The cost of auto insurance can be a significant financial burden, but understanding how “safe auto auto insurance” works can lead to substantial savings and peace of mind. This guide explores the multifaceted world of insurance policies designed for safe drivers, examining factors influencing premium calculations, the benefits of choosing such policies, and the role of technology in shaping the future of this sector. We will delve into practical strategies for finding the best coverage, highlighting how responsible driving habits directly impact your insurance costs.

From exploring the various types of policies available to understanding the impact of telematics and driving behavior data, we aim to empower you with the knowledge to make informed decisions about your auto insurance. We’ll also touch upon the legal and regulatory aspects to ensure you’re fully aware of your rights and responsibilities.

Defining “Safe Auto Auto Insurance”

The term “Safe Auto auto insurance” isn’t a formally recognized industry term like “liability” or “collision.” Instead, it’s a descriptive phrase referring to insurance policies and programs that incentivize and reward safe driving behavior. These policies often offer discounts and benefits to drivers who demonstrate a commitment to safety on the road. Essentially, it encompasses a range of insurance products designed to cater to the needs of responsible drivers.

Safe auto insurance programs typically work by leveraging data to assess risk. This data can come from various sources, including telematics devices, driving history reports, and even credit scores (though the latter is becoming increasingly controversial due to its potential for bias). The lower the perceived risk a driver presents, the lower the premiums they’ll likely pay.

Insurance Features Associated with Safe Driving

Many insurance companies offer features designed to promote and reward safe driving. These features often involve monitoring driving habits through technology, offering discounts for completing defensive driving courses, and providing incentives for maintaining a clean driving record. For example, some insurers offer discounts for installing telematics devices in vehicles, which track driving behaviors such as speed, braking, and acceleration. Drivers who consistently exhibit safe driving patterns receive lower premiums as a reward. Other companies might offer discounts for enrolling in and completing approved defensive driving courses, demonstrating a proactive approach to improving driving skills and safety.

Types of Safe Auto Insurance Policies

While there’s no single “Safe Auto” policy, several policy types fall under this umbrella. These include standard auto insurance policies with discounts for safe driving, usage-based insurance (UBI) programs, and pay-as-you-drive (PAYD) insurance. Standard auto insurance policies often include provisions for discounts based on factors like a clean driving record, safe driving courses completed, and the installation of safety features in the vehicle. UBI programs utilize telematics devices to monitor driving behavior and adjust premiums accordingly. PAYD insurance, a subset of UBI, charges drivers based on their actual mileage, rewarding those who drive less. These different policy types cater to the diverse needs and driving habits of individuals, ultimately aiming to encourage and reward safe driving practices.

Factors Influencing “Safe Auto Auto Insurance” Premiums

Several key factors contribute to the premium a driver pays for auto insurance, even for those considered “safe” drivers. Insurance companies utilize complex algorithms and risk assessment models to determine individual premiums, resulting in a wide range of pricing across different insurers and policyholders. Understanding these factors can empower consumers to make informed decisions about their insurance coverage.

Insurance companies employ sophisticated methods to assess risk and price premiums accordingly. While a “safe driver” designation implies lower risk, various elements still impact the final cost. These elements are carefully weighted to produce a premium that accurately reflects the potential for claims.

Driver Demographics and History

Demographic information plays a significant role in premium calculations. Age, gender, and driving history are consistently used. Younger drivers, statistically, have higher accident rates, leading to higher premiums. Similarly, gender can be a factor, although this is becoming less prevalent due to increasing scrutiny of gender-based pricing. Past driving records, including accidents, tickets, and at-fault claims, are critically examined. A history of multiple incidents significantly increases premiums, reflecting the increased risk associated with such drivers. For example, a driver with two at-fault accidents in the past three years would likely face substantially higher premiums than a driver with a clean record.

Vehicle Characteristics

The type of vehicle insured also influences premium costs. Insurers consider factors such as the vehicle’s make, model, year, and safety features. Generally, sports cars and high-performance vehicles are associated with higher premiums due to their increased risk of accidents and higher repair costs. Conversely, vehicles with advanced safety features, such as anti-lock brakes and electronic stability control, may qualify for discounts, reflecting their reduced accident potential. A comparison between insuring a fuel-efficient sedan versus a high-powered sports utility vehicle would clearly illustrate the disparity in premiums.

