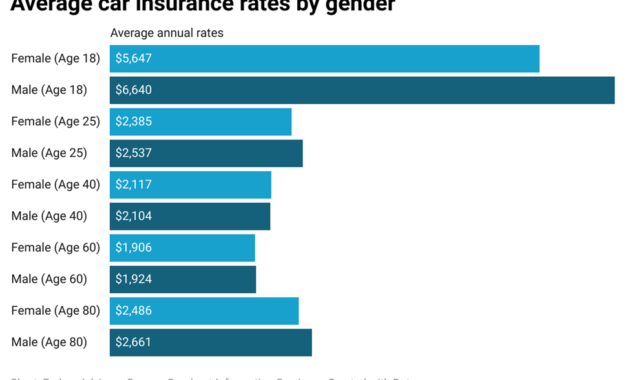

Car insurance price sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding the factors that influence car insurance premiums is crucial for every driver, as it empowers you to make informed decisions and potentially save money. From demographics and driving history to vehicle characteristics and location, numerous factors come into play when determining your insurance costs. This guide explores these factors in detail, providing insights into how you can potentially lower your premiums and navigate the complexities of car insurance. Factors Read More …