Navigating the complexities of insurance can be daunting, but understanding the role of the Utah Department of Insurance (UDI) is key to ensuring consumer protection and a stable insurance market. This comprehensive guide explores the UDI’s history, its crucial functions in licensing, regulation, and consumer advocacy, and its impact on the financial health of Utah’s insurance industry. We’ll delve into the department’s structure, its oversight of market trends, and its response to legislative changes, providing a clear picture of how the UDI safeguards Utah residents and businesses. From the licensing of insurance companies to the resolution of consumer complaints, Read More …

Tag: Consumer Protection

Navigating Texas Insurance: A Comprehensive Guide to the TX Department of Insurance

The Texas Department of Insurance (TDI) plays a crucial role in the Lone Star State, ensuring fair practices within the insurance industry and protecting consumers. From licensing insurers to mediating disputes, the TDI’s impact resonates throughout Texas, shaping the landscape of insurance availability, affordability, and accountability. This guide delves into the TDI’s multifaceted responsibilities, providing a clear understanding of its functions and the resources available to both insurers and consumers. Understanding the TDI’s structure, regulatory powers, and consumer protection initiatives is vital for navigating the complexities of Texas’s insurance market. Whether you’re an insurance professional seeking licensing information or Read More …

Understanding the Texas Department of Insurance (TDI): A Comprehensive Guide

Navigating the world of insurance can feel like traversing a complex maze, but understanding the regulatory body overseeing it is key to consumer protection and market stability. The Texas Department of Insurance (TDI) plays a pivotal role in ensuring fair practices and a healthy insurance market within the state. This comprehensive guide explores the TDI’s multifaceted responsibilities, from regulating insurers to advocating for consumer rights, providing a clearer picture of its impact on Texans. From its historical evolution to its current influence on the Texas economy, we’ll delve into the TDI’s core functions, its regulatory oversight of various insurance Read More …

Understanding the State of Florida Insurance Commissioner: Roles, Responsibilities, and Market Impact

The State of Florida Insurance Commissioner plays a pivotal role in safeguarding the interests of both consumers and the insurance industry within the Sunshine State. This individual, appointed to oversee a complex and often volatile market, wields significant authority in regulating insurance companies, resolving consumer disputes, and shaping insurance policy. This exploration delves into the Commissioner’s multifaceted responsibilities, examining recent actions, market challenges, and the crucial balance between consumer protection and industry stability. From navigating the aftermath of devastating hurricanes to addressing concerns over affordability and accessibility, the Commissioner’s influence extends far beyond the regulatory sphere. This examination will Read More …

Navigating the Florida Insurance Landscape: A Comprehensive Guide to the State of FL Dept of Insurance

The State of Florida Department of Insurance (FLDOI) plays a pivotal role in ensuring the stability and fairness of Florida’s insurance market. From regulating insurance companies and protecting consumers to navigating the complexities of natural disasters, the FLDOI’s impact is far-reaching. This guide provides a detailed overview of the department’s functions, responsibilities, and its vital contribution to the state’s economic and social well-being. We will explore its history, regulatory powers, consumer protection initiatives, and the challenges it faces in an ever-evolving landscape. Understanding the FLDOI’s operations is crucial for both consumers seeking insurance and companies operating within the Florida Read More …

Navigating the Ohio Insurance Department: A Comprehensive Guide

The Ohio Insurance Department plays a vital role in safeguarding consumers and maintaining the stability of the state’s insurance market. This guide delves into the department’s history, functions, and regulatory powers, offering a comprehensive overview of its impact on Ohio residents and the insurance industry. We’ll explore its consumer protection initiatives, licensing procedures, market oversight, and financial solvency assessments, providing a clear understanding of its multifaceted responsibilities. From understanding the licensing process for insurers to navigating consumer complaints and understanding rate regulations, this resource aims to empower both consumers and industry professionals with the knowledge needed to effectively interact Read More …

Understanding the North Carolina Insurance Commissioner: Roles, Responsibilities, and Impact

The North Carolina Insurance Commissioner plays a pivotal role in safeguarding the state’s insurance market, balancing the interests of consumers, insurers, and the broader economy. This individual, appointed to oversee the state’s insurance industry, wields significant regulatory power, shaping policy and impacting the lives of millions of North Carolinians. Their decisions directly influence insurance rates, consumer protections, and the overall health of the state’s insurance sector. This examination delves into the multifaceted responsibilities of the North Carolina Insurance Commissioner, exploring their regulatory authority, recent actions, budgetary considerations, public accountability, and the impact on consumers. We will analyze both the Read More …

Navigating the North Carolina Insurance Commission: A Comprehensive Guide

The North Carolina Insurance Commission plays a pivotal role in the state’s insurance landscape, ensuring fair practices, consumer protection, and market stability. Established to regulate and oversee the insurance industry within North Carolina, the Commission’s impact extends to every resident and business interacting with insurance providers. This guide delves into the Commission’s history, structure, and key responsibilities, providing a clear understanding of its multifaceted operations and influence on the state’s economic well-being. From licensing and regulating insurance companies to mediating consumer disputes and monitoring market conduct, the NC Insurance Commission’s reach is extensive. Understanding its functions is crucial for Read More …

Understanding the Michigan Department of Insurance: A Comprehensive Guide

The Michigan Department of Insurance (MDI) plays a vital role in protecting Michigan residents and ensuring the stability of the state’s insurance market. From regulating insurance companies and licensing agents to mediating consumer complaints and overseeing financial solvency, the MDI’s responsibilities are far-reaching and critical to the economic well-being of the state. This guide provides a detailed overview of the MDI’s functions, its regulatory processes, and the resources it offers to both consumers and industry professionals. Established to protect consumers and maintain a stable insurance market, the MDI’s history is intertwined with the evolution of the insurance industry in Read More …

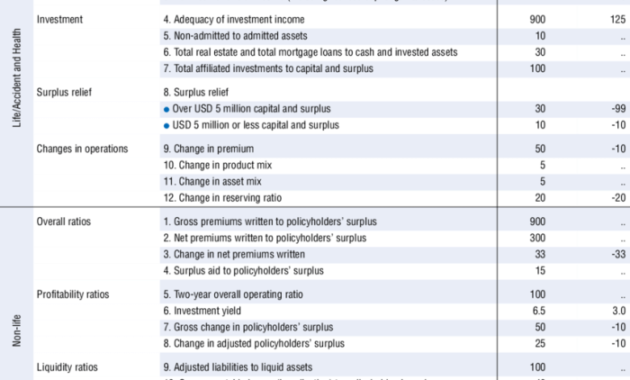

Understanding NAIC Insurance: A Comprehensive Guide

Navigating the complex world of insurance can be daunting. This guide delves into the crucial role of the National Association of Insurance Commissioners (NAIC) in ensuring fair and stable insurance markets. We’ll explore how NAIC insurance regulations impact both consumers and insurance companies, offering a clear understanding of this often-overlooked yet vital aspect of the industry. From defining NAIC insurance and its scope to examining its impact on consumer protection and market stability, we aim to provide a comprehensive overview. We’ll explore the challenges faced by insurance companies in complying with NAIC regulations and the various ways consumers benefit Read More …