The State of Tennessee Department of Commerce and Insurance (TDCI) plays a vital role in the state’s economic health and consumer protection. Established to regulate various sectors, from insurance companies to businesses, the TDCI ensures fair practices, protects consumers, and fosters a stable marketplace. This guide delves into the TDCI’s history, structure, responsibilities, and initiatives, providing a comprehensive overview of its impact on Tennessee’s economy and citizens.

We will explore the TDCI’s multifaceted regulatory functions, examining its oversight of insurance markets, its licensing procedures for businesses, and its robust consumer protection programs. We’ll also discuss the department’s commitment to transparency and accountability, highlighting its financial reporting practices and efforts to ensure fair and equitable treatment for all stakeholders.

Overview of the Tennessee Department of Commerce and Insurance (TDCI)

The Tennessee Department of Commerce and Insurance (TDCI) is a state agency responsible for regulating various industries to protect Tennessee consumers and businesses. Its history spans decades, evolving to meet the changing needs of the state’s economy and its citizens. The department’s work touches many aspects of daily life, from insurance coverage to the safety of consumer products.

The TDCI’s mission is to ensure fair and competitive marketplaces, protect consumers, and promote economic growth in Tennessee. Its organizational structure is comprised of several divisions, each focusing on specific regulatory areas. These divisions work collaboratively to achieve the department’s overall mission.

TDCI History and Evolution

The TDCI’s origins trace back to various independent regulatory bodies established throughout Tennessee’s history to oversee specific sectors. Over time, these entities were consolidated and reorganized, culminating in the creation of the modern TDCI. The exact date of its formal establishment as a unified department may require further research into Tennessee state archives. The department’s evolution reflects the ongoing need to adapt to new technologies, industries, and consumer protection challenges.

TDCI’s Regulatory Responsibilities

The TDCI’s regulatory responsibilities are extensive and cover a broad spectrum of industries. These include, but are not limited to, insurance, banking, securities, and various consumer protection areas. Within the insurance sector, the TDCI licenses and regulates insurance companies, agents, and adjusters, ensuring compliance with state laws and protecting policyholders. In the financial services realm, the department oversees aspects of banking and securities to maintain market stability and protect investors. Consumer protection initiatives cover a range of goods and services, aiming to prevent fraud and unfair business practices.

Examples of Recent TDCI Initiatives

The TDCI regularly undertakes initiatives to improve consumer protection and market regulation. For instance, recent efforts might have focused on addressing issues related to the rising costs of health insurance, implementing new regulations for the growing fintech sector, or strengthening consumer protection laws regarding data privacy. Specific examples of recent initiatives and their impact would need to be obtained from the TDCI’s official website or publications. These initiatives demonstrate the department’s proactive approach to addressing contemporary challenges and safeguarding the interests of Tennessee residents.

Insurance Regulation within Tennessee

The Tennessee Department of Commerce and Insurance (TDCI) plays a crucial role in overseeing the insurance industry within the state, ensuring fair practices, consumer protection, and the solvency of insurance companies. This regulation is vital for maintaining stability within the Tennessee insurance market and protecting the interests of both consumers and insurers.

