Securing adequate health insurance is a cornerstone of financial well-being, and understanding the intricacies of the Tennessee health insurance landscape is crucial for residents. This guide delves into the various plan types available, the Affordable Care Act’s role in the state, cost factors, and the process of finding providers. We’ll explore options like HMOs, PPOs, and the ACA marketplace, offering a clear path to making informed decisions about your healthcare coverage. From understanding the differences between individual and family plans to navigating the complexities of Medicaid, CHIP, and Medicare in Tennessee, this resource aims to empower you with the Read More …

Tag: health insurance plans

Navigating Single Health Insurance: A Comprehensive Guide

Securing affordable and comprehensive healthcare is a fundamental concern for individuals, and understanding the intricacies of single health insurance is crucial in this pursuit. This guide delves into the world of single health insurance plans, providing a clear and concise overview of their features, costs, and selection process. We’ll explore everything from eligibility and enrollment to understanding coverage and managing your policy, empowering you to make informed decisions about your healthcare future. The landscape of individual health insurance can seem daunting, with a multitude of plans, providers, and terms to decipher. This guide aims to simplify the process, offering Read More …

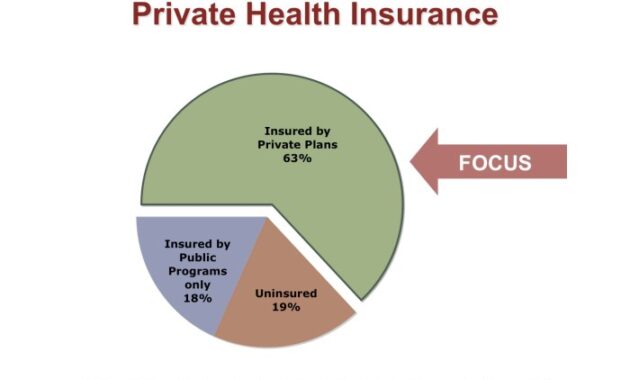

Navigating the Maze: A Comprehensive Guide to Private Health Insurance Plans

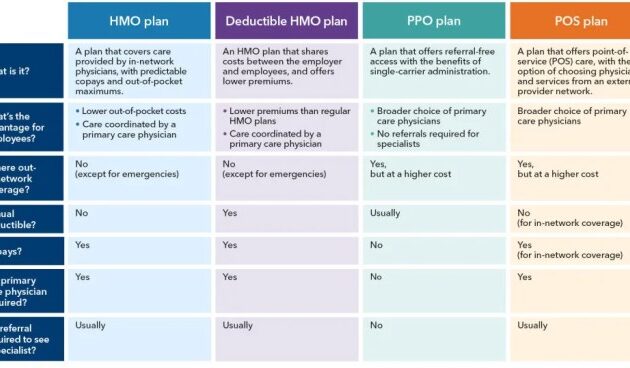

Choosing the right private health insurance plan can feel like navigating a complex maze. With a multitude of options—HMOs, PPOs, EPOs, POS plans, and HSAs—understanding the nuances of each plan type is crucial to securing adequate healthcare coverage while managing costs effectively. This guide unravels the intricacies of private health insurance, empowering you to make informed decisions that best suit your individual needs and circumstances. From understanding the factors that influence premium costs to mastering the process of filing claims and accessing healthcare services, we will explore every facet of private health insurance plans. We’ll delve into coverage details, Read More …

Unlocking Healthcare Peace of Mind: A Guide to No Deductible Health Insurance

Navigating the complexities of health insurance can feel like deciphering a foreign language. Terms like “deductible,” “copay,” and “out-of-pocket maximum” often leave individuals feeling overwhelmed and uncertain about their healthcare choices. This guide focuses on a specific type of plan that aims to simplify the process: no deductible health insurance. We’ll explore what it means, how it works, its potential benefits and drawbacks, and ultimately, help you determine if it’s the right fit for your healthcare needs. Understanding “no deductible” health insurance requires careful consideration of various factors. While the absence of a deductible sounds incredibly appealing – eliminating Read More …

Understanding MSA Group Insurance: A Comprehensive Guide

Navigating the complexities of healthcare can be daunting, but understanding your group insurance options is crucial for financial well-being and peace of mind. This guide delves into the specifics of MSA (Medical Savings Account) group insurance, exploring its various types, eligibility criteria, cost structures, and claims processes. We’ll unravel the intricacies of coverage, provider networks, and compare MSA plans with other common group insurance options, providing a clear and concise overview to empower you with the knowledge you need to make informed decisions. From defining MSA group insurance and outlining its different plan types to detailing the enrollment process Read More …

Navigating the Michigan Health Insurance Exchange Marketplace: A Comprehensive Guide

The Michigan Health Insurance Exchange Marketplace plays a vital role in ensuring access to affordable healthcare for Michigan residents. Understanding its intricacies—from eligibility requirements and plan options to financial assistance and enrollment processes—is crucial for navigating the system effectively. This guide provides a clear and concise overview of the marketplace, empowering individuals and families to make informed decisions about their health insurance coverage. This exploration delves into the history, evolution, and current state of the Michigan Health Insurance Marketplace, examining its impact on healthcare access and affordability within the state. We’ll dissect the various plan types, eligibility criteria, financial Read More …

Decoding Medical Insurance PPO: A Comprehensive Guide

Navigating the world of healthcare can feel like deciphering a complex code, especially when it comes to understanding your medical insurance options. One common type of plan, the Preferred Provider Organization (PPO), offers flexibility but also presents a unique set of considerations. This guide unravels the intricacies of PPO medical insurance, empowering you to make informed decisions about your healthcare coverage. We’ll explore the core features of PPO plans, comparing them to other common options like HMOs and POS plans. Understanding terms like deductible, copay, and coinsurance is crucial for managing your healthcare costs effectively. We’ll also delve into Read More …

Navigating the World of Medical Insurance Quotes Online: A Comprehensive Guide

Securing affordable and comprehensive medical insurance is a crucial aspect of financial planning. The process, however, can often feel daunting, particularly when navigating the complexities of online quote comparisons. This guide aims to demystify the search for medical insurance quotes online, providing a clear understanding of the process, potential pitfalls, and ultimately, empowering you to make informed decisions about your healthcare coverage. From understanding the various factors influencing quote prices to mastering the art of comparing different offers, we will explore the entire online medical insurance quote journey. We’ll delve into the user experiences offered by leading websites, highlighting Read More …

Navigating the Maze: Finding the Best Medical Insurance Plans for Family

Securing comprehensive medical insurance for your family is a crucial step in safeguarding your loved ones’ well-being. The sheer variety of plans available, each with its own complexities of coverage, costs, and networks, can feel overwhelming. This guide aims to demystify the process, offering a clear understanding of the different plan types, cost factors, and strategies for choosing the optimal coverage for your family’s unique needs and budget. From understanding the nuances of HMOs, PPOs, EPOs, and POS plans to navigating the complexities of deductibles, co-pays, and out-of-pocket maximums, we’ll provide you with the essential information needed to make Read More …

Decoding Private Insurance Plans: A Comprehensive Guide

Navigating the world of private health insurance can feel like deciphering a complex code. This guide aims to illuminate the intricacies of various private insurance plans, empowering you with the knowledge to make informed decisions about your healthcare coverage. We’ll explore the different plan types, their associated costs, and the crucial factors to consider when selecting a plan that best suits your individual needs and budget. From understanding HMOs and PPOs to deciphering deductibles and co-pays, we’ll break down the essential elements of private insurance. This comprehensive overview will equip you with the tools to compare plans effectively, analyze Read More …