The term “Rollin’ Insurance” evokes images of flexibility and mobility, suggesting insurance solutions designed for a constantly moving world. But what exactly does it encompass? This exploration delves into the multifaceted interpretations of this term, examining the diverse insurance types it might represent, the varied customer demographics it could serve, and the potential industry niches it could occupy. We’ll unpack the services, pricing, and legal considerations involved in bringing such a dynamic insurance concept to life.

From understanding the core concept of adaptable insurance policies to analyzing market trends and designing effective customer experiences, this guide provides a thorough overview of the opportunities and challenges associated with “Rollin’ Insurance.” We’ll consider various pricing strategies, technological integrations, and regulatory compliance measures, all while maintaining a focus on building trust and transparency with customers.

Understanding “Rollin Insurance”

The term “Rollin Insurance” lacks a standardized definition in the insurance industry. Its meaning is likely derived from its colloquial use, suggesting insurance coverage related to mobility or transportation, potentially encompassing various types of policies. The interpretation depends heavily on the context in which it’s used.

The ambiguity of “Rollin Insurance” allows for multiple interpretations, each potentially covering a distinct set of risks. It could refer to insurance policies directly linked to vehicles, or it could encompass broader coverage related to activities involving movement or transportation. This necessitates a closer look at potential interpretations and associated insurance types.

Insurance Types Associated with “Rollin Insurance”

Several types of insurance could fall under the umbrella of “Rollin Insurance,” depending on the intended meaning. These policies are typically designed to protect individuals and businesses against financial losses stemming from accidents or unforeseen events related to mobility.

- Auto Insurance: This is the most direct association, covering liability, collision, and comprehensive protection for vehicles. This could include car insurance, motorcycle insurance, and even RV insurance.

- Commercial Auto Insurance: This protects businesses that operate vehicles for commercial purposes, such as delivery services, trucking companies, and ride-sharing services.

- Travel Insurance: While not directly vehicle-related, travel insurance often covers transportation disruptions, medical emergencies, and lost luggage during trips, aligning with the “rollin'” aspect.

- Cargo Insurance: This protects goods during transit, covering damage or loss that might occur while they are being transported by various means.

Target Audience for Rollin Insurance Services

The target audience for services implied by “Rollin Insurance” is broad, encompassing anyone involved in transportation or mobility.

- Individual Vehicle Owners: This includes private car owners, motorcycle riders, and recreational vehicle owners.

- Businesses with Fleets of Vehicles: This encompasses companies operating delivery trucks, taxis, or ride-sharing services.

- Travelers: Individuals and families who frequently travel, both domestically and internationally, could benefit from travel insurance aspects of “Rollin Insurance.”

- Shipping and Logistics Companies: These companies would require cargo insurance to protect goods during transit.

Industry Niches Related to Rollin Insurance

The broad nature of “Rollin Insurance” allows for several industry niche applications. Focusing on specific transportation modes or risk profiles can create specialized insurance products.

- Autonomous Vehicle Insurance: This niche addresses the unique risks associated with self-driving cars and trucks, requiring specialized coverage.

- Drone Insurance: The growing use of drones for delivery and other purposes necessitates insurance policies to cover potential accidents or damages.

- Ride-Sharing Insurance: This focuses on the specific risks faced by ride-sharing drivers and passengers, often requiring supplementary coverage beyond standard auto insurance.

- Cybersecurity Insurance for Connected Vehicles: With increasing vehicle connectivity, insurance policies addressing cyberattacks and data breaches are becoming increasingly important.

Services Offered

Rollin Insurance provides a comprehensive suite of insurance products designed to protect individuals and businesses against a variety of risks. We strive to offer flexible and affordable coverage options tailored to meet the unique needs of our diverse clientele. Our commitment is to provide clear, transparent, and reliable insurance solutions.

