Navigating the world of car insurance can feel overwhelming, but understanding your options is crucial for securing the right protection. This guide delves into State Farm’s car insurance offerings, providing a detailed look at their coverage, pricing, customer service, and digital tools. We’ll compare State Farm to a major competitor, explore real-world scenarios, and address common questions to help you make an informed decision about your auto insurance needs.

From liability and collision coverage to the convenience of online tools and the importance of a strong financial backing, we aim to provide a comprehensive overview of what State Farm offers. We’ll also consider the various factors that influence premiums, highlight available discounts, and examine the overall customer experience to paint a complete picture of State Farm’s car insurance services.

State Farm Car Insurance Overview

State Farm is one of the largest providers of car insurance in the United States, offering a wide range of coverage options to meet diverse needs and budgets. They are known for their strong customer service and extensive agent network, providing a personalized approach to insurance planning.

State Farm’s car insurance offerings provide comprehensive protection for drivers, encompassing various coverage types designed to mitigate financial risks associated with accidents and vehicle damage. Understanding these options is crucial for selecting a policy that adequately safeguards your financial well-being.

Coverage Options

State Farm offers a variety of coverage options, including:

- Liability Coverage: This covers bodily injury and property damage caused to others in an accident you are at fault for. It’s usually expressed as a three-number combination (e.g., 100/300/100), representing the maximum amount paid per person injured, the maximum paid per accident, and the maximum paid for property damage.

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or weather-related damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault. Availability varies by state.

Obtaining a Quote

Getting a car insurance quote from State Farm is straightforward. You can obtain a quote online through their website, by contacting a local State Farm agent, or by calling their customer service line. The online process typically involves providing information about your vehicle, driving history, and desired coverage levels. A local agent can provide more personalized assistance and answer any questions you may have.

State Farm vs. Geico: A Comparison

The following table compares State Farm’s car insurance offerings to those of Geico, a major competitor. Note that prices and specific coverage options can vary based on individual circumstances and location. Customer service ratings are based on publicly available data from sources like J.D. Power.

| Feature | State Farm | Geico |

|---|---|---|

| Price (Average Annual Premium) | Varies by location and coverage; generally considered mid-range | Varies by location and coverage; often advertised as competitive |

| Coverage Options | Comprehensive range, including liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, and PIP (where available) | Similar comprehensive range, including liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments |

| Customer Service Ratings | Generally positive, but varies by region and agent | Generally positive, known for its ease of online management |

| Discounts | Offers various discounts, including safe driver, good student, multiple policy, and bundling discounts | Offers various discounts, including safe driver, good student, and multi-vehicle discounts |

State Farm’s Customer Experience

State Farm’s reputation is built not only on its comprehensive car insurance coverage but also on its commitment to providing a positive and efficient customer experience. This commitment extends across all aspects of interaction, from initial policy purchase to handling claims and resolving inquiries. A positive customer experience is crucial for building trust and loyalty, and State Farm actively works to achieve this through various channels and support systems.

State Farm strives to make the entire insurance process straightforward and hassle-free for its customers. This involves clear communication, readily accessible resources, and responsive customer service representatives who are trained to address customer needs effectively and empathetically. The company invests significantly in technology and training to ensure a seamless experience across all touchpoints.

Customer Testimonials Regarding Claims Processes

Numerous online reviews and testimonials highlight State Farm’s claims process as generally efficient and supportive. Customers often praise the responsiveness of adjusters, the clarity of communication regarding claim status, and the overall ease of navigating the process. For example, one common positive comment describes the adjuster’s prompt arrival at the accident scene and their professional demeanor throughout the claim settlement. Another frequent positive comment centers on the transparency of the claim process, with customers appreciating the regular updates and clear explanations of the next steps. However, as with any large insurance provider, some negative reviews exist, often citing delays in processing or challenges in communication. These experiences, while less frequent, underscore the importance of continuous improvement in customer service delivery.

