Securing affordable and comprehensive renters insurance is crucial for protecting your belongings and financial well-being. Navigating the world of insurance quotes, however, can feel overwhelming. This guide simplifies the process of renters insurance quote comparison, empowering you to make informed decisions and find the best policy to fit your lifestyle and budget. We’ll explore key coverage aspects, factors influencing costs, and effective strategies for comparing quotes to ensure you’re adequately protected.

From understanding the nuances of liability and personal property coverage to leveraging online comparison tools, we’ll provide a clear and concise path towards securing the right renters insurance. We’ll also address common misconceptions and offer practical tips to help you avoid costly oversights. Ultimately, our goal is to equip you with the knowledge and resources needed to confidently choose a policy that offers peace of mind.

Understanding Renters Insurance

Renters insurance is a crucial yet often overlooked aspect of securing your life and belongings. It provides financial protection against unforeseen events that can damage your personal property or cause you financial hardship. Understanding its key features can empower you to make informed decisions about your coverage.

Key Features of Renters Insurance

A standard renters insurance policy typically includes several key features designed to safeguard your possessions and financial well-being. These features work together to offer comprehensive protection against a wide range of potential problems. The specific details and limits of coverage will vary depending on the insurer and the chosen policy.

Types of Coverage Included

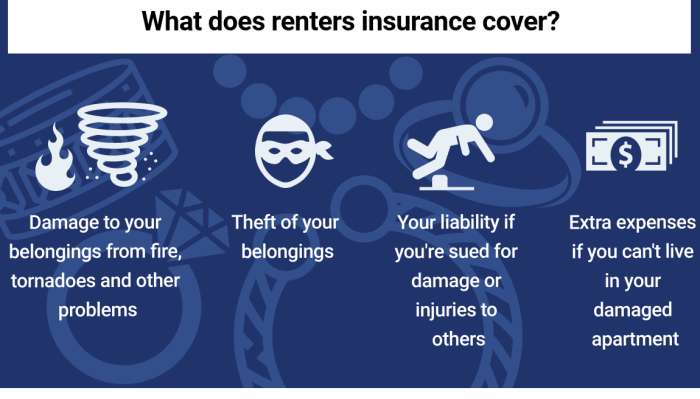

Renters insurance generally provides three main types of coverage: personal property coverage, liability coverage, and additional living expenses coverage. Personal property coverage protects your belongings from damage or theft. Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. Additional living expenses coverage helps pay for temporary housing and other expenses if your rental unit becomes uninhabitable due to a covered event. Many policies also offer optional add-ons, such as coverage for valuable items or identity theft protection.

Situations Where Renters Insurance is Beneficial

Renters insurance offers significant protection in various scenarios. For example, if a fire damages your apartment, renters insurance will cover the cost of replacing your lost or damaged belongings. If a guest is injured in your apartment and sues you, liability coverage will help pay for legal fees and settlements. If a storm makes your apartment uninhabitable, additional living expenses coverage will help pay for temporary housing and other essential expenses. Even seemingly minor events, such as theft of a laptop or damage from a burst pipe, can be financially devastating without adequate insurance.

Comparison of Coverage Levels

The following table compares the coverage levels offered by four hypothetical insurers (Insurer A, Insurer B, Insurer C, and Insurer D) for a standard renters insurance policy. Remember that these are examples and actual coverage levels and pricing will vary depending on your location, the insurer, and the specifics of your policy.

| Insurer | Personal Property Coverage (USD) | Liability Coverage (USD) | Additional Living Expenses (USD) |

|---|---|---|---|

| Insurer A | 30,000 | 100,000 | 5,000 |

| Insurer B | 25,000 | 100,000 | 3,000 |

| Insurer C | 40,000 | 200,000 | 7,000 |

| Insurer D | 35,000 | 150,000 | 6,000 |

Factors Affecting Renters Insurance Quotes

Several key factors influence the cost of renters insurance. Understanding these elements allows you to make informed decisions and potentially secure more affordable coverage. These factors interact to determine your final premium, so it’s important to consider them holistically.

Location’s Impact on Premiums

Your location significantly impacts your renters insurance premium. Areas with higher crime rates, a greater frequency of natural disasters (like hurricanes, earthquakes, or wildfires), and higher property values generally have higher insurance costs. For example, a coastal apartment in a hurricane-prone region will likely command a higher premium than a similar apartment in a less-risky inland location. Insurance companies assess risk based on historical claims data for specific geographic areas. A city with a high incidence of burglaries will naturally lead to higher premiums for renters there, reflecting the increased likelihood of claims.

