Securing SR22 insurance in Virginia can feel like navigating a complex maze, especially if you’re unfamiliar with the requirements. This guide aims to illuminate the process, providing clear explanations and practical advice to help you understand the intricacies of SR22 insurance in the Commonwealth. We’ll explore everything from the reasons behind SR22 mandates to the steps involved in obtaining and maintaining coverage, offering insights into costs, providers, and potential pitfalls along the way.

Understanding SR22 insurance is crucial for drivers in Virginia who have faced certain driving infractions. This specialized insurance policy demonstrates financial responsibility to the state, often a requirement after serious violations. This guide will demystify the process, helping you find the right coverage and navigate the complexities of compliance.

Understanding SR22 Insurance in Virginia

SR-22 insurance in Virginia is a form of financial responsibility insurance mandated by the state’s Department of Motor Vehicles (DMV). It’s not a type of insurance you purchase independently; rather, it’s a certificate filed with the DMV that proves you maintain the minimum required liability insurance coverage. This ensures that you can compensate others for injuries or damages caused by an accident you are at fault for.

The Purpose of SR22 Insurance in Virginia

The primary purpose of SR-22 insurance is to demonstrate to the Virginia DMV that a driver maintains the minimum required auto liability insurance coverage as a condition of their driver’s license reinstatement or continued driving privileges. This is a crucial element of the state’s system for ensuring financial responsibility after certain driving offenses. It protects the public by ensuring that drivers who have demonstrated risky behavior are financially accountable for potential damages.

Circumstances Requiring SR22 Insurance in VA

Several circumstances necessitate the filing of an SR-22 certificate in Virginia. These typically involve serious driving infractions that indicate a higher-than-average risk to public safety. The DMV will mandate SR-22 insurance as a condition of either retaining your license or getting it reinstated after suspension or revocation.

Duration of SR22 Requirements

The length of time you’re required to maintain SR-22 insurance varies depending on the severity of the offense and the judge’s or DMV’s ruling. It can range from one to three years, or even longer in some cases. The DMV will specify the exact duration when they require the SR-22 filing. It’s vital to maintain continuous coverage throughout the entire mandated period; lapses in coverage can lead to further penalties.

Examples of Driving Infractions Requiring SR22 Insurance

Several driving offenses can lead to an SR-22 requirement. These often include, but are not limited to: driving under the influence (DUI) or driving while intoxicated (DWI), serious traffic accidents resulting in injuries or significant property damage where the driver is at fault, multiple moving violations within a short period, and driving with a suspended or revoked license. The specific offenses and resulting penalties are determined on a case-by-case basis.

Comparison of SR22 and Standard Auto Insurance in VA

| Feature | SR-22 Insurance | Standard Auto Insurance |

|---|---|---|

| Purpose | Demonstrates financial responsibility to the DMV | Provides liability and potentially other coverages (collision, comprehensive) |

| Requirement | Mandated by the DMV after certain driving offenses | Voluntary, required by law only for minimum liability coverage |

| Cost | Generally more expensive than standard insurance | Cost varies based on factors like driving record, age, and vehicle |

| Coverage | Typically only includes the minimum liability coverage required by the state | Can include various coverages beyond the minimum liability requirements |

Obtaining SR22 Insurance in Virginia

Securing SR-22 insurance in Virginia is a necessary step for drivers who have had their licenses suspended or revoked due to certain driving offenses. This process involves several steps and requires specific documentation. Understanding these requirements will streamline the process and help you obtain the necessary coverage efficiently.

Steps Involved in Obtaining SR22 Insurance in Virginia

The process of obtaining SR-22 insurance generally involves these key steps: First, you’ll need to find an insurance provider that offers SR-22 filings in Virginia. Next, you will complete an application providing the necessary information and documentation. After the application is approved, the insurance company will file the SR-22 form with the Virginia Department of Motor Vehicles (DMV). Finally, you’ll need to maintain continuous coverage for the required period, typically three years. Failure to maintain coverage can result in further penalties.

