The State of Florida Department of Insurance (FLDOI) plays a pivotal role in ensuring the stability and fairness of Florida’s insurance market. From regulating insurance companies and protecting consumers to navigating the complexities of natural disasters, the FLDOI’s impact is far-reaching. This guide provides a detailed overview of the department’s functions, responsibilities, and its vital contribution to the state’s economic and social well-being. We will explore its history, regulatory powers, consumer protection initiatives, and the challenges it faces in an ever-evolving landscape.

Understanding the FLDOI’s operations is crucial for both consumers seeking insurance and companies operating within the Florida market. This comprehensive exploration will shed light on the department’s regulatory framework, its commitment to consumer protection, and its proactive approach to market oversight and data analysis. We will delve into the FLDOI’s response to major events and examine future trends shaping the industry.

Overview of the Florida Department of Insurance

The Florida Department of Insurance (FLDOI) plays a crucial role in regulating the insurance industry within the state, ensuring consumer protection and market stability. Its history, responsibilities, and organizational structure are vital to understanding its impact on Floridians and the insurance market.

The FLDOI’s origins trace back to the early 20th century, evolving from smaller regulatory bodies into the comprehensive agency it is today. While pinpointing a precise founding date is difficult due to the gradual development of insurance regulation, the department’s current form and responsibilities have solidified over the past several decades, shaped by legislative changes and evolving industry needs. Its evolution reflects the increasing complexity of the insurance market and the growing need for robust consumer protection.

FLDOI Mission and Responsibilities

The FLDOI’s mission is to regulate the insurance industry in Florida, protect consumers, and maintain a stable and competitive insurance market. This encompasses a wide range of responsibilities, including licensing and regulating insurance companies, agents, and adjusters; investigating consumer complaints; enforcing insurance laws; and overseeing the solvency of insurance companies operating within the state. The department also plays a significant role in responding to major catastrophic events, such as hurricanes, ensuring timely and fair claims processing for affected policyholders. This proactive approach is vital for maintaining public trust and confidence in the insurance system.

FLDOI Organizational Structure

The FLDOI is structured into several key divisions and bureaus, each with specific responsibilities. These divisions work collaboratively to fulfill the department’s overall mission. While the exact structure can be subject to minor reorganizations, key areas typically include divisions focused on consumer affairs (handling complaints and providing consumer education), financial regulation (overseeing the solvency of insurance companies), market regulation (licensing and regulating insurers and agents), and legal affairs (providing legal counsel and enforcement). Each division contains several bureaus, each specializing in a specific aspect of insurance regulation. For example, the financial regulation division might include bureaus focusing on life insurance, property and casualty insurance, and health insurance. This structured approach allows for specialized expertise and efficient management of the diverse aspects of insurance regulation.

FLDOI’s Regulatory Authority over Insurance Companies

The FLDOI possesses significant regulatory authority over insurance companies operating in Florida. This authority stems from state laws and regulations that grant the department the power to license and monitor insurers, ensuring their compliance with state statutes and regulations. The department reviews insurers’ financial statements, conducts market conduct examinations, and investigates complaints against insurers. The FLDOI has the power to impose sanctions, including fines, cease-and-desist orders, and even revocation of licenses, for violations of state laws or regulations. This regulatory oversight is critical for protecting consumers and maintaining the stability of the insurance market in Florida. The department’s actions help ensure that insurers remain financially sound and act ethically in their dealings with policyholders. The department’s regulatory power is not absolute, however, as it operates within the confines of Florida law and is subject to judicial review.

Consumer Protection Initiatives of the FLDOI

The Florida Department of Insurance (FLDOI) plays a crucial role in safeguarding the interests of Florida’s consumers in the insurance marketplace. Through a multifaceted approach encompassing complaint resolution, resource provision, consumer education, and proactive enforcement, the FLDOI strives to ensure fair and equitable treatment for all policyholders.

The FLDOI’s commitment to consumer protection is evident in its robust and accessible complaint process, its readily available resources, and its proactive educational campaigns aimed at empowering consumers to navigate the complexities of insurance. The department’s history also includes notable instances where decisive action protected consumers from exploitative insurance practices.

The Consumer Complaint Process

Florida residents facing insurance-related issues can file complaints with the FLDOI through various channels, including online submission via the department’s website, phone calls, and mail. The complaint process involves a thorough investigation by trained professionals who assess the validity of the claim and work to achieve a fair resolution. The department prioritizes communication with the complainant throughout the process, providing updates and guidance. Depending on the nature and complexity of the complaint, the resolution may involve mediation, negotiation, or formal administrative action. The FLDOI maintains a record of all complaints, allowing for the identification of systemic issues and trends within the insurance industry. This data informs the department’s future regulatory actions and consumer protection initiatives.

