Ever wondered about that seemingly random string of numbers on your insurance documents? It’s your insurance policy number, and it’s far more important than you might think. This number acts as your unique identifier within the insurance system, crucial for accessing your coverage, filing claims, and ensuring your information remains secure. This guide will delve into the significance of your policy number, explaining its format, where to find it, and how to protect it. We’ll explore the various ways your policy number is used, from verifying your coverage during a medical emergency to smoothly processing insurance claims. Understanding its Read More …

Tag: Insurance

Tz Insurance Solutions LLC: Comprehensive Insurance Solutions for a Secure Future

Tz Insurance Solutions LLC stands as a beacon of reliability in the complex world of insurance. This comprehensive overview delves into their operational structure, service offerings, and market positioning, providing a clear picture of their commitment to client satisfaction and innovative solutions. We’ll explore their unique approach, competitive advantages, and future aspirations, offering a nuanced understanding of this dynamic organization. From their core services and target clientele to their technological infrastructure and strategic growth plans, this exploration aims to illuminate the essence of Tz Insurance Solutions LLC and its role in shaping the future of insurance. Company Overview Tz Read More …

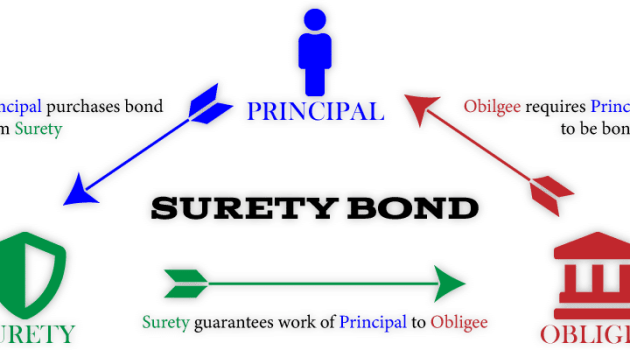

Understanding Surety Insurance: A Comprehensive Guide

Surety insurance, often overlooked, plays a vital role in securing numerous financial transactions. It acts as a crucial bridge, fostering trust between parties involved in contracts and other agreements. This guide delves into the intricacies of surety bonds, exploring their various types, applications across diverse industries, and the legal framework that governs them. We’ll unpack the processes involved, from application to claim settlement, and highlight the risk management aspects that are central to this unique form of insurance. From construction projects to financial dealings, surety bonds provide a safety net, mitigating risks and ensuring accountability. This exploration will illuminate Read More …

Understanding and Utilizing Safeguard Insurance: A Comprehensive Guide

Safeguard insurance, often overlooked in the broader landscape of risk management, plays a crucial role in protecting individuals and businesses from unforeseen financial setbacks. It acts as a critical safety net, shielding against a wide array of potential losses that traditional insurance policies might not fully address. This guide delves into the intricacies of safeguard insurance, exploring its scope, benefits, and practical applications. From defining the core concept and outlining the types of risks covered, to navigating the claims process and choosing the right provider, we will unravel the complexities of safeguard insurance, empowering you to make informed decisions Read More …

Understanding My Insurance: A Comprehensive Guide

Navigating the world of insurance can feel overwhelming, with its complex terminology and diverse offerings. This guide aims to demystify “my insurance,” exploring its various facets and providing clarity on common user needs and information-seeking behaviors. Whether you’re seeking information on health, auto, home, or life insurance, understanding your policy and its implications is crucial for financial security and peace of mind. We will explore the different stages of the insurance journey, from initial research to filing a claim, empowering you to make informed decisions. We’ll delve into the common questions and concerns individuals have regarding their insurance coverage, Read More …

Marquee Insurance Group: A Comprehensive Analysis

The insurance landscape is complex, and navigating it successfully requires a keen understanding of the players involved. Marquee Insurance Group, a significant player in the industry, offers a compelling case study in strategic planning, financial performance, and customer engagement. This analysis delves into the multifaceted operations of Marquee Insurance Group, examining its business model, financial health, product offerings, and overall market position. From its historical trajectory and key milestones to its current market standing and future growth potential, we will explore the factors contributing to Marquee Insurance Group’s success and identify areas for potential improvement. We will also consider Read More …

A Comprehensive Look at Lloyds of London Insurance: History, Operations, and Future Prospects

Lloyd’s of London, a name synonymous with global insurance, boasts a rich and complex history stretching back centuries. From its humble beginnings as a coffee house gathering of ship owners and merchants to its current position as a leading global insurer, Lloyd’s has weathered storms, adapted to evolving risks, and played a pivotal role in shaping the insurance landscape. This exploration delves into the unique structure, operations, and historical context of Lloyd’s, examining its significant contributions, notable challenges, and future trajectory within the ever-changing world of risk management. We will examine Lloyd’s unique syndicate system, its role in handling Read More …

Car Insurance in Canada for Non-Residents: A Guide

Car insurance in canada for non residents – Car insurance in Canada for non-residents can seem like a complex maze, but it doesn’t have to be. Whether you’re planning a temporary work assignment, a study abroad adventure, or a scenic vacation, understanding the ins and outs of car insurance as a non-resident is crucial. This guide will help you navigate the process and make informed decisions about your coverage. Navigating the Canadian car insurance landscape as a non-resident can be daunting, but with the right information and guidance, you can find the best coverage for your needs. This guide Read More …

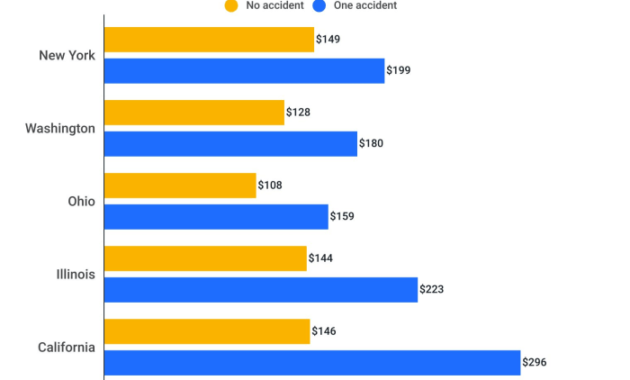

Can You Get in Trouble for No Car Insurance?

Can you get in trouble for not having car insurance? The answer is a resounding yes, and the consequences can be severe. Driving without insurance is a risky proposition that exposes you to significant legal and financial ramifications. Not only are you breaking the law, but you’re also putting yourself and others at risk in the event of an accident. Every state in the US has mandatory car insurance requirements, and failing to comply can lead to fines, license suspension, and even jail time. Moreover, if you’re involved in an accident without insurance, you’ll be personally responsible for all Read More …

Car Insurance Georgia: Your Guide to Safe Driving

Car insurance Georgia is a crucial aspect of responsible driving in the Peach State. Understanding the legal requirements, coverage options, and factors influencing premiums is essential for every driver. This guide provides a comprehensive overview of car insurance in Georgia, empowering you to make informed decisions about your coverage. From navigating the intricacies of different insurance types to finding the right policy for your needs, we’ll delve into the key considerations that ensure you’re adequately protected on the road. We’ll also explore how to drive safely in Georgia and minimize the risk of accidents, as well as provide insights Read More …