Location and Driving Habits

Geographic location significantly impacts insurance rates. Areas with high crime rates, frequent accidents, or severe weather conditions tend to have higher premiums due to the increased risk of vehicle damage or theft. Insurers also consider driving habits, though this is increasingly influenced by telematics. High-mileage drivers generally pay more, reflecting the increased exposure to accidents. For instance, a driver living in a densely populated urban area with a long commute would typically pay more than a driver in a rural area with limited driving.

Telematics and Driving Behavior Data

The use of telematics, through devices or smartphone apps, is transforming the way insurers assess risk. Telematics programs collect data on driving behaviors, such as speed, braking, acceleration, and time of day driving. This data allows insurers to create more accurate risk profiles, rewarding safer drivers with lower premiums and potentially penalizing risky behaviors. For example, a driver consistently maintaining speeds below the limit and exhibiting smooth braking patterns might receive a significant discount through a telematics program, while a driver with frequent hard braking and speeding incidents might see their premiums increase.

Premium Calculation Methods Comparison

Different insurers use varying methods to calculate premiums, although they all incorporate the previously discussed factors. Some may rely heavily on actuarial models based on historical data, while others might use more sophisticated algorithms incorporating machine learning to predict future risk more accurately. The weighting given to each factor can also differ significantly, leading to variations in premiums across insurers for the same driver. A driver might receive a relatively low premium from one insurer emphasizing safe driving history, while another insurer prioritizing geographic location might offer a higher premium.

Benefits of Choosing “Safe Auto Auto Insurance”

Selecting a car insurance policy tailored to safe drivers offers a multitude of advantages, extending beyond simply securing coverage. These policies often translate into significant financial benefits and peace of mind, enhancing your overall financial security. By rewarding responsible driving habits, these insurers incentivize safe practices on the road.

Choosing a policy designed for safe drivers can lead to substantial cost savings. These savings are realized through a variety of mechanisms, ultimately making insurance more affordable for those who demonstrate responsible driving behaviors.

Cost Savings and Discounts

Safe driving habits often translate directly into lower premiums. Many insurers offer discounts for factors such as accident-free driving records, completion of defensive driving courses, and maintaining a clean driving record. For instance, a driver with five years of accident-free driving might receive a 15% discount, while completing a defensive driving course could yield an additional 5% reduction. These discounts can accumulate, resulting in considerable savings over the policy term. Furthermore, some insurers offer bundled discounts when you insure multiple vehicles or combine auto insurance with other types of insurance, like homeowners or renters insurance, further reducing your overall cost. The specific discounts available will vary depending on the insurer and the specific policy.

Improved Financial Security

Beyond immediate cost savings, choosing a policy that rewards safe driving contributes to improved long-term financial security. Lower premiums free up funds that can be allocated towards other financial goals, such as saving for a down payment on a house, investing in retirement, or paying down debt. In the event of an accident, having adequate insurance coverage provides a safety net, protecting your assets and preventing financial hardship. The peace of mind that comes with knowing you’re adequately protected from significant financial losses due to accidents is invaluable. This financial security extends beyond the individual, offering protection to your family and dependents as well.

Finding and Comparing Safe Auto Auto Insurance Options

Choosing the right auto insurance policy can feel overwhelming, given the numerous providers and varying coverage options. A systematic approach, however, simplifies the process and helps you find a policy that best suits your needs and budget. This section provides a step-by-step guide to navigate the selection process effectively.

Steps to Finding Suitable Safe Auto Auto Insurance Policies

Finding the best Safe Auto policy involves several key steps. A methodical approach ensures you consider all relevant factors and make an informed decision.

- Assess Your Needs: Determine your coverage requirements. Consider factors such as the value of your vehicle, your driving history, and your financial situation. Do you need liability coverage only, or would comprehensive and collision coverage provide better protection?

- Gather Quotes: Obtain quotes from multiple Safe Auto insurance providers. Many providers offer online quote tools for quick comparisons. Be sure to provide accurate information to receive precise quotes.