Hypothetical Car Accident and Claim Handling

Imagine a scenario where a State Farm insured driver, Sarah, is involved in a rear-end collision. Upon the accident, Sarah would immediately contact State Farm via phone, app, or online portal to report the incident. A claim would be initiated, and a claims adjuster would be assigned. The adjuster would contact Sarah to gather information about the accident, including details of the other driver’s insurance and any witnesses. They would then schedule an inspection of the vehicle damage. Once the damage assessment is complete, State Farm would provide Sarah with an estimate for repairs or replacement, depending on the extent of the damage. Throughout this process, Sarah would receive regular updates on the status of her claim via email, phone, or app. Assuming no significant disputes, Sarah’s claim would be processed and settled within a reasonable timeframe, with payment made directly to the repair shop or to Sarah for vehicle replacement, depending on the chosen resolution.

Methods for Contacting State Farm Customer Service

State Farm offers a variety of convenient methods for customers to contact their customer service representatives. These include:

- Phone: Customers can reach State Farm’s customer service representatives via a toll-free number available 24/7.

- Online: The State Farm website offers a comprehensive online portal where customers can access their policy information, make payments, file claims, and find answers to frequently asked questions.

- Mobile App: The State Farm mobile app provides a convenient platform for managing policies, reporting claims, accessing roadside assistance, and communicating with customer service representatives.

Steps Involved in Filing a Claim with State Farm

Filing a claim with State Farm is designed to be a straightforward process. The steps typically involve:

- Report the accident to State Farm as soon as possible. This can be done via phone, online, or through the mobile app.

- Provide the necessary information, including details of the accident, the other driver’s information, and any witness details.

- Cooperate with the assigned claims adjuster, providing any requested documentation or information.

- Allow the adjuster to assess the damage to your vehicle.

- Review the claim settlement offer and agree to the terms.

- Receive payment for repairs or vehicle replacement.

State Farm’s Pricing and Discounts

State Farm car insurance premiums are determined by a variety of factors, ensuring a personalized rate for each policyholder. Understanding these factors and the available discounts can significantly impact the overall cost of your insurance. This section will detail the key elements influencing your premium and highlight the potential savings available through State Farm’s diverse discount programs.

Factors Influencing State Farm Car Insurance Premiums

Several key factors contribute to the calculation of your State Farm car insurance premium. These factors are analyzed individually and collectively to provide a fair and accurate reflection of your risk profile. A higher risk profile generally results in a higher premium.

Driving Record: Your driving history is a primary determinant. Accidents, tickets, and at-fault collisions significantly increase your premium. A clean driving record, conversely, often leads to lower rates. The severity and frequency of incidents heavily influence the impact on your premium.

Age: Younger drivers, statistically, are involved in more accidents. As a result, they generally pay higher premiums than more experienced drivers. Insurance companies consider age a strong indicator of risk. Premiums typically decrease as drivers gain experience and reach a certain age bracket.

Location: Geographic location plays a significant role. Areas with higher rates of accidents, theft, and vandalism typically have higher insurance premiums due to increased risk for insurance companies. Urban areas often have higher premiums than rural areas.

Vehicle Type: The type of vehicle you drive also impacts your premium. Higher-value vehicles, sports cars, and vehicles with a history of theft or accidents are generally associated with higher insurance costs. The vehicle’s safety features and repair costs are also considered.

State Farm Discounts

State Farm offers a wide range of discounts to reward safe driving habits and responsible choices. These discounts can substantially reduce your overall premium. Taking advantage of these opportunities can lead to significant savings.

Many discounts are available depending on your specific circumstances and eligibility. It’s advisable to contact State Farm directly to determine which discounts you qualify for.

Good Driver Discount: Maintaining a clean driving record for a specified period qualifies you for a good driver discount. This discount rewards safe driving and responsible behavior on the road.

Bundling Discount: Bundling your car insurance with other State Farm insurance products, such as homeowners or renters insurance, often results in a significant discount. This is a common and effective way to reduce your overall insurance costs.

