Securing your family’s financial future is a paramount concern, and choosing the right term life insurance policy is a crucial step in that process. Navigating the world of insurance providers can feel overwhelming, with numerous companies vying for your attention. This guide delves into the intricacies of selecting a top-rated term life insurance company, providing you with the knowledge and tools to make an informed decision. We’ll explore the key factors that distinguish top-rated companies, examining their financial strength, customer service, policy options, and claims processes. Understanding these aspects will empower you to compare different providers effectively and choose Read More …

Tag: affordable life insurance

Securing Your Future: A Guide to Term Life Insurance No Medical Exam

Navigating the world of life insurance can feel daunting, especially when faced with complex medical requirements. However, a viable alternative exists: term life insurance without a medical exam. This streamlined approach offers a convenient way to secure crucial financial protection for your loved ones without the often-lengthy and invasive medical evaluations. This guide will explore the benefits, eligibility criteria, and nuances of this increasingly popular insurance option, empowering you to make informed decisions about your family’s financial security. We’ll delve into the key differences between traditional term life insurance and its no-medical-exam counterpart, comparing costs, coverage amounts, and the Read More …

Understanding Term Life Insurance Costs: A Comprehensive Guide

Securing your family’s financial future is a paramount concern, and term life insurance plays a crucial role in achieving this goal. However, navigating the complexities of term life insurance costs can feel daunting. This guide demystifies the process, providing a clear understanding of the factors that influence premiums and offering practical strategies to find affordable coverage that meets your specific needs. We’ll explore everything from the impact of age and health to the role of insurers and the benefits of comparing quotes. Understanding term life insurance costs requires a nuanced approach. It’s not simply a matter of choosing the Read More …

No Health Exam Term Life Insurance: A Comprehensive Guide

Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this goal. However, the traditional process of obtaining life insurance often involves extensive medical examinations, which can be time-consuming and potentially deter individuals from seeking the coverage they need. This guide explores the increasingly popular alternative: no health exam term life insurance, offering a streamlined approach to securing vital financial protection. We will delve into the key features, eligibility requirements, application process, cost considerations, and advantages and disadvantages of no medical exam term life insurance. We’ll compare it to traditional term Read More …

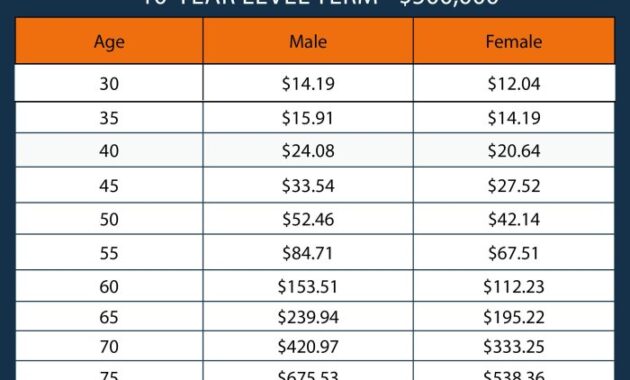

Decoding Life Term Insurance Rates: A Comprehensive Guide

Securing your family’s financial future through life insurance is a crucial step, but understanding the nuances of life term insurance rates can feel overwhelming. This guide dissects the factors influencing these rates, offering clarity and empowering you to make informed decisions. We’ll explore the interplay of age, health, lifestyle, and policy type to provide a comprehensive understanding of how these elements impact your premiums. From comparing rates across different insurers and policy lengths to identifying strategies for finding affordable coverage, we aim to equip you with the knowledge needed to navigate the world of life term insurance with confidence. Read More …

Securing Your Future: A Guide to Life Insurance No Medical Exam Required

The unexpected can strike at any moment, leaving families grappling with financial burdens after a loss. Life insurance provides a crucial safety net, but the traditional application process, often involving extensive medical examinations, can be daunting. This guide explores the world of life insurance policies that require no medical exam, offering a simpler path to securing your loved ones’ financial well-being. We’ll delve into the various types of no-medical-exam life insurance, comparing their costs, coverage amounts, and eligibility criteria. We’ll also address common misconceptions, outlining the advantages and disadvantages to help you make an informed decision that aligns with Read More …

Securing Your Future: A Guide to Life Insurance Policies with No Medical Exam

The prospect of securing your family’s financial future is a significant undertaking. Traditional life insurance often involves a rigorous medical examination, potentially creating barriers for some individuals. However, a growing number of life insurance policies are available without the need for a medical exam, offering a more accessible route to vital coverage. This guide explores the various types of no-medical-exam life insurance, their advantages, disadvantages, and the crucial factors to consider before making a decision. We’ll delve into the specifics of simplified issue, guaranteed issue, and other similar policies, comparing their coverage amounts, premiums, and eligibility requirements. Understanding the Read More …

Securing Your Future: A Guide to Life Insurance Over 50 No Medical Exam

Navigating the world of life insurance can feel daunting, especially as we age. The traditional route often involves medical examinations, potentially delaying coverage or even disqualifying applicants. However, a growing market caters specifically to individuals over 50 seeking life insurance without the need for a medical exam. This guide explores the landscape of these policies, highlighting their advantages, limitations, and crucial considerations to help you make informed decisions about protecting your loved ones’ financial future. This exploration will delve into the diverse policy types available, the factors influencing premium costs, and the strategies for securing affordable yet adequate coverage. Read More …

AARP Life Insurance: Securing Your Future with Confidence

Planning for the future can feel daunting, but securing your loved ones’ financial well-being is a vital step. AARP life insurance offers a range of plans designed to meet diverse needs and budgets, providing peace of mind during life’s transitions. This comprehensive guide explores the various AARP life insurance options, helping you understand their benefits, limitations, and suitability for your specific circumstances. We’ll delve into the specifics of coverage amounts, premium structures, and available riders, comparing AARP’s offerings to those of other providers. We’ll also examine customer experiences, the claims process, and address common questions to equip you with Read More …

Securing Your Future: A Guide to Top Rated Term Life Insurance

Finding the right term life insurance can feel overwhelming. With so many providers and policies, understanding what constitutes “top-rated” is crucial. This guide navigates the complexities, exploring the factors that determine a policy’s ranking, highlighting key features of top-performing options, and empowering you to make an informed decision that aligns with your specific needs and budget. We’ll delve into the intricacies of policy ratings, comparing different sources and criteria. We’ll also examine the essential features – death benefit, premiums, riders – and how they impact the overall value. By the end, you’ll possess a clear understanding of how to Read More …