Navigating the world of homeowners insurance can feel overwhelming, especially when faced with the numerous providers and policy options available. This guide delves into the specifics of obtaining a State Farm homeowners insurance quote, providing a clear understanding of the process, factors influencing costs, and ultimately, helping you make an informed decision to protect your most valuable asset: your home.

We will explore the various coverage options offered by State Farm, detailing the steps involved in obtaining a quote – both online and through an agent. We’ll examine key factors that significantly impact your premium, including location, home features, and claims history. Finally, we’ll provide illustrative examples to showcase how different homeowner profiles and property characteristics influence the final quote amount.

Understanding State Farm Homeowners Insurance

State Farm is one of the largest providers of homeowners insurance in the United States, offering a range of coverage options to protect your home and belongings. Understanding the nuances of their policies, including coverage types, premium factors, and the claims process, is crucial for making an informed decision. This section will provide a clear overview of these key aspects.

Types of State Farm Homeowners Insurance Coverage

State Farm offers several types of homeowners insurance policies, each designed to meet different needs and coverage levels. These policies generally fall under standardized coverage forms, such as HO-3 (Special Form), which is the most common, offering broad coverage for your dwelling and personal property against various perils. Other options include HO-4 (Renters Insurance), HO-6 (Condominium Owners Insurance), and HO-8 (Modified Coverage), each tailored to specific housing situations. The specific coverage details within each policy type vary depending on factors like the location of the property and the chosen coverage limits. For example, an HO-3 policy typically covers damage from fire, wind, and hail, while additional endorsements can be purchased for flood or earthquake coverage, which are usually not included in standard policies.

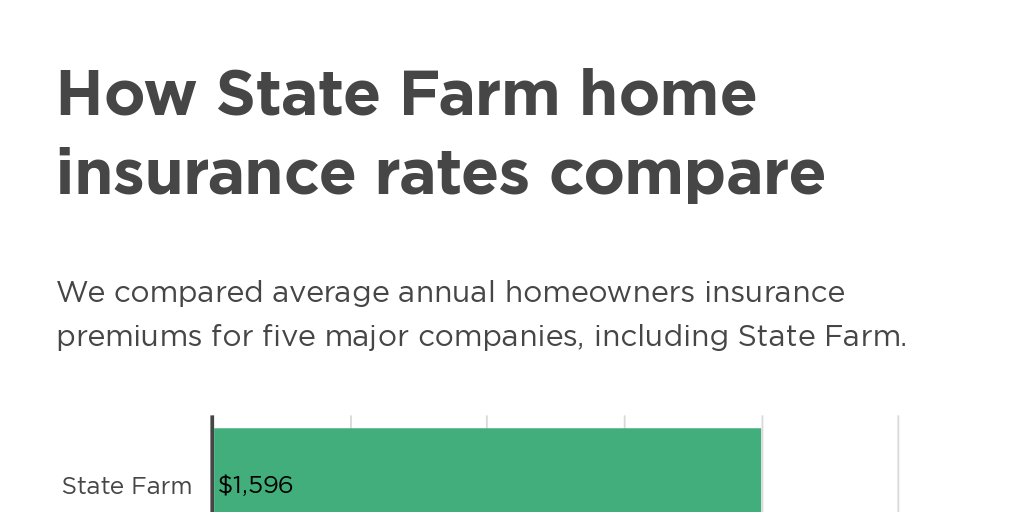

Factors Influencing State Farm Homeowners Insurance Premiums

Several factors significantly impact the cost of your State Farm homeowners insurance premium. These include the location of your home (areas prone to natural disasters generally have higher premiums), the age and condition of your home (newer homes with updated features may command lower premiums), the coverage amount you select (higher coverage equals higher premiums), your claims history (a history of claims can lead to increased premiums), and the security features of your home (security systems and other safety measures can result in discounts). Your credit score can also play a role, with better credit often correlating to lower premiums. For instance, a home in a hurricane-prone coastal region will generally have a higher premium than a similar home in a less-risky inland location.

State Farm Homeowners Insurance Claims Process

Filing a claim with State Farm typically involves contacting them directly via phone or online. You’ll need to provide details about the damage, including the date, time, and cause of the incident. A claims adjuster will then be assigned to assess the damage and determine the extent of the coverage. The adjuster will work with you to document the damage and provide an estimate of the repair or replacement costs. It is crucial to maintain thorough documentation of the damage, including photos and receipts for any repairs you’ve already undertaken. The claims process timeline can vary depending on the complexity of the damage and the availability of contractors. For example, a small, easily-repaired incident may be resolved quickly, while a major event like a fire could take considerably longer.