Types of Insurance Regulated by the TDCI

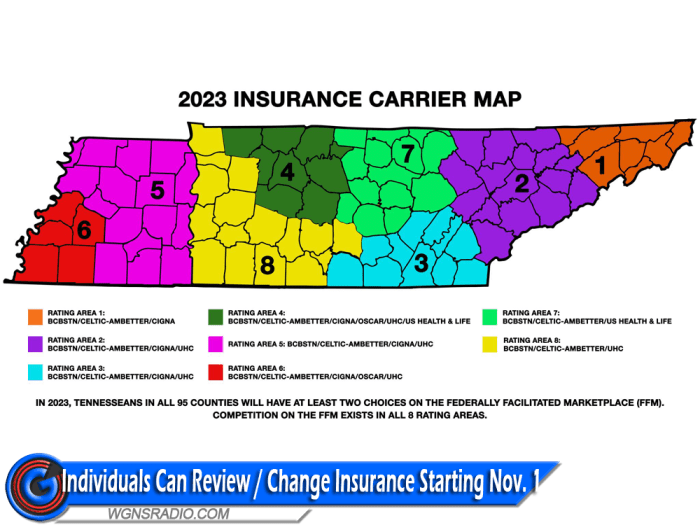

The TDCI’s regulatory authority extends to a broad range of insurance lines offered in Tennessee. This includes, but is not limited to, property and casualty insurance (covering homes, automobiles, and businesses), life insurance, health insurance, workers’ compensation insurance, and various other specialized insurance products. The department ensures that all insurers operating within the state adhere to established regulations and maintain appropriate levels of financial stability. This comprehensive oversight helps prevent market disruptions and safeguards policyholders’ interests.

Licensing and Compliance Processes for Insurance Companies

Insurance companies seeking to operate in Tennessee must first obtain a license from the TDCI. This process involves a rigorous review of the company’s financial strength, management expertise, and adherence to state regulations. Ongoing compliance requires insurers to submit regular financial reports, comply with state-mandated forms and procedures, and undergo periodic examinations to verify their continued solvency and adherence to regulations. Failure to comply can result in penalties, including fines and potential license revocation. The licensing and compliance processes are designed to protect consumers from dealing with financially unstable or unscrupulous insurers.

Methods Used by the TDCI to Monitor Insurance Company Solvency

The TDCI employs several methods to monitor the financial health and solvency of insurance companies operating in Tennessee. These include regular financial statement reviews, on-site examinations, and the use of sophisticated actuarial models to assess risk and predict future financial performance. The department also actively monitors market trends and economic conditions to identify potential threats to insurer solvency. This proactive approach helps ensure that insurers have the financial capacity to meet their obligations to policyholders. Early intervention in cases of financial distress can prevent insolvency and protect policyholders from significant losses.

Key Consumer Protection Measures Implemented by the TDCI in the Insurance Sector

The TDCI prioritizes consumer protection within the insurance market. Several key measures are in place to safeguard consumers’ rights and interests.

| Protection Type | Description | Contact Information | Additional Resources |

|---|---|---|---|

| Fair Claims Practices | Ensures insurers handle claims fairly and promptly, investigating claims thoroughly and providing timely payment. The TDCI investigates complaints of unfair claims handling practices. | Tennessee Department of Commerce & Insurance, 160 8th Ave N, Nashville, TN 37243-1000; 1-800-342-4029; www.tn.gov/commerce/ | Filing a complaint with the TDCI can initiate an investigation. |

| Consumer Education and Outreach | Provides resources and educational materials to help consumers understand their insurance policies and rights. This includes publications, workshops, and online resources. | Tennessee Department of Commerce & Insurance website (www.tn.gov/commerce/) | Online resources and educational materials are readily available. |

| Market Conduct Examinations | Regular examinations of insurance companies to assess their compliance with state laws and regulations concerning fair treatment of consumers. | Tennessee Department of Commerce & Insurance, 160 8th Ave N, Nashville, TN 37243-1000; 1-800-342-4029; www.tn.gov/commerce/ | These examinations aim to proactively identify and address potential issues. |

| Complaint Resolution Process | Provides a mechanism for consumers to file complaints against insurance companies for unfair or deceptive practices. The TDCI investigates complaints and works to resolve disputes. | Tennessee Department of Commerce & Insurance, 160 8th Ave N, Nashville, TN 37243-1000; 1-800-342-4029; www.tn.gov/commerce/ | The TDCI provides detailed instructions on filing a complaint. |

Commerce and Business Regulation in Tennessee

The Tennessee Department of Commerce and Insurance (TDCI) plays a vital role in fostering a healthy and competitive business environment within the state. Beyond its insurance regulatory functions, the TDCI oversees a broad spectrum of commercial activities, ensuring fair practices and consumer protection across numerous sectors. This section details the TDCI’s involvement in regulating businesses in Tennessee, outlining licensing procedures, enforcement actions, and the varying regulatory frameworks applied to different business types.