Required Documents for SR22 Insurance Application

Applying for SR-22 insurance requires providing comprehensive documentation to verify your identity and driving history. This typically includes a valid driver’s license, proof of residency, vehicle information (including VIN number), and details of any previous insurance policies. The insurer may also request a copy of the court order or DMV notice that mandates SR-22 coverage. Providing complete and accurate information expedites the application process.

Factors Influencing the Cost of SR22 Insurance in VA

Several factors significantly influence the cost of SR-22 insurance in Virginia. These include your driving history (accidents, violations), age, the type of vehicle you insure, your credit score, and the length of your SR-22 requirement. Drivers with a history of serious offenses or multiple violations will generally pay higher premiums than those with cleaner driving records. For example, a driver with a DUI conviction will likely face significantly higher premiums than a driver with a minor speeding ticket. The length of time the SR-22 is required also impacts cost; longer periods usually mean higher overall costs.

Comparison of Obtaining SR22 Insurance from Different Providers

Different insurance providers in Virginia may have varying processes and costs for obtaining SR-22 insurance. Some companies may specialize in high-risk drivers and offer more competitive rates, while others may have stricter requirements or longer processing times. It is advisable to compare quotes from multiple providers before making a decision. Factors to consider when comparing providers include their reputation, customer service, and the overall cost of the policy. Some companies may offer online applications for convenience, while others may require in-person meetings.

Flowchart Illustrating the Process of Securing SR22 Insurance

The process can be visualized using a flowchart.

[A rectangular box labeled “Start”] –> [A rectangular box labeled “Find an SR-22 provider in Virginia”] –> [A rectangular box labeled “Gather necessary documents (Driver’s License, Proof of Residency, Vehicle Information, etc.)”] –> [A rectangular box labeled “Complete and submit the insurance application”] –> [A diamond-shaped box labeled “Application Approved?”] –> [A path labeled “Yes” leading to a rectangular box labeled “Provider files SR-22 with the DMV”] –> [A path labeled “No” leading back to a rectangular box labeled “Address application issues”] –> [A rectangular box labeled “Maintain continuous coverage for the required period”] –> [A rectangular box labeled “End”]

SR22 Insurance Providers in Virginia

Finding the right SR22 insurance provider in Virginia can feel overwhelming, given the variety of companies and their differing policies. This section aims to clarify the landscape of SR22 insurance providers in the state, providing information to help you make an informed decision. Understanding the nuances of coverage, pricing, and customer service is crucial for securing the best possible policy.

SR22 Insurance Providers in Virginia: A Selection

Several insurance companies operate in Virginia and offer SR-22 insurance. It’s important to note that availability and specific offerings can change, so it’s always recommended to check directly with the company for the most up-to-date information. The following is a selection of commonly available providers, not an exhaustive list. Remember to compare quotes from multiple providers before making a decision.

Coverage Options and Pricing Structures

SR22 insurance is not a type of insurance in itself; rather, it’s a certificate filed with the Virginia Department of Motor Vehicles (DMV) proving you maintain the minimum required liability coverage. Therefore, the coverage options are largely determined by the state’s minimum requirements and your individual needs. Pricing varies significantly based on factors such as your driving record, age, location, the type of vehicle you drive, and the amount of coverage you choose. Generally, drivers with a history of violations or accidents will pay higher premiums. Companies often offer different levels of liability coverage (e.g., bodily injury and property damage), and some may offer additional coverage options like collision or comprehensive, though these are not required for SR22 compliance. It is advisable to obtain multiple quotes to compare prices.

Customer Service Ratings and Reviews

Customer service experiences can vary greatly among insurance providers. Before choosing a provider, researching their reputation for customer service is essential. Online resources like the Better Business Bureau (BBB) and independent review sites often provide ratings and customer reviews. Pay close attention to comments regarding claims processing speed, responsiveness to inquiries, and overall helpfulness of customer service representatives. Positive reviews suggest a smoother experience should you need to contact the provider for assistance.

Online Application Processes

Many insurance providers offer online application processes for increased convenience. These online portals typically allow you to get a quote, fill out an application, and sometimes even submit supporting documents electronically. The ease of use and features of online applications can vary, with some providers offering more user-friendly interfaces than others. Checking the provider’s website for information on their online application process is recommended. Some providers may still require some paperwork to be submitted physically.