Safety Feature Discount: Vehicles equipped with advanced safety features, such as anti-theft devices, airbags, and anti-lock brakes, often qualify for discounts. These features demonstrate a commitment to safety and reduce the likelihood of accidents and associated claims.

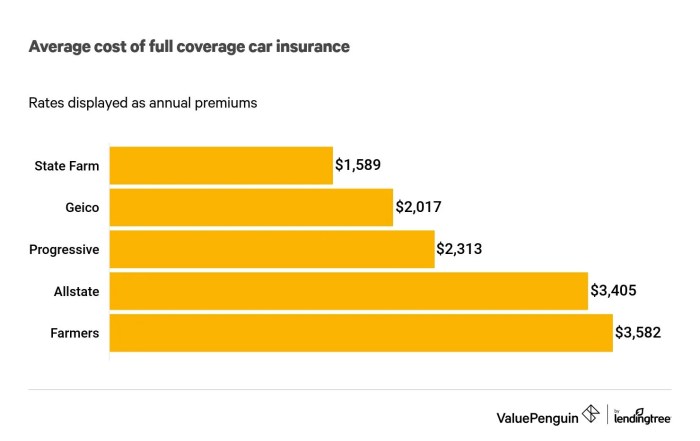

Comparison of State Farm Pricing to Industry Averages

The following table compares State Farm’s pricing to industry averages for similar coverage. Note that these figures are illustrative and can vary based on the specific factors mentioned above. Actual premiums will differ based on individual circumstances.

| Coverage Type | State Farm Average Premium | Industry Average Premium | Difference |

|---|---|---|---|

| Liability | $500 | $525 | -$25 |

| Collision | $300 | $320 | -$20 |

| Comprehensive | $200 | $210 | -$10 |

| Uninsured/Underinsured Motorist | $150 | $160 | -$10 |

Hypothetical Premium Calculation

Let’s consider a hypothetical driver profile: 35-year-old driver with a clean driving record, living in a suburban area, driving a mid-size sedan with standard safety features, and bundling with homeowners insurance. Based on publicly available information and general State Farm pricing trends, their estimated annual premium might be around $1,200. This is an estimate and the actual premium would depend on the specific details of their policy and eligibility for discounts. This hypothetical example demonstrates how different factors combine to influence the final premium.

State Farm’s Digital Tools and Resources

State Farm recognizes the importance of providing convenient and accessible tools for managing your insurance needs. Their suite of digital resources aims to simplify the process, empowering customers to handle their policies efficiently and effectively from the comfort of their homes or on the go. This includes a robust mobile app, a user-friendly website, and various online tools designed for seamless policy management.

State Farm’s digital offerings are designed to streamline interactions, reducing the need for phone calls and paperwork. This modern approach saves customers time and offers greater control over their insurance information.

State Farm Mobile App Features

The State Farm mobile app provides a comprehensive platform for managing your car insurance. Key features include the ability to view your policy details, make payments, report claims, access roadside assistance, and find nearby State Farm agents. Users can also easily update their personal information and view their ID cards digitally. The app’s intuitive interface and push notifications ensure users stay informed about important updates and deadlines. For example, the app might send a notification reminding you of an upcoming payment due date or provide an update on a claim’s progress. This proactive communication contributes to a more seamless and stress-free insurance experience.

State Farm Website Functionality

State Farm’s website mirrors the functionality of its mobile app, offering a comprehensive online portal for policy management. Customers can log in to access their policy information, make payments, submit claims, and update their contact details. The website also provides access to various helpful resources, including frequently asked questions, articles on car insurance topics, and information about available discounts. For example, a customer could easily access their policy documents, such as their declarations page, directly from the website, eliminating the need to contact State Farm’s customer service. The website also allows for policy comparisons, enabling customers to potentially adjust their coverage based on their changing needs.