Personal Belongings Value and Coverage

The value of your personal belongings is a crucial factor in determining your renters insurance premium. This includes everything from furniture and electronics to clothing and jewelry. A higher declared value necessitates a higher premium to reflect the increased potential payout in case of loss or damage. Accurately assessing the value of your possessions is critical. Consider creating a detailed home inventory, including photos and receipts, to support your claim in case of an incident. Underestimating the value of your belongings could leave you underinsured, while overestimating could unnecessarily inflate your premiums. For instance, someone with a large collection of valuable electronics will pay more than someone with minimal possessions.

Claims History’s Influence on Insurance Costs

Your claims history, both personal and that of your address, influences your insurance premiums. A history of filing claims, even for minor incidents, can lead to higher premiums. Insurance companies view frequent claims as indicators of higher risk. Conversely, a clean claims history can often result in lower premiums or discounts. For example, an individual with a past claim for water damage might face a higher premium than someone with no prior claims. Similarly, an apartment building with a history of burglaries might have higher insurance rates for all its residents, regardless of their individual claims history. This reflects the shared risk within a specific location.

Comparing Renters Insurance Quotes

Obtaining multiple renters insurance quotes is crucial for securing the best coverage at the most competitive price. By carefully comparing different policies, you can identify the best fit for your needs and budget. This process involves more than just looking at the price; it requires a thorough understanding of the coverage details and policy limitations.

Step-by-Step Guide to Comparing Renters Insurance Quotes

Comparing renters insurance quotes effectively requires a systematic approach. This ensures you don’t overlook key aspects of each policy.

- Gather Quotes: Obtain at least three to five quotes from different insurers. Utilize online comparison tools or contact insurers directly.

- Standardize Information: Ensure all quotes use the same coverage amounts for personal property and liability. This allows for a fair comparison.

- Review Coverage Details: Carefully examine each policy’s coverage details, including what’s covered, deductibles, and exclusions. Pay close attention to specifics like coverage for valuable items and additional living expenses.

- Compare Premiums: Compare the total annual premiums for each policy with similar coverage levels. Consider the value you receive for the price.

- Check the Insurer’s Reputation: Research the financial stability and customer service ratings of each insurance company. Look for independent ratings from organizations like A.M. Best.

- Read Policy Documents: Before making a decision, thoroughly read the full policy documents for each quote. This ensures you understand all terms and conditions.

- Ask Questions: If anything is unclear, contact the insurance provider to clarify any questions or concerns before committing to a policy.

Essential Factors to Consider When Comparing Quotes

Several key factors significantly influence the value and cost of renters insurance. Understanding these factors enables you to make an informed decision.

- Coverage Amount for Personal Property: This determines how much the insurer will pay to replace or repair your belongings in case of loss or damage. Consider the value of your possessions and choose a coverage amount that reflects this.

- Liability Coverage: This protects you from financial responsibility if someone is injured or their property is damaged on your premises. A higher liability limit provides greater protection.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but you’ll pay more in the event of a claim.

- Additional Living Expenses Coverage: This covers temporary housing and living expenses if your rental unit becomes uninhabitable due to a covered event (e.g., fire).

- Discounts: Many insurers offer discounts for bundling policies (e.g., renters and auto insurance), security systems, or being a long-term customer.

- Claims Process: Understand the insurer’s claims process, including how to file a claim and the typical processing time. Look for insurers with a reputation for smooth and efficient claims handling.

Assessing the Value and Coverage Offered by Different Policies

Directly comparing policies requires a structured approach. Consider creating a table to visually compare key features.

| Insurer | Annual Premium | Personal Property Coverage | Liability Coverage | Deductible | Additional Living Expenses | Discounts |

|---|---|---|---|---|---|---|

| Insurer A | $250 | $20,000 | $100,000 | $500 | $10,000 | None |

| Insurer B | $280 | $25,000 | $100,000 | $250 | $15,000 | 5% for bundled auto |

| Insurer C | $220 | $15,000 | $50,000 | $1000 | $5,000 | None |

Note: This table is for illustrative purposes only. Actual premiums and coverage amounts will vary depending on your location, risk profile, and the specific insurer.

Finding and Using Online Comparison Tools

Online comparison tools have revolutionized the way consumers shop for insurance, including renters insurance. These platforms aggregate quotes from multiple insurance providers, allowing you to compare coverage options and prices side-by-side, streamlining the often-daunting process of finding the right policy. This saves significant time and effort compared to contacting each insurer individually.