Available Resources for Florida Residents

The FLDOI offers a comprehensive suite of resources to assist Florida residents with insurance-related questions and concerns. These resources include a user-friendly website providing information on various insurance products, policyholder rights, and frequently asked questions. The department also offers publications and brochures on topics such as choosing insurance, understanding policy terms, and filing complaints. Additionally, the FLDOI maintains a toll-free helpline staffed by knowledgeable representatives who can answer questions, provide guidance, and assist with filing complaints. This readily accessible support system empowers consumers to effectively navigate the insurance landscape and advocate for their rights.

Consumer Education Efforts

Recognizing the importance of informed consumers, the FLDOI actively engages in educational initiatives to promote insurance literacy among Florida residents. These efforts include workshops, seminars, and online resources designed to educate consumers about their rights, responsibilities, and options. The department regularly publishes articles, blog posts, and social media updates to disseminate critical information about insurance policies, practices, and consumer protection laws. The FLDOI also partners with community organizations and consumer advocacy groups to expand its outreach and reach a wider audience. By equipping consumers with the necessary knowledge and understanding, the FLDOI aims to prevent disputes and promote fair insurance practices.

Notable Cases of Consumer Protection

The FLDOI has a history of successfully intervening in cases involving unfair insurance practices. For example, in [Year], the department investigated [Insurance Company] for [Specific unfair practice, e.g., systematically denying legitimate claims related to hurricane damage]. The investigation resulted in [Outcome, e.g., a significant financial settlement for affected policyholders and corrective actions by the insurance company]. Another significant case involved [Another Insurance Company] and [Another Specific unfair practice, e.g., charging excessive premiums for certain demographics]. The FLDOI’s intervention led to [Outcome, e.g., a cease-and-desist order and a mandated refund program for affected policyholders]. These examples highlight the FLDOI’s commitment to holding insurers accountable and protecting the rights of Florida’s consumers.

Regulation of Insurance Companies in Florida

The Florida Department of Insurance (FLDOI) plays a crucial role in overseeing the insurance industry within the state, ensuring consumer protection and maintaining market stability. This involves a rigorous regulatory framework governing the licensing, operations, and financial health of insurance companies operating in Florida.

Licensing and Approval Process for Insurance Companies

The licensing process for insurance companies in Florida is comprehensive and designed to verify the financial stability and operational competency of applicants. Companies must submit detailed applications demonstrating their financial strength, management expertise, and proposed business plans. The FLDOI conducts thorough background checks on key personnel and reviews the company’s proposed underwriting practices and reinsurance arrangements. Approval is contingent upon meeting stringent capital requirements and demonstrating compliance with all applicable state laws and regulations. The process can be lengthy, often taking several months to complete, reflecting the significant responsibility associated with protecting Florida consumers.

Financial Solvency Requirements for Insurance Companies

Maintaining the financial solvency of insurance companies is paramount to protecting policyholders. The FLDOI imposes robust financial requirements on insurers, including minimum capital and surplus levels, which vary based on the type and size of the insurer and the lines of business they conduct. Regular financial examinations are conducted to assess the insurer’s ability to meet its obligations. Insurers are required to submit annual financial statements, undergo periodic on-site examinations, and maintain adequate reserves to cover potential claims. Failure to meet these requirements can result in regulatory actions, including restrictions on new business, rehabilitation, or liquidation. The FLDOI uses a risk-based approach, focusing more intense scrutiny on companies exhibiting higher risk profiles.

Comparison of Florida’s Regulatory Framework with Other States

While the fundamental principles of insurance regulation are consistent across states, there are notable differences in specific requirements and enforcement approaches. Florida, for instance, is known for its relatively stringent requirements for surplus lines insurers – those offering coverage not readily available through admitted carriers. Some states may have more lenient capital requirements or different approaches to handling insolvent insurers. The specific regulatory environment can influence the types of insurance products available, the cost of insurance, and the level of consumer protection in each state. Comparisons often require detailed analysis of specific regulations within each jurisdiction. For example, a comparison might reveal that Florida’s requirements for catastrophe reserves are more rigorous than those in some other states due to the state’s vulnerability to hurricanes.