TDCI’s Role in Regulating Various Business Sectors

The TDCI’s regulatory reach extends to a diverse range of industries. This includes, but is not limited to, the regulation of securities, banking, real estate, and various professional licensing boards. The department’s goal is to protect consumers and ensure fair competition within these markets. For instance, the TDCI’s oversight of securities broker-dealers and investment advisors aims to prevent fraud and protect investors’ assets. Similarly, the regulation of real estate agents ensures ethical practices and protects homeowners and buyers. Specific regulatory approaches vary depending on the inherent risks and complexities of each industry.

Processes for Obtaining Business Licenses and Permits

Securing the necessary licenses and permits to operate a business in Tennessee involves navigating a process that varies based on the specific industry and business structure. Generally, businesses must register with the Tennessee Secretary of State and obtain any relevant licenses from the TDCI or other state agencies. This often involves submitting applications, providing documentation (such as proof of insurance, background checks, and business plans), and paying associated fees. The TDCI’s website provides comprehensive information and resources to guide businesses through the licensing process. Online portals often streamline application submissions and provide status updates. Failure to obtain the required licenses can result in significant penalties.

TDCI’s Enforcement Actions Against Businesses Violating Regulations

The TDCI employs a multi-pronged approach to enforcement, aiming to ensure compliance with state regulations. This includes proactive monitoring, responding to consumer complaints, and conducting investigations into suspected violations. Enforcement actions can range from issuing cease-and-desist orders to imposing fines and revoking licenses. The severity of the action depends on the nature and extent of the violation. For example, a minor infraction might result in a warning, while a serious violation, such as fraud, could lead to substantial fines and legal action. The TDCI publishes summaries of enforcement actions to promote transparency and deter future violations.

Comparison of Regulatory Frameworks for Different Business Types in Tennessee

Tennessee’s regulatory framework is tailored to the specific characteristics of different business types. For example, the regulatory requirements for a small retail business differ significantly from those for a financial institution or a healthcare provider. Small businesses may face simpler licensing requirements and less stringent oversight, while highly regulated industries, such as banking and healthcare, are subject to more intensive scrutiny and compliance standards to protect public safety and financial stability. The complexity of the regulatory framework also reflects the potential risks and impact on the public. The TDCI provides resources to help businesses understand the specific requirements applicable to their industry.

Consumer Protection and Resources

The Tennessee Department of Commerce and Insurance (TDCI) is committed to protecting Tennessee consumers through effective regulation and readily available resources. We strive to ensure fair and transparent practices in both the insurance and business sectors, empowering consumers to navigate these markets confidently. This section details the avenues available to consumers seeking assistance or redress for issues encountered.

Filing a Complaint with the TDCI

A consumer facing difficulties with an insurance company or a business regulated by the TDCI can follow a straightforward process to file a complaint. The process is designed to be accessible and efficient, aiming for a timely resolution.

Frequently Asked Questions Regarding Consumer Rights and Protections

Understanding your rights is crucial for effective advocacy. The following list addresses common inquiries regarding consumer protections in Tennessee.

- What are my rights if my insurance claim is denied? Tennessee law provides specific procedures and timelines for insurers to follow when processing claims. Consumers have the right to appeal a denial and receive a clear explanation of the reasons for the denial. The TDCI can assist in navigating this process.

- How can I file a complaint against a business for unfair or deceptive practices? The TDCI investigates complaints against businesses engaged in deceptive trade practices, unfair pricing, or other violations of Tennessee law. Consumers can file complaints online, by mail, or by phone, providing details of the issue and supporting documentation.

- What protections are available to me as a consumer in the insurance market? Tennessee’s insurance laws aim to protect consumers from unfair or deceptive practices by insurance companies. These protections include the right to fair claims handling, access to consumer information, and the ability to file complaints with the TDCI.

- What resources are available to help me understand my insurance policy? The TDCI website provides educational materials, frequently asked questions, and links to helpful resources that explain complex insurance terminology and concepts. The department also offers assistance in understanding your policy’s coverage and limitations.

- What happens after I file a complaint with the TDCI? The TDCI will investigate your complaint and attempt to mediate a resolution between you and the insurance company or business. If mediation is unsuccessful, the TDCI may take further action, including issuing cease and desist orders or referring the matter to other authorities.