Comparison of State Farm and Allstate Homeowners Insurance

Both State Farm and Allstate are major players in the homeowners insurance market, offering similar types of coverage. However, specific coverage details, premium pricing, and customer service experiences can vary. While both companies offer various discounts and options for customizing coverage, direct comparison requires considering individual circumstances, such as location, home characteristics, and desired coverage levels. Obtaining quotes from both companies and comparing them side-by-side allows for a more accurate assessment of which insurer best fits your specific needs and budget. For instance, one company might offer better coverage for specific perils in a certain geographic area, while another may provide more competitive pricing for a particular risk profile.

Obtaining a State Farm Homeowners Insurance Quote

Securing a homeowners insurance quote from State Farm is a straightforward process, offering flexibility through online tools and direct agent interaction. Choosing the best method depends on your personal preferences and time constraints. Both options provide access to competitive rates and comprehensive coverage.

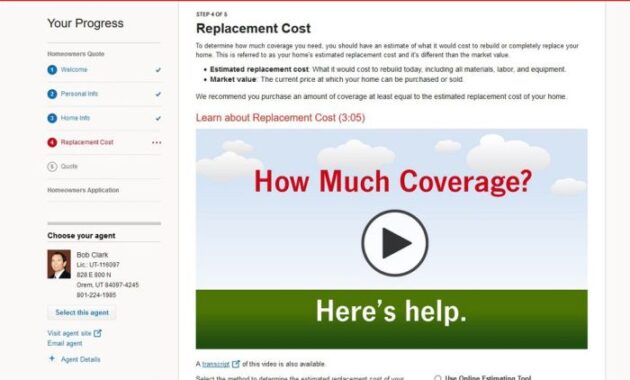

Getting a State Farm Homeowners Insurance Quote Online

The State Farm website provides a user-friendly platform for obtaining a homeowners insurance quote. This method offers speed and convenience, allowing you to receive an estimate at your own pace. The process requires providing specific details about your property and coverage preferences.

To obtain an accurate quote, you’ll need information such as your address, the year your home was built, its square footage, the type of construction (e.g., brick, wood), and details about any additional structures on your property (like a detached garage or shed). You will also need to provide information about your coverage needs, including desired liability limits and coverage amounts for personal property and other structures. Accurate information is crucial for receiving a precise quote that reflects your specific risk profile.

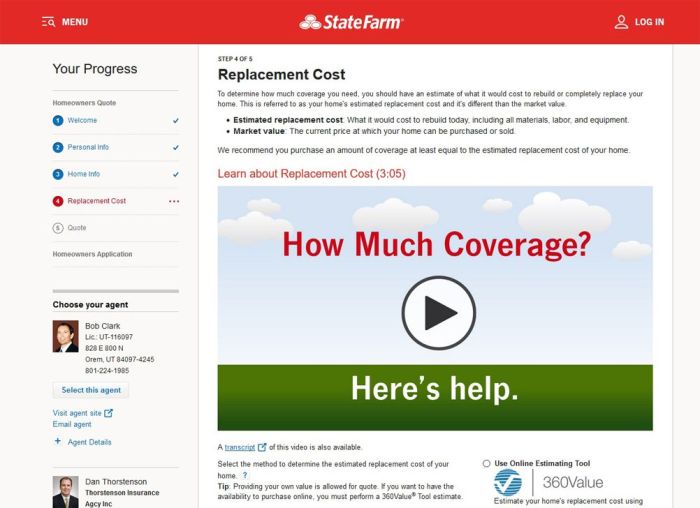

Contacting a State Farm Agent for a Homeowners Insurance Quote

Alternatively, you can contact a State Farm agent directly to obtain a quote. This approach allows for personalized assistance and the opportunity to ask questions and clarify any uncertainties about the policy options.

To contact a State Farm agent, you can use the State Farm website’s agent locator tool to find an agent near you. You can then contact them via phone, email, or in person at their office. Be prepared to provide the same information needed for an online quote, as detailed above. A knowledgeable agent can guide you through the process, ensuring you understand the different coverage options and select a policy that meets your individual needs and budget.

Comparison of Online and Agent Quote Methods

The following table compares obtaining a quote online versus contacting a State Farm agent.

| Method | Speed | Information Required | Customer Service Interaction |

|---|---|---|---|

| Online Quote | Fast, immediate estimate | Address, home details (year built, square footage, construction type), coverage preferences | Minimal; automated system |

| Agent Quote | Moderate; depends on agent availability | Same as online quote, plus potentially more detailed information about your property and lifestyle | High; personalized assistance and guidance |

Factors Affecting Quote Prices

Several key factors influence the price of a State Farm homeowners insurance quote. Understanding these factors can help you make informed decisions about your home and its protection, potentially leading to more favorable rates. This section details the most significant elements impacting your premium.

