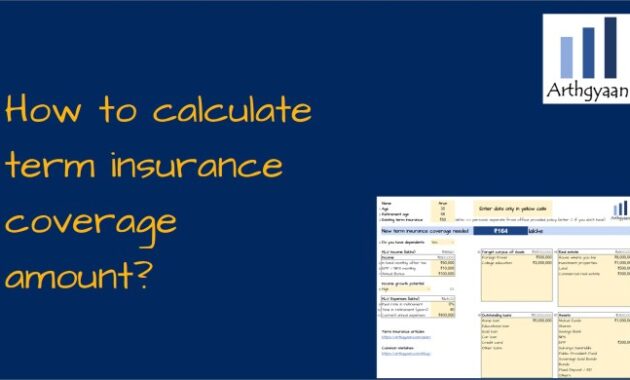

Securing your family’s financial well-being is a paramount concern, and understanding whole life insurance is a crucial step in that process. A whole life insurance policy calculator can demystify this complex financial instrument, providing a clear picture of potential costs and benefits. This guide will explore the functionality of these calculators, the factors influencing premium calculations, and how to interpret the results to make informed decisions about your future. We’ll delve into the intricacies of different policy types, the impact of age and health, and the various payment options available. Understanding these factors empowers you to navigate the world Read More …