Comparison Table of SR22 Insurance Providers in VA

| Provider | Coverage Options | Pricing Structure (General) | Customer Service Rating (Example) |

|---|---|---|---|

| Progressive | Liability, potentially additional coverages | Varies based on risk factors; generally competitive | BBB rating: A+ (Example – Check current rating) |

| Geico | Liability, potentially additional coverages | Varies based on risk factors; generally competitive | BBB rating: A+ (Example – Check current rating) |

| State Farm | Liability, potentially additional coverages | Varies based on risk factors; generally competitive | BBB rating: A+ (Example – Check current rating) |

| Allstate | Liability, potentially additional coverages | Varies based on risk factors; generally competitive | BBB rating: A+ (Example – Check current rating) |

Maintaining SR22 Insurance Compliance

Securing an SR22 in Virginia is only half the battle; maintaining continuous coverage is crucial. Failure to do so can lead to significant legal and financial repercussions, impacting your driving privileges and potentially incurring substantial fines. Understanding the renewal process, managing changes to your personal information, and correctly interpreting your certificate are key to avoiding these pitfalls.

Consequences of Non-Compliance

Failure to maintain continuous SR22 insurance coverage in Virginia results in immediate suspension of your driver’s license. This suspension can last for an extended period, even beyond the initial period mandated by the court. Furthermore, you will likely face additional fines levied by the Department of Motor Vehicles (DMV). These fines can be substantial, adding significantly to the already considerable cost of SR22 insurance. In some cases, reinstatement of your driving privileges may require additional steps beyond simply obtaining new SR22 coverage, such as completing driver improvement courses or paying back fees. The DMV will also likely report the lapse in coverage to your insurance history, potentially increasing your insurance premiums in the future.

Renewing SR22 Insurance in Virginia

Renewing your SR22 insurance is similar to renewing a standard auto insurance policy. Typically, your insurance provider will contact you several weeks before your policy’s expiration date. You’ll need to confirm your information and payment details. Failure to renew your policy on time will trigger a lapse in coverage, leading to the aforementioned consequences. It’s advisable to set reminders well in advance to ensure timely renewal. Direct communication with your insurer is key to avoid any potential delays or misunderstandings.

Ensuring Continuous Compliance

Maintaining continuous SR22 coverage requires proactive engagement. This includes setting reminders for renewal dates, promptly notifying your insurer of any changes in your personal information (address, vehicle, etc.), and regularly reviewing your certificate of insurance to ensure accuracy. Consider setting up automatic payments to prevent lapses due to missed payments. Open communication with your insurer is vital; don’t hesitate to contact them with questions or concerns. Keeping accurate records of all communications and payment confirmations can be invaluable should any discrepancies arise.

Handling Changes in Personal Information

Any change in your personal information, including your address, vehicle information, or even your name, must be reported to your insurance provider immediately. Failure to do so could lead to a lapse in coverage. When notifying your insurer, be prepared to provide all necessary documentation, such as proof of address change or vehicle registration updates. Keep copies of all correspondence for your records. A simple phone call or email to your insurer is typically sufficient to initiate the update process. Promptly updating your information ensures that your SR22 remains valid and prevents any potential issues with your license.