Hypothetical Scenario: FLDOI Intervention in Insurance Company Insolvency

Imagine a hypothetical scenario where “Sunshine State Insurance,” a significant auto insurer in Florida, experiences a series of catastrophic losses due to a series of severe hurricanes. Claims significantly exceed their reserves, leading to a rapid deterioration of their financial position. The FLDOI, through its monitoring system, detects the alarming trend and initiates a thorough investigation. This involves reviewing Sunshine State Insurance’s financial statements, conducting an on-site examination, and assessing the adequacy of their reinsurance arrangements. Recognizing the imminent risk of insolvency, the FLDOI may intervene through several actions. This could range from imposing restrictions on new business to initiating rehabilitation proceedings, aiming to restore the company’s financial health. If rehabilitation efforts prove unsuccessful, the FLDOI may order liquidation, ensuring that available assets are distributed fairly among policyholders and creditors under the guidance of the court. The FLDOI would actively work to minimize disruption to policyholders by facilitating the transfer of policies to other solvent insurers or by utilizing the Florida Insurance Guaranty Association (FIGA) to cover outstanding claims.

The Impact of Natural Disasters on the FLDOI and Florida’s Insurance Market

Florida’s vulnerability to hurricanes and other natural disasters significantly impacts both the Florida Department of Insurance (FLDOI) and the state’s insurance market. The frequency and intensity of these events create substantial challenges for insurers, consumers, and the regulatory body responsible for overseeing the system. The FLDOI plays a critical role in navigating these challenges, ensuring market stability and protecting policyholders.

The FLDOI’s Role in Managing Insurance Claims Following Major Natural Disasters

Following a major hurricane or other significant natural disaster, the FLDOI’s responsibilities expand dramatically. The department works to ensure that insurers promptly and fairly process claims, providing assistance to policyholders affected by the disaster. This involves monitoring insurers’ response, investigating complaints, and taking action against insurers who fail to meet their obligations. The department also plays a crucial role in communicating with the public, providing information and resources to help individuals navigate the claims process. This includes disseminating information about available assistance programs and helping individuals understand their policy coverages.

Challenges Faced by the FLDOI and the Insurance Industry During and After Natural Disasters

The aftermath of a major disaster presents numerous challenges for both the FLDOI and the insurance industry. The sheer volume of claims following a catastrophic event can overwhelm insurers’ capacity to process them efficiently. This can lead to significant delays in claim payments, causing financial hardship for policyholders already struggling to recover from the disaster’s impact. Furthermore, accurately assessing damages and determining the extent of insurance coverage can be complex and time-consuming, especially in the immediate aftermath of a disaster when access to affected areas may be limited. The FLDOI also faces the challenge of ensuring that insurers remain financially solvent in the face of significant payouts, which can threaten the stability of the insurance market as a whole. The industry faces challenges in accurately predicting future losses, leading to potential rate increases and difficulty attracting new insurers to the market.

Measures Implemented by the FLDOI to Mitigate the Impact of Natural Disasters on the Insurance Market

The FLDOI has implemented various measures to mitigate the impact of natural disasters on Florida’s insurance market. These include strengthening insurer solvency regulations, promoting the use of catastrophe modeling to better assess risk, and encouraging the development of innovative insurance products to address specific disaster-related risks. The department also works to educate consumers about the importance of adequate insurance coverage and disaster preparedness. Furthermore, the FLDOI actively participates in efforts to improve the state’s infrastructure and resilience to natural disasters, recognizing that reducing the frequency and severity of damage can help lessen the burden on the insurance system. For example, improved building codes and stricter enforcement can reduce the cost of rebuilding after a disaster.

Examples of the FLDOI’s Adaptation to Changing Climate Risks

The increasing frequency and intensity of hurricanes and other climate-related events necessitate a proactive and adaptive approach from the FLDOI. The department has adapted its regulatory approach by incorporating climate change projections into its risk assessments. This involves using updated catastrophe models that account for projected changes in hurricane intensity and sea-level rise. The FLDOI is also actively engaged in exploring innovative risk mitigation strategies, such as parametric insurance, which triggers payouts based on pre-defined parameters, rather than relying on individual damage assessments. The department’s focus on encouraging insurers to offer more robust and comprehensive coverage for flood and wind damage reflects this adaptation to the changing climate landscape. The experience of Hurricane Andrew in 1992 and subsequent hurricanes has led to significant reforms in building codes and insurance regulations, demonstrating a clear response to past events and a commitment to better preparing for future challenges.

Future Trends and Challenges Facing the FLDOI

The Florida Department of Insurance (FLDOI) faces a complex and evolving landscape in the coming years. Several significant trends and challenges will necessitate adaptation and innovation to maintain the department’s effectiveness in protecting consumers and ensuring the stability of Florida’s insurance market. These challenges range from the impacts of climate change and increasingly sophisticated fraud schemes to the need for technological modernization and legislative adjustments.

The increasing frequency and severity of natural disasters, particularly hurricanes, pose a significant ongoing challenge. This necessitates a proactive approach to risk mitigation, improved catastrophe modeling, and enhanced market resilience strategies. Simultaneously, the growing complexity of insurance products and the rise of InsurTech necessitate a careful balancing act between fostering innovation and maintaining robust consumer protection.