Insurance Coverage Comparison

Rollin Insurance offers a range of coverage options to suit different needs and budgets. The following table provides a comparison of some of our key insurance types. Note that specific coverage details and costs can vary based on individual circumstances and risk assessments.

| Type | Coverage | Target Demographic | Typical Cost (Annual) |

|---|---|---|---|

| Motorcycle Insurance | Liability, collision, comprehensive, uninsured/underinsured motorist | Motorcycle owners, riders | $500 – $2000 |

| Scooter Insurance | Liability, collision, comprehensive | Scooter owners, commuters | $300 – $1000 |

| Bicycle Insurance | Theft, damage, liability | Bicycle commuters, enthusiasts | $100 – $500 |

| E-bike Insurance | Theft, damage, liability, battery replacement | E-bike commuters, owners | $200 – $800 |

Benefits for Different Customer Segments

Rollin Insurance offers significant advantages to various customer groups. For example, motorcycle riders benefit from comprehensive coverage that protects against accidents and theft, offering peace of mind on the road. Commuters using scooters or e-bikes appreciate the affordable liability protection, ensuring they are covered in case of accidents involving others. Bicycle enthusiasts benefit from theft and damage coverage, protecting their valuable equipment. The cost-effectiveness of our policies makes insurance accessible to a wider range of individuals, regardless of their income level. Furthermore, our customer service is renowned for its responsiveness and helpfulness.

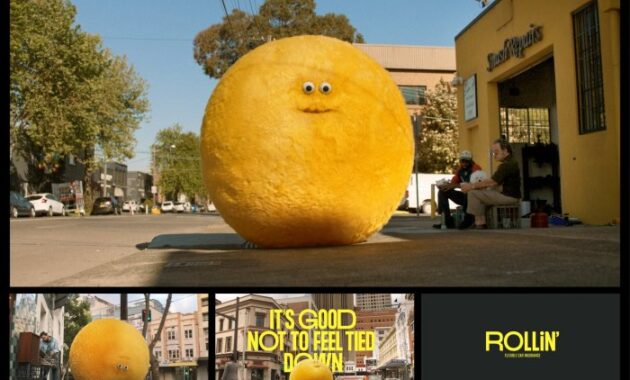

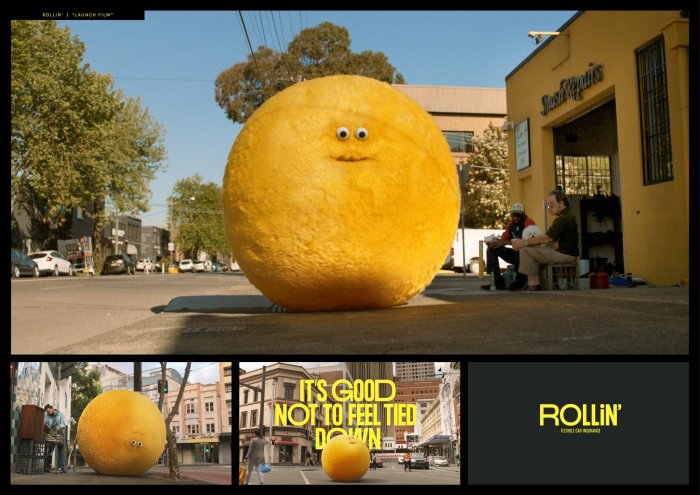

Marketing Campaign Targeting Young Urban Professionals

A marketing campaign targeting young urban professionals (25-40 years old) could leverage social media platforms like Instagram and TikTok. The campaign could showcase vibrant visuals of individuals using various forms of micro-mobility in urban settings, emphasizing the convenience and freedom these modes of transport offer. Short, engaging video ads could highlight the affordability and ease of obtaining a Rollin Insurance policy through a user-friendly mobile app. Influencer marketing, partnering with urban lifestyle bloggers and vloggers, could further amplify the campaign’s reach and credibility. The campaign messaging would focus on the peace of mind and protection Rollin Insurance provides, allowing young professionals to enjoy their urban lifestyle without financial worries.

Potential Partnerships

To expand our reach and offer enhanced value to our customers, Rollin Insurance is actively seeking partnerships with various organizations. These include micro-mobility vehicle manufacturers and retailers (for bundled insurance offerings), urban planning organizations (for community engagement and outreach), and financial technology companies (for seamless integration with payment platforms). Collaborations with ride-sharing services and public transportation providers could also provide cross-promotional opportunities and increase brand visibility. Furthermore, partnerships with local bicycle shops and repair centers could offer additional services and benefits to our policyholders.

Pricing and Market Analysis

Understanding the pricing strategies of Rollin Insurance requires a thorough examination of the competitive landscape and the factors influencing insurance costs. This analysis will compare pricing models, explore potential strategies for Rollin, and discuss the impact of external factors on its pricing structure.