- Compare Policies: Carefully review the quotes you receive, paying close attention to premiums, deductibles, and coverage details. Consider not only the price but also the level of protection offered.

- Verify Coverage Details: Before committing to a policy, thoroughly review the policy documents to ensure you understand the coverage limits, exclusions, and other terms and conditions.

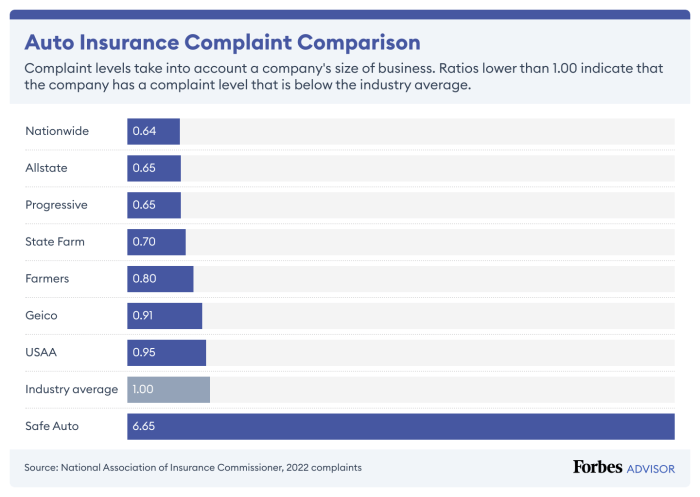

- Read Reviews: Research customer reviews and ratings of different Safe Auto providers. This can provide valuable insights into their customer service and claims handling processes.

- Choose a Policy: Select the policy that best balances your needs, budget, and risk tolerance. Remember that the cheapest policy isn’t always the best if it lacks sufficient coverage.

Comparison of Safe Auto Auto Insurance Providers

The table below illustrates how different Safe Auto providers might compare. Remember that these are examples, and actual premiums and features will vary depending on individual circumstances and location.

| Provider | Premium (Example) | Coverage (Example) | Features (Example) |

|---|---|---|---|

| Safe Auto Provider A | $500/year | Liability, Uninsured Motorist | 24/7 roadside assistance, online account management |

| Safe Auto Provider B | $600/year | Liability, Uninsured Motorist, Collision | Accident forgiveness, rental car reimbursement |

| Safe Auto Provider C | $700/year | Liability, Uninsured Motorist, Collision, Comprehensive | 24/7 claims service, multiple payment options |

Decision-Making Flowchart for Selecting an Insurance Policy

The process of choosing an insurance policy can be visualized using a flowchart. The flowchart below illustrates a simplified decision-making process. Imagine a series of boxes connected by arrows.

Box 1: Assess your needs (coverage, budget). Arrow points to Box 2.

Box 2: Obtain quotes from multiple providers. Arrow points to Box 3.

Box 3: Compare premiums, coverage, and features. Arrow points to Box 4 (Yes/No decision).

Box 4: Is the policy suitable? Yes: Arrow points to Box 5. No: Arrow points back to Box 2.

Box 5: Review policy documents and choose a policy.

Safe Driving Practices and Their Impact

Your driving habits significantly influence your auto insurance premiums. Insurance companies assess risk, and safer drivers are considered lower risk, resulting in lower premiums. Conversely, unsafe driving behaviors increase your perceived risk, leading to higher costs. Maintaining a clean driving record is paramount in securing affordable insurance.

Safe driving practices not only protect you and others on the road but also translate into significant savings on your car insurance. By consistently adhering to safe driving principles, you can significantly reduce the likelihood of accidents and, consequently, lower your insurance premiums. Conversely, a history of accidents and traffic violations will inevitably lead to higher premiums, sometimes substantially.

Safe Driving Practices Leading to Lower Premiums

Several driving habits consistently demonstrate a positive correlation with lower insurance costs. Adopting these practices can make a considerable difference in your overall insurance expenses.

- Defensive Driving: This involves anticipating potential hazards, maintaining a safe following distance, and always being aware of your surroundings. Defensive driving minimizes the chance of accidents, a key factor in determining insurance rates.