Climate Change and Increased Catastrophic Risk

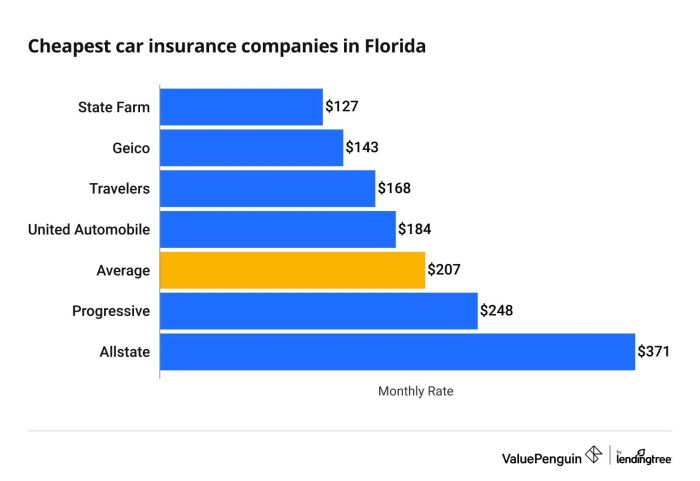

The undeniable impact of climate change on Florida’s vulnerability to hurricanes and other severe weather events presents a major challenge for the FLDOI. Increased frequency and intensity of storms translate to higher insurance premiums, potential market instability, and increased demand for claims processing. The FLDOI must actively engage in risk assessment, collaborate with meteorological agencies, and promote the adoption of mitigation strategies to address this escalating risk. For example, the increasing costs associated with hurricane damage have led to insurers raising premiums and even withdrawing from the market in certain high-risk areas, creating challenges for consumers seeking affordable coverage.

Technological Advancements and Cybersecurity

The insurance industry is undergoing a significant technological transformation, with InsurTech companies introducing innovative products and services. The FLDOI must adapt to this rapidly evolving environment by modernizing its own systems and regulatory processes. This includes leveraging data analytics to improve fraud detection, enhancing cybersecurity measures to protect sensitive consumer data, and developing a regulatory framework that supports innovation while safeguarding consumer interests. For instance, the adoption of blockchain technology could potentially streamline claims processing and reduce fraud, while simultaneously requiring the FLDOI to develop a robust regulatory framework to oversee its implementation.

Legislative and Policy Changes

Potential legislative changes, such as reforms to the Florida Hurricane Catastrophe Fund or adjustments to insurance rate regulation, will directly impact the FLDOI’s operations. The department must actively participate in the legislative process, advocating for policies that promote a stable and competitive insurance market while protecting consumers. For example, debates surrounding the appropriate level of rate regulation often involve balancing the needs of insurers to maintain profitability with the need to ensure affordable insurance for consumers. The FLDOI must navigate these competing interests to develop effective and sustainable solutions.

Areas for Improvement within the FLDOI

The FLDOI can benefit from several areas of improvement to enhance its efficiency, effectiveness, and responsiveness.

- Streamlining the claims processing system to reduce delays and improve transparency.

- Expanding consumer education and outreach programs to increase awareness of consumer rights and available resources.

- Investing in advanced data analytics and artificial intelligence to improve fraud detection and risk assessment.

- Strengthening cybersecurity infrastructure to protect sensitive consumer data from breaches.

- Improving communication and collaboration with stakeholders, including insurers, consumers, and other government agencies.

End of Discussion

The State of Florida Department of Insurance stands as a critical guardian of Florida’s insurance market, balancing the needs of consumers with the responsibilities of insurers. Through robust regulation, proactive consumer protection, and data-driven decision-making, the FLDOI strives to maintain a stable and fair insurance environment. Understanding its multifaceted role, from licensing insurers to responding to natural disasters, is essential for anyone involved in or affected by the Florida insurance market. The department’s ongoing commitment to adaptation and innovation ensures its continued effectiveness in navigating the challenges and opportunities of the future.

Quick FAQs

What types of insurance does the FLDOI regulate?

The FLDOI regulates a wide range of insurance lines, including auto, home, health, life, and commercial insurance.

How can I file a complaint against an insurance company?

You can file a complaint online through the FLDOI website or by contacting them directly via phone or mail. Their website provides detailed instructions and forms.

What resources are available for consumers who need help understanding their insurance policy?

The FLDOI website offers numerous resources, including publications, FAQs, and links to consumer assistance programs. They also provide educational materials and workshops.

Does the FLDOI offer assistance with insurance claims after a hurricane?

Yes, the FLDOI plays a crucial role in overseeing and assisting with insurance claims following natural disasters. They provide guidance and resources to both consumers and insurers during these events.