The unexpected theft of your vehicle can be a devastating experience, leaving you scrambling to understand your insurance options. Many renters mistakenly believe their car is fully protected under their renters insurance policy. While renters insurance offers some protection for personal property, its coverage of car theft is often limited and nuanced. This exploration delves into the complexities of renters insurance and car theft, clarifying what’s covered, what’s not, and the alternatives available to ensure your vehicle is adequately protected. This guide will navigate the often-confusing world of renters insurance, specifically addressing the crucial question of car theft coverage. Read More …

Tag: auto insurance

Renters and Auto Insurance: A Comprehensive Guide to Coverage and Cost

Navigating the world of insurance can feel overwhelming, especially when considering the often-overlooked intersection of renters and auto insurance. While seemingly separate, these policies frequently overlap, impacting your financial protection in unforeseen circumstances. This guide delves into the complexities of both, illuminating areas of shared coverage, cost-saving strategies, and crucial considerations for renters and car owners alike. We’ll explore how location, coverage choices, and bundling options influence your premiums, providing practical advice for securing affordable and comprehensive protection. Through illustrative scenarios and clear explanations, we aim to demystify the intricacies of renters and auto insurance, empowering you to make Read More …

Recommended Car Insurance Coverage: A Consumer Reports Guide

Navigating the world of car insurance can feel like driving through a fog. Numerous providers, varying coverage options, and fluctuating costs make finding the right policy a daunting task. This guide leverages the expertise of Consumer Reports, a trusted source for unbiased product evaluations, to illuminate the path towards securing optimal car insurance coverage tailored to your individual needs and budget. We’ll delve into Consumer Reports’ methodology for evaluating car insurance providers, exploring the criteria they use, the weighting system employed, and the data sources they rely upon. This analysis will equip you with the knowledge to interpret their Read More …

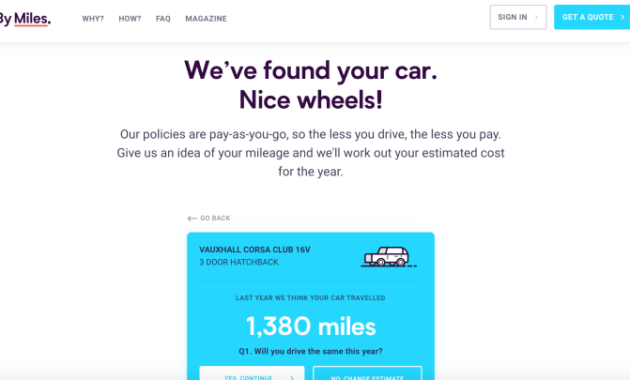

Secure Your Quick Car Insurance Quote: A Comprehensive Guide

Finding the right car insurance can feel overwhelming, but it doesn’t have to be a time-consuming ordeal. The demand for quick car insurance quotes reflects a modern need for speed and efficiency. This guide explores the user experience behind obtaining these quotes, analyzing the factors influencing speed and clarity, and offering insights into optimizing the entire process for both providers and consumers. We’ll delve into the various reasons people seek immediate quotes, examine the competitive landscape of major insurance providers, and discuss website optimization strategies to ensure a seamless and efficient quote generation process. From minimizing form fields to Read More …

Progressive Insurance: A Comprehensive Analysis of its Business Model, Marketing, and Future Outlook

Progressive Insurance stands as a prominent figure in the competitive landscape of the American auto insurance market. This in-depth exploration delves into the company’s multifaceted operations, from its innovative marketing strategies and technological advancements to its commitment to customer experience and social responsibility. We will examine Progressive’s historical trajectory, current market position, and projections for its future growth, providing a comprehensive understanding of this influential insurance provider. Through analysis of Progressive’s financial performance, marketing campaigns, technological integrations, and customer service initiatives, we aim to offer a balanced perspective on its strengths, weaknesses, and overall impact on the insurance industry. Read More …

Progressive Insurance Progressive: A Deep Dive into Brand, Products, and Market Position

Progressive Insurance has carved a significant niche in the competitive insurance market, distinguishing itself through innovative technology, memorable marketing campaigns, and a customer-centric approach. This exploration delves into the multifaceted nature of Progressive, examining its brand identity, diverse product offerings, customer experiences, and strategic positioning within the industry landscape. We will analyze its marketing strategies, compare it to competitors, and assess its overall impact on the insurance sector. From its quirky advertising featuring Flo to its technologically advanced Name Your Price® tool, Progressive consistently seeks to modernize the insurance experience. This analysis will uncover the key elements that contribute Read More …

Understanding Plymouth Rock Assurance Car Insurance: A Comprehensive Guide

Navigating the world of car insurance can be daunting, but understanding your options is crucial for securing the right coverage. This guide delves into Plymouth Rock Assurance car insurance, providing a detailed look at its offerings, customer experiences, and how it compares to competitors. We’ll explore policy features, pricing, and the claims process, equipping you with the knowledge to make an informed decision about your auto insurance needs. From its history and financial stability to customer reviews and policy specifics, we aim to offer a comprehensive overview of Plymouth Rock Assurance. We’ll analyze its various coverage options, highlight key Read More …

Plymouth Rock Insurance Company: A Comprehensive Overview

Plymouth Rock Assurance Corporation, a prominent name in the insurance industry, has carved a significant niche for itself through its diverse product offerings and customer-centric approach. This exploration delves into the company’s history, financial standing, market position, and customer experiences, providing a comprehensive understanding of its operations and impact within the competitive insurance landscape. We will examine its strengths, weaknesses, and how it compares to its rivals, offering valuable insights for both potential customers and industry analysts. From its humble beginnings to its current standing as a major player, Plymouth Rock’s journey reflects the evolution of the insurance sector. Read More …

Understanding Progressive Quote Car Insurance: A Comprehensive Guide

Progressive car insurance, known for its innovative quote system, offers a dynamic approach to pricing that adapts to individual driver profiles. Unlike traditional methods with fixed rates, Progressive utilizes a system that considers various factors to provide personalized quotes. This approach aims for greater fairness and affordability, reflecting the unique risk associated with each driver. This guide delves into the intricacies of Progressive’s quote system, exploring its benefits, the factors influencing pricing, the quote acquisition process, and a comparison with traditional insurance models. We will examine how individual characteristics and driving history impact the final cost, ultimately providing a Read More …

Understanding Premium Motor Insurance: Coverage, Costs, and Benefits

Premium motor insurance offers a higher level of protection and benefits compared to standard policies. This comprehensive guide explores the key features, costs, and advantages of premium motor insurance, helping you understand if it’s the right choice for your needs. We’ll delve into the specific coverages, additional benefits, and the factors that influence the premium price, providing a clear comparison with standard options. From understanding the target customer profile to navigating the purchasing and claims processes, this guide aims to demystify premium motor insurance and empower you to make an informed decision. We’ll also examine real-world scenarios illustrating the Read More …