- Observing Speed Limits: Speeding significantly increases the risk of accidents. Consistently adhering to speed limits demonstrates responsible driving and reduces the likelihood of incurring penalties and higher premiums.

- Avoiding Distracted Driving: This includes refraining from using cell phones, eating, or engaging in other activities while driving. Distracted driving is a leading cause of accidents, directly impacting insurance costs.

- Proper Vehicle Maintenance: Regular maintenance, including tire rotations, oil changes, and brake checks, ensures your vehicle is in optimal condition, reducing the risk of mechanical failures that could lead to accidents.

- Buckling Up: Always wearing a seatbelt is crucial for safety and is often considered during insurance risk assessment. It demonstrates a commitment to safety, potentially impacting your premiums.

Consequences of Unsafe Driving Habits on Insurance Costs

Conversely, unsafe driving behaviors directly impact insurance premiums, often leading to substantial increases. The consequences can be far-reaching, affecting not only your immediate insurance costs but also your long-term insurability.

- Accidents: Any accident, regardless of fault, will likely result in higher premiums. The severity of the accident directly correlates with the premium increase. Multiple accidents can lead to significantly higher rates or even policy cancellation.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations increase your insurance risk profile, resulting in higher premiums. The number and severity of violations directly influence the impact on your rates.

- DUI/DWI Convictions: Driving under the influence is a serious offense with severe consequences, including extremely high insurance premiums, or even the inability to obtain insurance. These convictions can remain on your record for many years, significantly impacting your insurance costs.

- Points on Driving Record: Accumulating points on your driving record due to violations increases your insurance risk, leading to higher premiums. Insurance companies closely monitor driving records, and points can significantly affect your rates.

Maintaining a Clean Driving Record

Maintaining a clean driving record is crucial for securing affordable car insurance. A clean record demonstrates responsible driving and reduces your perceived risk, leading to lower premiums. Conversely, any infractions can have lasting consequences.

Strategies for maintaining a clean driving record include defensive driving techniques, consistent adherence to traffic laws, and regular vehicle maintenance. These practices significantly reduce the likelihood of accidents and traffic violations, positively impacting your insurance costs. For instance, a driver with a spotless record for five years might qualify for significant discounts compared to a driver with multiple accidents or violations.

Technological Advancements in Safe Driving and Insurance

The automotive and insurance industries are undergoing a significant transformation driven by rapid technological advancements. These innovations are not only enhancing safety on the roads but also fundamentally changing how insurance risk is assessed and how insurance products are designed. The integration of technology is leading to more accurate risk profiling, personalized premiums, and proactive safety measures.

Technological advancements are revolutionizing both driving safety and the insurance industry’s approach to risk assessment. Advanced Driver-Assistance Systems (ADAS) are playing a crucial role in accident reduction, while innovative data analysis techniques allow insurers to offer more tailored and affordable coverage.

Advanced Driver-Assistance Systems (ADAS) and Accident Reduction

ADAS features, such as automatic emergency braking (AEB), lane departure warning (LDW), and adaptive cruise control (ACC), are demonstrably reducing the frequency and severity of accidents. Studies have shown that AEB systems, for example, can significantly decrease rear-end collisions, a common type of accident. The effectiveness of these systems is further enhanced by their increasing sophistication, with features like blind-spot monitoring and pedestrian detection becoming increasingly prevalent. The widespread adoption of ADAS is contributing to a statistically measurable decrease in accident-related injuries and fatalities.

Technology’s Impact on Insurance Risk Assessment

Telematics, the use of technology to monitor driving behavior, is transforming how insurance companies assess risk. By collecting data on factors such as speed, braking, acceleration, and mileage, insurers can create more accurate risk profiles for individual drivers. This allows for the development of usage-based insurance (UBI) programs, where premiums are adjusted based on actual driving behavior. Drivers with safer driving habits are rewarded with lower premiums, incentivizing safer driving practices. Furthermore, the analysis of telematics data allows insurers to identify high-risk driving patterns and offer targeted safety interventions or driver education programs.