Online comparison tools work by using algorithms to match your specific needs and profile with the best available policies from their network of insurance providers. You input your details—address, desired coverage amounts, personal information—and the tool searches its database, returning a selection of quotes tailored to your situation. The tools often provide a clear breakdown of coverage details, allowing for a comprehensive comparison of what each policy offers.

Benefits of Using Online Comparison Tools

Using online comparison tools offers several key advantages. The most significant benefit is the time saved. Instead of spending hours researching and contacting individual insurers, you can receive multiple quotes within minutes. Furthermore, these tools promote transparency by presenting all the information in a clear, concise manner, facilitating easy price and coverage comparisons. This transparency allows consumers to make informed decisions based on their specific needs and budget. Finally, the competitive nature of the online market often leads to more competitive pricing than you might find by contacting insurers directly.

Drawbacks of Using Online Comparison Tools

While online comparison tools are extremely helpful, they also have limitations. The range of insurers represented on any given platform may not be exhaustive; you might miss out on a policy offered by a company not included in the tool’s network. Also, the algorithms used to match you with policies might not perfectly capture the nuances of your individual circumstances, potentially leading to an imperfect selection of quotes. Lastly, while the tools present information clearly, understanding the complexities of insurance coverage still requires careful reading and potentially seeking clarification from the insurers themselves.

Tips for Using Online Comparison Tools Effectively

To maximize the effectiveness of online comparison tools, it’s crucial to provide accurate and complete information. Inaccurate data can lead to inaccurate quotes. Be sure to compare not only price but also the level of coverage offered. A cheaper policy with insufficient coverage is ultimately more expensive in case of a claim. Take advantage of the tools’ filtering options to refine your search based on specific needs, such as liability limits or personal property coverage amounts. Finally, remember that the quote is just the first step; review the policy documents carefully before making a final decision.

Reputable Online Resources for Comparing Renters Insurance Quotes

Several reputable websites offer renters insurance comparison services. While specific company names and their rankings are subject to change, a quick search for “renters insurance comparison” on a search engine will typically yield a range of options. It’s important to check reviews and ensure the site is secure and trustworthy before providing your personal information. Look for sites that clearly display their methodology and partner insurance providers, and prioritize sites with established reputations and positive user feedback. Always compare several sites to get the broadest range of quotes.

Understanding Policy Documents and Fine Print

Renter’s insurance policies, while seemingly straightforward, contain crucial details that significantly impact your coverage. Understanding these details, including both the explicit terms and the often-overlooked fine print, is vital to ensuring you have the protection you need. Failing to thoroughly review your policy can lead to unexpected limitations or even denial of claims.

Understanding the intricacies of your policy document is paramount to protecting your belongings and financial well-being. A thorough review will empower you to make informed decisions and avoid potential pitfalls.

Common Exclusions in Renters Insurance Policies

Renters insurance, while comprehensive, typically excludes certain types of losses. These exclusions are designed to manage risk and prevent the insurer from bearing undue financial burdens. Familiarizing yourself with these exclusions is crucial for managing your expectations and planning accordingly.

- Earthquakes and Floods: Most standard renters insurance policies do not cover damage caused by earthquakes or floods. Separate policies are often required for these specific perils. For example, a policy might not cover damage from a burst pipe during a hurricane if the hurricane itself caused the pipe to burst.

- Intentional Acts: Damage caused intentionally by the policyholder or a member of their household is typically excluded. This means that damage from vandalism committed by the policyholder is not covered.

- Gradual Damage: Wear and tear, gradual deterioration, or rust are usually excluded. For instance, a gradually leaking roof that damages your belongings over several months might not be covered under a standard policy.

- Certain Types of Property: Some policies may have limitations on coverage for specific items, such as valuable jewelry, collectibles, or high-value electronics. These items may require separate endorsements or riders to ensure adequate coverage. For example, a policy might have a lower coverage limit for electronics unless additional coverage is purchased.

The Importance of Carefully Reading Policy Documents

Carefully reading your policy documents is not merely advisable; it’s essential. It allows you to fully understand your coverage limits, deductibles, and exclusions. This proactive approach prevents future misunderstandings and ensures you’re adequately protected.

“Understanding your policy is the first step in ensuring you receive the coverage you expect in the event of a claim.”

This detailed understanding ensures that you are prepared for unforeseen events and can make informed decisions about your coverage needs.

Filing a Claim with a Renters Insurance Company

Filing a claim involves a systematic process that typically begins with contacting your insurance provider as soon as possible after an incident. Accurate and timely reporting of the incident is crucial for a smooth claims process.