Property Location

The location of your property significantly impacts your insurance costs. Factors considered include the risk of natural disasters (hurricanes, earthquakes, wildfires, floods), crime rates, and the proximity to fire hydrants and emergency services. For example, a home situated in a hurricane-prone coastal area will generally command a higher premium than a similar home located inland in a region with lower crime statistics and readily accessible emergency services. Insurance companies use sophisticated models incorporating historical data and geographic information systems (GIS) to assess risk based on location. Areas with a higher frequency of claims will naturally reflect higher premiums.

Home Characteristics

The age, size, and construction materials of your home directly influence your insurance quote. Older homes, while often charming, may have outdated electrical systems or plumbing that increases the risk of damage and subsequent claims. Larger homes generally require more extensive coverage and thus, higher premiums. The construction materials used – for example, brick versus wood framing – also impact the assessment of risk. Brick homes, being more fire-resistant, typically attract lower premiums compared to wood-framed homes. The condition of the roof and other exterior elements also plays a crucial role in the underwriting process. A well-maintained home with updated features reflects lower risk and can lead to more competitive pricing.

Risk-Reducing Features

Security systems, fire alarms, and other risk-reducing features can significantly lower your insurance premiums. State Farm, like many insurers, rewards homeowners who take proactive steps to mitigate potential risks. A monitored security system, for instance, can demonstrably reduce the likelihood of burglaries, leading to a reduction in the premium. Similarly, features like smoke detectors, sprinkler systems, and impact-resistant windows can significantly reduce the risk of fire and wind damage, resulting in lower premiums. These features demonstrate a commitment to home safety, which translates to lower insurance costs.

Claims History

Your claims history, both with State Farm and other insurers, is a major factor in determining your future premiums. Filing multiple claims, especially for significant events, can lead to increased premiums. Insurers view a history of claims as an indicator of higher risk. Conversely, a clean claims history demonstrates responsible homeownership and can result in more favorable rates. It is crucial to understand that while occasional claims are expected, a pattern of frequent claims can negatively impact your insurance costs. Maintaining a good claims history is a proactive step towards securing lower premiums in the long term.

Policy Customization and Add-ons

State Farm, like many other homeowners insurance providers, allows for significant policy customization through the addition of supplemental coverages, often called add-ons or endorsements. These additions tailor your policy to better reflect your specific property, possessions, and risk profile, providing more comprehensive protection than a standard policy might offer. Understanding these options and their associated costs is crucial for securing the right level of insurance coverage.

Choosing the right add-ons involves balancing the increased protection they offer against the higher premiums. While a basic policy covers the essentials, add-ons can significantly enhance your coverage in specific areas, providing peace of mind in the event of unforeseen circumstances. This section details common add-on coverages and the process of customizing your policy.

Available Add-on Coverages and Their Associated Costs

State Farm offers a range of add-on coverages to address various potential risks. These coverages extend beyond the basic policy’s protection, offering enhanced financial security against specific perils. The cost of each add-on varies depending on factors such as your location, the value of your property, and the specific coverage limits selected. For example, flood insurance premiums are influenced by your property’s proximity to flood-prone areas, while earthquake insurance costs are determined by seismic activity in your region.

Coverage Levels and Their Benefits

Different coverage levels, often expressed as percentages of your home’s value or specific dollar amounts, determine the extent of reimbursement in the event of a covered loss. Higher coverage levels generally come with higher premiums but offer greater financial protection. For instance, choosing a higher coverage level for personal property would result in more comprehensive reimbursement for stolen or damaged belongings. Conversely, selecting a lower coverage level might save on premiums but leave you with a larger out-of-pocket expense in the event of a significant loss. It’s crucial to strike a balance between affordability and adequate protection based on your individual circumstances and risk tolerance. For example, a homeowner with valuable collectibles might opt for a higher level of personal property coverage.

Customizing a State Farm Homeowners Insurance Policy

Customizing your State Farm homeowners insurance policy is a straightforward process. You can typically work directly with a State Farm agent to discuss your specific needs and identify appropriate add-on coverages. The agent will guide you through the available options, explaining the benefits and costs of each. They will help you determine the appropriate coverage levels for your home, personal belongings, and liability. You can also access online tools and resources provided by State Farm to explore coverage options and get personalized quotes. Remember to provide accurate information about your property and possessions to ensure the policy accurately reflects your risk profile and needs.