Innovative Insurance Products Leveraging Technology

Several innovative insurance products are emerging that leverage technological advancements. Usage-based insurance (UBI), as mentioned above, is a prime example. Pay-per-mile insurance is another, where drivers pay only for the miles they drive, beneficial for low-mileage drivers. Furthermore, some insurers are integrating wearable technology, such as smartwatches, to monitor driver health and potentially offer discounts for maintaining a healthy lifestyle. The development of connected car technology allows for real-time data transmission, enabling proactive risk management and immediate assistance in case of accidents. Predictive modeling, using machine learning algorithms, allows insurers to better anticipate risk and personalize insurance offerings based on individual driver profiles and predicted driving behaviors. For example, a driver consistently exhibiting safe driving habits via telematics might receive a proactive discount offer, while a driver demonstrating risky behavior might receive targeted driver education or safety recommendations.

Legal and Regulatory Aspects of “Safe Auto Auto Insurance”

The legal framework surrounding auto insurance varies significantly across jurisdictions, impacting both insurers and consumers. Understanding these legal requirements and the role of regulatory bodies is crucial for ensuring fair practices and consumer protection within the auto insurance market. This section will explore the key legal and regulatory aspects of auto insurance, focusing on requirements, regulatory oversight, and consumer protections.

Minimum Insurance Requirements

Each state or country mandates minimum levels of auto insurance coverage. These requirements typically specify minimum amounts for bodily injury liability, property damage liability, and sometimes uninsured/underinsured motorist coverage. For example, in some states, minimum liability coverage might be $25,000 per person and $50,000 per accident for bodily injury, while others may have significantly higher requirements. Failure to maintain the minimum required coverage can result in substantial fines and license suspension. These minimums are designed to protect accident victims and ensure that at least some compensation is available, regardless of the at-fault driver’s financial resources.

The Role of Regulatory Bodies

Regulatory bodies, such as state insurance departments or national agencies, play a vital role in overseeing the auto insurance industry. Their responsibilities include setting and enforcing minimum coverage requirements, ensuring fair pricing practices, investigating consumer complaints, and licensing insurance companies. These bodies often conduct market analyses to identify potential anti-competitive behavior or unfair pricing strategies. They also establish and enforce rules regarding insurance policy language, preventing misleading or deceptive practices. For instance, they might regulate how insurers calculate premiums to prevent discrimination based on factors unrelated to risk.

Consumer Protection Laws

Numerous consumer protection laws exist to safeguard policyholders. These laws often address issues such as fair claims handling practices, prompt payment of claims, and the right to appeal adverse decisions. Many jurisdictions have laws requiring insurers to provide clear and understandable policy language, to promptly acknowledge claims, and to investigate claims thoroughly and fairly. These laws also frequently mandate that insurers provide consumers with the opportunity to dispute claims decisions through an internal appeals process or an external arbitration system. Additionally, consumer protection laws often prohibit insurers from engaging in unfair or deceptive practices, such as redlining (refusing insurance based on location) or unfairly denying claims.

Final Review

Ultimately, securing safe auto auto insurance is about more than just finding the cheapest policy; it’s about finding the right balance between cost-effectiveness and comprehensive coverage. By understanding the factors that influence premiums, actively practicing safe driving, and leveraging available technology, you can significantly reduce your insurance costs while ensuring you have the protection you need. This guide provides a solid foundation for navigating the complexities of auto insurance and making informed choices that benefit both your wallet and your safety.

FAQ Resource

What is the difference between a standard auto insurance policy and a “safe auto” policy?

A standard policy provides basic coverage, while a “safe auto” policy often incorporates features like usage-based insurance (UBI) programs that reward safe driving habits with lower premiums. They may also offer discounts for safety features in your vehicle.

How does my credit score affect my safe auto insurance premiums?

In many jurisdictions, insurers consider credit history as a factor in determining premiums. A good credit score can often lead to lower rates.

Can I switch to a safe auto insurance policy if I already have insurance?

Yes, you can typically switch providers or policies at any time. Shop around and compare quotes to find the best option for your needs.

What happens if I have an accident while using a safe auto insurance policy?

Your coverage will be processed according to your policy’s terms and conditions. While a safe driving record generally leads to lower premiums, an accident may still result in increased rates in the future.