Examples of Successful Consumer Protection Cases

The TDCI has a history of successfully resolving consumer complaints, resulting in significant financial recoveries and policy changes. For example, in one case, the TDCI intervened on behalf of numerous consumers who had been victims of an insurance company’s deceptive marketing practices, resulting in a settlement that provided restitution and significant fines for the offending company. Another case involved a successful investigation into a business engaging in unfair debt collection practices, leading to a court order requiring the business to cease its illegal activities and compensate affected consumers. Specific details of these cases are often confidential to protect the identities of involved parties, but the outcomes demonstrate the TDCI’s commitment to consumer protection.

Resources and Support for Consumers

The TDCI offers a range of resources to assist consumers facing issues with insurance or businesses. These resources include:

* Online Complaint Filing System: A user-friendly online portal for submitting complaints.

* Phone Assistance: Dedicated staff available to answer questions and provide guidance.

* Educational Materials: Brochures, fact sheets, and online resources explaining consumer rights and protections.

* Mediation Services: The TDCI offers mediation services to help resolve disputes between consumers and insurance companies or businesses.

* Referral Services: The TDCI can refer consumers to other relevant agencies or organizations that can provide additional assistance.

Financial Reporting and Transparency

The Tennessee Department of Commerce and Insurance (TDCI) maintains rigorous financial reporting requirements for the businesses and insurance companies under its purview, promoting accountability and transparency in the state’s economic landscape. These requirements are designed to protect consumers and ensure the stability of the insurance market. The Department also employs various methods to ensure its own operations are open and accessible to the public.

The TDCI’s commitment to financial transparency extends to both the entities it regulates and its own internal operations. This commitment is crucial for maintaining public trust and fostering a healthy business environment in Tennessee.

Financial Reporting Requirements for Regulated Entities

Businesses and insurance companies regulated by the TDCI are subject to a variety of financial reporting requirements, depending on their specific industry and licensing. These requirements generally involve the regular submission of financial statements, including balance sheets, income statements, and cash flow statements, prepared in accordance with generally accepted accounting principles (GAAP). Insurance companies face additional, more stringent requirements, including detailed reporting on reserves, policyholder liabilities, and investment portfolios. The frequency of reporting varies, with some companies required to submit reports monthly, quarterly, or annually. Failure to comply with these reporting requirements can result in penalties, including fines and license revocation. The specific regulations are detailed in the Tennessee Code Annotated and the TDCI’s administrative rules.

TDCI Transparency Measures

The TDCI employs several methods to ensure transparency in its operations. These include publishing its budget and audited financial statements publicly on its website, providing regular updates on its activities and initiatives through press releases and media outreach, and responding to public records requests in a timely manner. The Department also maintains an open-door policy, encouraging citizens to contact them with questions or concerns. Furthermore, the TDCI actively participates in public hearings and forums, allowing stakeholders to provide input on proposed regulations and policies. This commitment to transparency ensures accountability and fosters public trust in the Department’s operations.

TDCI Budget Allocation and Use

The TDCI’s budget is appropriated annually by the Tennessee General Assembly. The budget is allocated to various programs and functions, including insurance regulation, commerce and business regulation, consumer protection, and administrative support. A significant portion of the budget is dedicated to staffing, technology, and enforcement activities. The Department regularly reviews its budget to ensure efficient allocation of resources and to adapt to changing needs and priorities. Detailed budget information, including expenditure breakdowns, is available on the TDCI’s website. The budget is subject to regular audits to ensure compliance with state regulations and financial best practices.

TDCI Annual Report

The TDCI’s annual report provides a comprehensive overview of the Department’s activities and accomplishments during the preceding fiscal year. Key findings typically include statistics on the number of licenses issued, enforcement actions taken, consumer complaints resolved, and financial performance. Performance indicators may include measures of efficiency, effectiveness, and customer satisfaction. The report also highlights significant legislative changes and policy initiatives undertaken by the Department. The annual report is a valuable resource for understanding the TDCI’s role in protecting consumers and fostering a thriving business environment in Tennessee. It is typically published online and distributed to stakeholders.

Future Directions and Challenges for the TDCI

The Tennessee Department of Commerce and Insurance (TDCI) faces a dynamic future, requiring proactive adaptation to evolving technological landscapes, economic shifts, and shifting consumer expectations. Successfully navigating these challenges will be crucial to maintaining the TDCI’s effectiveness in protecting consumers and fostering a healthy business environment in Tennessee.