- Report the incident: Contact your insurance company immediately to report the loss or damage. Provide details about the event, including date, time, and circumstances.

- Document the damage: Take photographs or videos of the damaged property and the surrounding area. This visual evidence is essential for supporting your claim.

- Provide necessary documentation: Gather any relevant documentation, such as receipts for damaged items, police reports (if applicable), and any other supporting evidence.

- Complete claim forms: Your insurance company will provide claim forms that require detailed information about the loss. Complete these forms accurately and thoroughly.

- Cooperate with the adjuster: An insurance adjuster will likely contact you to assess the damage. Cooperate fully with their investigation and provide any requested information.

Key Terms and Definitions in a Standard Renters Insurance Policy

The following table Artikels some key terms and their definitions that are commonly found in renters insurance policies. Understanding these terms will help you navigate your policy more effectively.

| Term | Definition | Term | Definition |

|---|---|---|---|

| Actual Cash Value (ACV) | The replacement cost of an item minus depreciation. | Liability Coverage | Protection against financial responsibility for injuries or damage caused to others. |

| Deductible | The amount you pay out-of-pocket before your insurance coverage kicks in. | Replacement Cost Value (RCV) | The cost to replace damaged or lost items with new ones of similar kind and quality. |

| Personal Property Coverage | Coverage for your belongings in the event of loss or damage. | Premium | The amount you pay regularly to maintain your insurance coverage. |

Illustrative Examples of Coverage Scenarios

Understanding the different coverage options within a renters insurance policy is best done through real-world examples. These scenarios illustrate how various aspects of your coverage can protect you from significant financial losses.

Liability Coverage: A Crucial Safety Net

Imagine you’re hosting a small get-together at your apartment. A guest trips over a rug you hadn’t properly secured, injuring their leg and requiring extensive medical treatment. The guest’s medical bills total $50,000, and they sue you for negligence. Without liability coverage, you would be personally responsible for these costs. Renters insurance liability coverage typically provides protection against such lawsuits, covering the costs of medical bills, legal fees, and settlements up to your policy’s limit (often $100,000 or more). This scenario highlights the critical role liability coverage plays in protecting your financial well-being from unexpected accidents.

Personal Property Coverage: Protecting Your Belongings

A fire breaks out in your apartment building, damaging your apartment and destroying many of your possessions. You lose your laptop ($1,500), your television ($800), clothing ($2,000), and various other items totaling an additional $3,000. Replacing these items would be incredibly expensive. Renters insurance with adequate personal property coverage would reimburse you for the actual cash value or replacement cost of your lost or damaged belongings, up to your policy’s limit, minus your deductible. This coverage helps mitigate the significant financial burden of replacing lost personal property after a covered event.

Additional Living Expenses: Maintaining Stability After a Disaster

A severe storm causes extensive damage to your apartment building, making it uninhabitable for several months. You need to find temporary housing, incurring costs for a hotel ($3,000 per month) and additional meals ($500 per month). Your usual transportation costs also increase due to the temporary relocation. Additional living expenses (ALE) coverage in your renters insurance policy would help offset these costs, allowing you to maintain a stable living situation while your apartment is being repaired or rebuilt. The ALE coverage will reimburse you for these extra expenses, up to a specified limit and policy period, ensuring you aren’t financially burdened during a difficult time. This coverage could significantly reduce the financial strain of displacement.

Summary

Comparing renters insurance quotes doesn’t have to be a daunting task. By understanding the key factors influencing premiums, utilizing online comparison tools effectively, and carefully reviewing policy documents, you can confidently select a policy that provides the right level of coverage at a competitive price. Remember, renters insurance is an investment in your financial security, offering protection against unforeseen events and providing peace of mind. Take the time to compare quotes diligently; your future self will thank you.

Essential FAQs

What is the difference between liability and personal property coverage in renters insurance?

Liability coverage protects you financially if someone is injured or their property is damaged on your premises. Personal property coverage protects your belongings from loss or damage due to covered perils (e.g., fire, theft).

How much renters insurance do I need?

The amount of coverage you need depends on the value of your belongings. It’s recommended to create a home inventory to accurately assess this value. Consider also your liability needs – a higher liability limit is often advisable.

Can I get renters insurance if I have a poor credit history?

While credit history can sometimes influence premiums, many insurers consider other factors. It’s best to compare quotes from multiple providers to find the most suitable option.

What is a deductible, and how does it affect my claim?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but you’ll pay more if you file a claim.