Securing affordable renters insurance is crucial for protecting your belongings and mitigating financial risks. However, navigating the complexities of renters insurance prices can feel overwhelming. This guide unravels the factors influencing cost, offering strategies to find competitive policies and a clearer understanding of what your coverage entails.

From understanding the impact of your credit score and location to exploring different coverage levels and deductibles, we’ll equip you with the knowledge to make informed decisions about your renters insurance. We’ll also delve into practical tips for securing the best possible price and avoiding costly mistakes.

Factors Influencing Renters Insurance Costs

Several key factors interact to determine the cost of renters insurance. Understanding these elements allows renters to make informed decisions about their coverage and budget effectively. This includes considerations such as the level of coverage desired, the location of the rental property, the renter’s credit history, and their claims history.

Coverage Amounts

The amount of coverage you choose significantly impacts your premium. Higher coverage limits, meaning more financial protection for your belongings in case of loss or damage, naturally result in higher premiums. For example, choosing a policy with $50,000 in personal property coverage will cost more than a policy with $25,000. It’s crucial to strike a balance between adequate protection and affordability. Consider the value of your possessions when determining your coverage needs. Remember to regularly update your coverage amount as the value of your belongings changes.

Location

Your location plays a considerable role in determining your renters insurance premium. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, typically command higher premiums due to the increased risk. Similarly, areas with higher rates of theft or vandalism may also lead to more expensive insurance. A renter in a high-risk area like coastal Florida will likely pay significantly more than a renter in a low-risk area of the Midwest.

Credit Score

In many states, insurance companies use credit-based insurance scores to assess risk. A higher credit score often translates to lower premiums, reflecting the perception that individuals with good credit are less likely to file claims. Conversely, a lower credit score may lead to higher premiums. Improving your credit score can be a proactive step towards securing more favorable renters insurance rates.

Claims History

Your past claims history significantly influences your premiums. Filing multiple claims in the past can lead to higher premiums as insurers view you as a higher risk. Conversely, a clean claims history can result in lower premiums. It’s essential to carefully consider whether filing a claim is truly necessary, weighing the potential cost increase against the benefits of the claim payout.

Deductibles

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible typically results in lower premiums. This is because you are assuming more of the financial risk. However, a higher deductible means you will have to pay more in the event of a claim. Consider your financial situation and risk tolerance when selecting your deductible. A lower deductible offers more immediate financial protection, but at a higher premium cost.

Average Renters Insurance Costs Across Different States

| State | Average Annual Premium | Average Deductible | Factors Contributing to Cost Variations |

|---|---|---|---|

| California | $200 | $500 | High cost of living, earthquake risk, wildfire risk |

| Florida | $250 | $1000 | Hurricane risk, high property values, frequent claims |

| Texas | $150 | $500 | Large geographic area, varying risk levels across the state |

| New York | $180 | $750 | High population density, higher cost of living, potential for property damage |

Finding Affordable Renters Insurance

Securing affordable renters insurance doesn’t require sacrificing crucial coverage. By employing smart strategies and understanding the market, you can find a policy that fits your budget without compromising your protection. This section Artikels effective methods for minimizing costs while maintaining adequate coverage for your belongings and liability.

Finding the most cost-effective renters insurance policy involves a multi-pronged approach. This includes comparing quotes from multiple insurers, understanding the factors that influence premiums, and carefully considering your coverage needs. Choosing the right deductible and bundling options can also significantly impact your overall cost.

Strategies for Securing Cost-Effective Renters Insurance

Several strategies can help you find the most affordable renters insurance. These involve proactive steps to compare policies, adjust coverage levels, and explore potential discounts.

- Compare Quotes from Multiple Insurers: Obtain quotes from at least three different insurance providers to compare prices and coverage options. Don’t rely solely on online comparison tools; contact insurers directly to discuss your specific needs and potentially uncover additional discounts.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in the event of a claim, but it will typically result in a lower premium. Carefully weigh the financial implications of a higher deductible against the potential savings.

- Consider Coverage Levels: Evaluate your possessions and determine the appropriate coverage amount. Overinsuring can lead to unnecessary expenses. Ensure you have adequate coverage for your belongings, but avoid excessive amounts.

- Bundle with Other Insurance: Many insurers offer discounts when you bundle renters insurance with other policies, such as auto insurance. This can lead to substantial savings.

- Look for Discounts: Inquire about potential discounts offered by insurers. Some companies offer discounts for things like being a homeowner’s insurance customer, having a security system, or being a member of certain organizations.

Benefits and Drawbacks of Bundling Renters Insurance

Bundling renters insurance with other insurance policies, such as auto insurance, is a common strategy to reduce costs. However, it’s crucial to weigh the benefits against potential drawbacks.

- Benefits: Bundling often leads to significant discounts, simplifying billing, and potentially providing a more streamlined claims process. For example, a customer bundling their car and renters insurance with State Farm might receive a 10-15% discount on their overall premium.

- Drawbacks: Bundling might limit your choices of insurers and potentially lock you into a less favorable policy if the bundled package doesn’t perfectly meet your needs. It’s important to compare bundled options against purchasing policies separately to ensure you are getting the best deal.

Reputable Insurance Providers with Competitive Pricing

Several reputable insurance providers are known for offering competitive renters insurance rates. It’s essential to compare quotes from multiple companies to find the best deal for your specific circumstances. Remember that pricing varies based on location, coverage, and individual risk factors.

- State Farm: A major insurer with a wide range of coverage options and often competitive pricing.

- Allstate: Another large insurer offering a variety of renters insurance plans.