Major Challenges Facing the TDCI

The TDCI’s primary challenges involve maintaining regulatory relevance in a rapidly changing marketplace. This includes adapting to the rise of fintech, the increasing complexity of insurance products, and the growing prevalence of cyber threats targeting both businesses and consumers. Furthermore, ensuring adequate staffing and resources to effectively oversee a diverse range of industries and responsibilities remains a significant ongoing concern. Maintaining public trust in the face of evolving public perception of government regulation is also a critical factor. For example, the increasing sophistication of insurance fraud schemes requires continuous improvement in detection and prevention methods. Similarly, the rapid development of artificial intelligence (AI) in insurance underwriting and claims processing presents both opportunities and challenges for effective oversight.

Policy Changes and Reforms to Improve TDCI Effectiveness

Several policy reforms could enhance the TDCI’s efficiency and impact. Streamlining regulatory processes to reduce bureaucratic burdens on businesses, while maintaining robust consumer protections, is a key area for improvement. Increased investment in technology and data analytics could significantly improve the TDCI’s capacity for risk assessment, fraud detection, and market monitoring. For instance, implementing a modern, user-friendly online portal for consumer complaints and information requests would enhance transparency and accessibility. Furthermore, enhanced collaboration with other state agencies and federal regulatory bodies could lead to more efficient and coordinated regulatory efforts. Consideration should be given to modernizing licensing and certification processes to reflect current industry best practices and reduce processing times.

Strategies for Adapting to Changes in the Regulatory Landscape

The TDCI must embrace proactive strategies to maintain its relevance. This includes fostering a culture of continuous learning and professional development among its staff to keep pace with emerging technologies and industry trends. Strategic partnerships with industry stakeholders, consumer advocacy groups, and academic institutions can provide valuable insights and facilitate collaborative problem-solving. Proactive engagement in national and international regulatory discussions will ensure Tennessee’s regulatory framework remains aligned with best practices. Investing in advanced data analytics capabilities will allow the TDCI to identify emerging risks and trends more effectively. For example, analyzing consumer complaint data can reveal patterns of fraud or systemic issues requiring targeted regulatory interventions.

Hypothetical Scenario and TDCI Response

A significant cyberattack targeting a major Tennessee-based insurance company, resulting in a massive data breach and disruption of services, could severely impact the TDCI. The TDCI’s response would involve immediate activation of its emergency response plan, coordinating with law enforcement and other state agencies to investigate the breach and mitigate its impact. This would include working with the affected company to ensure compliance with data breach notification laws, protecting consumer data, and restoring essential services. The TDCI would also leverage its regulatory authority to enforce compliance with cybersecurity standards and best practices across the insurance industry. Public communication would be crucial, ensuring transparency and providing consumers with accurate information and support. This hypothetical scenario highlights the importance of proactive cybersecurity measures and robust emergency response capabilities for the TDCI.

Final Summary

The State of Tennessee Department of Commerce and Insurance stands as a critical guardian of Tennessee’s economic well-being and consumer rights. Its far-reaching regulatory responsibilities, coupled with a commitment to transparency and consumer protection, create a stable and fair business environment. By understanding the TDCI’s functions and resources, businesses and consumers alike can navigate the regulatory landscape with confidence, leveraging the department’s services and protections to their advantage.

Key Questions Answered

What types of insurance does the TDCI regulate?

The TDCI regulates a wide range of insurance products, including auto, home, health, life, and commercial insurance.

How can I file a complaint against an insurance company?

Visit the TDCI website for detailed instructions and forms. You can typically file a complaint online or by mail.

What resources are available to consumers who have insurance disputes?

The TDCI offers mediation and arbitration services to help resolve disputes between consumers and insurance companies. Their website also provides educational materials and FAQs.

Does the TDCI offer assistance in obtaining business licenses?

Yes, the TDCI website provides detailed information and guidance on the process of obtaining various business licenses and permits in Tennessee.

How can I access the TDCI’s annual report?

The TDCI’s annual report is typically available on their official website in the “About Us” or “Transparency” section.