the value of your possessions can result in insufficient coverage. Finally, avoid hastily clicking through the online quote process without carefully reading the policy details. Understanding the terms and conditions of the policy is vital before making a decision.

Comparing Multiple Online Quotes: A Step-by-Step Guide

To effectively compare multiple quotes, gather quotes from at least three different insurers. Create a spreadsheet or use a comparison tool to organize the information. List the key features of each quote side-by-side, including the premium, deductible, coverage limits for personal property, liability coverage, and any additional coverage options. Pay close attention to what is and isn’t covered under each policy. For example, some policies may cover additional living expenses if your apartment becomes uninhabitable due to a covered event, while others might not. Once you have a clear comparison, analyze the data to identify the policy that best balances cost and coverage based on your needs and budget. Remember, the cheapest option isn’t always the best if it lacks sufficient coverage.

Factors Affecting Quote Prices

Several key factors influence the cost of renters insurance. Understanding these factors can help you make informed decisions and potentially secure a more affordable policy. This section will detail these factors, explaining their impact on your premium.

Several interconnected elements determine your renters insurance quote. These range from your location and the value of your possessions to the level of coverage you select. Let’s examine these factors in more detail.

Location’s Impact on Premiums

Your location significantly impacts your renters insurance premium. Areas with higher crime rates, a greater frequency of natural disasters (like hurricanes, earthquakes, or wildfires), or a higher cost of living generally have higher insurance premiums. Insurance companies assess risk based on historical data for each region. For example, a renter in a coastal city prone to hurricanes will likely pay more than a renter in a less disaster-prone inland area. Similarly, apartments in high-crime neighborhoods might command higher premiums due to the increased risk of theft or vandalism.

Personal Belongings Value and Coverage

The value of your personal belongings is a crucial factor determining your premium. Renters insurance covers the replacement cost of your possessions in case of theft, damage, or loss. The higher the value of your belongings, the more expensive your coverage will be. This is because a higher coverage limit means the insurance company faces a greater potential payout in case of a claim. For instance, someone with a high-value collection of electronics or antiques will pay more than someone with primarily inexpensive furniture and clothing. Accurately assessing the value of your possessions is vital to avoid underinsurance, which could leave you with significant financial losses in the event of an incident. Consider creating a detailed home inventory to help determine the value of your belongings.

Factors Affecting Quote Prices: A Prioritized List

The following list prioritizes factors influencing renters insurance quotes, with those having the most significant impact listed first:

- Location: Crime rates, disaster risk, and cost of living in your area are primary drivers of premium costs.

- Value of Personal Belongings: The higher the value of your possessions, the higher your premium.

- Coverage Limits: Choosing higher coverage limits for personal property, liability, or additional living expenses will increase your premium.

- Deductible Amount: A higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) will generally result in a lower premium. A lower deductible means a higher premium.

- Credit Score: In some states, your credit score can be a factor in determining your premium. A higher credit score may lead to lower premiums.

- Claims History: A history of filing insurance claims may lead to higher premiums in the future.

Choosing the Right Policy

Selecting the right renters insurance policy involves careful consideration of your individual needs and risk assessment. Finding the appropriate coverage requires understanding your possessions’ value, potential liabilities, and the specific risks associated with your living situation. This process ensures you have adequate protection without overspending on unnecessary coverage.

Understanding Policy Exclusions

It’s crucial to thoroughly review the policy’s exclusions, which are specific items or situations not covered by the insurance. Common exclusions might include damage caused by floods, earthquakes, or specific types of pests. Understanding these limitations allows you to assess your personal risk and consider supplemental coverage if needed. For example, if you live in a flood-prone area, you might need to purchase flood insurance separately, as it’s rarely included in standard renters insurance policies. Similarly, valuable jewelry or collectibles might require separate endorsements to ensure adequate coverage beyond the standard policy limits.

Comparing Coverage Levels

Renters insurance policies offer various coverage levels, typically categorized as “actual cash value” (ACV) and “replacement cost value” (RCV). ACV covers the replacement cost minus depreciation, while RCV covers the full replacement cost of damaged or stolen items. Choosing between these options depends on your financial situation and risk tolerance. For example, a policy offering RCV might be more expensive but provides greater financial security in the event of a significant loss. Lower coverage levels will result in lower premiums but leave you with a greater financial burden if a loss occurs. Consider the value of your belongings and your ability to replace them without significant financial strain.

Renters Insurance Policy Checklist

Before purchasing a policy, use this checklist to ensure you’re making an informed decision:

- Inventory your belongings: Create a detailed list of your possessions, including their estimated value. Take photos or videos as supporting documentation.

