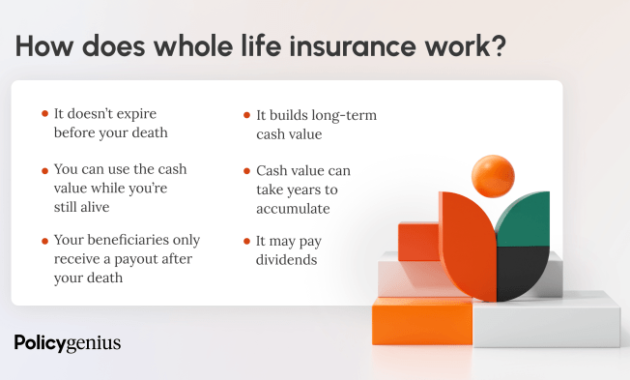

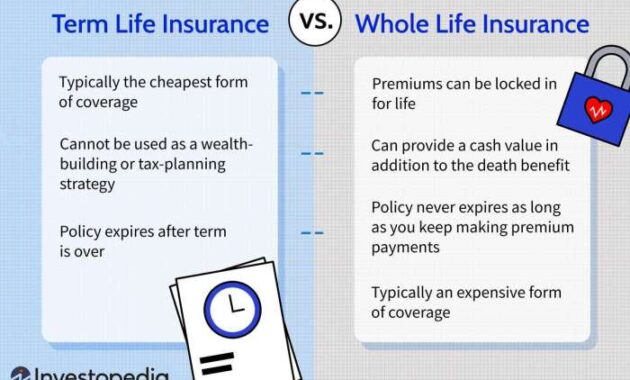

Whole life insurance often evokes images of complex financial instruments, but its core purpose is remarkably simple: providing lifelong financial protection for your loved ones while simultaneously offering potential long-term growth. This guide unravels the intricacies of whole policy life insurance, demystifying its features, benefits, and potential drawbacks to empower you with the knowledge needed to make informed decisions about your financial future. We’ll explore the fundamental differences between whole life and term life insurance, delve into the mechanics of cash value accumulation, and examine how whole life policies can serve as powerful tools in estate planning and wealth Read More …