Navigating the world of SR-22 insurance can feel like traversing a minefield, especially when you don’t own a car. This guide demystifies the process of obtaining non-owner SR22 insurance online, offering a clear path through the complexities of requirements, costs, and insurer selection. We’ll explore the reasons behind SR-22 mandates, the online application process, and crucial factors to consider when choosing a provider. Understanding these elements empowers you to make informed decisions and ensure your compliance with legal obligations. From understanding the purpose of SR-22 insurance and its implications to comparing costs and coverage options from various online insurers, Read More …

Tag: high-risk insurance

Decoding $20 Down Payment Car Insurance: Risks, Rewards, and Reality

The allure of securing car insurance with a mere $20 down payment is undeniable, particularly for those on tight budgets. This seemingly attractive offer, however, presents a complex landscape of potential benefits and significant drawbacks. Understanding the intricacies of this market is crucial for both consumers seeking affordable coverage and insurers navigating the associated risks. This exploration delves into the realities of $20 down payment car insurance, examining its implications for both parties involved. We will investigate the target demographic, analyze the financial ramifications for both insurers and policyholders, and compare this unconventional approach to traditional car insurance models. Read More …

Securing Insurance for High-Risk Drivers: A Comprehensive Guide

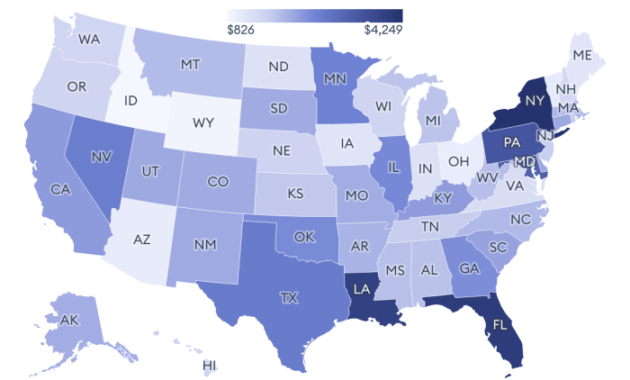

Navigating the world of auto insurance can be challenging, especially for those deemed “high-risk.” This often involves higher premiums and limited options, leaving many feeling frustrated and uncertain. This guide delves into the complexities of securing insurance for high-risk drivers, examining the factors that contribute to higher premiums, the types of policies available, and strategies for finding affordable coverage. We’ll explore the legal landscape and offer practical advice to help you navigate this often-difficult process. Understanding the criteria insurance companies use to assess risk is crucial. Factors such as age, driving history (including accidents, tickets, and DUI convictions), vehicle Read More …

Securing Cheap Insurance SR22: A Guide to Affordable Compliance

Navigating the world of SR-22 insurance can feel like traversing a minefield. The requirement itself often stems from a past driving infraction, adding a layer of stress to an already challenging situation. However, understanding the nuances of SR-22 coverage and employing smart strategies can significantly reduce the financial burden. This guide explores how to find cheap insurance SR22 while ensuring you meet all legal obligations. We’ll delve into the factors influencing SR-22 costs, from your driving history and age to the state you reside in and the insurance provider you choose. We’ll also provide practical tips for lowering your Read More …