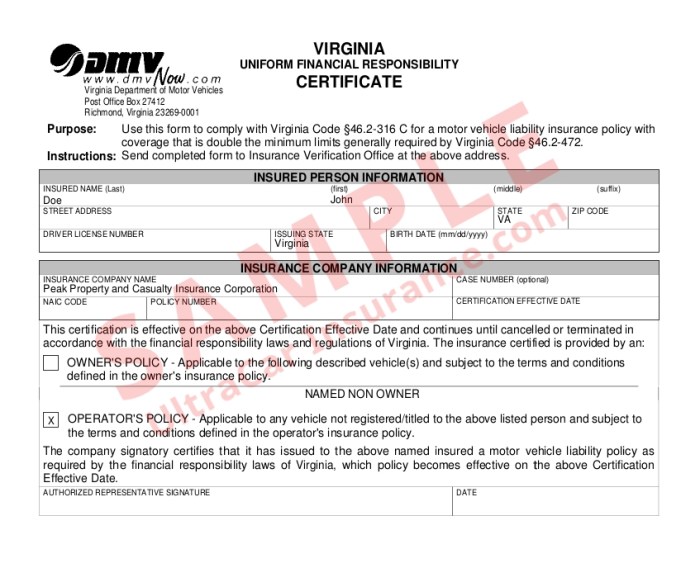

Interpreting the SR22 Certificate of Insurance

The SR22 certificate is a crucial document proving your compliance with the court’s mandate. It confirms that you maintain the required liability insurance coverage. The certificate typically includes your name, driver’s license number, policy number, coverage limits, and the effective dates of coverage. It also clearly states that the policy meets the requirements of the Virginia DMV’s SR22 filing. Reviewing this document regularly helps ensure accuracy and alerts you to any potential issues. If you notice any discrepancies or have questions about the information contained within the certificate, contact your insurance provider immediately for clarification. Understanding the information presented on your certificate empowers you to maintain compliance and protect your driving privileges.

The Cost of SR22 Insurance in Virginia

Securing SR22 insurance in Virginia, while necessary to reinstate driving privileges, comes with a financial commitment that varies significantly depending on several interconnected factors. Understanding these factors allows drivers to better budget and potentially explore strategies to minimize the cost. This section details the key influences on SR22 insurance premiums in Virginia and offers insights into cost-saving measures.

Factors Affecting SR22 Insurance Costs

Several factors contribute to the final cost of SR22 insurance in Virginia. These include the driver’s age, driving history, the type of vehicle insured, the coverage limits selected, and the insurance company chosen. The higher the risk a driver presents to the insurance company, the higher the premium will be. This is because insurance companies base their premiums on statistical risk assessments.

Driving History’s Impact on SR22 Premiums

A driver’s driving history is perhaps the most significant factor influencing SR22 insurance costs. Previous accidents, traffic violations, and DUI convictions significantly increase premiums. A clean driving record, conversely, may lead to lower premiums. For instance, a driver with multiple speeding tickets and a DUI conviction will likely face substantially higher premiums compared to a driver with a spotless record. The severity and recency of infractions also play a crucial role; a recent DUI will have a more substantial impact than an older speeding ticket.

Comparison of Virginia SR22 Costs to National Averages

Precise figures for average SR22 insurance costs in Virginia and nationally are difficult to pinpoint due to the variability of factors mentioned above. However, anecdotal evidence and industry reports suggest that SR22 insurance premiums in Virginia generally align with or slightly exceed national averages. This is influenced by factors like the state’s traffic laws and accident rates. While a national average might be quoted, the actual cost for an individual in Virginia will vary greatly based on their specific circumstances.

Strategies for Reducing SR22 Insurance Costs

While the need for SR22 insurance necessitates increased costs, drivers can still employ strategies to mitigate the expense. Maintaining a clean driving record after obtaining SR22 coverage is paramount. Shopping around and comparing quotes from multiple insurance providers is crucial, as rates can vary considerably between companies. Consider increasing your deductible; a higher deductible usually translates to a lower premium. Exploring options for defensive driving courses can also potentially lead to reduced premiums in some cases, as these courses demonstrate a commitment to safer driving habits.

Potential Cost Variations

The following table illustrates potential cost variations based on different factors. Note that these are illustrative examples and actual costs will vary depending on the specific circumstances and the chosen insurance provider.

| Factor | Low Cost Scenario | Medium Cost Scenario | High Cost Scenario |

|---|---|---|---|

| Driving History | Clean record | One minor accident | Multiple accidents/DUI |

| Age | 30+ years old | 25-30 years old | Under 25 years old |

| Vehicle Type | Economy car | Mid-size sedan | High-performance sports car |

| Coverage Limits | Minimum required | Slightly above minimum | High coverage limits |

| Estimated Annual Premium | $500 – $700 | $800 – $1200 | $1500 – $3000+ |

Illustrative Scenarios and Examples

Understanding SR22 insurance in Virginia often becomes clearer through real-life examples. These scenarios illustrate both the necessity and the consequences associated with this type of high-risk auto insurance.