- Determine your coverage needs: Calculate the total value of your belongings and consider your liability risks. This will help you decide on the appropriate coverage amount.

- Compare quotes from multiple insurers: Obtain quotes from at least three different insurers to compare prices and coverage options.

- Review policy exclusions carefully: Understand what is and isn’t covered by the policy. Consider supplemental coverage if necessary.

- Choose your coverage level (ACV or RCV): Weigh the cost versus the benefits of each option based on your financial situation and risk tolerance.

- Check the liability coverage: Ensure the liability coverage is sufficient to protect you from potential lawsuits.

- Read the policy documents thoroughly: Understand all terms and conditions before signing.

- Confirm the claims process: Understand how to file a claim and what documentation is required.

Filing a Claim

Filing a renters insurance claim can seem daunting, but understanding the process can make it significantly less stressful. This section Artikels the steps involved, the necessary documentation, and provides examples of common claim scenarios. Remember to always refer to your specific policy documents for detailed instructions.

The process generally begins with contacting your insurance company’s claims department, usually via phone or through their online portal. They will guide you through the initial steps and assign a claims adjuster to your case. The adjuster will then investigate the incident, assess the damages, and determine the extent of coverage based on your policy.

Required Documentation for a Claim

Gathering the necessary documentation promptly is crucial for a smooth claims process. This helps expedite the assessment and ensures a fair settlement. The specific documents required might vary slightly depending on the nature of the claim, but generally include:

- Your policy information: This includes your policy number and contact information.

- A detailed description of the incident: Include the date, time, and location of the event. Explain what happened and how the damage occurred.

- Photographs and/or videos of the damage: Visual evidence is essential in supporting your claim. Take multiple photos from different angles, showing the extent of the damage.

- Police report (if applicable): If the damage resulted from a theft, vandalism, or other criminal activity, a police report is usually required.

- Receipts and estimates for repairs or replacements: This helps substantiate the cost of repairs or replacement of damaged items. Keep all receipts for any expenses related to the claim.

- Inventory of damaged property: Create a detailed list of all damaged or stolen items, including their make, model, purchase date, and estimated value. If possible, provide proof of purchase.

Claim Resolution Steps

Once the claim is filed and the necessary documentation is submitted, the claims adjuster will assess the situation. This involves verifying the details of the incident, reviewing the supporting documents, and possibly conducting an inspection of the damaged property. The adjuster will then determine the amount of compensation based on your policy coverage and the assessed value of the damages. The resolution may involve direct payment to you, payment to a repair service, or a combination of both. You will receive regular updates on the progress of your claim throughout the process.

Common Claim Scenarios and Resolutions

Understanding common claim scenarios can help you prepare for potential situations. Here are a few examples:

- Theft: If your apartment is burglarized, you’ll need to file a police report and provide a detailed inventory of stolen items with proof of purchase if possible. Your insurance will cover the value of the stolen items up to your policy’s limits, less your deductible.

- Fire Damage: In case of a fire, you’ll need photos and a fire department report. Coverage will typically include the cost of repairing or replacing damaged belongings and temporary living expenses if your apartment is uninhabitable.

- Water Damage: Water damage from a burst pipe or leaky roof can be covered. You’ll need to document the damage with photos and possibly obtain an estimate for repairs from a qualified contractor. Your coverage will depend on the cause of the damage and the specifics of your policy.

- Wind Damage: Damage caused by a strong windstorm (such as broken windows or damaged belongings) will require documentation of the storm event (weather reports) and photos of the damage. The extent of coverage will depend on the severity of the damage and the terms of your policy.

Last Point

Securing renters insurance is a crucial step in protecting your personal belongings and financial well-being. By understanding the process of obtaining online quotes, carefully comparing options, and selecting a policy that aligns with your individual needs, you can confidently safeguard your future. Remember, a little proactive planning can provide significant peace of mind.

Detailed FAQs

What is the average cost of renters insurance?

The average cost varies significantly based on location, coverage amount, and personal factors. Expect to pay anywhere from $15 to $30 per month, but it’s best to get personalized quotes for accurate pricing.

What happens if I don’t have renters insurance and something is stolen or damaged?

Without renters insurance, you’re personally responsible for replacing or repairing any stolen or damaged belongings. This can lead to significant financial hardship.

How long does it take to get an online quote?

Most online quote processes take only a few minutes. You’ll typically need to provide basic information about your apartment, belongings, and desired coverage.

Can I get renters insurance if I have a pet?

Yes, but the cost may be higher depending on the type and breed of pet. Be sure to disclose pet ownership when obtaining quotes.

What if my landlord requires renters insurance?

Your landlord will likely require proof of insurance, usually in the form of a policy declaration page. Make sure to obtain this from your chosen insurer.