Comparison of Pricing Models

Several insurance providers offer similar services to Rollin Insurance, each employing different pricing models. For example, some might use a tiered system based on coverage levels and policy features, offering basic, standard, and premium packages with varying prices. Others may adopt a usage-based model, adjusting premiums based on factors like mileage or driving behavior. A third approach could be a subscription model, providing a fixed monthly fee for a defined set of services. These different models appeal to diverse customer segments and risk profiles. A direct comparison of premiums across providers requires access to specific pricing data which is not available here, but the methodologies Artikeld above are common within the insurance sector.

Potential Pricing Strategies for Rollin Insurance

Rollin Insurance could leverage several pricing strategies to gain a competitive advantage. A value-based pricing strategy could focus on offering competitive premiums while highlighting the unique value proposition of its services. Penetration pricing, initially offering lower premiums to gain market share, could be employed, followed by a gradual increase as market dominance is established. Premium pricing could position Rollin as a high-end provider with superior services and customer support, justifying higher premiums. The optimal strategy would depend on Rollin’s target market and competitive landscape. For instance, a younger demographic might be more receptive to usage-based pricing, while older, more risk-averse customers may prefer a fixed-premium model.

Factors Influencing Rollin Insurance Pricing

Numerous factors influence Rollin Insurance’s pricing decisions. These include the cost of claims, administrative expenses, regulatory requirements, and the desired profit margin. The level of risk associated with insuring specific customer segments also plays a significant role. For instance, insuring drivers with a history of accidents or violations will likely result in higher premiums than insuring low-risk drivers. Furthermore, the type and extent of coverage offered directly impacts the price. Comprehensive coverage naturally costs more than liability-only coverage.

Impact of External Factors on Pricing

External factors, such as economic conditions and competition, significantly impact Rollin Insurance’s pricing. During economic downturns, customers may be more price-sensitive, forcing Rollin to adjust its pricing to remain competitive. Conversely, during periods of economic growth, Rollin might have more flexibility to increase prices. Intense competition from other insurance providers could necessitate price adjustments to remain attractive to customers. Conversely, a less competitive market might allow Rollin to maintain higher premiums. For example, a sudden influx of new competitors offering similar services at lower prices would necessitate a response from Rollin, potentially through price reductions or the enhancement of service offerings to justify a higher price point. Conversely, a period of consolidation within the insurance market, leading to fewer competitors, could give Rollin greater pricing power.

Customer Experience and Communication

Providing a seamless and positive customer experience is paramount to the success of Rollin Insurance. This involves carefully designing the customer journey, implementing a robust customer service strategy, and crafting effective marketing materials that build trust and transparency. A well-defined approach to customer communication ensures customer satisfaction and loyalty.

Ideal Customer Journey for Rollin Insurance Purchase

The ideal customer journey for Rollin Insurance begins with easy online access to information. Potential customers should be able to quickly understand coverage options and pricing through a user-friendly website and easily accessible FAQs. The online application process should be straightforward, intuitive, and require minimal paperwork. Upon purchase, customers receive immediate confirmation and access to their policy documents digitally. Regular communication, such as renewal reminders and proactive updates, keeps customers informed and engaged. In the event of a claim, a clear and efficient claims process, with prompt communication and support, is crucial. This entire process is designed to minimize friction and maximize customer satisfaction.

Customer Service Strategy for Inquiries and Claims

Rollin Insurance’s customer service strategy centers around prompt, personalized, and efficient support. Multiple channels, including phone, email, and a live chat feature on the website, will be available for customer inquiries. A dedicated team of trained customer service representatives will be responsible for handling inquiries, providing policy information, and guiding customers through the claims process. For claims, a streamlined online portal will allow customers to submit claims easily, track their progress, and communicate with claims adjusters. Regular follow-up and proactive communication will keep customers informed about the status of their claims. The goal is to resolve inquiries and claims quickly and fairly, fostering customer trust and loyalty.

Examples of Effective Marketing Materials

Rollin Insurance’s marketing materials will emphasize simplicity, clarity, and transparency. Brochures will feature clear and concise explanations of coverage options, highlighting key benefits and competitive pricing. Website copy will be easy to read and understand, using plain language and avoiding jargon. Marketing materials will include compelling visuals, such as infographics illustrating coverage details and customer testimonials showcasing positive experiences. Social media campaigns will focus on building a community and engaging with potential customers through interactive content and informative posts. A consistent brand voice and messaging across all platforms will reinforce the company’s commitment to customer satisfaction.