Scenario: Obtaining SR22 Insurance After a DUI

Imagine Sarah, a Virginia resident, recently received a DUI conviction. As a result, the Virginia Department of Motor Vehicles (DMV) has revoked her driving privileges. To regain her license, she’s required to obtain SR22 insurance. Sarah first contacts her current insurance provider to inquire about SR22 coverage options. If her current provider doesn’t offer SR22, she begins researching companies that do. She compares quotes from several insurers, considering factors like price and coverage limits. Once she selects a provider, she provides the necessary documentation, including her driver’s license information, proof of vehicle ownership, and details of her DUI conviction. The insurer then files the SR22 form with the DMV, and once it’s approved, Sarah can apply for license reinstatement.

Scenario: Consequences of Failing to Maintain SR22 Coverage

Consider John, another Virginia resident, who was mandated to carry SR22 insurance after an at-fault accident. He obtained the necessary coverage but, due to financial difficulties, let his policy lapse. The insurer notified the DMV of the lapse. As a result, John’s driving privileges were immediately suspended. He faces fines and potential legal repercussions. Furthermore, reinstating his license will now require additional steps and may involve a waiting period before he can again apply for SR22 insurance.

Scenario: Reinstating SR22 Coverage After a Lapse

After facing the consequences of his lapse in coverage, John seeks to reinstate his driving privileges. He first pays all outstanding fines and fees associated with the lapse. He then contacts an SR22 insurance provider, providing all necessary documentation, including proof of financial responsibility. He will likely face higher premiums than before due to his lapse in coverage. Once the new SR22 insurance is in place and reported to the DMV, he can reapply for license reinstatement. The DMV will review his application and, upon approval, reinstate his driving privileges.

Common Misconceptions About SR22 Insurance

Understanding the realities of SR22 insurance is crucial to avoid potential pitfalls. Here are some common misconceptions:

It is important to note that SR22 insurance is not a separate type of insurance policy, but rather a certificate that demonstrates proof of financial responsibility. It is added to an existing auto insurance policy.

- Misconception: SR22 insurance is more expensive than standard auto insurance. Reality: While it often costs more, the increase is due to the higher risk associated with the driver, not the SR22 certificate itself. The cost varies greatly based on individual risk factors.

- Misconception: SR22 insurance is difficult to obtain. Reality: While it might require more effort to find a provider, many insurers offer SR22 coverage. It’s important to shop around and compare quotes.

- Misconception: Once you obtain SR22 insurance, you no longer need to worry about it. Reality: Maintaining continuous coverage is crucial. A lapse in coverage can lead to license suspension and further penalties.

- Misconception: SR22 insurance is only for DUI convictions. Reality: While DUI convictions are a common reason for requiring SR22 insurance, it’s also mandated in other situations, such as serious accidents or multiple moving violations.

Conclusion

Successfully navigating the SR22 insurance process in Virginia requires careful planning and understanding. By familiarizing yourself with the requirements, comparing providers, and maintaining consistent compliance, you can regain your driving privileges and avoid further complications. Remember, proactive planning and a thorough understanding of your obligations are key to a smooth and successful experience. This guide has provided a foundation for understanding SR22 insurance; however, always consult directly with insurance providers and legal professionals for personalized advice.

FAQ Overview

What happens if my SR22 insurance lapses?

A lapsed SR22 policy will result in immediate suspension of your driving privileges in Virginia. You’ll need to reinstate your coverage and potentially face additional penalties.

Can I get SR22 insurance if I have multiple violations?

Yes, but it will likely be more expensive. Insurance companies consider your driving history when determining rates. Multiple violations significantly increase your premiums.

How long will I need to carry SR22 insurance?

The duration varies depending on the severity of your offense and the requirements set by the Virginia DMV. It could range from one to three years or longer.

How does my driving record affect the cost of SR22 insurance?

A poor driving record significantly impacts the cost. More violations and accidents will result in higher premiums. A clean driving record after the initial offense may help lower costs upon renewal.