Common Add-on Coverages and Their Benefits

Understanding the benefits of various add-on coverages is vital in tailoring your policy. Here are five common add-ons:

- Flood Insurance: Protects against losses caused by flooding, a peril often excluded from standard homeowners insurance policies. This is particularly important for homeowners in flood-prone areas.

- Earthquake Insurance: Covers damage to your home and belongings caused by earthquakes. This is essential in seismically active regions.

- Personal Liability Umbrella Policy: Provides additional liability coverage beyond what’s included in your basic policy, protecting you against significant lawsuits.

- Scheduled Personal Property Coverage: Offers specific coverage for high-value items such as jewelry, art, or collectibles, providing higher limits than standard personal property coverage.

- Identity Theft Protection: Covers costs associated with identity theft, including credit monitoring and legal assistance. This becomes increasingly crucial in today’s digital age.

Illustrative Examples of Homeowner Scenarios and Quotes

Understanding how various factors influence State Farm homeowners insurance quotes can be clarified through real-world examples. These examples illustrate the range of potential premiums based on different homeowner profiles and property characteristics.

Homeowner Scenario Examples and Corresponding Quotes

The following table presents two distinct homeowner scenarios, highlighting how differing circumstances affect insurance quote amounts. These are illustrative examples and should not be considered actual quotes. Actual quotes will vary based on specific details and State Farm’s underwriting guidelines.

| Homeowner Profile | Home Description | Quote Amount (Illustrative) | Key Factors Affecting the Quote |

|---|---|---|---|

| Young Family with Two Children (35 and 38 years old), residing in a suburban neighborhood. | 2,500 sq ft, 15-year-old colonial style home in a quiet suburban neighborhood with a good fire department rating. Includes a swimming pool. | $2,200 annually | Age of home, presence of a pool (increased liability), location (crime rates, proximity to fire services), family size (increased liability). |

| Retired Couple (65 and 68 years old), living in a rural area. | 1,800 sq ft, 30-year-old ranch-style home in a rural area with a lower fire department rating. No pool. Home has a security system. | $1,500 annually | Age of home (higher risk of wear and tear), location (increased risk of certain perils, lower fire protection), home security system (reduced risk), age of homeowners (potential for increased health-related claims). |

Detailed Hypothetical Home and Quote Breakdown

Let’s examine a hypothetical scenario in more detail to illustrate the breakdown of a sample quote.

This example uses a hypothetical 3,000 square foot, two-story home built in 2010, located in a medium-risk area with a good fire department rating. The home has a detached garage and is situated on a half-acre lot. The homeowner is a single professional (40 years old) with no prior claims.

| Coverage Type | Coverage Amount | Annual Cost |

|---|---|---|

| Dwelling Coverage | $500,000 | $1,000 |

| Other Structures Coverage | $50,000 | $100 |

| Personal Property Coverage | $250,000 | $500 |

| Liability Coverage | $300,000 | $400 |

| Medical Payments Coverage | $5,000 | $50 |

| Total Annual Premium | $2,050 |

Note: This is a hypothetical example and does not reflect actual State Farm pricing. The actual cost will vary depending on several factors.

Closure

Securing adequate homeowners insurance is a crucial step in responsible homeownership. Understanding the nuances of obtaining a State Farm quote, including the factors influencing cost and the various coverage options, empowers you to make a well-informed choice that best protects your investment. By carefully considering your individual needs and utilizing the resources Artikeld in this guide, you can confidently navigate the process and find the right coverage for your home.

Quick FAQs

What types of coverage does State Farm offer beyond basic dwelling coverage?

State Farm offers a range of additional coverages, including personal liability, medical payments to others, loss of use, and various endorsements for specific perils like flood or earthquake.

Can I bundle my homeowners and auto insurance with State Farm?

Yes, bundling your homeowners and auto insurance with State Farm often results in significant discounts on your overall premiums.

How long does it typically take to receive a quote from State Farm?

Online quotes are typically instantaneous, while quotes obtained through an agent may take a few hours to a day, depending on the agent’s availability and the complexity of your request.

What happens if I need to file a claim?

State Farm provides a detailed claims process, usually involving contacting them directly to report the incident and then working with an adjuster to assess the damage and determine the payout.

How often can I expect my State Farm homeowners insurance premiums to be reviewed?

Premiums are typically reviewed annually, and adjustments may be made based on factors such as claims history, changes to your property, or changes in the overall insurance market.