- Progressive: Known for its online tools and potentially competitive rates.

- GEICO: A well-known insurer with a strong reputation and often competitive pricing, especially for those who bundle policies.

- USAA: Offers competitive rates primarily to military members and their families.

Step-by-Step Guide to Obtaining Renters Insurance Quotes

Obtaining quotes from multiple providers is crucial to securing the best renters insurance rate. This process involves several straightforward steps.

- Gather Necessary Information: Compile information about your address, belongings, and desired coverage amounts.

- Contact Multiple Insurers: Reach out to at least three different insurance providers, either online or by phone.

- Request Quotes: Provide the necessary information to each insurer and request a personalized quote.

- Compare Quotes: Carefully compare the quotes, paying close attention to coverage levels, premiums, and deductibles.

- Choose a Policy: Select the policy that best meets your needs and budget.

- Finalize the Purchase: Complete the application process and make the necessary payments.

Understanding Renters Insurance Coverage

Renters insurance provides crucial financial protection against unforeseen events that can damage your belongings or cause you liability. Understanding the different types of coverage, their limitations, and how they compare across providers is key to choosing a policy that meets your needs. This section will detail the typical components of a renters insurance policy, highlighting both what’s covered and what’s excluded.

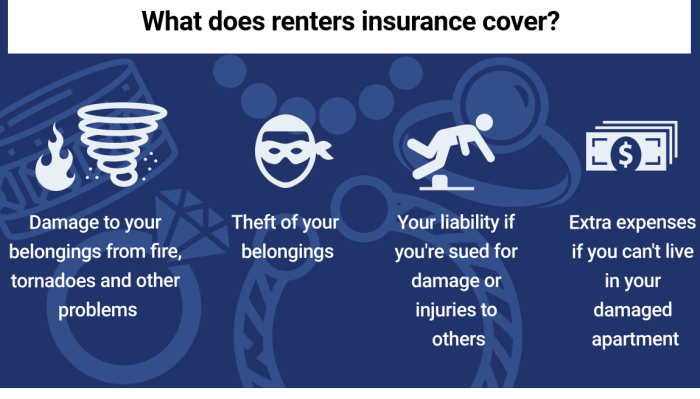

Types of Coverage in a Standard Renters Insurance Policy

A standard renters insurance policy typically includes three main types of coverage: personal property coverage, liability coverage, and additional living expenses coverage. Personal property coverage protects your belongings from damage or theft. Liability coverage protects you financially if you are held responsible for someone else’s injuries or property damage. Additional living expenses coverage helps pay for temporary housing and other necessary expenses if your rental unit becomes uninhabitable due to a covered event. The specific amounts of coverage for each are customizable and depend on the policy you choose.

Coverage Limitations and Exclusions

It’s important to understand that renters insurance policies have limitations and exclusions. Common exclusions include damage caused by floods, earthquakes, and acts of war. Many policies also have limits on the amount they will pay for specific items, such as jewelry or electronics. Additionally, there are often deductibles, which are the amount you must pay out-of-pocket before the insurance company starts paying. For example, a policy might exclude coverage for damage caused by gradual wear and tear, or for items left outside the insured premises. Carefully reviewing the policy document is crucial to understanding these limitations.

Coverage Comparison Across Providers

Coverage amounts and specifics can vary significantly between insurance providers. For example, one company might offer higher liability coverage limits than another, while another might offer more favorable terms for replacing high-value items. Some insurers might offer add-ons or endorsements to cover specific items or risks, such as flood or earthquake insurance, which are usually excluded from standard policies. Comparing quotes from multiple providers is essential to find the best coverage at the most competitive price. Consider not only the price but also the level of coverage and the reputation of the insurance company.

Common Scenarios Where Renters Insurance Provides Financial Protection

Renters insurance can be a lifesaver in various situations. Understanding these scenarios highlights the value of this often overlooked coverage.

- Theft: If your apartment is burglarized and your belongings are stolen or damaged, renters insurance can help replace them.

- Fire: In the event of a fire in your building, renters insurance will cover the damage or loss of your personal property.

- Water Damage: Damage from burst pipes or a leaky roof can be devastating. Renters insurance often covers this type of damage.

- Liability: If a guest is injured in your apartment and sues you, liability coverage will help pay for legal fees and settlements.

- Wind Damage: Damage from a strong storm can be significant. Renters insurance can help with repairs or replacements.

- Additional Living Expenses: If your apartment becomes uninhabitable due to a covered event, such as a fire, additional living expenses coverage can help pay for temporary housing and other essential expenses.

Conclusive Thoughts

Ultimately, securing the right renters insurance policy involves a balance between adequate coverage and affordable premiums. By understanding the factors that influence price, employing smart strategies for comparison shopping, and carefully evaluating your coverage needs, you can find a policy that provides peace of mind without breaking the bank. Remember to regularly review your policy and adjust coverage as needed to reflect changes in your lifestyle and possessions.

FAQ Overview

What is the average cost of renters insurance?

The average annual cost varies significantly by location, coverage amount, and individual factors. Expect to pay anywhere from $15 to $30 per month, but this is just a broad estimate.

Can I get renters insurance without a credit check?

Some insurers may offer policies without a credit check, but it’s less common. Those that do may offer higher premiums.

What happens if I file a claim?

Filing a claim will likely affect your future premiums. The extent of the impact depends on the specifics of the claim and your insurer’s policies.

How often should I review my renters insurance policy?

It’s advisable to review your policy annually or whenever there’s a significant change in your possessions or living situation (e.g., buying new electronics, moving to a new apartment).