Online Tools for Managing Car Insurance

Beyond the app and website, State Farm offers several online tools designed to simplify specific car insurance tasks. These tools may include online forms for reporting claims, digital ID cards for easy access to insurance information, and online payment options for convenient and secure transactions. State Farm also often provides access to educational resources and guides on various aspects of car insurance, such as understanding coverage options or determining the appropriate liability limits. These resources aim to empower customers with the knowledge to make informed decisions about their insurance coverage.

Enhanced Customer Experience Through Digital Tools

State Farm’s digital tools significantly enhance the customer experience by providing 24/7 access to policy information and services. This convenience eliminates the need to wait for phone calls or office hours, empowering customers to manage their insurance needs at their own pace and convenience. The ability to access digital ID cards, instantly report claims, and receive proactive notifications through the app and website contribute to a smoother, more efficient, and ultimately more positive customer experience. The readily available online resources also foster a sense of self-sufficiency, enabling customers to quickly find answers to their questions and resolve issues independently.

State Farm’s Financial Strength and Stability

Choosing a car insurance provider involves considering not only price and coverage but also the company’s long-term financial health. A financially stable insurer is crucial to ensure your claims are paid promptly and reliably, even during challenging economic times. State Farm’s enduring success is a testament to its robust financial standing and commitment to its policyholders.

State Farm’s financial strength is consistently recognized by leading rating agencies. These independent assessments provide valuable insights into an insurer’s ability to meet its obligations. A high rating indicates a low risk of insolvency and a greater capacity to pay claims. This is particularly important given the potentially significant costs associated with major accidents or widespread natural disasters.

State Farm’s Financial Ratings

Major rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, regularly assess the financial stability of insurance companies. State Farm consistently receives top ratings from these agencies, reflecting its strong capital position, consistent profitability, and prudent risk management practices. These ratings offer policyholders reassurance that State Farm possesses the financial resources to honor its commitments. For example, A.M. Best, a highly respected rating agency specializing in the insurance industry, frequently awards State Farm a superior rating, indicating exceptional financial strength and operating performance. This consistent high rating demonstrates State Farm’s long-term commitment to financial stability.

Implications of State Farm’s Financial Stability for Policyholders

State Farm’s robust financial position translates into several key benefits for its policyholders. Firstly, it significantly reduces the risk of claim denials due to insurer insolvency. Secondly, it ensures the timely processing and payment of claims, minimizing financial burdens during already stressful situations. Thirdly, a financially sound insurer is more likely to maintain competitive pricing and offer a wider range of coverage options. This stability provides policyholders with peace of mind, knowing their insurance needs will be met reliably, regardless of unforeseen circumstances.

State Farm’s History and Reputation

Founded in 1922, State Farm has a long and distinguished history within the insurance industry. Its commitment to customer service, coupled with its consistent financial strength, has established it as one of the most trusted and respected names in the sector. This enduring reputation reflects its unwavering dedication to both its policyholders and its employees. State Farm’s longevity and market leadership are a testament to its effective business model and prudent financial management, providing a strong foundation for future growth and stability.

End of Discussion

Choosing car insurance is a significant decision, requiring careful consideration of coverage, cost, and customer service. This exploration of State Farm’s car insurance reveals a company with a long-standing reputation, a wide array of coverage options, and a commitment to digital convenience. By weighing the factors discussed – pricing, customer testimonials, available discounts, and financial stability – you can determine if State Farm’s car insurance aligns with your individual needs and budget. Remember to obtain personalized quotes from multiple providers to ensure you’re securing the best possible coverage at the most competitive price.

FAQ Compilation

What types of vehicles does State Farm insure?

State Farm insures a wide range of vehicles, including cars, trucks, motorcycles, and RVs. Specific coverage options may vary depending on the vehicle type.

Does State Farm offer roadside assistance?

Yes, roadside assistance is often available as an add-on to State Farm car insurance policies. Specific services and coverage may vary depending on the chosen plan.

How long does it take to get a claim approved?

The claim approval process varies depending on the complexity of the claim. Simple claims may be processed quickly, while more complex claims may take longer.

Can I pay my State Farm bill online?

Yes, State Farm offers convenient online payment options through their website and mobile app.