Best Practices for Building Trust and Transparency

Building trust and transparency is achieved through consistent communication and proactive engagement. Rollin Insurance will prioritize clear and accurate policy language, avoiding confusing terms or hidden fees. Regular communication, including newsletters and email updates, will keep customers informed about policy changes and industry news. Customer testimonials and case studies will showcase the company’s commitment to fair and efficient claims processing. Transparency in pricing and coverage options, alongside readily available contact information and responsive customer service, will reinforce trust and build customer loyalty. Active participation in industry initiatives that promote ethical practices further strengthens the company’s commitment to transparency and builds customer confidence.

Technological Considerations

Technology is paramount to the success of any modern insurance provider, and Rollin Insurance is no exception. A robust technological infrastructure will not only streamline internal processes and improve operational efficiency but also enhance the customer experience, fostering loyalty and attracting new clients. This section explores the key technological components necessary for Rollin Insurance’s success and how data analytics can be leveraged for optimal performance.

Technological Solutions for Rollin Insurance

Several technological solutions can significantly improve Rollin Insurance’s efficiency and customer experience. A comprehensive, user-friendly online platform allowing for policy purchases, claims filing, and account management is crucial. This platform should be accessible across multiple devices (desktops, tablets, smartphones) and offer seamless integration with other systems. Furthermore, integrating a robust customer relationship management (CRM) system will help manage customer interactions, track preferences, and personalize communication. Real-time chatbots can provide immediate answers to frequently asked questions, freeing up human agents to handle more complex issues. Finally, implementing telematics technology for certain insurance products can offer personalized pricing based on driving behavior, rewarding safe driving habits.

Key Technologies for Rollin Insurance

The success of Rollin Insurance hinges on a carefully selected suite of technologies. These include:

- A secure and scalable cloud-based infrastructure to handle data storage and processing.

- A customer relationship management (CRM) system for efficient customer interaction and data management.

- A user-friendly online platform for policy management and claims processing.

- Advanced analytics tools for data analysis and predictive modeling.

- Telematics technology for risk assessment and personalized pricing (where applicable).

- Secure payment gateways for online transactions.

- Robust cybersecurity measures to protect sensitive customer data.

Data Analytics for Improved Offerings and Customer Service

Data analytics plays a vital role in enhancing Rollin Insurance’s offerings and customer service. By analyzing customer data, such as demographics, policy types, claims history, and driving behavior (where applicable through telematics), Rollin Insurance can identify trends and patterns. This allows for the development of more accurate risk assessment models, leading to more competitive and personalized pricing. Furthermore, analyzing customer feedback and interaction data can reveal areas for improvement in customer service and product development. For example, identifying common customer pain points in the claims process can inform process improvements and reduce claim processing times. Predictive modeling, using historical data, can help anticipate future claims and allocate resources effectively. Companies like Lemonade have successfully used data analytics to streamline their claims process and offer faster payouts, leading to increased customer satisfaction.

Final Conclusion

Ultimately, the success of “Rollin’ Insurance” hinges on its ability to adapt to the evolving needs of a mobile society. By carefully considering the various insurance types, target demographics, pricing models, and technological integrations, providers can create a truly innovative and valuable service. This necessitates a strong focus on customer experience, regulatory compliance, and leveraging data analytics to enhance offerings and build lasting customer relationships. The potential for “Rollin’ Insurance” is significant, promising a future where insurance is as fluid and adaptable as the lifestyles it protects.

Questions Often Asked

What types of insurance could fall under the umbrella of “Rollin’ Insurance”?

Many types! This could include short-term rental insurance, travel insurance, event insurance, on-demand liability coverage for gig workers, and even insurance for recreational vehicles.

How does “Rollin’ Insurance” differ from traditional insurance?

It emphasizes flexibility and short-term coverage, often utilizing technology for on-demand purchasing and claims processing, unlike traditional long-term policies.

What are the potential risks associated with offering “Rollin’ Insurance”?

Potential risks include accurate risk assessment for short-term policies, managing high volumes of small claims, and ensuring compliance with diverse state regulations.

What technological solutions are crucial for a successful “Rollin’ Insurance” business?

A robust mobile app, a secure online platform, and data analytics tools for risk assessment and customer service optimization are essential.